Binance is bringing back tokenized equities after its 2021 debut, offering investors a bridge between traditional stocks and crypto markets.

Theme Tokenization

According to ARK Invest's projections, the value of tokenized assets could climb to 11 trillion dollars by 2030, compared to a current market estimated around 22 billion. In other words, ARK is not talking about a gadget, but about a plumbing change for finance.

The so-called Ethereum Killer blockchains are stirring to nibble away market shares and gain media spotlight. But deep down, in reality as in collective perception, there is only one master. Its name comes up in every conference, every strategic plan, every institutional tweet. Ethereum is no longer just a technology…

Société Générale, through its subsidiary SG-Forge, and the SWIFT network have just taken a major step forward in integrating blockchain with traditional finance. Together, they executed the settlement of tokenized bonds using a stablecoin backed by the euro, the EUR CoinVertible. This unprecedented experiment, compliant with the European MiCA framework, marks a key milestone towards concrete interoperability between classic banking systems and cryptos.

Franklin Templeton has upgraded two traditional funds to work on blockchain platforms, letting institutions manage stablecoin reserves with familiar tools.

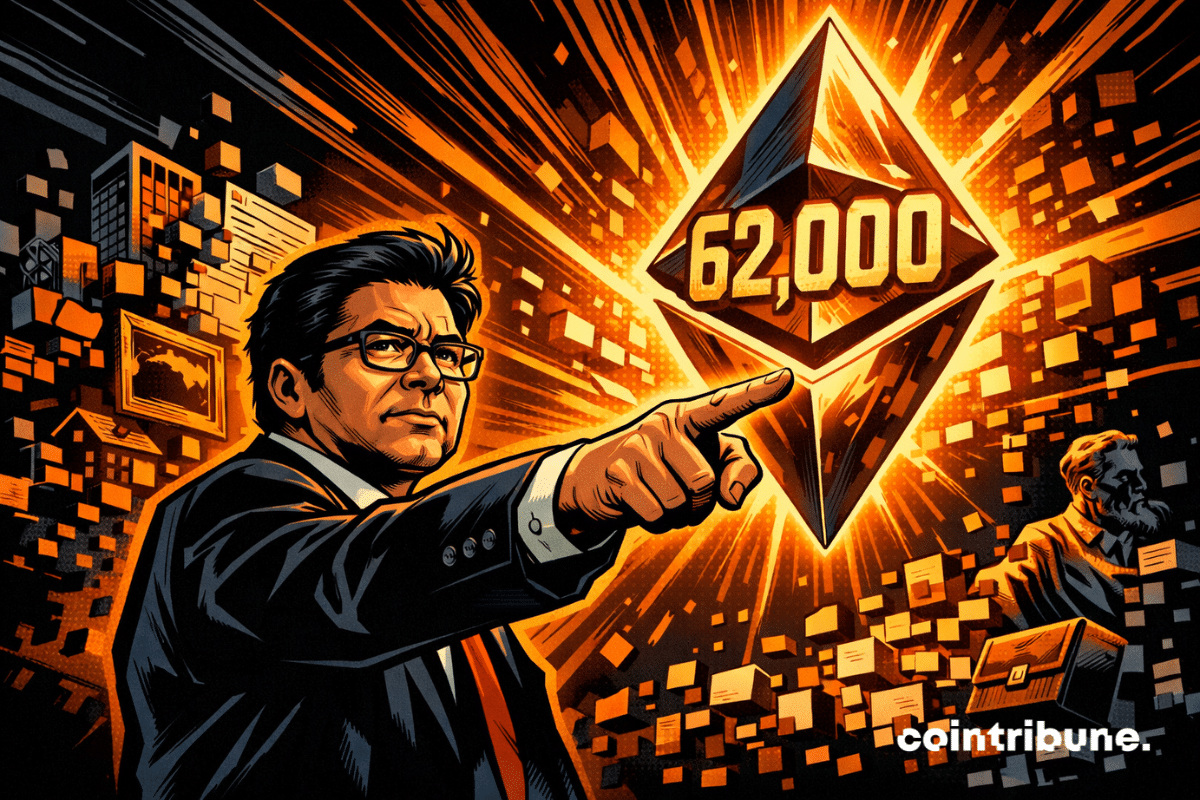

While Bitcoin naps, BitMine stacks ETH: one million staked, billions locked... and an ambition that would make even traditional finance blushing on Ethereum drip.

Bitmine and Fundstrat head of research Tom Lee rehashed debates across crypto markets after forecasting a sharp rise in Ethereum’s price. Speaking at Binance Blockchain Week, Lee stated that Ether could reach $62,000 in the coming months as blockchain adoption enters a new phase. His remarks also reaffirmed his long-held bullish view on Bitcoin.

Crypto markets are entering 2026 with stronger structural support than in earlier cycles. Clearer regulation, expanding financial products, and closer links to traditional finance are reshaping how digital assets are adopted and perceived. Coinbase’s research leadership expects this momentum to persist rather than weaken.

BlackRock’s BUIDL fund has delivered $100M in dividends and grown beyond $2B, marking a milestone in tokenized money market funds.

Crypto giants rush into a rapidly growing market: tokenized stocks. Discover the latest figures!

Ethereum is establishing itself as a new central player in global finance. Driven by the rise of tokenization, the blockchain is now attracting the attention of Wall Street. Major institutions like BlackRock and Robinhood are actively exploring this technology, marking a turning point in crypto adoption. For Tom Lee, co-founder of Fundstrat, Ethereum is becoming a key infrastructure of the financial system. A dynamic that, according to him, could push the asset's price to unprecedented levels.

JPMorgan Chase is expanding its blockchain strategy with the launch of a tokenized money-market fund on Ethereum. The product is backed by $100 million in internal capital and targets qualified investors seeking daily yield through an on-chain structure backed by short-term debt. Market observers say the move reflects clearer regulation, rising client demand, and growing interest in tokenized real-world assets.

Tokenization of real-world assets (RWAs) is moving closer to mainstream finance, though its short-term impact on crypto markets may remain limited. NYDIG says longer-term value will depend on how open, connected, and regulated these assets become across blockchain networks.

Crypto settles at the heart of Wall Street: DTCC launches the tokenization of US markets. Discover the details in this article!

Bhutan is pushing its digital economy forward by placing portions of its traditional reserves on blockchain infrastructure. As tokenized real-world assets gain momentum, the country is securing an early foothold. The introduction of TER, a gold-backed token from Gelephu Mindfulness City (GMC), strengthens Bhutan’s ongoing blockchain plans.

During Binance Blockchain Week, Peter Schiff was invited by Changpeng Zhao to authenticate a gold bar live. Unable to confirm its authenticity, the economist simply replied: "I don't know." A brief but revealing scene, which reignites the debate between physical gold and bitcoin, and raises questions about the verifiability of assets in a world increasingly oriented towards decentralization and blockchain transparency.

BlackRock argues that tokenization is becoming a defining trend in global finance, with real-world asset adoption surging and the industry entering a new phase of digital transformation.

The news may seem trivial at first glance, but it marks a strategic turning point for Sony. After conquering trade shows worldwide with PlayStation, the group now wants to leave its mark on a rapidly evolving sector: crypto payments. Behind the scenes, Sony Bank is accelerating, preparing a regulatory offensive, and laying the foundations for a future stablecoin, an initiative that could transform the way millions of players consume their digital content.

Flash crashes, digital dominos and states lying in wait: the IMF sees tokenization less as a revolution than as an explosive cocktail ready to blow up finance... but hush, it's bubbling.

Amundi launches its first tokenized money market fund, letting investors hold and trade fund units digitally alongside traditional channels.

Coinbase Ventures has just unveiled its investment strategy for 2026, outlining the strong points of a changing Web3 ecosystem. Nine key areas have been identified, revealing the sectors where capital could soon flow. More than a simple manifesto, this roadmap lays out the technological and economic bets of one of the most influential players in the crypto industry, a strong signal sent to developers, investors, and builders of the decentralized web.

The Real-World Asset (RWA) tokenization market is experiencing exponential growth, rising from $85 million in 2020 to $24 billion in June 2025, a 308-fold increase in three years according to the latest reports from RedStone, Gauntlet, and RWA.xyz. In this context of radical transformation of financial markets, Stobox and REAL Finance have signed a Memorandum of Understanding (MoU) to explore new technical and commercial synergies between regulated tokenization platforms and emerging blockchain networks.

Tokenized gold hits $3.9B with gold-based tokens XAUT and PAXG leading the market while stablecoin supply continues to grow.

Chainlink takes the lead in the RWA sector just as the crypto market corrects. Development data on GitHub shows a clear gap with Hedera, Avalanche and others, confirming that Chainlink establishes itself as the technical benchmark of the segment. For institutional investors, this code dominance, despite the price drop, becomes a signal hard to ignore.

BlackRock’s BUIDL Token Gains Institutional Traction as Binance Expands Support

A muted end to 2025 may be laying the groundwork for a stronger crypto breakout in 2026. Bitwise chief investment officer Matt Hougan says the absence of a late-year rally strengthens his view that next year will bring the next major upswing for digital assets.

While some are still looking for the "send" button on their crypto wallet, Singapore is about to roll out tokenized bonds in CBDC. Should we expect a subtle revolution?

XStocks has reached $10 billion in just four months, drawing over 45,000 token holders and highlighting the rapid rise of tokenized stocks.

DBS and J.P. Morgan are working together to enable seamless tokenized deposits between banks while exploring interoperability across blockchain platforms.

Growing attention to the long-delayed Fort Knox audit has reignited debate between gold and Bitcoin. Binance founder Changpeng Zhao (CZ) has once again joined the discussion, questioning gold’s verifiability while responding to long-time critic Peter Schiff. Rising interest in tokenized gold and continued market uncertainty have added fresh momentum to the conversation.