The former chief economist of the IMF, Kenneth Rogoff, accuses Bitcoin of contributing to the de-dollarization movement of the economy and weakening the supremacy of the dollar.

Trading Exchange RSS

Remittances are redefining the role of cryptocurrencies in Latin America. Amid inflation, migration, and low financial inclusion, stablecoins emerge as a concrete solution for millions of people who depend on them.

The symbolic surpassing of $100,000 by Bitcoin has pushed the total capitalization of crypto-assets beyond €3 trillion. Fueled by this momentum, the neobank bunq has launched bunq Crypto, a crypto tab alongside regular checking accounts. The service has been available since April 29, 2025, in six European countries (France, Ireland, Netherlands, Spain, Italy, and Belgium), with Germany set to follow later in the year.

JUP surged 12% on Monday with rising volume and bullish signals. Analysts believe the token could be heading toward $1.

Christine Lagarde dreams of a digital euro supplanting the dollar in global exchange reserves. The United States, on the other hand, is betting on bitcoin.

The announcement had the effect of a shockwave: Donald Trump gives his full support to the Bitcoin Act, an ambitious bill planning for the purchase of one million bitcoins by the U.S. government. Far from the usual controversies, this initiative marks a decisive turning point in the country’s economic strategy, with profound geopolitical implications.

Bitcoin: historically low fees while the price hovers around $109,430! Is this the beginning of a new bullish cycle? Analysis.

Is El Salvador stopping its bitcoin hunt? The IMF confirms the stability of reserves, but Nayib Bukele is playing hide and seek with his crypto ambitions. What will happen next?

Ethereum validators want to nearly double the network's gas limit! More transactions, but also more challenges. Find out why this choice could change everything for the future of the crypto network.

While all eyes are on the development of RWAs in the Ethereum ecosystem or on the new Ondo blockchain, Avalanche positions itself as an outsider in this market. Indeed, the investment management company VanEck has just made an investment fund available to support the growth of RWAs in the Avalanche ecosystem.

Musk leaves the government before mandatory transparency. Tesla is in free fall, X is down, he seeks refuge in his factories. Is the economy of the empire already on borrowed time?

Interoperability is the great unfinished promise of Web3. As blockchains remain siloed, MetaMask, the quintessential Ethereum wallet, makes a strong move by integrating Solana, one of the fastest and most popular ecosystems at the moment. Thanks to its Snaps technology, this technical advancement paves the way for unified management. This is a strong signal in a sector that still struggles to fulfill its promise of a seamless decentralized web, where the investor controls their assets without borders or friction.

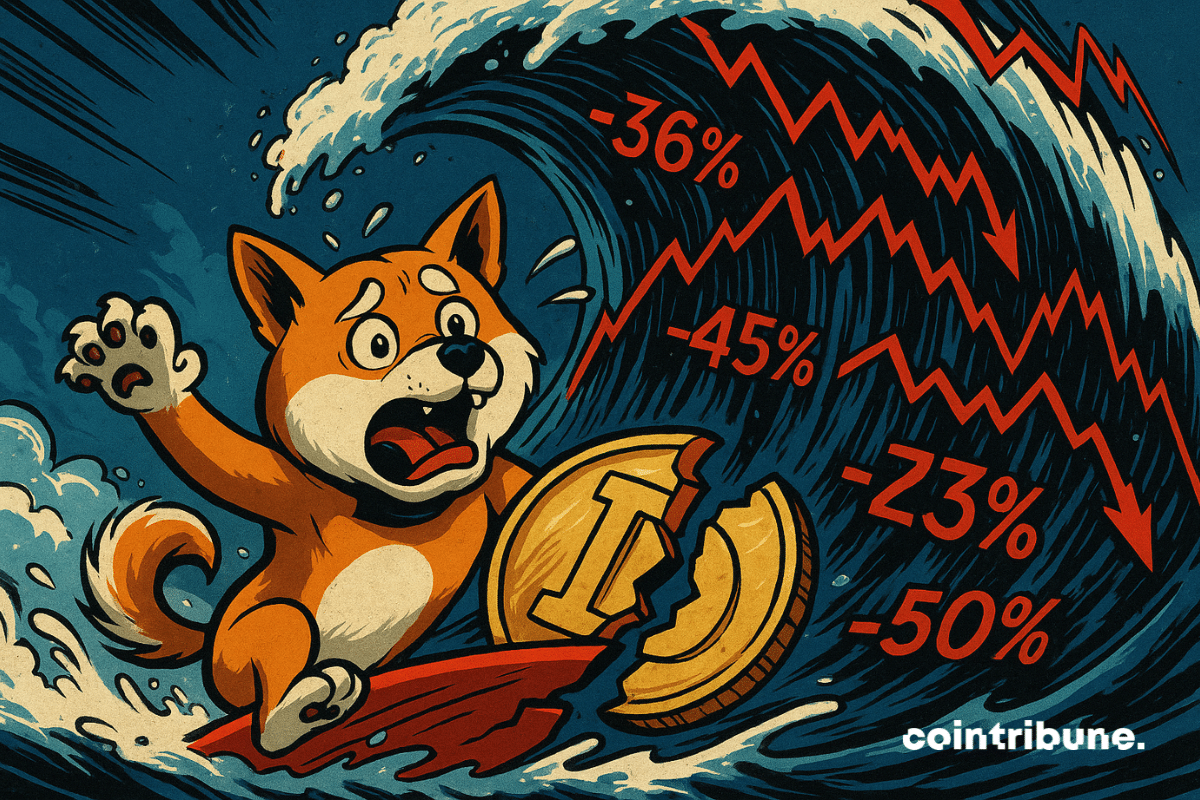

Dogecoin has just experienced a disruption that goes beyond the usual volatility of the crypto market. In one hour, the memecoin faced a liquidation imbalance of 200%, triggering a wave of losses on long positions. This unusual figure reveals far more than erratic movement. It highlights the increasing exposure of traders to relentless market mechanics. This is not an epiphenomenon, but a revealing signal of latent tension, in a climate where consolidation often conceals imminent breakages.

The French crypto sector is dragging its feet in the face of MiCA. The AMF is sounding the alarm: will you be ready before the fateful date? Find out why the race against time has just begun!

Fed meeting June 2025: inflation, unemployment, trade tensions... Discover how these crucial issues could disrupt interest rates and why some are already betting on bitcoin. Don't miss out!

After reaching a new historic peak, Bitcoin is entering a slight stabilization phase. Discover our complete technical analysis and the scenarios to watch for BTC.

Trump, the king of communication, denies a crypto fundraising. Fake news or a bluff? The behind-the-scenes of a series where nothing is really certain.

The price of Bitcoin is reaching historic peaks, but the interest it generates has never been so divisive. While some see it as a final opportunity, others question the relevance of an investment at this stage. This year, signals from financial institutions, influential investors, and the markets themselves are fueling a strategic debate: should we still buy Bitcoin, or has that train already left?

The Sui foundation expresses its support for the Cetus proposal to recover the funds stolen during the hack.

The wind is blowing strong in the crypto market, and Blockchain Group has just poured digital oil into it. The French company listed in Paris has raised no less than 72 million dollars to acquire nearly 590 new Bitcoins. A bold, frontal move, and especially unprecedented in France. While others talk about diversification, Blockchain is buying the future at face value.

A crypto revolution is underway: Binance allows live trading through its social platform. Details in this article!

How long will Japan be able to absorb the surge in borrowing rates without resorting to printing money?

Bitcoin is flirting with 110,000 dollars, but intriguing whales are playing their own game. Who will win: the impatient or the strategists? Discover this secret battle where the future of BTC is at stake!

In a crypto ecosystem where every move is scrutinized by investors, the sudden rise of XRP on the regulatory scene is intriguing. In just a few days, the likelihood of approval for a spot ETF backed by this asset has jumped to 83%, according to Polymarket. This figure, far from trivial, crystallizes a strategic turning point in the battle between the crypto industry and the SEC. More than just a speculative signal, it embodies a possible shift towards long-awaited institutional legitimization.

What if the euro finally established itself as a global reference? In Berlin, Christine Lagarde surprised her audience by asserting that the European single currency could replace the dollar as the main pillar of international reserves. Behind this bold statement, the president of the ECB outlines a clear strategy: to provide the European Union with the necessary levers to exert financial and geopolitical influence. Thus, in a reshaping world, this ambition redefines monetary power dynamics and places the euro at the center of a new global equilibrium in the making.

As Bitcoin flirts with new highs and the crypto market once again dresses in green, an anomaly strikes hard: XRP, usually in the spotlight, is experiencing an unexpected collapse in its flows. Far from the excitement energizing ADA, SOL, or even SUI, Ripple seems to be going its own way... and not in a good direction. A look back at a reshuffling that could redefine the priorities of institutional investors.

X, formerly Twitter, soon to be a bank, wallet, and exchange? Musk is betting big with X Money, the "crazy ambition" to dethrone banks… stay tuned!

Trump accelerates in crypto: raising $3 billion for bitcoin. Amid scandals and strategy, the Trump saga in blockchain continues to shake Washington.

Trump keeps the suspense going, Brussels breathes, the stock market dances. But behind the curtain, the threats still loom. Who will emerge victorious from this customs waltz?

The month of June is expected to be less eventful than May in terms of crypto unlocks. According to Tokenomist, $3.3 billion worth of tokens will be released in June, representing a 32% decrease compared to the $4.9 billion in May. Could this wave of liquidity upset the fragile balance of the market?