Grayscale shakes up certainties. In its latest report, the asset manager anticipates a new ATH for bitcoin by June 2026, breaking with the traditional four-year cycle. Against a backdrop of rising public debt, inflationary pressure, and a changing regulatory framework in the United States, this projection relies on clear macroeconomic signals. At a time when trust in fiat currencies is eroding, Grayscale sees bitcoin as a safe haven asset undergoing a structural transformation. Such a vision challenges and redefines market benchmarks.

Trading Exchange RSS

Bitcoin has outperformed most altcoins over the past three months despite a broader market pullback. As investors rotated capital toward BTC, sectors such as Ethereum, AI tokens, and memecoins recorded significantly deeper declines.

For the third consecutive week, crypto ETPs have attracted new capital, according to CoinShares. Last week, net inflows accelerated further, extending an already strong sequence after the previous two weeks. In detail, the momentum is mainly American. The United States accounts for the majority of purchases, far ahead of Germany and Canada, while Switzerland stands out against the trend with net outflows during the period.

President Trump says he will review the case of Samourai Wallet co-founder Keonne Rodriguez, raising hopes for a possible pardon.

Regulatory pressure on the US crypto sector has eased sharply since President Donald Trump returned to office. Enforcement priorities at the Securities and Exchange Commission have shifted, with crypto firms now facing far fewer legal actions than in previous years.

Italy lights the fuse: its 2026 budget, criticized by the ECB, threatens to explode bank stability and stifle an already weakened economy. Between controversial taxes and risks of rationed credit, Rome is playing a dangerous game. Why is the ECB sounding the alarm? The details shaking Europe.

JPMorgan Chase is expanding its blockchain strategy with the launch of a tokenized money-market fund on Ethereum. The product is backed by $100 million in internal capital and targets qualified investors seeking daily yield through an on-chain structure backed by short-term debt. Market observers say the move reflects clearer regulation, rising client demand, and growing interest in tokenized real-world assets.

Visa has introduced a stablecoins advisory practice to help businesses and financial institutions adopt and implement stablecoin solutions amid growing market demand.

The case quickly took a diplomatic turn. After the hacking of Upbit, one of the largest South Korean crypto exchanges, Binance finds itself at the center of a controversy: some investigators in Seoul claim that the platform only froze a small portion of the stolen funds. Binance, on the other hand, strongly disputes this version and assures it acted immediately.

MetaMask has reached a long-awaited milestone: the wallet, long associated with Ethereum, now natively supports bitcoin. The announcement was made official on December 15, 2025, with the promise of further blockchain integrations in 2026.

Despite strong institutional demand and nearly a billion dollars injected into XRP ETFs, the token fell below the symbolic $2 threshold. While incoming flows multiply, the spot market remains under pressure. This divergence between fundamentals and price is striking. Why is XRP falling while major investors are buying? Between a bullish signal and technical fragility, the market seems divided. Such a situation complicates reading the upcoming trends.

Tom Lee and BitMine strike hard: 320 million dollars in Ethereum added in one week, despite a volatile market. A risky or visionary strategy? While ETH is breaking transaction records, BitMine bets everything on its crypto treasury.

Algorithms decide what we see, but according to which rules? Vitalik Buterin, co-founder of Ethereum, directly challenges Elon Musk and denounces the opacity of X (ex-Twitter). In a context of mistrust towards centralized platforms, he proposes a radical alternative: auditing X’s algorithm thanks to blockchain and ZK-proofs. A strong stance that revives the debate on the governance of social networks in the Web3 era.

Bitcoin falls, Saylor buys. Two billion injected in two weeks, while the market panics. What if, after all, the crypto oracle wore a tie and sold shares?

Bitcoin suddenly dropped to 86,700 dollars on Monday, December 15, triggering more than 210 million dollars in liquidations in one hour. This rapid and unexpected move surprised the market, recalling the strong vulnerability of cryptos to volatility and economic tensions.

In 2025, Nvidia is no longer just a capitalization machine. The company has found another acceleration, this time political. Donald Trump, against part of his own camp, chose to open a very costly door for it.

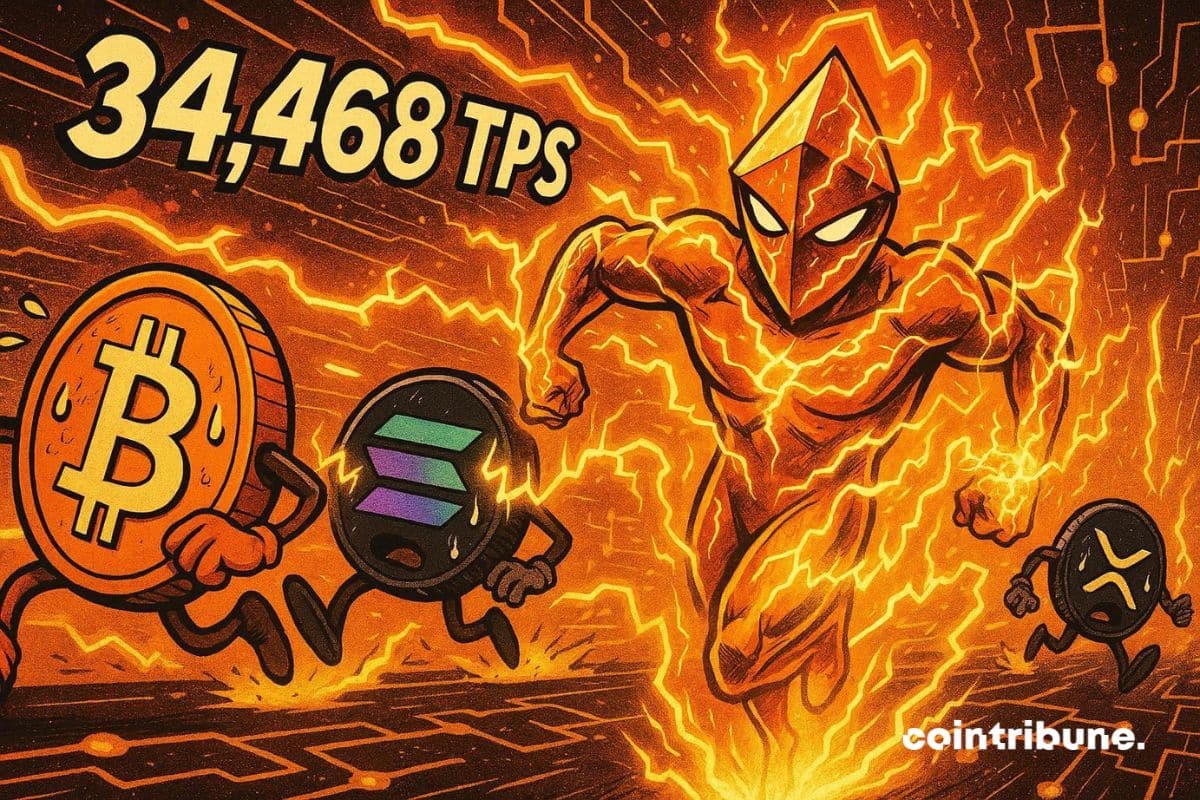

Ethereum just made a thunderous impact in the crypto world: 34,468 transactions per second, a record that shatters everything that existed so far. Thanks to Layer 2 and ZK-Rollups, the blockchain proves it is ready for mass adoption. But how will this record affect the price of ETH in 2026?

During his notable appearance on The Joe Rogan Experience on December 3, 2025, Jensen Huang delivered a striking assessment. The head of Nvidia (NVDA), now the world's most valuable company at $4 trillion, considers artificial intelligence to be a new industrial revolution. But this revolution comes with major security challenges.

Experts warn that advances in quantum computing could one day threaten Satoshi’s Bitcoin, potentially affecting market prices while the majority of coins stay protected.

Kevin Hassett, a leading contender to chair the Federal Reserve (Fed), said the central bank would remain independent even if it faces pressure from the White House. His remarks come as financial and crypto markets watch closely for signals on interest rates and the future path of U.S. monetary policy.

Bitcoin at $180,000 in 2026? Not so fast, according to Barclays. While some analysts predict a historic bull run, the British bank anticipates a bleak year for crypto. Between caution and optimism, who is right?

Bitcoin increasingly moved independently from US stocks in the second half of 2025. While equities benefited from rate cuts and strong earnings, Bitcoin entered a correction after its October peak, highlighting a clear market divergence.

BONK continues to face steady selling pressure, with price action offering no clear signs of a rebound. Recent moves reflect hesitation rather than strength, leaving traders cautious. As expected, the market remains without a clear direction, and volatility stays muted.

The stablecoin market hits a historic milestone. For the first time, these fiat-backed cryptos surpass $310 billion in capitalization. A performance that cements their role as an essential pillar in the crypto ecosystem.

The Bank of Japan is about to break with three decades of accommodative monetary policy. An almost certain rate hike puts markets under pressure. Contrary to usual expectations focused on the Fed or the ECB, it is Tokyo that worries. For bitcoin, the prospect of a stronger yen and the drying up of the carry trade revives fears of a liquidity shock. In an already fragile market, this pivot could redefine short-term balances.

While markets remain under pressure, bitcoin is moving in an unusual calm. Stuck around 90,000 dollars, the asset shows volatility at its lowest. For several analysts, this phase of stagnation signals a major movement to come. Technical signals converge towards an imminent range breakout.

The XRP market shows encouraging signs as retail investor optimism reaches new highs on social platforms. Meanwhile, exchange-traded funds linked to this crypto continue an impressive streak of capital inflows.

Ethereum faces short-term volatility but shows strong long-term potential, with intrinsic value projected to reach trillions as the network grows.

Crypto companies are returning to public markets after several years on the sidelines. Listings in 2025 reflected renewed confidence following a prolonged slowdown. The larger test, however, still lies ahead. White & Case partner Laura Katherine Mann says 2026 will determine whether crypto IPOs can maintain investor trust beyond market cycles.

One week after the launch of the new version of Read2Earn, Cointribune steps up the pace. This time, the program is enriched with a special quest in partnership with the crypto exchange Kraken, one of the most recognized players in the sector. Objective: to help you better understand how to invest in crypto with complete peace of mind, while giving you access to an exclusive contest with rewards at stake.