Bithumb erroneously distributes billions in bitcoin instead of a few wons… then recovers in 48 hours. Is it genius or just a big keyboard cold?

Trading Exchange RSS

Bitcoin tries to catch its breath after a spectacular plunge. Fallen to 59,930 dollars, the king of cryptos is trying today a difficult return around 70,000 $. However, is this recovery sustainable or is it just a respite before the next shock?

The largest holders of Ethereum are changing strategies and accumulating ETH at a frantic pace. After the recent dip below $2,000, could these massive moves signal a historic rebound? Between technical analysis and expert predictions, here’s why the crypto market is holding its breath.

U.S. spot Bitcoin exchange-traded funds (ETFs) showed signs of stabilization on Friday after several days of sustained selling pressure. The rebound was led by BlackRock’s flagship product, even as the broader crypto market continued to experience sharp price volatility. While inflows returned, recent data indicate that investor sentiment remains cautious, with market participants closely monitoring ETF flows for signals on near-term direction.

Beijing has just clarified its position in a radical way. The People's Bank of China formally bans the issuance of stablecoins backed by the yuan and tokenized assets, for both Chinese and foreign companies. A red line now established.

The Bitcoin network has just absorbed a major technical shock. Its mining difficulty has dropped by 11.16%, the biggest decrease recorded since the mining ban in China in 2021. This sharp decline, revealing structural tensions, renews concerns about the system's robustness and the growing pressure on mining companies. While difficulty is supposed to guarantee protocol stability, its current plunge acts as a silent warning about the network's real state and the resilience of its infrastructure.

Markets are holding their breath ahead of the next Fed meeting with a possible monetary turning point as early as March. As inflation slows and the political context becomes more complex, an unexpected signal is gaining strength. According to CME data, more than 23% of traders are now betting on a rate cut. This shift in sentiment, still a minority but growing, could well reshuffle the cards.

The sudden drop in bitcoin and Ethereum triggered a series of historic liquidations on Coinbase, exposing a major vulnerability in crypto lending. Within hours, millions of dollars in collateralized loans were wiped out, revealing the limits of a system designed to withstand shocks. This new episode of tension, far from anecdotal, calls into question the robustness of financing mechanisms backed by cryptos.

While the crypto fear index reaches historic highs, Metaplanet's CEO displays a disconcerting calm. Simon Gerovich brings up Buffett's philosophy to encourage investors to do exactly the opposite of the crowd: buy when everyone is selling. A bold stance as his company continues accumulating bitcoin despite the storm.

On February 9, 2026, MegaETH will officially launch its mainnet, promising a revolution for Ethereum. With ultra-fast crypto transactions and rewards for early adopters, discover how to position yourself today to maximize your gains.

I'm shocked! A Korean exchange mistakenly offers 44 billion in bitcoin. The price plummets. Regulators choke. And trust? Evaporated.

Ethereum has just lost 40% of its value, but Tom Lee sees a rare opportunity in it. Between historical parallels and technological potential, this drop could well mark the beginning of a spectacular rebound. Should you seize the opportunity or stay cautious?

The EU has found TikTok’s features addictive and is calling for platform reforms, with potential fines if changes are not made.

Zcash has entered a prolonged pullback after a strong run late last year. Prices have fallen sharply since November, erasing gains that once made the token a market leader in 2025. At the same time, activity from a key corporate holder has slowed, raising questions about near-term demand. Elsewhere in crypto, other treasury firms continue to buy despite heavy paper losses.

Bitcoin has just crossed a critical threshold that changes the game. According to CryptoQuant, the break of its 365-day moving average is no longer a mere technical signal: it marks the clear entry into a new bearish cycle. This slide occurs in a context of institutional demand withdrawal and degraded on-chain signals. The bullish momentum now seems behind, replaced by a market dynamic structured around caution, watchfulness... and the risk of prolonged decline.

In the space of 24 hours, bitcoin recorded nearly 900 million dollars of realized losses, a level never seen since the collapse of FTX in 2022. This chilling figure, from on-chain data, illustrates much more than a simple drop, but marks a brutal turning point in investor sentiment. Such a massive and sudden wave of loss-making sales signals a new phase of capitulation, revealing the persistent fragility of a market still far from regaining its balance.

Bitcoin bounced back on February 6, crossing 70,000 $ again after falling below 60,800 $ a few hours earlier. This stunning recovery, amid extreme volatility, occurs in a market shaken between bullish hopes and selling shocks. Should this be seen as a simple technical rebound or the beginning of a lasting reversal?

Metaplanet continues its Bitcoin purchases and intrigues investors facing a pressured market. More details in this article!

European companies developing tokenized securities are urging EU lawmakers to act quickly, warning that existing rules are stalling growth in regulated on-chain markets. Industry participants argue that prolonged delays could divert capital and trading activity to the United States, where tokenization is advancing under established market frameworks. These calls come ahead of a parliamentary debate on the future of Europe’s digital market infrastructure.

Bitcoin plunges into the abyss, but BlackRock acts as savior with its ETF, displaying record volumes. Coincidence or strategy? Investors cling, hoping for an unlikely recovery.

Strategy reported a $12.6 billion Q4 loss as Bitcoin prices fell sharply, marking one of the largest quarterly losses for a U.S. public company.

While Bitcoin collapses below $65,000, Binance surprises the market by investing $233 million in 3,600 BTC. A bold decision that divides experts: some see it as a strong signal of confidence, while others believe the disappearance of Bitcoin would make the world better. Between opportunity and risk, how should investors react?

In the fourth quarter of 2025, Tether's USDT recorded historic on-chain activity, with 4.4 trillion dollars transferred and 2.2 billion transactions. While the overall cryptocurrency market underwent a sharp contraction, the USDT market cap reached a record 187.3 billion dollars, driven by massive retail adoption and a user base exceeding 534 million worldwide. Tether thus confirms its growing role as a stable and reliable financial infrastructure.

Two Democratic senators demand an urgent investigation into undisclosed Chinese investments in SpaceX. As Elon Musk has just merged his space giant with xAI for $1.25 trillion, Washington wonders: what if Beijing had already set foot in the most sensitive technologies of the United States?

Ether has fallen below $2,000, confirming a marked retracement phase. Indeed, the movement is accompanied by a visible disengagement of holders, an influx toward exchanges, and degraded technical signals. This threshold break tests the market structure and investor resilience.

Crypto: Aster launches its layer-1 blockchain on testnet. A new step towards a trading-oriented infrastructure. All the details here!

The crypto market has sharply declined. In a few hours, major assets lost several months of gains, bringing bitcoin, Ethereum and Solana back to forgotten levels. After the 2025 momentum, investors hoped for consolidation. Instead, a wave of panic took over. More than 2 billion dollars were liquidated, revealing an atmosphere of extreme fear. The entire ecosystem is affected, from tokens to listed stocks, indiscriminately.

Gemini, the crypto exchange founded by the Winklevoss brothers, exits international markets, downsizes, and now bets on prediction markets, a booming sector, with a risky but strategic wager.

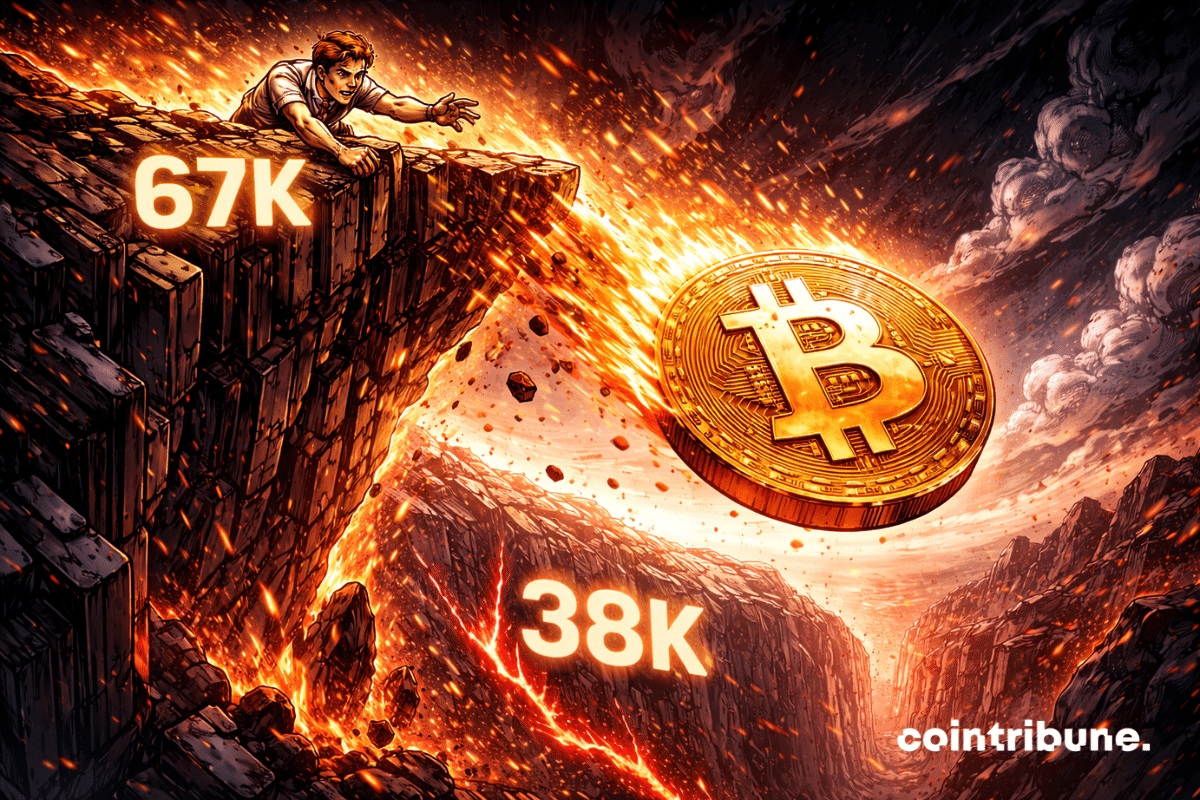

Bitcoin wavers below 67,000 dollars and concern is rising. In an already fragile context, Stifel bank issues a severe warning: a return to 38,000 dollars is now possible. Such a retreat, over 40% decline, would far exceed usual corrections. This scenario, supported by technical and macroeconomic signals, brings crypto market volatility back to the forefront. And this time, it is no longer a mere warning.

Washington on loop mode: crypto lobbies offer keys to local banks, but the Senate still hesitates. Towards an unlikely alliance to save the law? To be continued...