While the market remains struggling, another transformation, more discreet but decisive, is taking shape. In this new year, bitcoin will no longer seek to charm traders. It will integrate, step by step, into the real economy. If the price falls, usage, however, progresses. A pivotal year is opening, where the price drop contrasts with the silent rise of payment technologies. BTC no longer waits for the next bull run to exist: it finally becomes a daily tool.

Transaction

Momentum around Coinbase is rising as the company enters a new phase of financial stability and public-sector experimentation. Latest data show revenue increasing while costs remain controlled. And as expected, this combination has created a sturdier foundation than in earlier market cycles.

Bitcoin is close to volatility indigestion, its Sharpe Ratio is falling, and whales are salivating. Should you buy when everything collapses? Here is a crypto puzzle worthy of a financial noir novel.

Cash App is preparing one of its biggest updates yet as parent company Block sets a timeline to add stablecoin operations to the platform. New tools for both Bitcoin and digital dollar payments are being prepared for rollout, with early 2026 cited as the target window. Essentially, Block is pushing to expand access to digital payments while keeping Bitcoin at the center of its ecosystem.

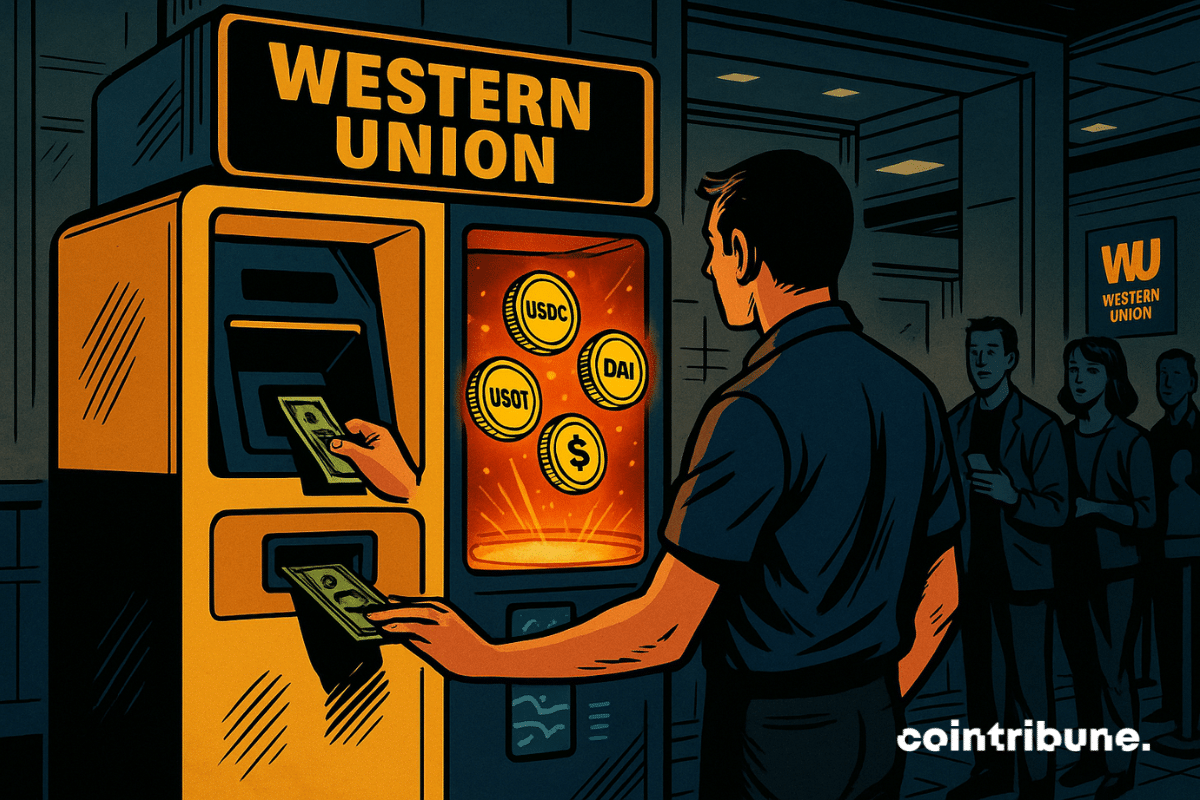

Facing the rise of crypto solutions, Western Union is undergoing a major transformation. The company is piloting the use of stablecoins for its cross-border settlements. Present in more than 200 countries, it aims to modernize its financial flows for 150 million customers. This shift, far from symbolic, reveals a clear desire to adapt to a new era where speed, cost reduction, and decentralized infrastructures redefine the standards of international transfers.

When Solana attacks Ethereum at the throat: Yakovenko reveals the dubious backstage of Layer-2s. Behind the security promises? Omnipotent multisigs and bridges with shaky trust.

Coinbase, the well-groomed crypto exchange, is cooking up a Base token. JPMorgan sees billions there. Should we worry when banks applaud tokens they do not control?

Cardano has just crossed 115 million on-chain transactions. Remittix, for its part, opens its testing phase for a wallet designed for cross-border payments. Two distinct pieces of information, but indicative of a common trend: the growth of concrete uses in an ecosystem long dominated by speculation. Far from theoretical promises, these projects illustrate a shift towards measurable, functional, and user-oriented applications.

While cryptos are in turmoil, Elon Musk moves 133 million in bitcoin without a word: secret plan, space whim or just portfolio management? Mystery at the top.

Wall Street trembles, BlackRock applauds, and the dollar digitalizes without asking the Treasury's opinion… Stablecoins are taking hold, while crypto weaves its planetary monetary web.

Bitcoin v30 expands OP_RETURN, triggering technical discord: between ambitious modernity and betrayal of roots, the protocol's core heats up faster than a saturated node!

BNB touches the heights while the US government stalls. Record, Kazakh investors and low-cost transactions: Binance fears neither shutdown nor speculation. A crypto that doesn't fall asleep!

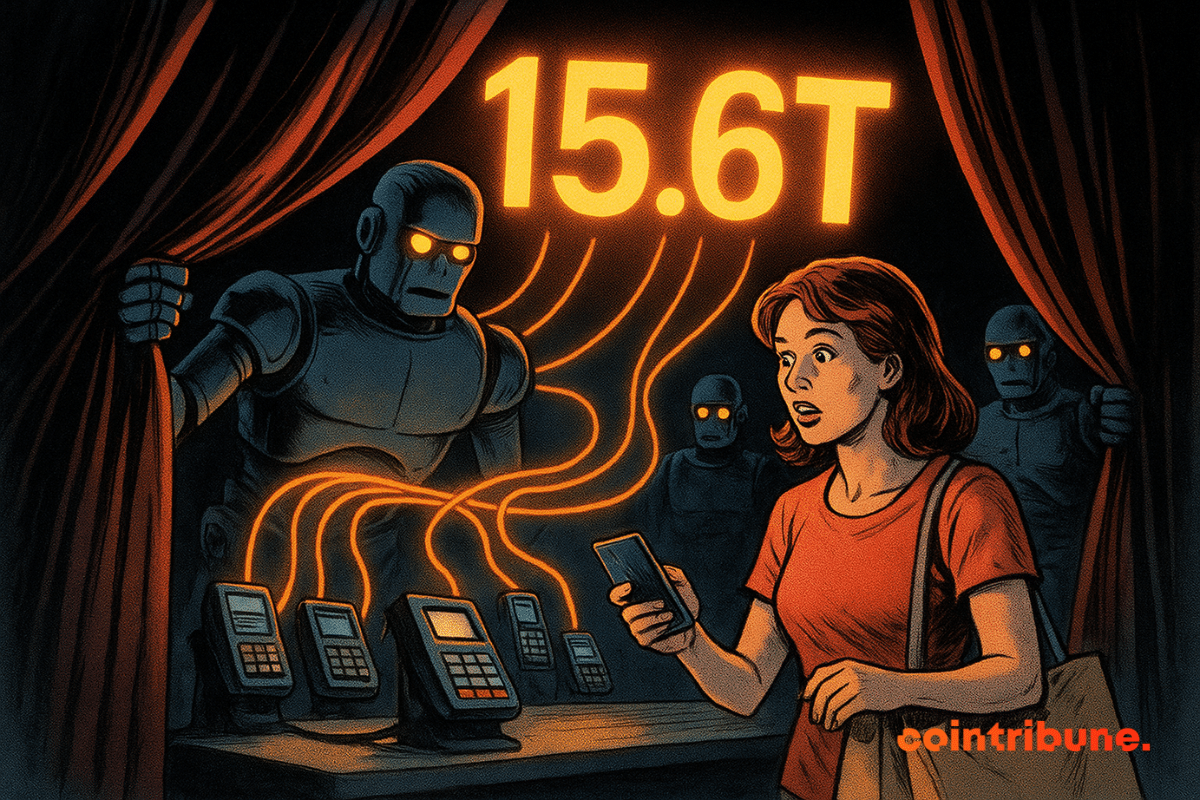

Stablecoins had their busiest quarter ever in Q3 2025, with transaction volumes hitting record highs. However, a new report reveals that much of this activity came from bots rather than individual users. At the same time, small retail transfers surged to unprecedented levels, highlighting stablecoins’ dual role as a trading tool and an emerging option for everyday payments.

While Europe accelerates towards digital payments and prepares the digital euro, the ECB creates a surprise. It recommends keeping cash at home. This injunction reveals a reality too often overlooked in official speeches: the fragility of digital systems in the face of crises. Such a deliberate return to cash does not mark a step backwards, but a clear anticipation of systemic risks, between outages, geopolitical tensions and cyberattacks.

The crypto ecosystem has just suffered one of the most sophisticated attacks in its history. A "crypto-clipper" injected via compromised NPM modules quietly diverts wallet addresses during transactions. How did this breach escape security radars?

August was marked by two opposing signals in the crypto market. Ethereum reached an unprecedented peak of activity, confirming the growing interest of investors in its ecosystem. Conversely, Bitcoin suffered a brutal shock after the massive liquidation of 24,000 BTC by a single actor. This contrast is not just a technical divergence. It illustrates an ongoing rearrangement, between regulatory innovations, strategic repositioning of players, and the evolution of the balance of power between major assets.

Behind Bitcoin's apparent stability, an imbalance threatens the network's sustainability. Since April, transaction fees have dropped by more than 80%, shaking the remuneration model of mining companies. Amid the rise of ETFs and after a demanding halving, it is Bitcoin's internal economy that is faltering. Lower fees, fewer incentives, more risks to protocol security, the crisis is here, structural, and raises a question the ecosystem can no longer ignore.

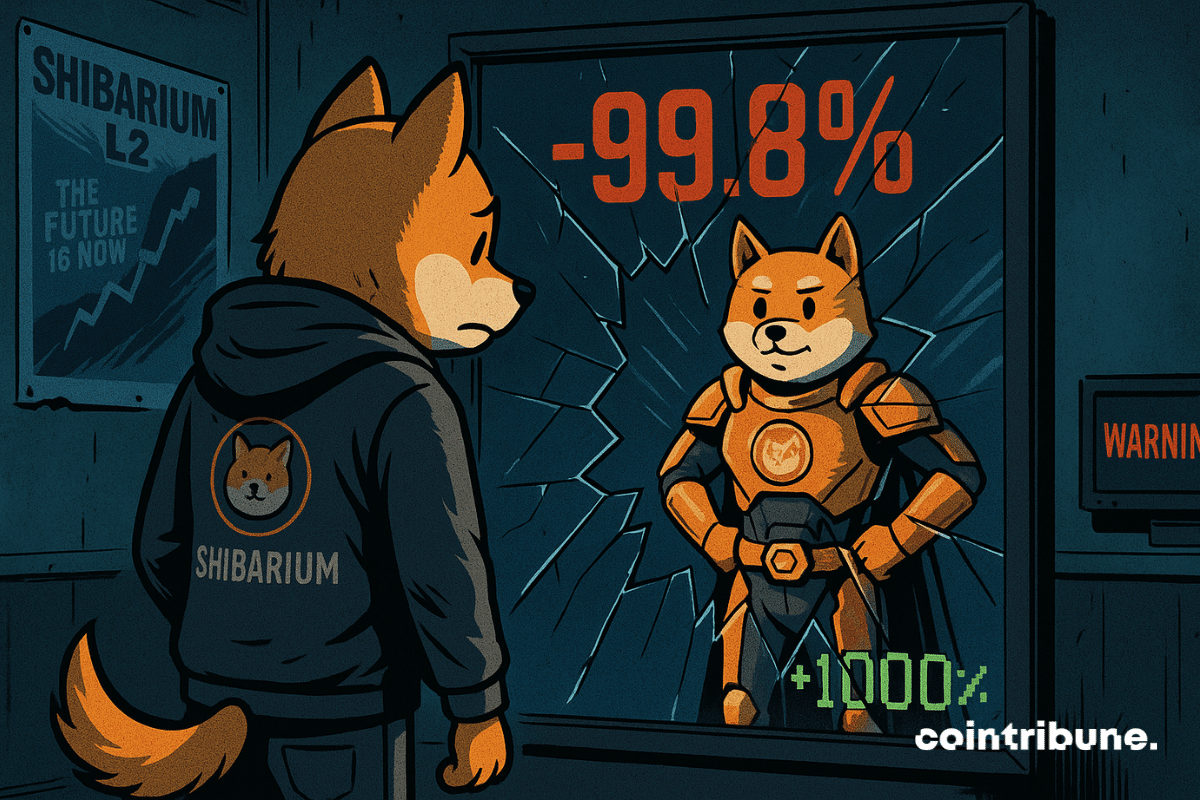

Shibarium collapses. In ten days, the daily transactions of the Shiba Inu layer 2 blockchain dropped from 4.8 million to less than 10,000, a fall of 99.8%. This is not a slowdown, but a brutal stop. Launched a year ago as the engine of the SHIB ecosystem, the network is facing a spectacular loss of momentum. In a lethargic crypto market at this end of August, this plunge raises questions about the real adoption of this project, which is nevertheless highly exposed in the media.

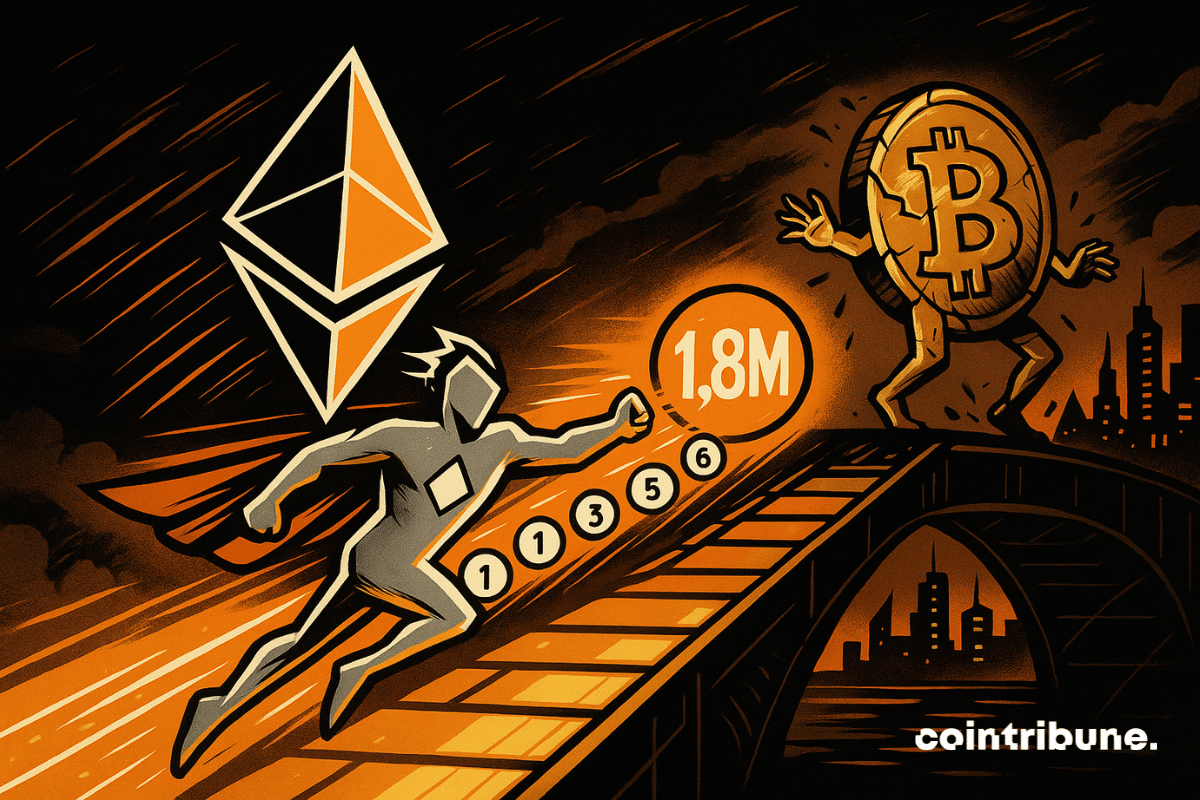

While the market oscillates between technical consolidation and the return of institutional appetite, an extraordinary movement attracts all attention. An actor holding more than 5 billion dollars in bitcoin redirects a major part of its capital towards Ethereum. The scale of the amounts, the transparency of on-chain transactions, and the timing of the operation are striking. More than a simple arbitrage, this strategic repositioning seems to redraw the power relations between the two historical pillars of the crypto universe.

Bitcoin clears the space around it: small ones slip away, the big ones get richer. Meanwhile, the network coughs, fees drop, and ETFs flee.

Since touching a daily high of $24.74 on August 13, Chainlink’s (LINK) northward price movement has cooled, pushing the asset a few levels lower. Despite LINK’s upward trend stalling, large holders are still accumulating the coin. Generally, these whale buyers view this slip as a “buy the dip” window for a potential next leg higher. So, what are the current bets regarding LINK’s future trend?

Grayscale eyes a Cardano ETF, prices soar, and traders speculate. But will ADA be able to maintain its top position or will it fall victim to its own crypto success?

The future of stablecoins is taking shape in this colorful and often unpredictable world of cryptos. Records are breaking one after another, driven by massive adoption and piling innovations. And while some see it as a simple fad, others bet that this wave will not stop anytime soon. The numbers speak for themselves... and they have rarely been so eloquent.

Panic on the crypto planet: panicked whales, small holders bleeding. And Binance picking up BTC like it's raining. Bitcoin itself looks grim…

Bitcoin is playing hide and seek with $120,000: Galaxy is balancing tons, the market is panting, but the whales are sharpening their harpoons to come back stronger.

Ethereum hits the gas accelerator... but who will stay the course? A small journey through ambitious technology, elitist blockchain, and scaling promises more slippery than a snake on RAM.

Ethereum is sprinting in Web3: zkEVM, secret clients, and proofs in 10 seconds… Meanwhile, rivals are taking a nap and Vitalik is adjusting his stopwatch.

On July 4, 2025, a Bitcoin wallet that had been inactive since 2011 suddenly moved 80,000 BTC, worth $8.6 billion. The transaction, eclipsing all previous records, is as intriguing as it is fascinating. No words, no announcements, just a massive movement captured by the blockchain. Both rare in its volume and exceptional due to the age of the funds, this act by an anonymous holder raises questions about the hidden dynamics of the market and the intentions of large whales.

While the old hands cash in their winnings, Bitcoin is performing acrobatics: it wobbles, balances, and might even leap. The suspense continues, hats off to the moles.

Polkadot aimed to become the backbone of Web3. However, the latest figures reported by Messari for the first quarter of this year reveal a sharp decline: decreased activity, falling users, and dropping market capitalization. While other ecosystems consolidate their traction, Gavin Wood's project struggles to fulfill its promises. The contrast between the network's advanced technical architecture and its low adoption fuels doubts: can Polkadot still embody the decentralized future it claimed to want to build?