World Liberty Financial (WLFI), the crypto venture co-founded by Eric Trump and Donald Trump Jr., has taken a major leap into the spotlight. On Wednesday, the brothers joined a Nasdaq bell-ringing ceremony in Times Square, celebrating a $1.5 billion token arrangement that could push their firm into the upper ranks of decentralized finance.

Wall Street

American indices continued their rise, boosted by July inflation below forecasts. This macroeconomic signal propelled expectations of a Fed rate cut as early as September, now almost certain in investors' eyes. Driven by this momentum, optimism also spreads to the crypto market and Asian tech giants, drawing a global movement where macroeconomics, traditional finance, and DeFi advance together.

For years, Ethereum has been a big player in crypto. But it has always struggled to win over Wall Street. Now, a new group of treasury companies may have cracked the code to make ETH more palatable to traditional investors.

When Jack Dorsey injects Bitcoin into Wall Street, stock indices tremble... and the bankers, they sweat. Block, a crypto pioneer, enters the S&P 500. Just like that.

Wall Street flirts with a cypherpunk: 30,000 bitcoins, a SPAC, an impatient heir, and a wink to Satoshi. The question remains who will press the button...

While Wall Street counts its points, Bitcoin takes the prize, ridicules the S&P 500, and shoots at full speed into the coffers of a stunned BlackRock. Who would have believed it?

When ETFs fill up like broken pockets and bitcoin breaks through the ceiling, traditional markets wonder: have cryptos become acceptable to the suit-and-tie crowd?

Wall Street's offensive knows no bounds. In less than a year, spot Bitcoin ETFs have captured a quarter of the global trading volumes of the flagship cryptocurrency. This spectacular breakthrough is reshuffling the cards between traditional finance and native crypto platforms, revealing a profound transformation in the sector.

As the U.S. federal debt has just crossed the staggering threshold of $36 trillion, Larry Fink, CEO of BlackRock, warns: without a significant rebound in growth, the world's most powerful economy risks hitting a fiscal wall. Behind this alert lies an explosive equation involving chronic deficits, political inertia, and increased dependence on foreign investors.

Circle makes a splash on the stock market! The issuer of USDC aims for 7.2 billion dollars for its IPO. Massive support from BlackRock, oversized ambitions, regulated crypto model... this entry to Wall Street could redefine the rules of the game. So, revolution or absorption?

When Kraken gives wings to Wall Street: US stocks on the blockchain, without schedules or borders, while traditional finance counts its hours and intermediaries... Guaranteed suspense.

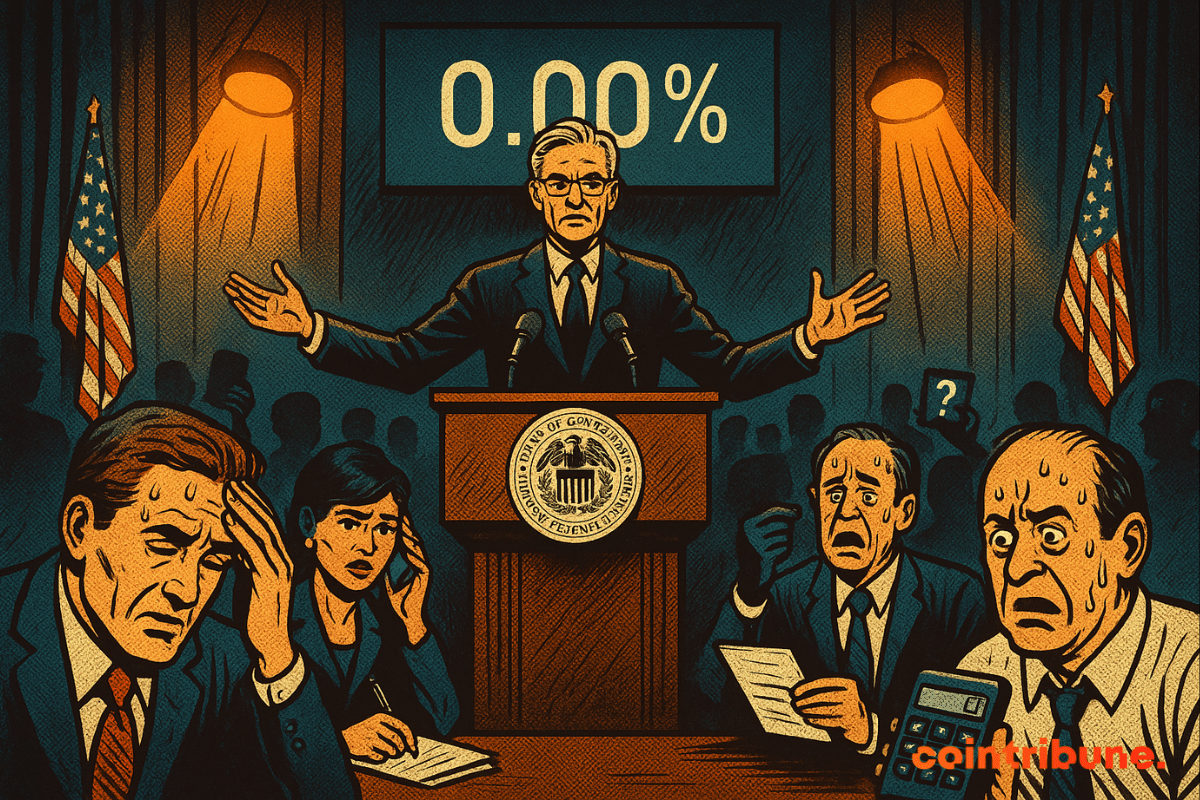

When the Federal Reserve opts for inaction, markets wobble. By keeping its rates unchanged this Wednesday, the world's leading central bank met expectations but did not alleviate tensions. Thus, amid persistent inflation, slowing consumption, and uncertainties about employment, the Fed's message remains deliberately vague. This strategy of waiting increases the nervousness of financial markets and fuels speculation, particularly in the crypto world, where every word of Jerome Powell is scrutinized as a crucial indicator.

Buffett leaves the ship in the middle of a storm, handing the helm to Abel and a fortune along the way. And he continues to preach discipline, even surrounded by flames, debts, and burning cryptos.

Ripple, which wanted to acquire Circle for 5 billion, got the door slammed in its face. Result: a duel of stablecoins where USDC does not intend to let itself be overshadowed.

Global stock markets are plunging with significant losses on Wall Street and internationally. This drop, exacerbated by economic uncertainty, falling oil prices, and the trade war between the United States and China, raises questions about the short-term outlook for financial markets.

According to a recent analysis by Bloomberg Intelligence, several large publicly traded American companies may soon adopt bitcoin as part of their cash reserves, in response to growing economic uncertainties.

On Monday, April 21, 2025, a remarkable divergence appeared in the global financial markets. While American stocks were experiencing a sharp decline, the crypto sector showed impressive resilience, gaining 60 billion dollars in capitalization.

While Trump plays the customs officer, Tesla wavers, Alphabet holds firm, and Wall Street takes on water. The markets, on the other hand, brace for the next presidential tweet.

The financial landscape is in turmoil. While Bitcoin, often criticized for its legendary volatility, goes through a phase of relative stability, the S&P 500 is surging like a speculative asset. Ironically, Wall Street's flagship index, a symbol of traditional finance, is now rivaling the unpredictability of memecoins. A role reversal that questions certainties and redraws the boundaries between risk and security.

Trump's new taxes destabilize the markets. What are the consequences for the American economy? The full analysis here!

A historic day on Wall Street: on April 4, 2025, American markets lost $3.25 trillion, more than the total market capitalization of crypto. This brutal drop, triggered by tariff measures from Trump, reveals a deep crisis. Bitcoin, however, endures. An analysis of an economic shift.

Bitcoin shows a surprising resilience in the face of market collapse. While gold retreats, it rises alone toward $100,000, fueled by a breakthrough narrative.

Donald Trump is once again making his mark at the helm of the United States. By launching a vast tariff offensive against almost all of the country's trading partners, the president is triggering an economic and diplomatic earthquake. Wall Street is falling, allies are worried, and Beijing is retaliating. This decision, as much strategic as ideological, marks the overt return of hard protectionism and places American economic sovereignty at the center of the global game.

Under a heavy fiscal sky, cryptos and stocks waver. Trump's "Liberation" resembles a storm. The wind shifts, and hopes dwindle, one tweet after another.

While the stock market stumbles, gold dances on the ashes of commercial promises. Trump stirs the embers, the Fed holds its breath in this theater of golden uncertainty.

Under the neon lights of Wall Street, History seems to stutter. The stock market stumbles, drunk on speculation, while the old crashes smile in the wings, ready to take the stage again.

Money migrates, silent and methodical. Wall Street, once untouchable, sees its throne wobble under the hurried steps of investors, captivated by a Europe shining with trillions.

Crypto ETFs are crashing down like an uncontrollable wave. Avalanche joins the dance, but history has taught us that markets sometimes have a short memory... and a brutal correction.

Financial and crypto markets continue to experience severe declines as investors await inflation data and the FED's decisions. Despite favorable regulatory advancements, Bitcoin and Ethereum are falling, in hope of a relief that will certainly come from the upcoming CPI and FOMC data. But what will it really be?

Bitcoin (BTC) fell to $78,000 this Monday, losing 4% on the day, as stock markets plummet. According to recent crypto data, the BTC/USD pair hit $79,170 on Bitstamp, continuing a downward trend that began before the weekly close. What's next for Bitcoin?