BIS Backs The Fed, Sounds Alarm On Global Economic Risks

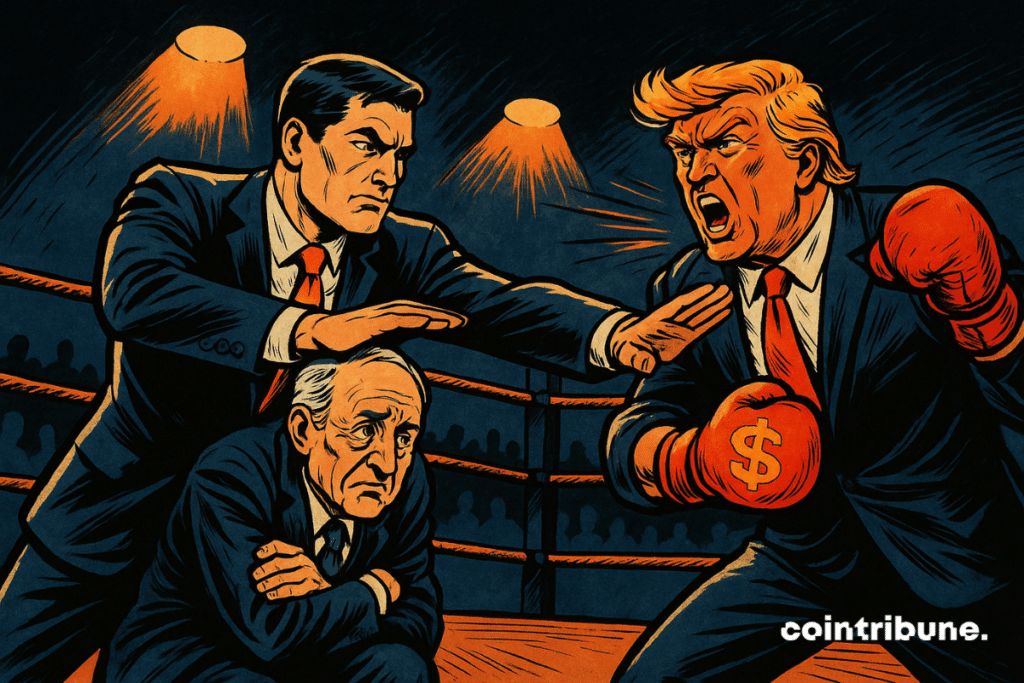

For several weeks, Donald Trump’s statements against the current Fed Chairman Jerome Powell have been causing turmoil in the financial markets. This unprecedented pressure prompted the Bank for International Settlements (BIS) to intervene publicly. The goal: to defend the independence of central banks, a crucial pillar for the stability of the global economy.

In Brief

- The BIS warns about political risks threatening the independence of global central banks.

- Trump’s attacks on Powell weaken financial stability and the global economy.

BIS: Last Barrier Against Political Risk on the Global Economy

In its annual report published Sunday, the BIS warns about the growing risks of political interference in the management of interest rates. Without directly naming Donald Trump, the Basel-based institution emphasizes the vital role of an independent monetary policy. According to it, a central bank must be able to do what it deems necessary, even if it does not align with the government’s wishes.

More explicitly, recent tensions stem from Trump’s verbal attacks on Powell. The latter called the current Fed Chairman a “beast” and “stubborn” on the Truth Social network. The American president indeed wants a rapid rate cut, despite persistent inflation and the uncertain impact of tariffs. These pressures undermine financial stability and generate worrying volatility for investors.

In this regard, the BIS highlights in its report that central banks face a “delicate trade-off.” The dilemma? Support economic growth through low rates or preserve monetary value in the face of growing public debt.

What Impact on Cryptocurrencies and the Real Economy?

The attack against the Fed’s financial independence does not only concern the United States. It could also disrupt the global economy, including crypto markets.

A Fed subjected to political power would actually create a dangerous precedent, threatening the credibility of economic measures. For holders of bitcoin or digital assets, this uncertainty could reinforce the thesis of a safe-haven asset outside of the classic monetary system.

Conversely, an economic crisis triggered by a loss of confidence in the Fed could also cause a general decline in risky assets. It will thus depend on the ability of central banks to resist political pressures and to navigate through this phase of economic uncertainty.

The BIS therefore plays the caution card to protect the global economy. Faced with Trump’s ambitions, monetary independence could well become one of the major geopolitical issues of 2025.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

My name is Ariela, and I am 31 years old. I have been working in the field of web writing for 7 years now. I only discovered trading and cryptocurrency a few years ago, but it is a universe that greatly interests me. The topics covered on the platform allow me to learn more. A singer in my spare time, I also cultivate a great passion for music and reading (and animals!)

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.