Weekly recap: Bitcoin, Binance, Ethereum, Solana... crypto news you shouldn't miss!

From revolutionary announcements, technological evolution, and regulatory turbulence, the crypto ecosystem continues to prove that it’s a territory of limitless innovation and a field of regulatory and economic battles. Here is a summary of the most impactful news from the past week concerning Bitcoin, Ethereum, Binance, Solana, and others.

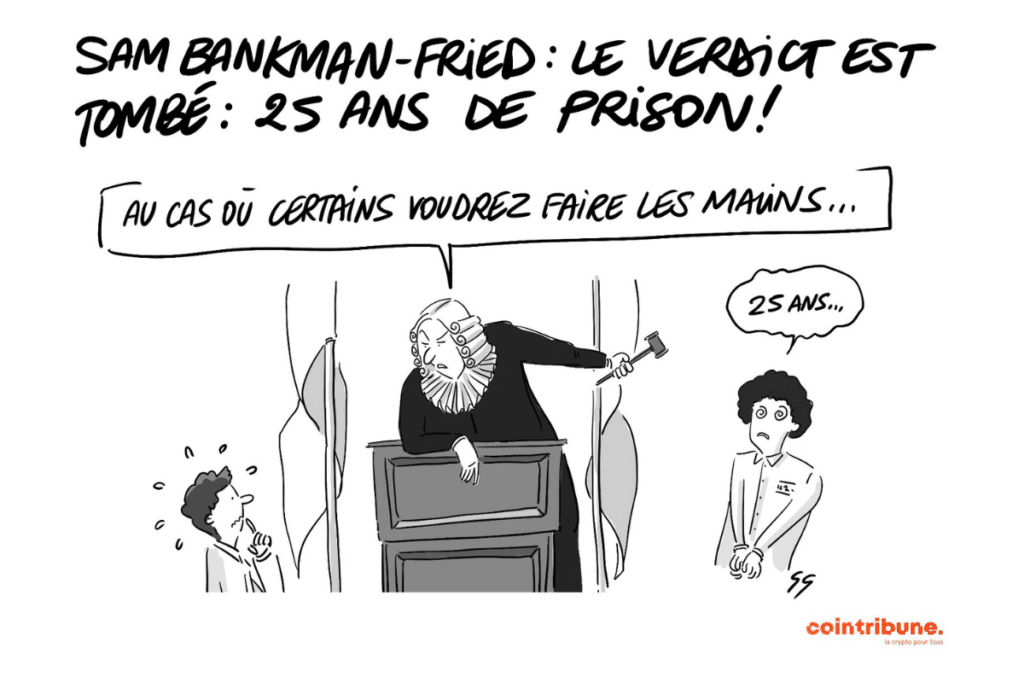

Verdict for Sam Bankman-Fried: 25 Years in Prison

Sam Bankman-Fried, the former CEO of FTX, has been sentenced to 25 years in prison, a sentence that concludes one of the most significant financial scandals in modern finance. This sentence results from a fraud of exceptional magnitude, with estimated losses of over 10 billion dollars for investors and clients of FTX. Prosecutors highlighted the complexity and boldness of the fraudulent schemes devised by Bankman-Fried and the profound impact of his actions on the crypto industry.

Despite this severe conviction, the case is not yet fully resolved. Bankman-Fried’s attorneys, believing the punishment disproportionate for a non-violent crime, are considering an appeal. This situation illustrates the gravity with which authorities intend to handle malpractices in the crypto space. Bankman-Fried’s case remains a clear warning for the sector.

Google Indexes Bitcoin Addresses: A Nuanced Advance

Google has taken a major initiative by beginning to index Bitcoin addresses, a decision that divides the crypto community. This step is seen as important towards the widespread adoption of Bitcoin because it could facilitate public access to information about this digital currency. By integrating Bitcoin addresses into its search results, Google could potentially contribute to its adoption by a broader audience.

However, this novelty also raises concerns about privacy and security. The increased visibility of Bitcoin addresses challenges the principle of anonymity, a fundamental pillar on which trust in Bitcoin is based. Voices are being raised to warn against the risks of surveillance and loss of privacy.

Spike in Fees on Ethereum: The BlobScriptions Effect

Ethereum, known for its promises of reduced fees and accessibility, is facing an unexpected rise in transaction costs due to the introduction of “BlobScriptions”. This phenomenon, triggered by the launch of the Ethscriptions protocol by developer Middlemarch, allows users to directly insert multimedia content into Ethereum’s “blobs”.

In just a few days, over 4500 BlobScriptions have been created, consuming a significant portion of the blob capacity and causing a spike in fees. The leap in costs, from almost zero to over 500 gwei per transaction, has led to many complaints and highlights the challenge of balancing innovation and accessibility, all while keeping Ethereum an attractive platform for developers and users in the face of rising fees.

China: Bitcoin ETFs About to Land

China, through Hong Kong, is preparing to welcome the first Bitcoin ETFs (Exchange-Traded Funds). This advance could mark a significant turning point for the adoption of Bitcoin in Asia, signaling growing acceptance of cryptos by regional financial regulators. The potential of such an initiative in China, particularly in Hong Kong, presents an opportunity to attract considerable investments into Bitcoin, thus favoring its valuation and legitimization in the global market.

The announcement of the imminent approval of these ETFs by the Hong Kong Securities and Futures Commission indicates a willingness to align with Western markets while boosting local investment in digital assets. Despite the substantial difference in the size of the ETF market between Hong Kong and the United States, the evident interest of Chinese investors in Bitcoin, coupled with China’s history as a major crypto mining center, suggests a significant impact on the Bitcoin market and potentially on the regulatory policies of other Asian financial powers.

KuCoin in Turmoil: Accusations of Misconduct

The crypto exchange KuCoin and its founders Chun Gan and Ke Tang, are currently targeted by serious accusations from the American justice system. They are accused of violating several regulations, including not complying with the Bank Secrecy Act and failing to adequately register their money transfer business. These allegations put KuCoin under intense legal scrutiny and risk redefining the future of the platform and its operators.

One of the most serious allegations is non-compliance with anti-money laundering standards, suggesting that KuCoin, through its negligence, might have facilitated illicit financial activities. Furthermore, KuCoin’s marketing approach, specifically targeting American customers for anonymous crypto exchanges, adds to the complexity of the charges against them.

Revolutionary Fusion in AI Crypto: FET, AGIX, and OCEAN Join Forces

In an unprecedented move, three of the leading cryptocurrency projects focused on artificial intelligence, Fetch.ai (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN), have announced their intention to merge into a single entity. This merger aims to create a super-project named ASI (Artificial SuperIntelligence) and is expected to mark a significant step towards the democratization of artificial intelligence and the challenge posed to current technology giants. The goal is to develop a decentralized AI platform, free from the control of large corporations, thereby promoting open and accessible innovation.

The new entity, ASI, plans to have a fully diluted valuation of 7.5 billion dollars, reflecting the ambition and scope of this unified project. Despite this fusion at the token level, the three projects will continue to operate independently while collaborating closely within a collective led by Ben Goertzel, the pioneer of SingularityNET, with Humayun Sheikh of Fetch.ai as its president.

Coinbase Against the SEC: A Regulatory Turning Point

Coinbase, one of the largest cryptocurrency exchanges based in the United States, just experienced a significant legal defeat against the Securities and Exchange Commission (SEC). The court granted the SEC the right to pursue Coinbase on charges centered around the platform’s staking program, which it describes as offering and selling unregistered securities. This judicial decision paves the way for a broader legal battle, likely to redefine the regulatory framework surrounding cryptos and their classification as securities.

The stakes of this confrontation are considerable, for Coinbase as well as for the entire crypto industry. On one side, Coinbase argues that cryptos do not fall under the jurisdiction of the SEC, contending that these assets constitute a new class requiring a separate regulatory framework. On the other, the SEC maintains that certain cryptocurrencies meet the criteria for financial securities and should be regulated as such. This legal battle could, therefore, deeply influence how crypto assets are perceived and regulated in the United States, with potential repercussions on global markets.

That’s the main news to bear in mind for this week. But if you’re looking for a more comprehensive recap and deeper analyses directly in your inbox, don’t hesitate to subscribe to our weekly newsletter.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more