Markets Bounce Back, But Dollar Faces Pressure From Trump and Fed Uncertainty

While American stock indices hit new records, a palpable tension persists behind the scenes of the global market. The recent upswing brought by a trade agreement between Washington and Hanoi does not erase uncertainties: unclear monetary policy, persistent tariff threats, employment slowdown… Investors are walking a tightrope between hope and disillusionment.

In Brief

- Stock markets reach new highs, but the economy sends conflicting signals.

- Trump sends mixed signals with a strategic trade deal and persistent tariff pressure.

- The dollar weakens, while gold and bitcoin benefit from growing instability.

Calm on the Surface, Turmoil Beneath

On Wednesday, the markets briefly smiled again. The S&P 500 closed at an all-time high of 6,277 points, the Nasdaq soared by 0.94%, while Apple and Tesla set the tone with strong performances. On the surface, everything seems fine.

But this market rebound masks a widespread nervousness. The euphoria was fueled by a surprise deal between the United States and Vietnam, viewed as an encouraging sign for upcoming trade negotiations. Donald Trump is playing a delicate game: announcing this deal just days before July 9, the critical date for imposing new tariffs. He blows hot and cold, nurturing hope for a compromise while maintaining pressure.

Meanwhile, employment figures surprised negatively. The ADP report reveals a loss of 33,000 private-sector jobs in June, whereas analysts expected +98,000. This chill on the labor market reignites expectations for monetary easing. The Fed finds itself trapped between a market needing a lifeline and an inflation rate still capricious.

Trump: Agent of Chaos or Timing Strategist?

Donald Trump has not lost his ability to polarize markets. Approaching July 4, he pushes his “One Big Beautiful Bill”: a massive budget bill, while launching a new tariff offensive. The deal with Vietnam, although welcomed by Wall Street, seems more a tactical counterbalance than a diplomatic shift.

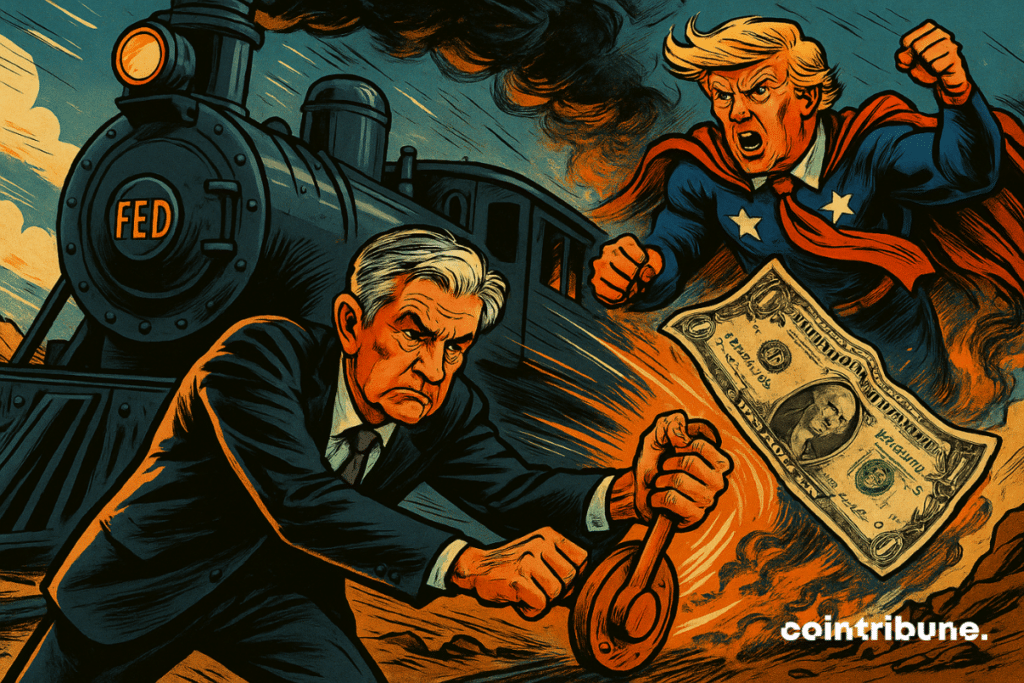

This double game creates a schizophrenic climate: investors want to believe in regained stability, but every tweet or Congressional vote can trigger a shockwave in the stock market. Divided Republican factions over the tax bill weaken the prospect of a quick vote. And Powell, Fed Chairman, sees his room for maneuver shrinking drastically.

The dollar, meanwhile, continues to wobble. Weakened by upcoming budget deficits and tariff uncertainties, it is retreating against major currencies. Bond markets now anticipate with over 20% probability two rate cuts by September. A dynamic that reveals the extent of underlying stress.

Flight to Quality: Gold Shines, Dollar Erodes

Faced with this explosive cocktail: uncertain growth, huge deficits, trade tensions, investors are adjusting their bets. Gold, a true economic anxiety barometer, has appreciated by 27% since January. Bitcoin too is regaining strength, driven by growing distrust of fiat currencies.

The picture is paradoxical. The stock market climbs, yes, but it is a cautious, wary ascent. One misstep, and everything could collapse. Powell, under pressure, now points to Trump’s tariff policy, accusing him of blocking any leeway on interest rates. In this unstable environment, one feeling dominates: that of a reprieve. The calm of the indices is that of a dormant volcano.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.