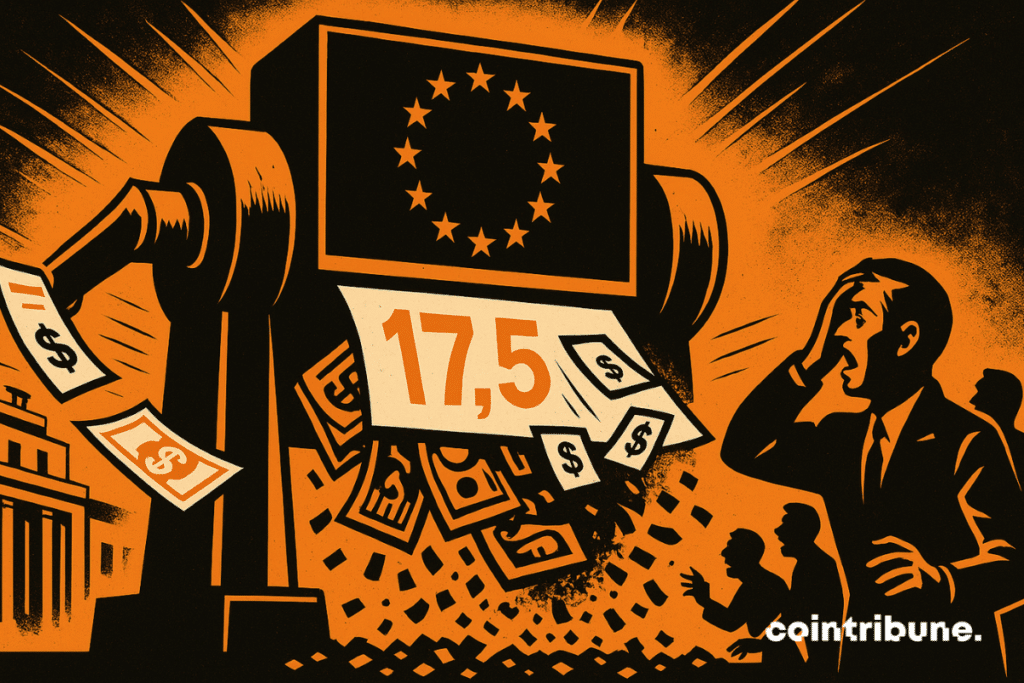

$17.5B In Cat Bonds At risk After ESMA Warning

European regulators are targeting $17.5 billion of cat bonds held in UCITS funds. ESMA considers these securities, exposed to natural disasters, too complex and risky for retail investors. If the European Commission follows this recommendation, a wave of forced sales could shake an already strained market.

In brief

- ESMA recommends excluding catastrophe bonds from UCITS funds, considering these assets too complex for retail investors.

- About $17.5 billion is directly threatened, representing nearly one-third of the global cat bonds market.

- An unfavorable European decision could trigger a wave of forced sales, with potentially destabilizing effects on the market.

- Major players like Neuberger Berman and PGGM support regulatory caution, highlighting liquidity risks and massive losses.

The European Regulatory Alert Shakes the Cat Bonds Market

The European Securities and Markets Authority (ESMA) sent a strong signal to the European Commission regarding the legitimacy of catastrophe bonds (cat bonds) in UCITS portfolios, these funds known as safe and intended for a wide audience of retail investors, while it had already warned against tokenized stocks.

The institution believes these instruments, linked to extreme natural events, present an inappropriate level of risk for non-professional savers. To date, about $17.5 billion of these securities are exposed to possible regulatory reclassification, representing nearly one-third of a global market estimated at $56 billion. This request comes as hurricane season is already underway in the United States, a period during which these bonds can be triggered.

ESMA cites technical and structural reasons to justify its warning. Cat bonds require a deep understanding of catastrophe modeling, climate physics, and risk transfer mechanisms between insurers and financial markets. Here are some key points :

- High complexity : models used to structure and evaluate these securities require expertise in data science, insurance, and climatology ;

- The risk of severe losses : in case of a trigger event (earthquake, cyclone…), the investor can lose all or part of their capital ;

- Unsuitability for the general public : according to ESMA, these products do not belong in funds intended for uninformed retail investors ;

- A threat of forced sales : if the Commission follows the regulator’s opinion, managers will have to quickly remove these assets from their UCITS portfolios, potentially under unfavorable market conditions.

A rushed divestment could destabilize the secondary market for cat bonds, whose liquidity is still largely untested.

An Industry Divided Between Caution and Performance Defense

The warning issued by ESMA is not unanimous within the industry. Some large institutions, like Neuberger Berman or the Dutch PGGM, agree with the regulator.

For Peter DiFiore, CEO at Neuberger Berman, believing these products are liquid is a dangerous illusion. “We have not yet seen a real liquidity event in this market”, he stated, noting that his fund, which manages $1.3 billion in cat bonds, holds none in UCITS vehicles.

At PGGM, Eveline Takken-Somers also points to systemic risks : “An earthquake in San Francisco could wipe out 30 to 40% of a portfolio all at once. If you are not aware of this, you could regret it.”

Conversely, some managers argue for keeping cat bonds in portfolios accessible to the public via UCITS, citing their exceptional performance. Daniel Grieger, CIO at Plenum Investments, strongly defends this asset class : “Cat bonds delivered solid returns during the Covid pandemic, the interest rate shock, and even disruptions caused by Trump’s tariffs.”

For him, ESMA is looking in the wrong direction, and its position contradicts the ambitions of the European Union for savings and investment (SIU), which aims to broaden financial options for small savers.

While some traditional products like catastrophe bonds are challenged for their opacity, bitcoin, though still criticized, benefits from total transparency thanks to its public blockchain.

At the market level, an unfavorable decision could lead to massive sales, reducing liquidity and affecting reinsurers’ financing conditions. The risk also includes some managers withdrawing entirely from this asset class, causing a contraction of supply.

For now, the European Commission has not decided. A consultation period is expected, during which technical and political arguments will be reviewed. The outcome of this debate could redefine investment boundaries in the European Union and lay the foundation for a new regulatory architecture for so-called alternative products, as evidenced by enhanced crypto company oversight on the Old Continent.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.