Has the crypto casino definitely closed its doors? Probably. There are signs that cannot be mistaken...

News

For a long time reserved for bitcoin, the role of strategic treasury asset is now expanding to other cryptos. Upexi, listed on Nasdaq, is a concrete illustration of this: it has strengthened its treasury with 735,692 SOL, valued at over 105 million dollars. And that's not all: the company also announces the tokenization of its shares on the Solana blockchain.

BALI, INDONESIA – April 2025 — Coinfest Asia, the largest crypto and Web3 festival in the world, is officially back. Taking place August 21–22 at Nuanu Creative City – Bali’s creative and cultural hub—the event will bring together a global crowd of 10,000+ founders, builders, investors,…

While Wall Street sets more records, the dollar is collapsing at an unprecedented rate since 1973. This wide gap is not trivial. It reflects a global shift fueled by geopolitical tensions, a Federal Reserve under political pressure, and macroeconomic uncertainties. The benchmarks are crumbling, and markets are seeking safe havens. In this silent but brutal reconfiguration, cryptocurrencies are once again asserting themselves in the strategic landscape, propelled by their decentralized logic in the face of state currency instability.

Pioneering in the market of proof of humanity, the company Tools For Humanity aims to increasingly expand the database of its Worldcoin project. It is only under this condition that it will be possible to effectively distinguish between humans and machines in the digital world. By prioritizing users verified by World ID in transactions on Worldchain, Sam Altman's company wants to encourage even more people to use the famous Orb and iris scan.

"Driven by an unexpected easing in the Middle East and a resurgence of stock market optimism, the S&P 500 closed this Thursday at 6,141.02 points, nearing its all-time high. Increasing by 0.8%, the benchmark index marks a significant rebound since its low in April, despite ongoing uncertainties regarding trade tariffs and regional stability."

In recent days, the crypto market has been closely watching a particularly reliable technical model. With a historical accuracy of 78%, this model could herald the imminent arrival of a new peak for Bitcoin. Is the market ready to surpass its previous records?

Billions are flowing in, but Bitcoin remains stagnant. While spot ETFs recorded record inflows in June 2025, the leading cryptocurrency barely reacts. Just a 2% increase for the month is a trivial move in a market accustomed to violent surges. This unexpected calm, despite unprecedented institutional momentum, raises questions among observers. What does this inertia really reveal? Behind the visible flows, a new equilibrium is emerging in the crypto arena, far from the classic patterns of speculative euphoria.

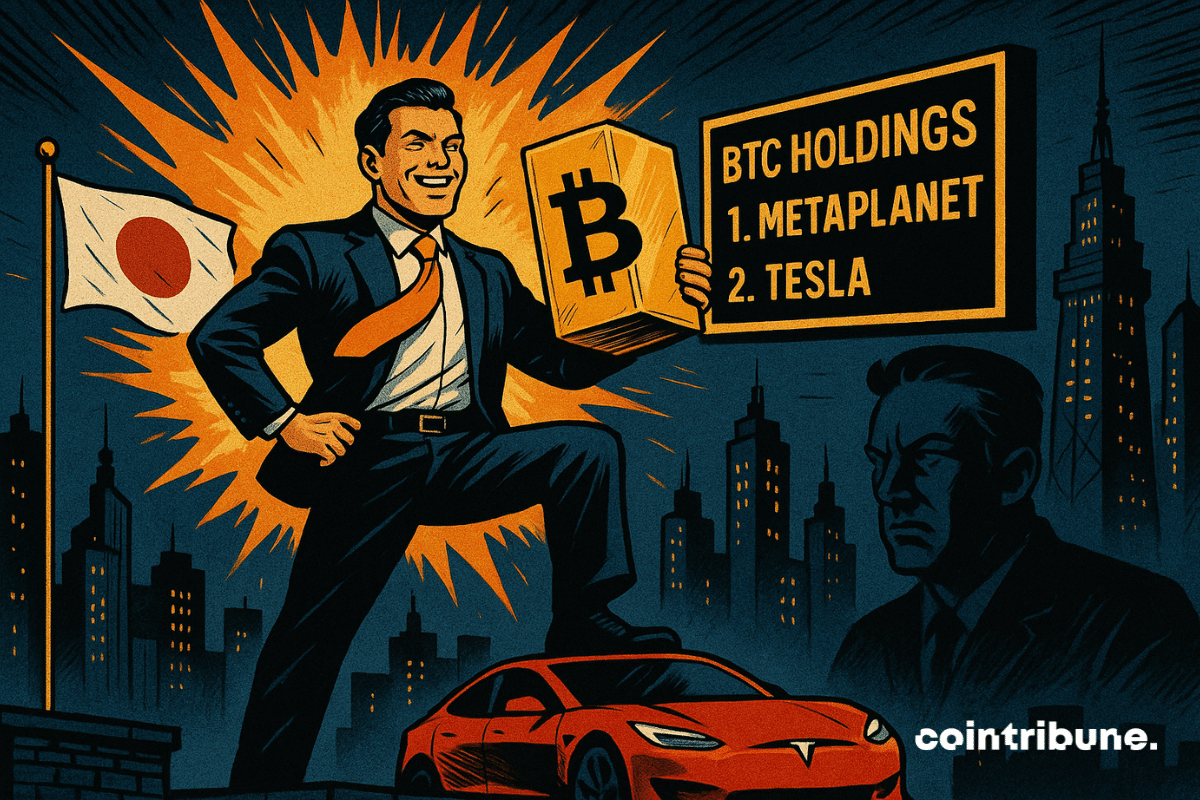

The race for bitcoin among companies has taken a new turn. Metaplanet, a Japanese company undergoing transformation, has just surpassed a symbolic milestone by overtaking Tesla in the ranking of the largest corporate bitcoin reserves. Who would have imagined that a struggling former hotel company would compete with Elon Musk's giant?

Will crypto replace banks for AI? The radical hypothesis of Tether is becoming clearer. The details in this article!

Kraken, often discreet but never truly withdrawn, has just taken a strategic step that could reshuffle the crypto market in Europe. By obtaining its regulatory license under the MiCA framework, the platform is stepping into the big leagues at a continental level, just behind Coinbase, but not too far behind to be considered lagging. In an environment where compliance is becoming a must-have, Kraken chooses to embrace regulation rather than circumvent it. And this choice could pay off handsomely.

Creating an efficient trading bot has long been a hassle. It required a combination of technical expertise, patience, and countless manual attempts. Beginners soon gave up. Even advanced users wasted precious time. With the launch of its AI Agent Optimizer, Runbot is shaking things up. This new conversational assistant turns strategy optimization into a simple exchange with artificial intelligence. No code. No technical lines. Just a clear discussion that leads to more effective strategies.

The Pi Network token jumped 38% this week, fueled by a series of signals interpreted as the beginnings of a partnership with Google AI. In the wake of this momentum, Nicolas Kokkalis's participation in a panel on artificial intelligence at Consensus 2025 and the imminent Pi2Day, scheduled for this Saturday, June 28, are stirring speculation. Although still in transition to its mainnet, the project is capturing attention and fostering hopes for a strategic turning point for its ecosystem.

The U.S. is facing a serious financial challenge. The national debt is now over $36 trillion, and rising interest rates are making it more expensive to borrow money. Much of the debt that was issued during the COVID-19 era is about to roll over, meaning it needs to be refinanced at today’s much higher rates.

Tether is ramping up its Bitcoin mining plans, aiming to become the industry's biggest player by year-end.

The Federal Reserve just made a big change that could make it easier for crypto companies to get bank accounts. On Monday, the Fed said it would no longer use “reputational risk” as part of its official bank supervision process. That vague label was often used to warn banks away from doing business with crypto firms, and many in the industry say it led to years of unfair “debanking.”

While Americans pamper stablecoins, the Bank of France bares its teeth: crypto, dollar, and sovereignty do not mix well for the guardians of the monetary temple.

Russia no longer tests. It imposes. By decreeing the mandatory integration of the digital ruble into the national banking and commercial system, Moscow leaves no room for doubt. The transition to a controlled, programmable, and centralized currency is underway. Gone are the ambiguities of experimentation, making way for the architecture of an unprecedented monetary system where each transaction could, tomorrow, be traced, regulated... or even blocked. This choice is not merely technological: it is political, strategic, almost ideological. For behind the apparent modernization of payments lies a much larger game.

The ceasefire in the Middle East triggers a new rise in bitcoin.

After weeks of consolidation and volatility, Ethereum is regaining its strength and has shown a spectacular increase of 15% from its lows. This remarkable rebound puts ETH back in a strategically technical position where $2,800 becomes a credible target.

Tokens we thought were safe, a report that strikes, the BIS takes aim at stablecoins. Crypto-mania or toxic bubble? The global finance reassesses its strategies... under high tension.

"On the eve of an extraordinary options expiration estimated at 20 billion dollars, the crypto market holds its breath. With bitcoin hovering around 107,800 dollars, every price movement becomes a battle between buyers and sellers. In this strategic duel, billions are at stake. The outcome will depend on the buyers' ability to lock in key levels before the outcome. Maximum pressure builds as the fateful deadline approaches."

In an economic climate marked by geopolitical tensions and a wait-and-see approach regarding the Fed's decisions, Morgan Stanley disrupts the consensus. The investment bank anticipates seven rate cuts in 2026, starting in March, with a terminal rate between 2.5% and 2.75%. This sharp projection, published on June 25th, contrasts with the prevailing caution and reignites debates about the U.S. monetary calendar.

While the market focuses on price curves, a key indicator of real activity has collapsed. Payment volume on the XRP Ledger has dropped by nearly 70% in just a few days. Behind this discreet withdrawal lies a deeper questioning of the network's vitality, its concrete adoption, and the robustness of its operational model.

Crypto reserve in Arizona: a bill passed despite criticism from the governor. Discover the details in this article!

In a Web3 landscape saturated with EVM blockchains cloning each other, Alephium stands out with a bold approach. This Swiss Layer 1 combines the security of Proof-of-Work, the scalability of sharding, a seamless user experience, and an innovative energy model. With Danube, its latest update, the project has reached a major milestone. To understand the stakes, we met with Maud Bannwart, a central figure in the team and a true bridge between technology and its uses.

When crypto takes to the track, Bitget makes a sharp turn with MotoGP. Speed and trading meet, at high speed and at zero cost for innovation.

Bitcoin is tightening its grip on the crypto market as institutional interest grows. Meanwhile, XRP climbs, and Ethereum and Solana face shifting investor focus.

Bitcoin climbed back above $105K after a sharp dip amid Middle East tensions. $700M liquidated as traders pull back ahead of a key options expiry.

Thanks to OptimumP2P, Ethereum increases the communication speed between its nodes.