While Trump buries the digital dollar, Beijing is setting up its own on all continents. One click, one yuan, and finance trembles. The United States watches... gritting its teeth.

Archive 2025

As they clash with missile strikes, Israel and Iran are launching attacks... on the blockchain. Nobitex has suffered from it, cryptocurrency hacked, propaganda unleashed.

American President Donald Trump is urging Congress to promptly pass the GENIUS Act on stablecoins. A race against time is on to make the United States the global leader in digital assets. But does this rush conceal personal interests?

For several months, France has been bustling on the digital scene. At the heart of this excitement: Telegram, the messaging app favored by digital dissidents. Its founder, Pavel Durov, is no longer content with defending freedom of expression: he directly accuses the French authorities. In a recent interview, he raised a serious alarm. According to him, France is drifting, and this drift could precipitate a societal collapse.

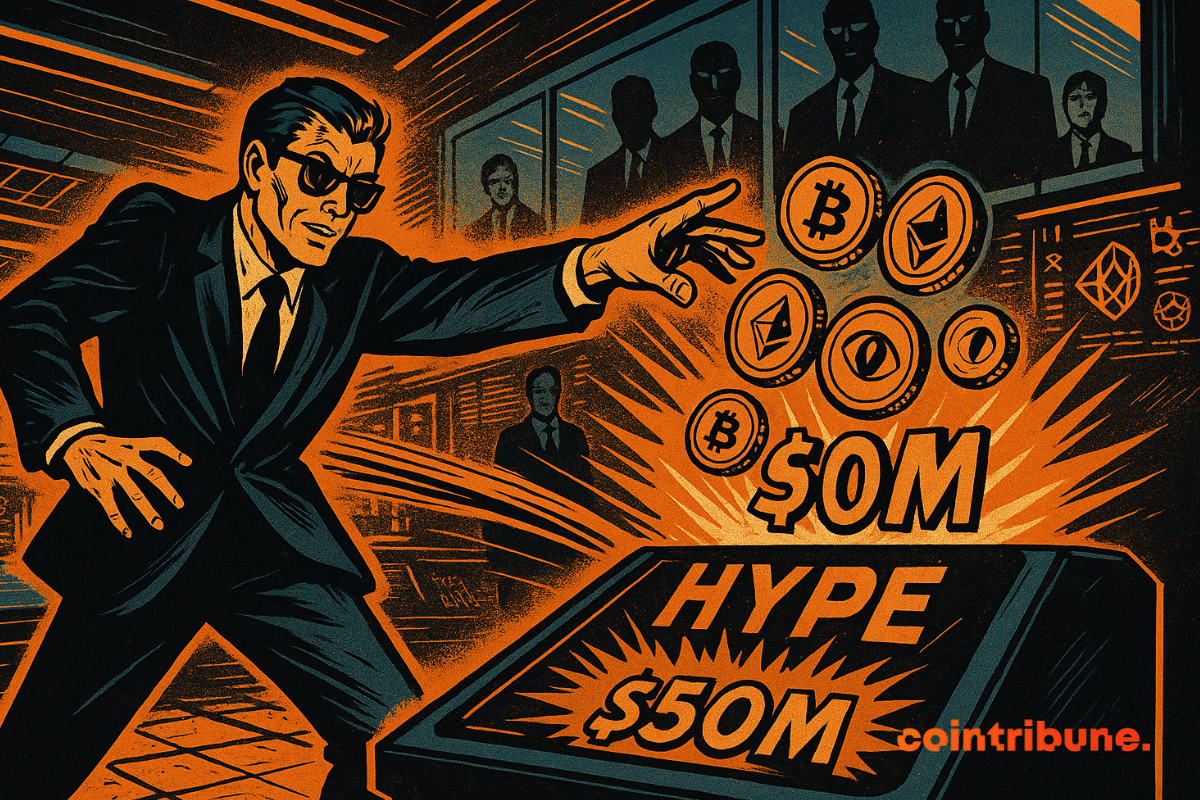

Eyenovia has made a bold leap into crypto, raising $50 million to back the HYPE token and rebranding as Hyperion DeFi.

While Bitcoin is stagnating, some altcoins are wavering. This is the case with Pi Network, whose token PI, still not officially listed, just brushed against a new low of $0.40. This sharp drop, followed by a slight rebound, fuels a renewed tension around a project that is as closely followed as it is questioned. Between intense speculation, conflicting technical indicators, and imminent deadlines, the cryptocurrency is now moving in a critical zone that could determine its short-term future.

Economist Peter Schiff is openly opposing the U.S. government on the future of stablecoins. While Washington relies on these cryptocurrencies to strengthen the dollar, Schiff predicts the opposite. But is he right to be concerned?

As Bitcoin enters a new phase of maturity, an unexpected phenomenon redefines its scarcity: every day, more BTC become inactive for ten years or more than new coins are mined. A silent but consequential reversal.

Ethereum stays strong above $2,500, outshining Bitcoin as whales accumulate and pressure builds for a breakout.

One can lose everything in crypto... even after death! Binance is offering to anticipate the irreversible with a "digital will." Should this be seen as an admission or progress?