Ethereum’s next major protocol upgrade, Fusaka, is scheduled for launch in early November. Developers aim to boost scalability and network resilience while trimming unnecessary features.

Archive July 2025

Mara Holdings, one of the largest publicly traded Bitcoin mining firms, has released a bold financing plan: the company aims to raise up to $1 billion through a debt sale to support its Bitcoin acquisition strategy and operational needs.

Cryptocurrency adoption has witnessed remarkable growth in 2025, with individuals and even large institutions pivoting towards digital asset ownership. Interestingly, data shows that the recent wave of crypto embrace is largely driven by digital payment and artificial intelligence.

Bitcoin’s rally is starting to cool, and eyes are now turning to altcoins. With volumes soaring, Binance is right in the thick of it.

JPMorgan Chase is reportedly exploring a new lending product that would allow clients to borrow against their crypto holdings. According to sources cited by the Financial Times, the U.S. banking giant is in internal discussions to launch crypto-collateralized loans, potentially as early as next year. The plan would let clients use cryptocurrencies such as Bitcoin, Ethereum, or even crypto-focused ETFs as collateral in exchange for cash or credit. While still in its exploratory phase, the product would be JPMorgan’s clearest signal yet that it is taking crypto seriously.

Chris Larsen, co-founder of Ripple, moves 175 million dollars worth of XRP at a high price. Could this massive movement signify a strategic dumping? Discover the implications of this action on the crypto market and the risks for investors.

China remains indifferent to threats and is getting rid of American debt. Bitcoin is lurking.

In response to the increase in customs duties decreed by Donald Trump, 30% on European imports starting August 1st, Brussels is deploying heavy artillery. The Commission has approved a counter-tariff attack of 93 billion euros, targeting strategic American sectors. An economic escalation is unfolding between two major blocs, against a backdrop of political tensions and fragile global trade.

Ethereum wavers between past profits and the cold sweats of summer: an explosive cocktail mixing variable rates, rapid predictions, and a DeFi that grits its teeth.

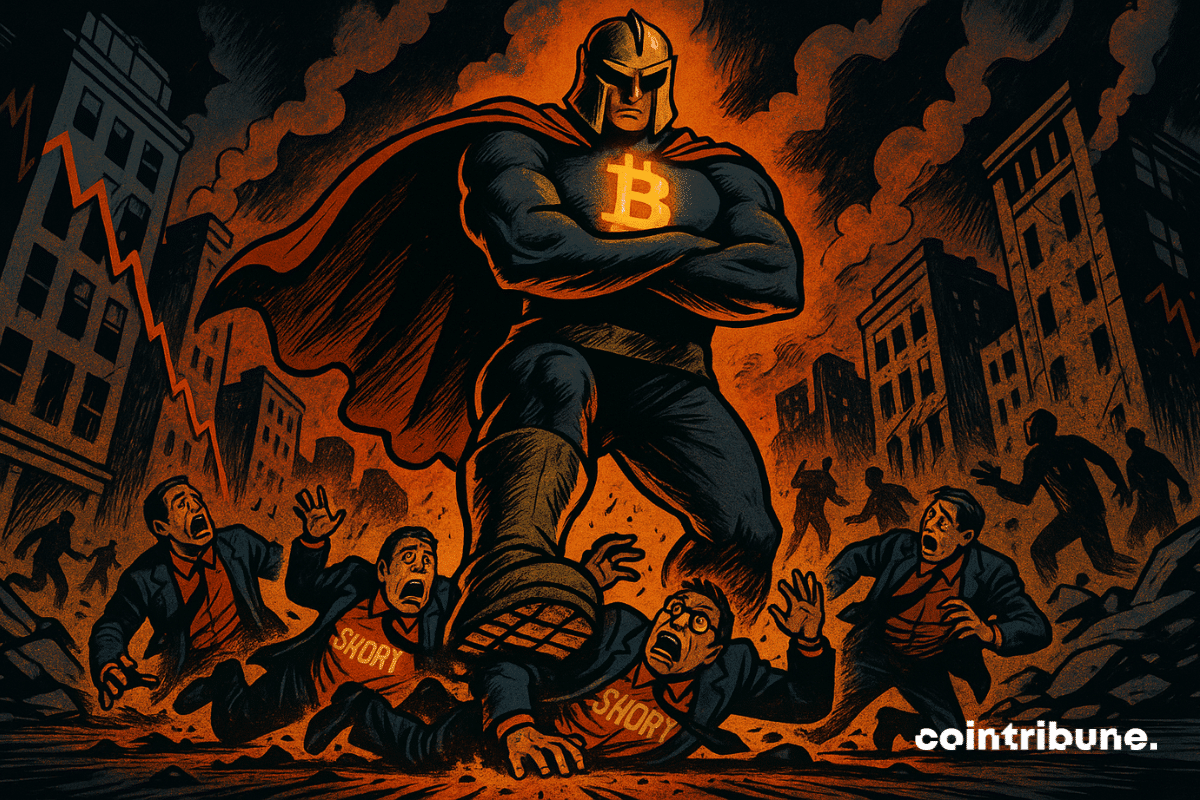

For several sessions, the bitcoin market has been showing signs of increasing tension. An unusual accumulation of liquidity above the price and a rapid increase in its dominance are reigniting speculation. In the shadows of the charts, short sellers and eager buyers are engaged in a tactical duel. For several technical analysts, the stage is set: a massive short squeeze now seems inevitable.