House Republicans want to make a big move: combine the ban on a digital dollar with a crypto law already supported by some Democrats. A risky strategy that reveals both the urgency to define a regulatory framework and the ideological divides in the U.S. Congress.

Archive 2025

Metaplanet changes dimension. The former Japanese real estate player, now a pioneer in bitcoin treasury, is now affirmed as a model of institutional adoption. With the simultaneous opening of two subsidiaries in Miami and Tokyo, the company no longer just stores the rare asset: it builds a real income infrastructure around bitcoin.

Usually September bleeds, this time bitcoin smiles: +8%. But behind the miracle, the Fed pulls the strings and the crypto ecosystem holds its breath.

Ethereum network stakers are facing record-long exit times, with about 2.5 million ETH ($11.25 billion) pending withdrawal from the validator set, according to dashboard reports. Given this backlog of unsettled transactions, the waiting time for withdrawal has stretched to more than 46 days—the longest in the network's history. For comparison, the last big peak in wait time, which occurred in August, only had an 18-day wait.

The internationalization of the Chinese currency is no longer a fantasy. The growth of international payments in yuan is skyrocketing. Bitcoin is lurking.

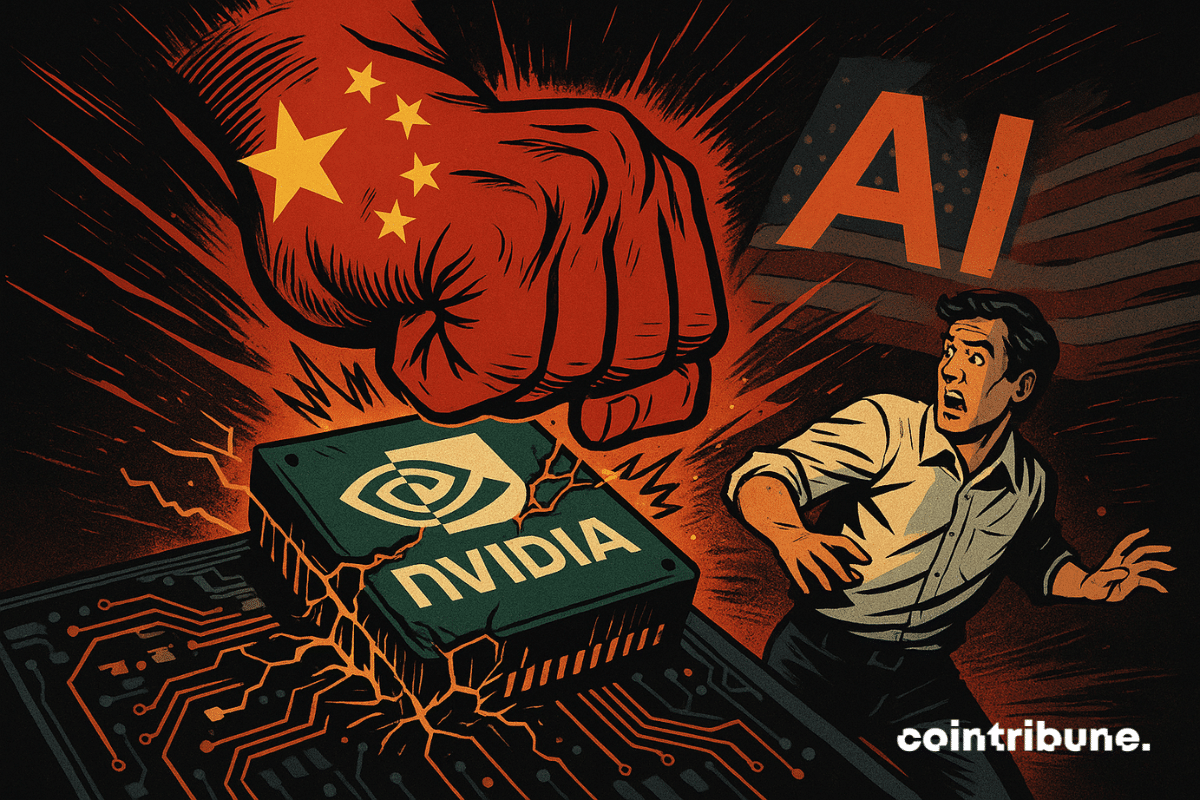

The technological battle between Beijing and Washington reaches a new level. According to the Financial Times, China has ordered its digital giants, including Alibaba and ByteDance, to immediately suspend their purchases and tests of Nvidia's latest artificial intelligence chips, the RTX Pro 6000 D. This decision illustrates the rising tensions around semiconductors, now at the heart of the geopolitical and economic rivalry between the two superpowers.

Powell cuts timidly, Trump shouts louder than ever, and crypto cheers. In Washington, the FED lowers its arms, while Bitcoin and stablecoins revise their choreography.

On CNBC, Eric Trump stated that Bitcoin has "taken the role of gold in today’s world," elevating crypto to the status of a strategic safe haven asset. This media appearance coincides with the launch of American Bitcoin, a mining and BTC holding company he is close to. Far from a mere announcement, this statement fits within a dynamic where publicly traded companies are beginning to integrate bitcoin at the heart of their reserve strategy.

Solana and XRP arrive in the regulated court of the CME. Altcoins take the microphone… but who will really make institutional markets buzz?

The spectacular fall of SafeMoon continues to cause ripples. After the conviction of its CEO for fraud, the FBI now opens its doors to victims to try to recover part of the lost funds. But is restitution in the crypto universe as complex as hoped?