Bitcoin ETF Tsunami: Over $2.2 Billion Raised in One Week

Spot Bitcoin ETFs are experiencing a spectacular enthusiasm from investors. Driven by BlackRock’s IBIT ETF, they have recorded net inflows of $2.2 billion for the week of February 12 to 16, 2023.

2.2 billion $ in 7 days, the incredible surge of Bitcoin ETFs

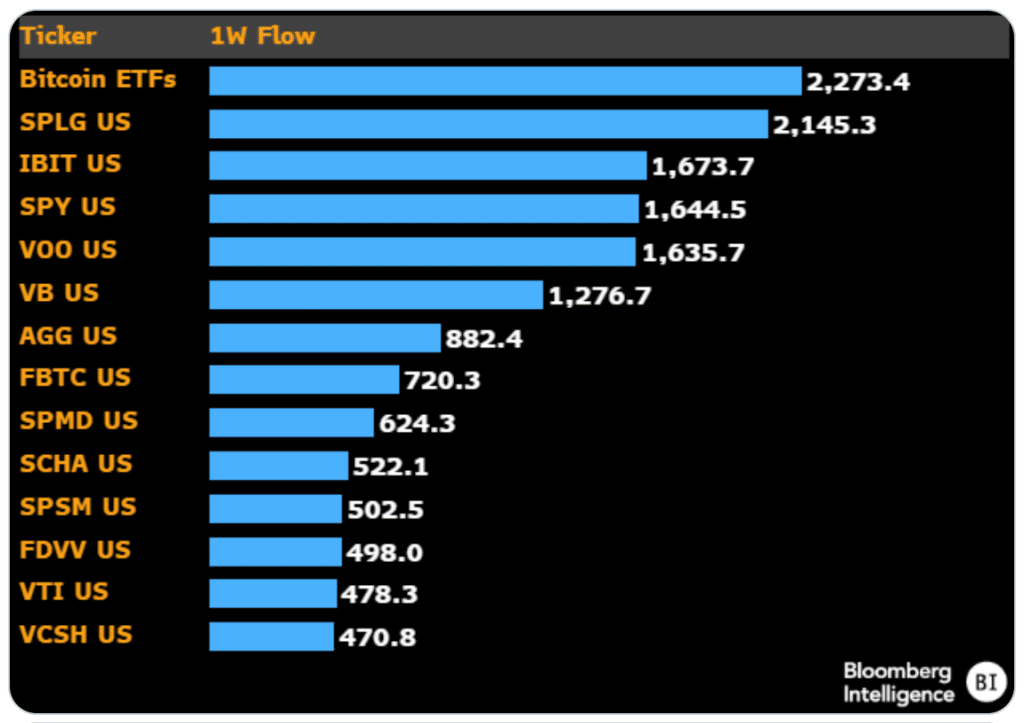

The exchange-traded funds (ETFs) focused on Bitcoin have had a prolific week, with net inflows exceeding $2.2 billion between February 12 and 16. According to Eric Balchunas, an analyst at Bloomberg, their combined volume surpassed the incoming flows of any of the other 3,400 ETFs available in the United States.

This record collection highlights the growing appeal of crypto markets to investors. It also establishes the rising power of specialized Bitcoin ETFs.

Undoubtedly, BlackRock’s IBIT ETF stands out as the current favorite. It alone amassed net inflows of $1.6 billion for the week, capturing nearly three-quarters of the total flows. Since its launch in January, this flagship fund has already attracted $5.2 billion, which represents half of the cumulative net inflows of BlackRock’s 417 ETFs.

This resounding success reflects the growing appetite of institutional investors for exposure to bitcoin through regulated investment vehicles. Unlike previous funds like Grayscale’s GBTC, these new ETFs offer daily liquidity, reduced fees, and the security of assets with the best custodians.

This momentum also benefits other giants in the sector. Over the week, Fidelity, Ark 21Shares, and Bitwise attracted more than $1.2 billion of new capital. These four asset management behemoths now hold more than $12.3 billion under management.

Adoption boosting the price of BTC

This massive influx of capital into Bitcoin ETFs is one of the driving factors behind the spectacular rise in the leading cryptocurrency’s price in recent months. BTC is currently trading at around $51,000, up 24% since the beginning of February and 91% over the last four months.

The SEC’s approval of the first spot Bitcoin ETFs on January 10 triggered a significant positive shift in market sentiment. Investors see it as an encouraging sign regarding the growing adoption of crypto-assets within the traditional financial system.

This bullish trend is likely to continue throughout 2024 with the entrance of new players into this lucrative emerging market of Bitcoin ETFs. In a recent letter to the SEC, several Wall Street heavyweights have even called for regulatory relaxation to act as custodians for these funds, which would further amplify the current frenzy.

With these enticing prospects, there is no doubt that these products, offering simplified access to Bitcoin, are destined to break new adoption records among retail and institutional investors in the months to come.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.