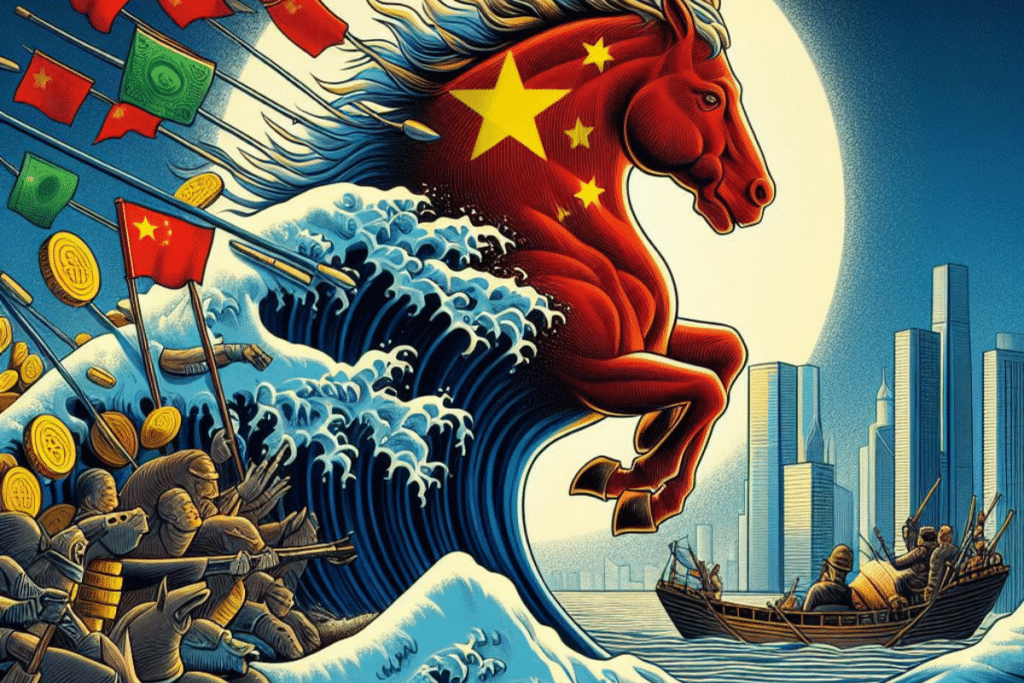

China Plays Its Last Card to Revive Ailing Economy: The Fate of the BRICS in Play?

As China’s growth sputters, Beijing is opening the fiscal and monetary floodgates in an attempt to stimulate its battered economy. From loosening credit, early distribution of local borrowing quotas, to massive issuances of state bonds, the Middle Kingdom is multiplying unprecedented expansionary measures. The goal: to return to robust growth by 2024.

Loosening of Credit and Advance Distribution of Local Borrowing Quotas

In the face of its sharp economic slowdown, China is now unhesitatingly pulling every fiscal and monetary lever at its disposal to try to reinvigorate its anemic economy.

Between massive easing of credit, early distribution of local borrowing quotas, and record issuances of state bonds, Beijing seems ready to take all risks to achieve vigorous growth by 2024. It’s a risky bet when the public deficit is already flirting with 5% of GDP, its highest level in three decades.

According to Bloomberg, China is even planning to unlock some 60% of the 2024 local borrowing quota as early as December 2023, amounting to $319 billion. Much sooner than usual.

The idea is simple: by massively injecting liquidity into the coffers of heavily indebted provinces starting in January 2024, the government hopes to stimulate local investments in infrastructure and thereby reboot the economic engine.

This last-ditch strategy seems to particularly reveal the authorities’ nervousness in the face of ongoing economic activity deterioration. Even if it means exacerbating the financial dependence of provinces and the spiraling out-of-control public debt in China. At the risk of directly threatening the country’s economic and financial stability, with potential implications for the BRICS.

Massive Issuance of State Bonds

In the same vein, China announced on October 25th the launch of state bonds for 1 trillion yuan ($130 billion). Officially to fund the prevention of natural disasters, these massive issuances will actually serve to boost sluggish growth, which fell to 4.9% in the third quarter from 6.3% in the second quarter.

With an already very loose monetary policy, China is now betting on fiscal stimulus to regain its pre-pandemic growth momentum. While this measure reflects Beijing’s determination to support the economy at all costs, it is not without danger and reignites concerns about the sustainability of Chinese debt.

Let’s recall that in 2022, China already recorded its worst fiscal deficit in three decades at -4.3% of GDP. With this new $319 billion stimulus plan, the 2023 deficit now threatens to easily exceed the -5% mark. And this is without even taking into account the colossal indebtedness of local governments and state-owned enterprises, carefully excluded from official statistics.

According to several economists, the real Chinese public deficit would exceed 15% of GDP by a significant margin. A figure that worries the markets about China’s ability to repay its debts.

In the short term, this fiscal stimulus plan is timely to give a much-needed boost to a drained Chinese economy. But in the long term, beware the devastating effects of a public debt spiraling out of control, which could truly undermine the finances of the Middle Kingdom and trigger a global financial earthquake.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.