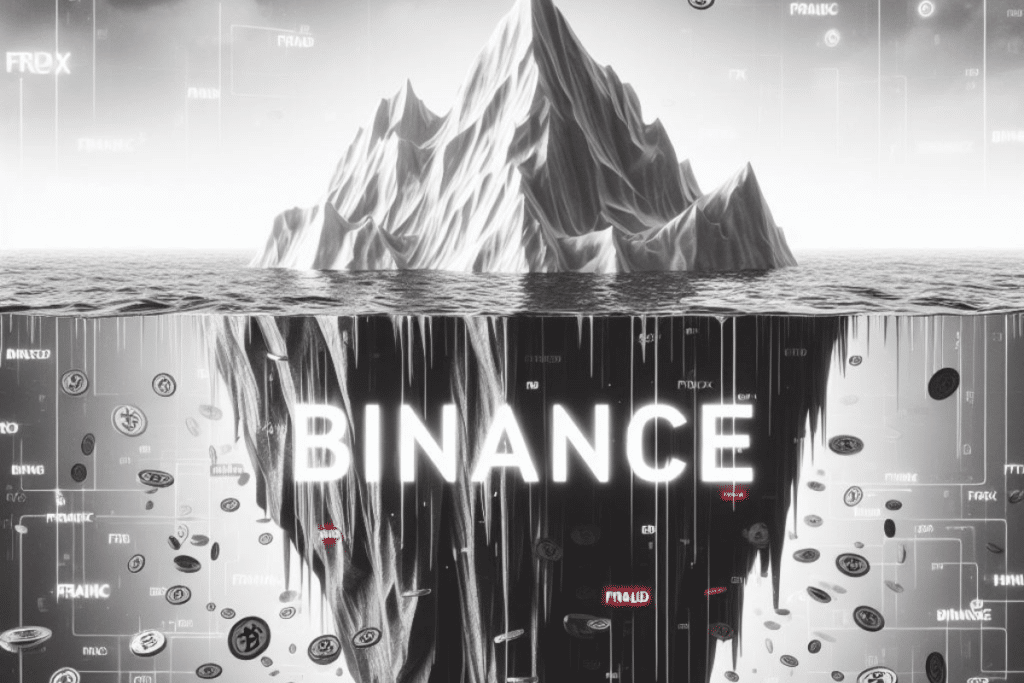

Crypto: Binance Bankruptcy? SEC Accuses CZ of Imitating FTX.

The shadow of the crypto exchange FTX looms over Binance. Following recent revelations, the SEC suspects the world’s leading cryptocurrency exchange platform of fraud similar to that perpetrated by FTX. Here is a look back at a case with potentially dramatic consequences for the future of crypto-assets.

The SEC tightens the noose around Binance

The American securities regulator has been closely scrutinizing the acts of the crypto exchange Binance for several months. Last June, the SEC filed a lawsuit against Binance’s American subsidiary for regulatory shortcomings and risks to user funds.

Following the recent settlement reached between Binance and the U.S. Department of Justice as part of a money laundering investigation, the SEC now hopes to find new tangible evidence of fraud orchestrated by Changpeng Zhao, the founder of Binance.

According to WSJ, it particularly suspects the existence of backdoors that would allow it to control certain assets without the users’ knowledge, in a manner similar to the scheme put in place by Sam Bankman-Fried at FTX.

If these allegations prove to be true, it would deal a fatal blow to the credibility of Binance and the crypto sector. Especially since CZ has recently stepped down as CEO, replaced by former SG executive Richard Teng.

The specter of a domino effect on the entire crypto ecosystem

The FTX affair has shaken a sector already weakened by the crypto crash at the beginning of 2022. The possibility of a new scandal of such magnitude at the world leader Binance would spread panic and likely trigger a wave of massive withdrawals.

Especially after the recent troubles of reputedly safe platforms like Celsius Network or Voyager Digital, now bankrupt.

However, the SEC’s allegations of fraud remain to be proven. And Binance seems to be doing everything in its power to restore trust, with its change in governance and new commitments to regulatory compliance.

Towards Enhanced Regulation

Beyond its potential impact on the viability of business models based on crypto, the Binance scandal once again raises the issue of their legal framework.

So far, most governments have remained uninvolved, adopting a wait-and-see approach in the face of the sector’s rapid growth over the past few years.

The string of misconduct observed at FTX and potentially Binance appears to have convinced the authorities to take action.

Regulators and central banks may thus take a tougher stance in the coming months and impose strict rules on crypto players.

Such a change would have a radical impact on this largely decentralized ecosystem. However, it would also represent a sign of maturity for crypto-assets in search of legitimacy.

The Binance case sounds like yet another wake-up call. If the acts of fraud were confirmed by justice, it would probably spell the end of the original decentralizing ambitions of crypto-enthusiasts. But new, more transparent models could emerge from the ashes of this regulatory Big Bang. Stay tuned… And here is what you need to know about the market.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.