Ripple Labs and the U.S. Securities and Exchange Commission (SEC) are close to concluding their long-running legal dispute. The two parties have reached an agreement involving a $50 million settlement payment. The case, which has spanned nearly four years, centered on whether Ripple’s sale of XRP constituted an unregistered securities offering.

Crypto Trading

In the complex world of trading, understanding and analyzing market trends are essential for success. Among the various tools of technical analysis, the Hurst cycle stands out for its ability to predict market movements based on historical trends. This article explores in detail the Hurst cycle, starting with its fundamental principle, its advantages, and its practical application in trading.

Trading on financial markets requires precise analysis and a deep understanding of market trends. Technical indicators are essential tools in this process. They provide key information to guide trading decisions. However, with the multitude of indicators available, it can be difficult for traders to choose those that best suit their needs and strategies. This article offers a clear guide on the most popular technical indicators, their selection, and optimal usage.

In the world of trading, moving averages stand out as prominent technical indicators. They allow traders to analyze short-term price fluctuations, providing a clearer view of market dynamics. However, their use requires a deep understanding and prudent interpretation. This article explores the fundamentals of moving averages, their different types, their limitations and pitfalls, as well as practical tips for their use.

In the dynamic world of trading, technical indicators play a crucial role in traders' decision-making. Among these tools, the Relative Strength Index (RSI) stands out for its versatility and effectiveness. This indicator helps assess the strength of market trends and identify potential reversal points. However, despite its popularity, the RSI presents challenges and limitations that traders must understand to use it effectively. This article explores the RSI in detail, from its functioning to its practical application, while highlighting the precautions to take to optimize its use in trading strategies.

Bollinger bands are a technical analysis tool that provides essential insights into volatility and price trends in financial markets. However, this widely recognized indicator requires a deep understanding to be used effectively. Overview of the specifics of Bollinger bands.

Support and resistance are levels at which prices stop on the chart, confronting buyers and sellers of the asset. Aiming to understand price movements, they serve as the foundation for stock market investment strategies. But how can these levels be identified? What are the advantages and limitations? How to trade cryptocurrencies using these indicators? The answers in this article.

Chartism is a graphical analysis technique of financial markets. Widely used in crypto trading, it is an essential decision-making tool. Will this digital currency rise or fall? When is the right time to buy or sell? Let’s discover everything there is to know about this analysis method in the crypto market.

The MACD is a leading technical indicator in the trading field. Used to analyze market trends, it helps traders make informed decisions based on price movements. However, despite its popularity, the MACD can sometimes be misunderstood or misused, raising questions about its interpretation and practical application. This article explores the MACD in detail, from how it works to its use in trading, including its advantages and limitations.

Day trading is an increasingly popular practice in financial markets, attracting many investors due to its potential for quick gains. This form of trading involves buying and selling financial assets within the same day, exploiting short-term price fluctuations. However, despite its appeal, day trading carries risks and demands a thorough understanding of market strategies. This article reveals the fundamentals of day trading, its benefits, risks, and the tools needed to succeed with this strategy.

Scalping is one of the most well-known and widely used strategies in cryptocurrency trading. This technique can be highly profitable, provided that you have a solid understanding of it. Let’s explore what scalping entails and how you can significantly increase your profits using this strategy.

As financial markets continue to evolve, many individual investors seek ways to achieve gains while managing their busy schedules. This is where swing trading comes in. This medium-term trading strategy is known for its profit potential and flexibility. But how can one practice it successfully? This article outlines the basics of swing trading, its advantages and disadvantages, and the steps to practice it effectively.

The recent arrest of Telegram’s CEO, Pavel Durov, has shaken the crypto market, leading to a sharp 20% drop in the value of Notcoin. A Crypto Market Shaken by Pavel Durov’s Arrest Pavel Durov’s arrest has cast a shadow over the entire crypto market. Within…

Trading in financial markets is a complex and dynamic activity, requiring not only a deep understanding of the markets but also access to the right tools. In this rapidly evolving environment where information and trends change swiftly, having the best trading tools is a must to remain competitive and effective.

Technical analysis is a fundamental component of trading, allowing investors to navigate the financial markets insightfully. It is based on studying price movements and trading volumes to predict future trends. This article aims to demystify technical analysis by explaining its basic principles, essential tools and indicators, how to read and…

Fundamental analysis plays a crucial role in cryptocurrency trading, offering investors insight into the intrinsic value and long-term potential of digital assets. In a market characterized by volatility and constant innovation, mastering this analytical approach distinguishes solid investment opportunities from high risks. This article aims to demystify fundamental analysis in crypto trading by addressing its basic principles, key indicators to watch, strategies for effective analysis, and common pitfalls to avoid, thus providing a practical guide for investors aspiring to navigate successfully in this complex universe.

Trading in financial markets is an activity that requires not only discipline but also a deep understanding of various analysis methods. Whether one is interested in stocks, forex, or other instruments, effective analysis is key to success in often unpredictable financial markets. For traders, whether novice or seasoned, grasping the…

Cryptocurrency trading relies heavily on the interpretation of signals. These signals, key indicators for buying and selling decisions, play a crucial role in any trader's strategy. However, understanding them and using them effectively is not always straightforward. Certain strategies and tricks can help you decipher these signals. This article discusses the different types of trading signals, strategies for using them to your advantage and common mistakes to avoid for optimal interpretation.

Trading, with its fluctuations and uncertainties, calls for rigorous risk management to ensure the sustainability and profitability of investments. Faced with a volatile and unpredictable market, understanding and mastering the different types of risk is important for protecting capital and maximizing gains. This article sets out the strategies for effective risk management in trading.

Trading, a complex and constantly evolving activity, requires a deep understanding of taxation, particularly in France where tax rules are diverse. For traders, whether they operate in stocks, cryptocurrencies, or other digital assets, mastering the tax aspects is crucial to maximizing returns and minimizing risks. This article sheds light on the current tax rules for traders, from amateurs to professionals, and offers strategic advice for optimized tax management.

Trading, whether it involves stocks, cryptocurrencies like Bitcoin, or other assets, requires not only a sound investment strategy but also a deep understanding of tax obligations. In France, declaring trading income can be complex, with specific rules and significant tax implications. This article aims to clarify this process by providing detailed information on the different categories of trading income, the important steps for compliant declaration, tax optimization methods, and the pitfalls to avoid for effective and error-free tax management.

The rise of cryptocurrencies has transformed the financial landscape, introducing new tax challenges for investors. Among these is the flat tax on cryptocurrency gains. This uniform tax changes the way crypto gains are taxed, affecting investment strategies and tax planning. Investors need to adapt to this reality to optimize their returns while remaining compliant with crypto trading tax requirements. This article details what the flat tax is, its application to cryptocurrencies, its implications for investors, and provides strategies for effectively managing tax obligations in this context.

The term bear market is used by crypto investors to refer to a market where most stocks are declining in value, as opposed to the term bull market, which stands for a market on the rise. A bear market has its distinct characteristics and is important to understand if you…

A bull market is a market in which prices are rising or are expected to rise. The word is widely used by crypto investors in contrast to the term bear market, a market where most stocks are declining in value. Usually, it’s quite easy to profit in a …

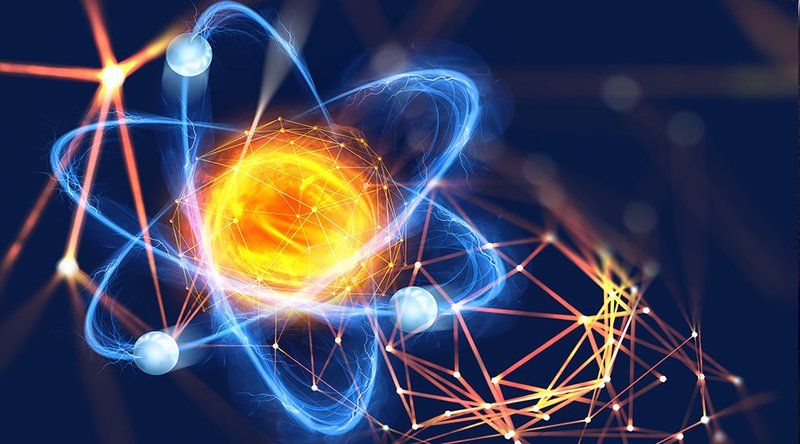

An atomic swap is a peer-to-peer exchange that allows two users to exchange digital assets without going through an exchange, centralised or not. How does it work? While the core principles of an atomic swap are relatively easy to grasp, the whole thing is a bit harder to get…

For the uninitiated, taking your first steps on the BitMEX exchange can seem complicated. The interface is uninviting and, let’s face it, intimidating. But by getting to know this platform and with a little help registering, it quickly becomes much more accessible. In this comprehensive guide to creating a BitMEX…