End of Monero (XMR)? Crypto analysis of February 8, 2024

Monero experienced a drop of over 30% before correcting by half the next day. Let’s take a closer look at the future outlook for the price of XMR.

Monero’s Situation (XMR)

propelled to $174. This price level then served as resistance. However, the Monero price formed higher and higher peaks, suggesting increasing bullish pressure. Unfortunately, the inevitable happened: Binance delisted Monero. The value of Monero then plummeted violently, breaking several supports and going from $165 to $100. The following day, the cryptocurrency recovered somewhat by testing the $132 level. As a result, Monero responded on its networks and was supported by all staunch defenders of anonymity. This morning, the Monero price is hovering around $119.

This recent drop has pushed XMR below its 50 and 200-day moving averages, underscoring the increased volatility that the cryptocurrency has experienced. This suggests that an adjustment in strategy may be necessary on the part of investors. As for the oscillators, they have naturally been adjusted downwards, positioning well below the midpoint threshold. From an optimistic point of view, this could indicate that the cryptocurrency is currently undervalued. Nevertheless, from a more pessimistic angle, it could also be interpreted as a sign that momentum is shifting towards a bearish trend.

The current technical analysis was conducted in collaboration with Elie FT, passionate investor and trader in the cryptocurrency market. He is now a trainer at Family Trading, a community of thousands of independent traders active since 2017, where you will find live sessions, educational content, and peer support regarding financial markets in a professional and warm atmosphere.

Focus on Derivatives (XMR/USDT)

Contrary to its price, the open interest in XMR/USDT has clearly increased significantly. Indeed, it has recorded an increase of more than 246%, with nearly $50 million added to Monero’s perpetual contracts. On the side of liquidations, a sharp increase can be observed at this time. However, these have not affected its open interest. In summary, it can be understood that speculators’ interest has been predominantly on the sellers’ side.

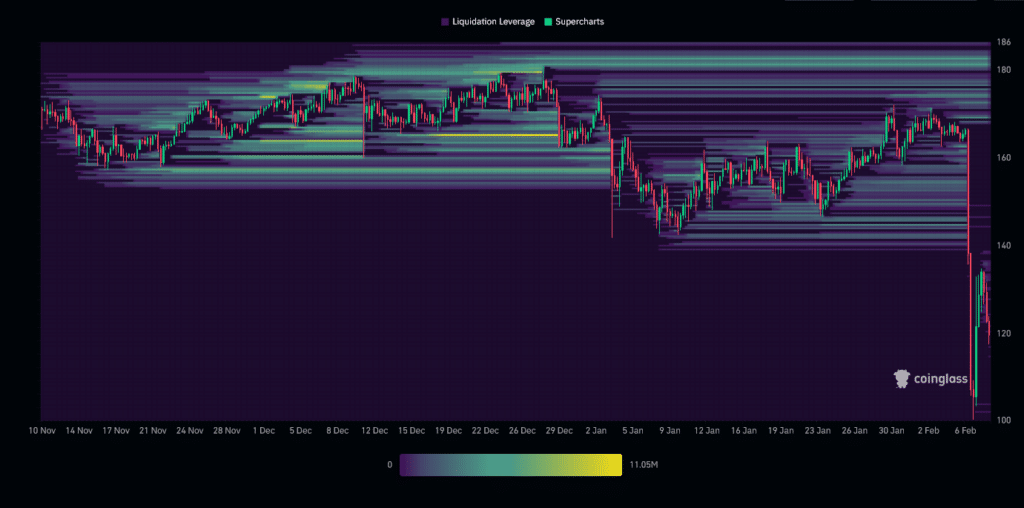

The XMR liquidation heatmap from the last three months reveals that the cryptocurrency has brazenly traversed various liquidation zones. Currently, the most significant zones are above its current price. Notably, the $170 zone, and even more importantly, the $180 zone. As the market approaches these levels, there could be a massive trigger of orders, potentially increasing the volatility of the cryptocurrency. These zones therefore represent major points of interest for investors.

The Hypotheses for the Price of Monero (XMR)

- If the price of Monero manages to hold above $96, we could anticipate a bullish recovery up to the $174 threshold. The next resistance to consider if the bullish movement continues would be $200, and even $250. At this stage, this would represent a near +97% increase.

- If the price of Monero fails to hold above $96, a return to $85 could be envisioned. The next level to consider if the bearish movement persists would be around $60. At this stage, this would represent a drop close to -53%.

Conclusion

Monero, the cryptocurrency with the advantage of enhancing privacy, has seen this asset become a weakness. Indeed, it is starting to be boycotted by exchange platforms, which naturally worries investors and leads to a drop in its price. Nonetheless, the cryptocurrency seems to be facing this situation. Now, it will be crucial to closely observe the price reaction at different key levels to confirm or dispel the current hypotheses. It is also important to remain vigilant about potential “fake outs” and “squeezes” in the market in each scenario. Finally, let us remember that these analyses are based solely on technical criteria and that cryptocurrency prices can also evolve quickly based on other more fundamental factors.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Family Trading est une Communauté de traders a compte propre active depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et trader de passion sur le marché crypto.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more