ETF performance after listing

The most anticipated event in the crypto sphere in recent months is the listing of a spot ETF for Bitcoin. The good news is that it’s official, we can now buy Bitcoin via a spot ETF. It’s a major step forward in the democratization of Bitcoin. That’s why we’re going to look together at how a listing can impact the choice of investors and its performance.

The Emergence of ETFs

A bit of history to understand the excitement around the possibility of having a spot ETF. First, the first ETF was created in 1990 in Canada. It was a major revolution in the world of investing.

Moreover, it can be seen that Canada is often one of the pioneers in this field, whether it be for a stock ETF or a bond ETF. Canada was also the first to propose a listing on Bitcoin future and not spot.

At its inception, these products were primarily for institutions, but later they became democratized to make them available to investors. ETFs can replicate the fluctuations of stock indices, sectors, but also types of assets (gold, bonds, bitcoin, etc.).

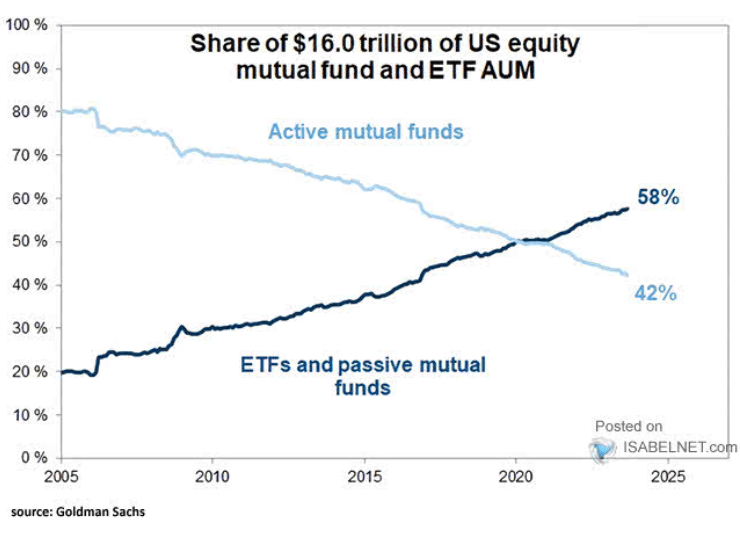

Let’s take the example of stock indices. As they are composed of several companies, like a basket of stocks, this allows investors to have shares in multiple companies in one place. This allows for a diversified product. It’s for this same reason that in the past 20 years, passive management has progressively found its place to surpass active management recently.

It should be added that generally, putting your money under active management implies higher management fees than buying a simple index ETF where the fees remain inexpensive.

The Popularization of ETFs

The popularization of ETFs has become so significant that it has practically become an incentive for those starting in the stock market. When you want to take your first steps in the financial markets, passive management remains one of the best options. For example, it is easier to buy an index ETF because the companies within an index must face an update following the qualification criteria. That is, we remove companies that do not meet the criteria and add new ones. Consequently, the component is optimized.

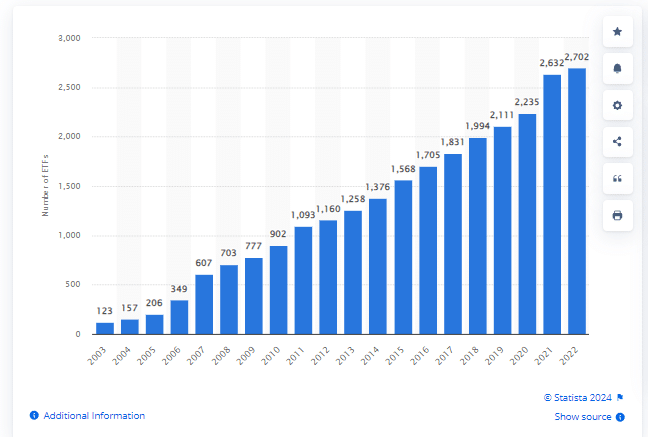

Here is precisely the evolution of the volume after the listing of ETFs throughout the 2000s (chart below). A strong growth can be observed.

Is the Listing of an ETF a Solution to Meet Needs?

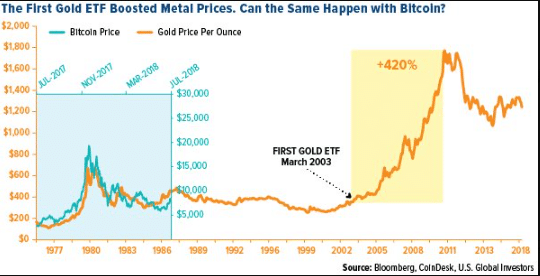

ETFs can strongly influence the evolution of the underlying. Initially, making an index, a sector, a type of assets (bitcoin, gold, bonds…) accessible via an ETF is often the result of underlying demand or a need. For example, owning physical gold or buying Bitcoin through an external platform may halt the interest of some investors. Consequently, when a product becomes more easily accessible in the same place as other assets, it can become an incentive to acquire additional products. On the other hand, when a portfolio is under management, it is easier to add synthetic gold or Bitcoin via an ETF than to have to individually purchase these assets outside of the stock exchange. Another important element that can increase demand is also tax treatment. ETFs can be placed more easily in tax-advantaged accounts.

In the case of Bitcoin, adoption by institutions after so much reluctance in recent years gives credibility. Consequently, this may attract even the most skeptical.

Can an ETF Impact Financial Markets?

As explained earlier, ETFs can respond both to the demand and the needs of investors. When demand increases, it is necessary to purchase the underlying components. For example, in the case of a Bitcoin ETF, it will be necessary to buy Bitcoins since the product will track the evolution of Bitcoin. Investors essentially own Bitcoins through the ETF. Therefore, as long as the demand remains constant over time, it may increase the value of Bitcoin since the supply is limited.

Here is an example of the release and evolution of the gold ETF. It can be seen that this new accessibility to investors has increased the demand and price of gold.

ETFs have an impact on financial markets because they are incentivizing and facilitating products. They are inexpensive in terms of management fees, they are regulated, and can have advantageous tax treatments. Consequently, this type of product can meet the needs of investors, which indirectly leads to an increase in demand. The more it increases, the more the demand for the underlying assets also increases.

In terms of volatility, ETFs can also play a role. For example, they can absorb a certain level of volatility since it does not involve the individual trading of stocks.

Can ETFs Be a Source of a Market Crash?

So many ETFs have been created that the competition has become quite fierce. Some will have large volumes and others not. Consequently, an ETF with large volumes will have fewer problems in the face of market downturns. However, those with lower liquidity may experience problems. This was the case for the ETP that was supposed to represent the inverse variation of the VIX. Here is the evolution of the ETP:

When the VIX awoke in February 2018 after several months of absence, the product lost more than 80% of its value in one evening. Consequently, this led to the end of this product. That’s why liquidity remains an important element. You need to choose your ETF carefully.

The Evolution of ETFs After Listing

Obviously, as previously stated, competition can be tough among ETF producers. Once an ETF listing is created, there will be several producers who will release their version. Example: Blackrock, Vanguard, Fidelity… Even though popularity is universal, it is worth noting that there is a greater use of such products in the US. That’s why the listing of an ETF in the US can have a lot more influence on the evolution of the underlying since it’s a source of investors who appreciate ETFs. This is particularly the case for Bitcoin. The potential of investors in the USA being significant, it can influence the variation of Bitcoin in the long term.

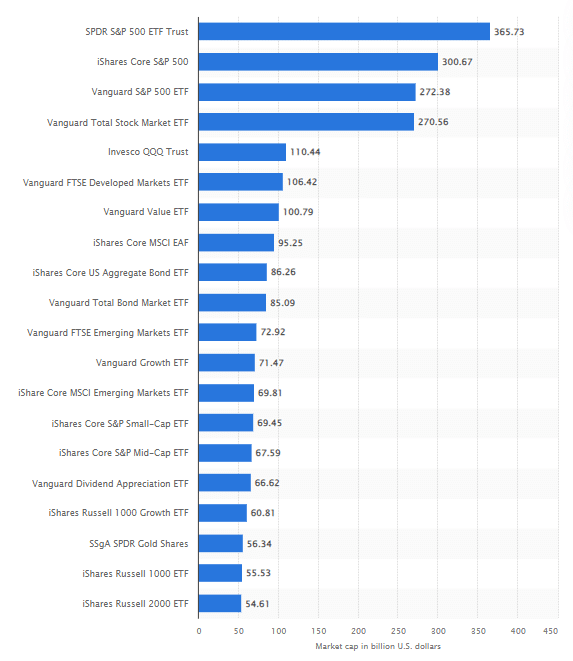

In 1993, the first US ETF listing was created. We’re talking about the SPY (symbol) which will track the variation of the S&P500. It’s now the ETF with the largest capitalization at the global level (see the chart below). It can also be seen that all the ETFs with the largest volume are US-based.

For example, we can see the performance of the SPY since its listing in 1993, a performance of +1900%:

If the largest ETFs are found in the US, it’s because demand is both high and popular. It’s one more reason why Bitcoin was eagerly awaited because it can generate potential and attract the most hesitant. It can make access easier. Obviously, even if the ETF product is quite popular, there must also be a significant underlying demand for it to have a good performance.

The Interest of ETF Producers

Companies such as Blackrock or Vanguard are primarily here to make money. Therefore, if there is high potential to make money through the management fees of the ETF, this will generate interest in it. This is also why we initially had the CEO of Blackrock who was against Bitcoin and then, it is also the same person who pushed to create a spot ETF on Bitcoin. They do not want to miss the potential to make money knowing that investors’ interest in crypto is growing. Here, it’s more about setting aside beliefs to meet demand and make money.

Conclusion

The demand for ETFs and passive management is becoming more and more popular, especially in the US. It can become a simplified access for certain assets like gold or Bitcoin. But beyond that, especially in the long run, it’s rather the interest in the underlying that will be important.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Après avoir travaillé pendant 7 ans dans une banque canadienne dont 5 ans dans une équipe de gestion de portefeuille comme analyste, j’ai quitté mes fonctions afin de me consacrer pleinement aux marchés financiers. Mon but ici, est de démocratiser l'information des marchés financiers auprès de l'audience Cointribune sur différents aspects, notamment l’analyse macro, l’analyse technique, l’analyse intermarchés…

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.