Geopolitical tensions revive market reflexes. In times of uncertainty, investors traditionally turn to assets perceived as safe havens. For Robert Kiyosaki, bitcoin could benefit from this dynamic. The author of the best-seller "Rich Dad, Poor Dad" believes that the recent surge in gold is a strong signal. According to him, this movement could herald a forthcoming surge in crypto, in a context where investors seek alternatives to traditional financial assets.

Warsh likes Bitcoin, hates high rates, and frequents Stanford. Senators, meanwhile, like investigations and blockades. Trump is keeping his fingers crossed.

Kraken has just crossed a historic milestone by becoming the first crypto platform to obtain a "Master Account" from the Fed. A revolution that could transform transactions, strengthen investor confidence, and accelerate the integration of cryptocurrencies into the traditional financial system.

Bitcoin is surging. In just a few hours, BTC jumped 6% to near $73,000, its highest level in nearly a month. A strong signal in a still very turbulent macroeconomic context. Is this the start of a true bullish reversal?

Bitcoin is at the heart of political discourse, but where are the results? David Bailey, Trump’s former crypto advisor, reveals why government promises remain unfulfilled. Between unused strategic reserves and pending regulations, BTC is still waiting for its time.

The co-founder of Ethereum had never expressed things with such frankness before. In a message that immediately sparked a reaction from the crypto community, Vitalik Buterin publicly acknowledges the limitations of his own creation. Behind this unexpected mea culpa lies a vision much more strategic than it seems.

Bitcoin is going through a period of strong turbulence as geopolitics, energy, and Fed decisions reshape the entire crypto market. Between persistent inflation, extreme volatility, and institutional investors' withdrawal, the leading cryptocurrency faces unprecedented macroeconomic pressure.

In the global race for artificial intelligence, every update counts. With GPT-5.3 Instant, OpenAI is not content with a simple technical adjustment. The company aims to correct one of the major criticisms aimed at ChatGPT, its imprecise or awkward answers. Presented as "more accurate and less embarrassing," this new version aims to reduce hallucinations and excessive refusals. A strategic evolution in a market where the credibility of models becomes a central issue.

Political storm around crypto in the United States. Trump urges Congress while banks try to impose their rules.

Ether reserves on trading platforms have just reached a multi-year low. In a few weeks, millions of ETH have left centralized exchanges, reducing the supply immediately available for trading. This movement occurs while the price hovers around 2,000 dollars, in a market searching for direction. Such a contraction of reserves changes the balance between liquidity, selling pressure, and accumulation dynamics.

Mining bitcoin costs $87,000, it sells for $69,000. So miners sell their machines and retrain in AI. Gotta eat, even in crypto.

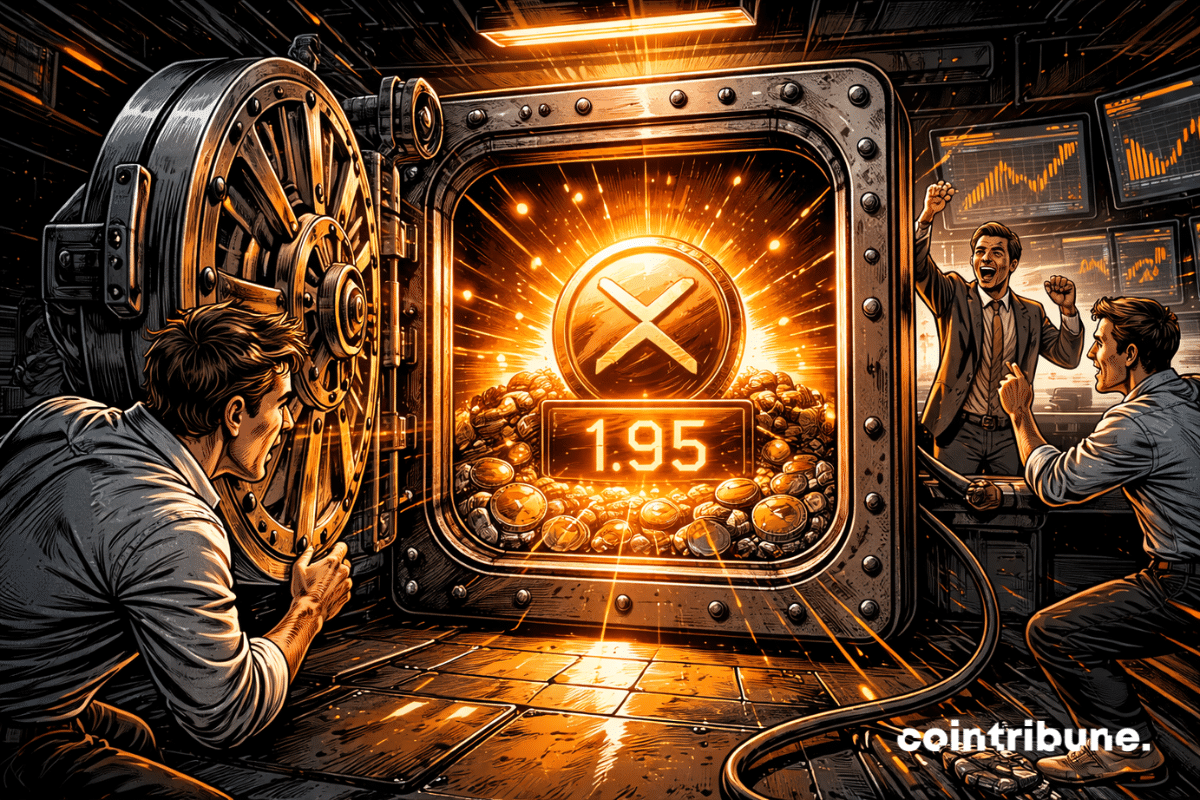

For 24 hours, XRP has been moving independently of bitcoin. A rare divergence in a market where correlation with BTC usually dominates altcoin dynamics. While bitcoin tries to stabilize its price, Ripple's token follows a distinct trajectory, amidst persistent bearish pressure. This movement comes as XRP's trading volume grows significantly.

The crypto market keeps suffering. While bitcoin resists more or less, altcoins are collapsing. And CryptoQuant's data is unequivocal: this drop could well be the worst of the entire cycle.

Tokenized real assets on Ethereum now exceed 15 billion dollars, largely driven by the rise of tokenized gold. Behind this figure, a deeper movement is visible. Crypto no longer just "creates tokens." It begins to package traditional assets in a 24/7 usable, transferable, and divisible format. And Ethereum establishes itself as the main track.

Stablecoins seriously worry the ECB. With a market of 300 billion dollars, their growth threatens the EURO and European monetary sovereignty. Why and how could these digital assets disrupt the old continent's economy?

After five consecutive weeks of massive outflows, crypto investment products have made a spectacular reversal. More than one billion dollars flowed in a single week, restoring hope to a pressured market. Does this rebound mark a real change of direction or is it just a temporary lull?

The US and Israeli strikes on Tehran triggered an immediate reaction in the Iranian crypto market. Within minutes, withdrawals on local platforms jumped 700%, signaling financial panic and an urgent search for protection amid geopolitical escalation.

The $1 threshold is once again a point of vigilance for XRP. According to data from the derivatives markets, up to $650 million in positions could be exposed if this technical level is breached. Indeed, the charts indicate a weakening of the price structure and suggest a possible drop below this symbolic support. The market is entering a decisive phase where the technical momentum could quickly intensify.

Despite geopolitical pressure, bitcoin could enter a historic bullish phase according to Bitwise. More details here!

Amid rising tensions in the Middle East, bitcoin surpassed 70,000 dollars without causing massive sell-offs. No sharp movements, no visible capitulation in on-chain data. While geopolitical crises have often triggered rapid pullbacks in risky assets, BTC holders show unusual calm. This contrast questions the current strength of the market and its ability to absorb the international shock.

Senators wanted housing. The anti-CBDC crowd shoved their crusade in. The Fed is muzzled. China is rejoicing. Crypto enthusiasts applaud. Nobody saw it coming.

Michael Saylor continues his offensive on bitcoin. Strategy has just announced a new massive purchase, further strengthening a balance sheet already dominated by the flagship asset. This operation, the 101st since the beginning of its accumulation strategy, takes place in a market context closely watched by institutional investors. With each acquisition, the company increases its exposure and confirms an intact conviction: making bitcoin the central pillar of its treasury.

Hafiz Huzefa Ismail, aka "Dark Bank", turned hundreds of millions of euros of dirty money into cryptocurrencies before being extradited to France. His sophisticated system involving traffickers and cybercriminals reveals the dangers of the crypto ecosystem.

Bitcoin cycles never trigger by chance. They emerge when macroeconomic and technological dynamics converge. Today, NYDIG identifies an unprecedented alignment: the rapid rise of artificial intelligence and the prospect of a more flexible monetary policy could create a favorable environment for bitcoin. In a context where markets anticipate financial easing, this combination could shift the balance of risk assets.

Tom Lee's ether treasury company is not slowing down. Bitmine Immersion Technologies has just announced a massive purchase of ether, consolidating its position among the largest institutional holders of the world's second largest crypto. A strategy that raises questions and comes at a time when Ethereum is showing signs of awakening.