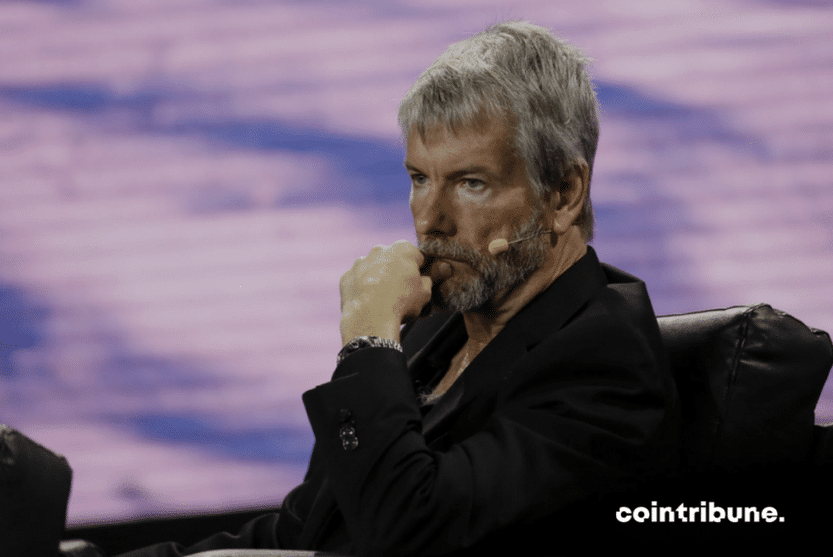

“People refer to [#BTC] as currency, or digital currency and that’s an unfortunate historical artifact. It’s digital property,” says $MSTR Founder & Chairman @saylor. pic.twitter.com/1I15H8F04A

— Squawk Box (@SquawkCNBC) March 11, 2024

A

A

M. Saylor: "Bitcoin does not need to replace fiat currency"

Tue 12 Mar 2024 ▪

6

min read ▪ by

Getting informed

Michael Saylor made waves by unequivocally stating on CNBC that the primary purpose of bitcoin is to serve as a store of value.

“Bitcoin doesn’t need to be a means of exchange”

Andrew Ross Sorkin recently drew mockery by claiming that bitcoin was “too volatile to be a store of value”… Faced with ridicule, the journalist had Michael Saylor on this Monday to clarify things.

He first asked him if it was “impossible for the governments of the United States and China to do something that would endanger its growth”?

The Microstrategy CEO’s answer caused a stir:

“That’s not a very good question. Skeptics often say bitcoin is too good to be true. That governments will eventually take it away from us. This thinking is based on a misunderstanding of what bitcoin is. People talk about currency, about cryptocurrency, but this is an unfortunate linguistic legacy.

It’s not a digital currency. It is primarily a digital asset. Once we understand that, it becomes clear that bitcoin’s raison d’être is the preservation of the world’s savings. There’s nothing wrong with holding an asset. You can own a tower in Manhattan. The property right is universal, in Europe, in China, or in the United States. That’s the way to perceive and embrace it.

All controversies related to cryptos are linked to their use as a means of exchange. But it’s important to understand that a means of exchange is only worth a trillion dollars. A store of value is worth a hundred trillion dollars. Bitcoin is going to create controversy if it’s presented as a currency, so I recommend considering it as a store of value.”

Should bitcoin become a means of payment?

Andrew Sorkin went further by asking whether bitcoin “can and should one day become a means of exchange”?

Response from the gigachad:

“It doesn’t need to become a means of exchange. No one tries to buy a coffee with a piece of their New York tower. All the rich people I know own real estate in New York, and none of them complains about not being able to spend their apartment as if it were a means of exchange.

The main attraction of bitcoin is to be a store of value. The fact that it can also serve as a means of payment is a distraction. Governments will always be in charge of legal tender. And that’s perfectly fine.

Bitcoin competes with gold, which it will swallow sooner or later. It also competes with risky assets for long-term investment. It competes with the strategy of buying an apartment to do AirBNB.”

These statements do not sit well with some who cling to the vision of a world without government, without central banks, etc…

Many developers like Zack Voell think that bitcoin can and should replace fiat money. Hence, they constantly propose modifying it (BCH, CTV, etc) to allow this unnecessary scaling up.

Others, more humble, accept to reevaluate their concept of bitcoin. Like Quattro:

“He’s right. One reason people think BTC won’t rise is that they view it as a direct competitor to state currencies as a means of exchange.”

Saylor standing his ground

The statements of the CEO of Microstrategy are consistent with his vision that he had hinted at us at the Bitcoin 2023 conference in Prague:

“No country can stop inflation. No one can stop inflation. I could make you master of the world, and you wouldn’t stop inflation.”

And in an interview a few weeks later:

“Believing that bitcoin will replace fiat currency is a distraction causing mental dead ends for many people. […] Bitcoin doesn’t need to replace fiat money to succeed. […] Global wealth is about 850 trillion dollars in real estate, debt securities, shares, art… Bitcoin is a better asset. People will stop buying real estate for 25 or 30 times the annual rent. They will sell everything until the ratio falls to 10. Similarly for shares of multinationals valued at 25 times their annual profits.”

Bitcoin can certainly serve as currency, but it doesn’t need to replace fiat money.

One has the advantage of existing in a fixed quantity, which protects against inflation. The other has the advantage of being created from nothing, which facilitates investments.

A system with a fixed quantity currency is too rigid. Imagine if bitcoin was our only currency and everyone had their own wallet. How does EDF manage to build six nuclear reactors (50 billion euros)

How do you do it if you’re not allowed to create money out of thin air? You would have to knock on the door of five million French people and persuade each of them to lend the equivalent of 10,000 euros for 15 years. It doesn’t scale.

A complex society needs the tool of debt. And bitcoin to protect against inflation, which mostly comes from physical limits to growth.

Don’t miss our article: Can bitcoin replace fiat money?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Bitcoin, geopolitical, economic and energy journalist.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.