Marathon Digital Surpasses Tesla and Apple, Bitcoin Mining Stock Soars on Wall Street

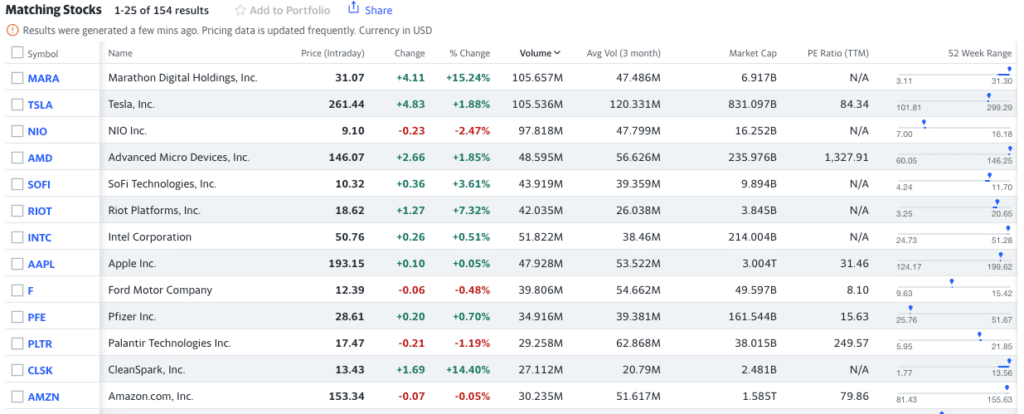

Yesterday, Marathon Digital Holdings (MARA) became the most traded American stock of the day, with an impressive volume of 327 million dollars. Over 105 million shares of this Bitcoin mining company changed hands in 24 hours, surpassing heavyweights like Tesla, Apple, and Amazon.

Powered by Bitcoin, Marathon Digital Surprises on Wall Street

As we approach the critical date for filing the first US Bitcoin Spot ETF, set for January 2023, activity around Bitcoin miners is heating up. In addition to Marathon Digital, its competitor Riot Platforms also ranks in the top 10 of the most traded stocks yesterday, with 40 million shares exchanged.

This enthusiasm reflects the market’s very high expectations regarding the positive impact of the Bitcoin Spot ETF. Its approval could indeed pave the way for massive influxes of institutional capital into the crypto ecosystem, benefiting mining players like Marathon or Riot directly.

But this is not the only catalyst. Another major event anticipated by the industry is the Bitcoin halving, scheduled for April 2023. This technical adjustment that halves miner rewards every four years usually triggers a surge in price.

Anticipating this appreciation, miners are therefore ramping up their investments. Riot Platforms has, for example, acquired $291 million worth of additional equipment. Meanwhile, Marathon Digital has announced that it spent $179 million on two mining centers, bringing its extraction capacity to nearly one billion dollars.

Investors Dive Back into Crypto-Related Stocks

Riding on these promising prospects, Bitcoin-related stocks have been on a very positive dynamic since the beginning of the year. Marathon Digital and Riot Platforms show gains of 767% and 452% respectively. The same is true for exchange platforms like Coinbase, whose price has soared by 450% over the same period.

After a dark year marked by the implosion of FTX, this spectacular rebound bears witness to the renewed investor confidence in the future of the sector. Proof that the tide has turned, more than 6 billion dollars in short positions on crypto-related stocks have been liquidated since the beginning of the year.

The sudden fervor around Marathon Digital, yesterday’s most traded stock on Wall Street, perfectly symbolizes this fierce appetite of investors for the leaders of a crypto sector rising from its ashes.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.