Liquidity squeeze: The impact on crypto

Performance in the first half of 2023 has been largely supported by liquidity. Furthermore, the good news in June was the agreement reached on the debt ceiling limit. It has been increased until 2025, which subsequently reassured a number of financial market operators. It’s not the agreement itself on the ceiling limit that’s worth keeping an eye on, but rather the impacts of a liquidity squeeze on Bitcoin and the crypto market for the second half of the year.

What is liquidity?

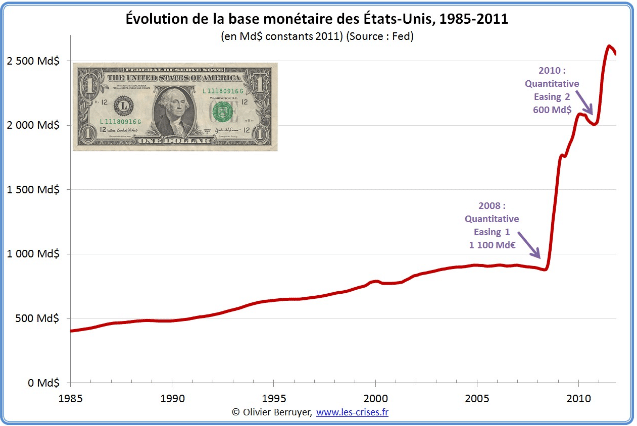

Ever since the financial crisis in 2008, financial markets have become increasingly addicted to liquidity. As population growth is rather low, we have to rely on debt growth to boost economic growth. That’s why, since 2008, there’s been a big change in terms of liquidity. To save the US economy and boost growth, we had to start injecting liquidity into the financial system. This is more commonly known as money printing.

What’s more, Bitcoin also emerged during the same period. That’s why it is worth bringing up that Bitcoin might be a counter-offensive to central bank interventions.

Generally speaking, when talking about liquidity, we’re talking about bank reserves. There’s a whole parallel mechanism with the central bank. This is why we also talk about the FED’s net liquidity. It is made up of the FED’s balance sheet, the repo market (RRP) and the TGA treasury account. The calculation is as follows, Balance sheet – (TGA + RRP).

- The Treasury General Account is the government’s account. It is used to finance expenses and is funded by bond issuances as well as received taxes;

- The repo market is a market where financial institutions trade with each other;

- The Fed’s balance sheet includes its assets and liabilities.

The impacts of liquidity in 2022-2023

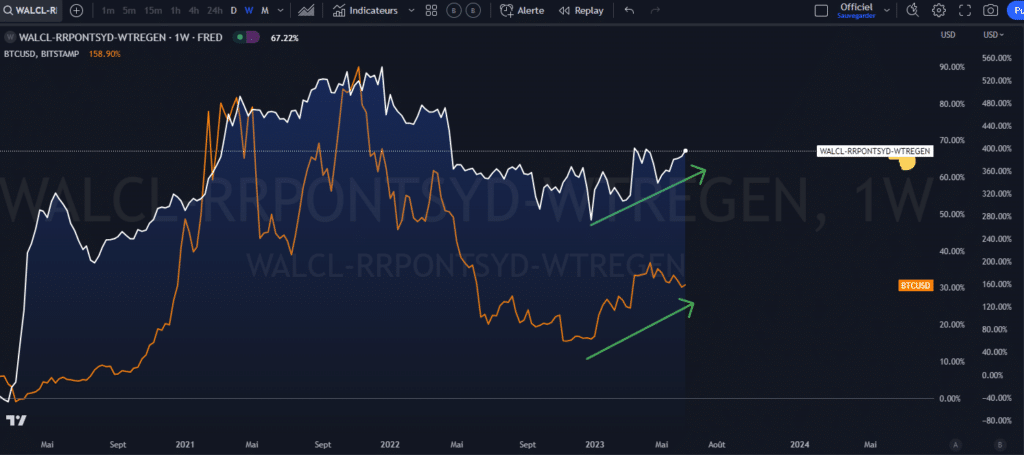

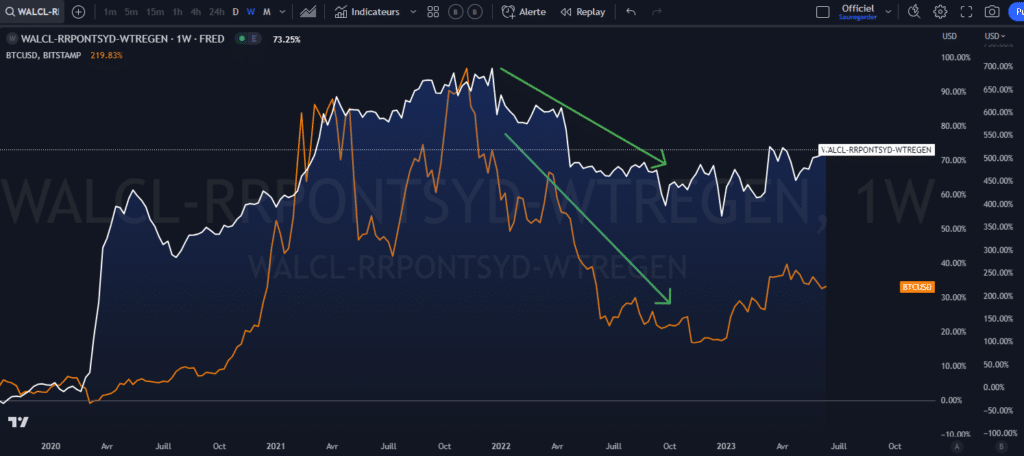

Following the issues that arose in March 2023 with the US regional banks, there was a major intervention by the US central bank. This intervention increased net liquidity in the system. The graph below shows the increased level of liquidity. This fuelled and sustained all movements on the financial markets for the first half of the year.

In a different dynamic, the fall in liquidity during 2022 also supported the bearish movement (downward trend in liquidity).

When studying the relationship between the two, a strong correlation can be observed.

Why is there a risk for the crypto market?

The risk would be to once again experience a decrease in liquidity in the coming months following the agreement to increase the debt ceiling limit. First and foremost, it is important to note that the agreement was completed under several conditions. Here are some of these conditions:

- Raise the debt ceiling for 2 years;

- Cap non-defense spending for the next 2 years;

- Recover some unused COVID-19 relief funds;

- Cut IRS funding;

- Resume student loan repayments.

When the debt ceiling was reached in January 2023, the Treasury General Account had to draw from its capital to fulfill the government’s obligations. This process was favorable to the financial markets as it meant that this money was reinjected into the economy for public spending.

But the account was almost completely drained during the first semester. Hence the urgency for an agreement to increase the ceiling until 2025. As we can now issue bonds and treasury bills, the account will be replenished through the issuance. Projections for the amount are around 500-600 trillion. This increase in the treasury account could decrease the net liquidity of the Fed. This would be the case if not offset by an increase in the balance sheet or a decrease in the repo market in parallel.

How to deal with a decrease in liquidity?

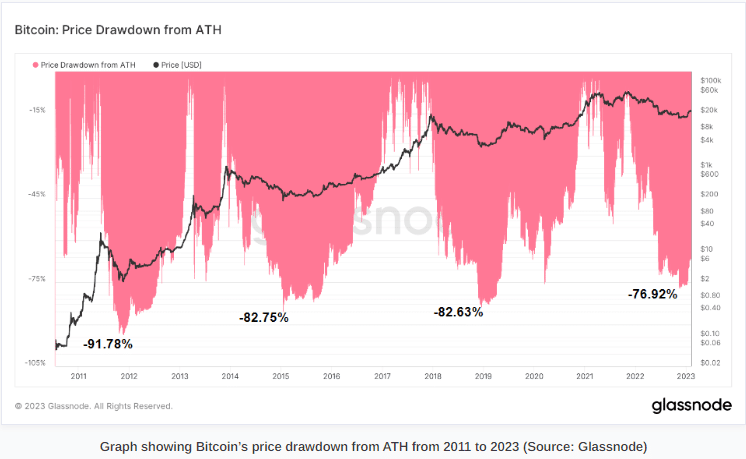

Initially, it is important to be aware that the crypto market remains a fairly volatile asset class. Therefore, movements can be quite attractive on the upside but can also create some fears on the downside. Here is an example of the level of drawdowns on Bitcoin:

There are several ways to deal with this. Firstly, it is important to avoid excessive leverage to limit losses. Of course, it is also advisable to invest only the money that is not needed. Another common practice to navigate periods of volatility is Dollar Cost Averaging (DCA). This process involves averaging the price by investing fixed small amounts at different intervals. This avoids investing a lump sum and facing a large loss if the volatility is high.

While staying within the crypto industry, there are also stablecoins that some operators can use to protect themselves during more difficult periods. However, stablecoins are not necessarily risk-free investments (as seen with LUNA and TerraUSD).

Can liquidity flow into treasury bills at the expense of stablecoins?

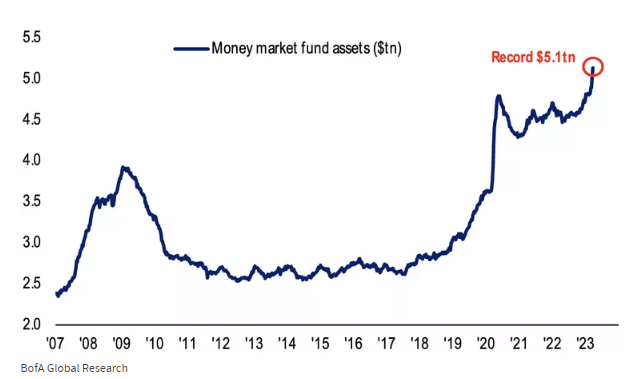

With the rapid rise in central bank interest rates, there has been a strong interest in moving liquidity into treasury bills, as we can see on the chart the shift of liquidity towards treasury bills:

These products are precisely short-term bonds (less than a year). They currently offer over 5% risk-free return. This return is also higher than the inflation rate of 4.1%. As macroeconomic conditions are still quite uncertain, obtaining a 5% return is very enticing. Therefore, operators are more likely to move their liquidity towards treasury bills than stablecoins.

Following the pandemic, we witnessed the emergence of stablecoins. They offered attractive rates at various levels. Meanwhile, banks were offering rates close to 0%. Consequently, there was a strong enthusiasm for storing liquidity in stablecoins. But now we have treasury bills offering rates of over 5%, which attract liquidity and those seeking security.

Conclusion

Now that tensions have eased regarding the potential US debt default, it is mainly what follows that can become problematic. The impact concerning the new issuances of bonds and treasury bills can be significant and push liquidity down. As we have seen during the first semester of 2023, it was liquidity that supported the upward movements. Therefore, all assets that are sensitive to liquidity variations may experience periods of turbulence again.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Après avoir travaillé pendant 7 ans dans une banque canadienne dont 5 ans dans une équipe de gestion de portefeuille comme analyste, j’ai quitté mes fonctions afin de me consacrer pleinement aux marchés financiers. Mon but ici, est de démocratiser l'information des marchés financiers auprès de l'audience Cointribune sur différents aspects, notamment l’analyse macro, l’analyse technique, l’analyse intermarchés…

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.