SEC charges Binance and CZ

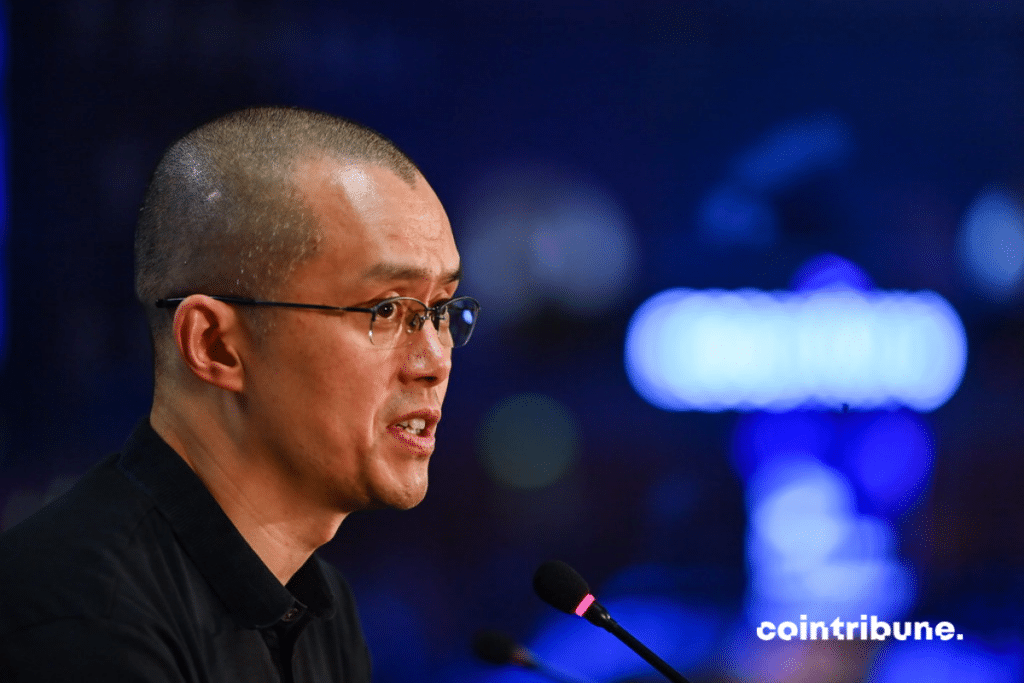

After the CFTC, it’s now the SEC’s turn to go after Binance and its founder Changpeng Zhao (CZ).

Binance and Changpeng Zhao targeted by the SEC

The SEC has filed a lawsuit against Binance, the world’s largest exchange with over 200 million customers (Binance.com).

US subsidiary (BAM Trading Services) that operates Binance.US is also implicated, as well as Changpeng Zhao himself.

The SEC claims that Zhao and Binance did not prohibit US customers from trading on Binance.com, contrary to what had been publicly stated. Important US customers secretly obtained special privileges.

Although CZ and Binance publicly stated that Binance.US is a separate entity dedicated to US investors, the SEC alleges that CZ secretly controlled the operations of the Binance.US platform behind the scenes.

More concerning is that Zhao and Binance would exercise such control over the assets of US customers that they could “divert customer assets as they please, including to an entity Zhao owned and controlled called Sigma Chain.”

The company Sigma Chain allegedly engaged in transactions aimed at artificially inflating trading volume on the exchange. Worse yet, CZ would have sent “billions of dollars of assets belonging to his clients to another company named Merit Peak, also owned by Zhao.”

Binance is also accused of failing to comply with securities laws, particularly regarding the BNB and BUSD tokens, certain cryptocurrency lending products, and staking services.

“Through thirteen charges, we allege that Zhao and Binance entities engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law,” says Gary Gensler, SEC Chairman.

“Zhao and Binance misled investors about their risk controls and corrupted trading volumes while actively concealing who was operating the platform, the manipulative trading of its affiliated market maker, and even where and with whom investor funds and crypto assets were custodied.”

“We allege that Zhao and the Binance entities not only knew the rules of the road, but they also consciously chose to evade them and put their customers and investors at risk—all in an effort to maximize their own profits,” said Gurbir S. Grewal, Director of the Enforcement Division.

The noose tightens around the king of shitcoins. The BNB has been in free fall since the announcement of the lawsuit.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.