Web3 is moving from vision to execution. Blockchains, dApps, and NFTs are no longer experimental: they aim to define the next digital standard. To accelerate this transition, Ultra has launched a one-million-dollar grant fund for developers ready to build the on-chain tools, games, and services of tomorrow. By combining funding, support, and community governance, this program allows builders to transform ambitious ideas into concrete, scalable, and high-impact solutions.

Article long

Tether, once allergic to regulation, now bows to Washington. Opportunism? Late awakening? Crypto is opening a highway... but watch out for the toll!

As of August 1, 2025, the rate of the Livret A will plunge to 1.7%, penalizing the 58 million French people who invest their savings there. A strategic but unpopular decision, which reignites the debate on access to fair and effective savings. In response, the Bank of France revives a long-underused solution: the Popular Savings Account. In this battle of returns, the lines of fracture between safety and performance are being redrawn.

Bitcoin remains king, but its throne is shaking. Its dominance is gently slipping, allowing for a resurgence of altcoins. Leading the way are Ethereum and XRP, as challengers regain ground.

The crypto market has just crossed the symbolic threshold of 4 trillion dollars in capitalization, a level unmatched since the bull run of 2021. However, this push goes far beyond a simple speculative rebound. It reflects a reallocation of capital towards major assets, a renewed confidence among investors, and a silent transformation of exchange infrastructures. More than just a strong comeback, it seems that the crypto ecosystem is entering a new phase of maturity.

Bitcoin is no longer just a hedge. Major public companies now treat it as a core asset, with market values shaped by how they hold it.

When the Assembly knits bitcoin to recycle excess electricity, power plants smile, miners get busy... and digital gold suddenly becomes more French than a baguette under the arm.

After years of uncertainty and tug-of-war between innovation and crypto regulation, the United States finally seems ready to define its course on the burning issue of crypto. On July 17, the Securities and Exchange Commission (SEC) heralded a historic legislative turning point: the passage of the GENIUS Act in the House of Representatives. This ambitious text, now on its way to Donald Trump's desk for enactment, aims to lay the groundwork for clear, proactive, and decidedly future-oriented regulation. Behind the acronyms and well-rehearsed speeches, a message is emerging: crypto is no longer a regulatory anomaly but a strategic lever for the American economy.

The preferred savings account of the French is about to face a serious setback. The rate of the Livret A, held by more than 55 million people, will drop to 1.7% on August 1, 2025, down from 2.4% today. This is a significant decline, the largest since 2009, validated by the Banque de France and in accordance with the regulatory formula. In an still fragile economic climate, this decision reignites the debate on the profitability of regulated savings and raises questions about the future choices of savers in search of alternative solutions.

The AI tokens TAO, NEAR, and ICP are experiencing a spectacular surge, fueled by the announcement of colossal investments in AI and energy. Google, Meta, and Donald Trump are giving new life to AI cryptos. Do these projects have the solid backing to sustain the trend?

JPMorgan and Citigroup are stepping into the stablecoin space as fintech competition intensifies and U.S. lawmakers push ahead with new crypto regulations under the GENIUS Act, signaling a broader shift in traditional banking.

Having firmly established its presence in 2023 and 2024, GM Vietnam — Vietnam Blockchain Week now enters a new chapter, defined by greater ambition, expanded scale, and the spirit of Southeast Asia’s next-generation builders.

Ethereum suddenly emerges from its lethargy. By breaking through a strategic price zone, the asset marks one of its sharpest movements in weeks. Increased volumes, aligned technical signals, and a resurgence of volatility: all the markers of a market awakening are present. This unexpected sequence repositions Ethereum at the center of attention, amidst the liquidation of short positions and the return of speculative appetite. Such a surge raises as many questions as it intrigues, as the ecosystem still struggles to regain a clear direction.

While Pi Network mobilizes millions of users worldwide, its absence on Binance raises questions. Why does the largest exchange platform ignore such a popular project? While Gate.io and Bitget already allow the exchange of PI tokens, Binance remains inflexible. This strategic silence in the face of community enthusiasm does not go unnoticed and reignites debates about the project's credibility, security, and maturity. A decision that, by itself, could reshape the future of cryptocurrency.

Donald Trump has just avoided a major political setback by rallying dissenters from his own camp. Thanks to a direct intervention in the Oval Office, he is back on track for the adoption of the flagship laws of Crypto Week. However, internal tensions regarding central bank digital currencies (CBDCs) hint at a battle that is far from over.

Wall Street flirts with a cypherpunk: 30,000 bitcoins, a SPAC, an impatient heir, and a wink to Satoshi. The question remains who will press the button...

Independence Day for the United States, July 4th embodies more than just a national holiday. It is an ode to audacity, vision, and innovation. This symbolic date has been chosen by Credefi to mark a decisive turning point: its official entry into the American market. From Silicon Valley, the European DeFi protocol asserts its commitment to anchoring decentralized finance in the real economy. Far from being a mere publicity stunt, this expansion reflects a thoughtful strategy, an engaging dialogue with traditional finance, and a clear ambition: to connect the worlds of blockchain and tangible assets, from Sofia to Wall Street.

Digital asset exchange Bitfinex has spotted an interesting trend: grassroots demand for Bitcoin has outpaced supply. Bitfinex’s recent findings come at a time when the apex asset continues to carve strong upward price trajectories amid interest from top industry players. More so, this supply shock indicates the growing appeal of the OG crypto among new market participants despite its high value.

On Tuesday, in a turn as unexpected as it is symbolic, the United States House of Representatives canceled crucial votes on two major cryptocurrency bills. This setback, occurring during the height of "Crypto Week," follows a procedural failure that exposes the deep political divisions surrounding the regulation of digital assets. While attention was focused on the imminent adoption of the "Clarity" and "GENIUS" texts, discussions are now stalled, casting uncertainty on the future of the U.S. crypto framework.

Jerome Powell's term will expire in May 2026, and Donald Trump has already announced that he is considering three to four candidates to replace him. This crucial decision could radically transform American monetary policy and create shockwaves in global financial markets.

The video game industry is undergoing a transformation. Traditional monetization models are crumbling, giving way to new ecosystems driven by technology, creativity, and community participation. At the heart of this shift is Ultra, a pioneering platform that connects Web2 and Web3 without causing division. Gus van Rijckevorsel, CEO of Ultra,…

In a world where the security of cryptocurrencies is becoming a priority, Tangem Wallet disrupts the norms. Gone are the lengthy passwords, forgotten seed phrases, and complex interfaces. Tangem offers a radically new experience: simple, robust, and secure, as intuitive as a bank card. Intended for both newcomers and seasoned investors, this physical wallet combines complete autonomy with ease of use. At a time when the risks of exposure on centralized platforms are skyrocketing, Tangem positions itself as a credible, innovative alternative suited for everyday usage. This is why Tangem doesn't just settle for being an option, but becomes an obvious choice.

From geek to chosen one, Bitcoin is making its revolution. Wall Street sings its praises, Washington is stocking it up... What if gold had found something shinier than itself, but without the bars?

Bitcoin's current price is seen as a buying opportunity by experts like CZ and Kiyosaki, with long-term growth still expected.

Crypto trading isn’t what it used to be. Not long ago, you had to stare at charts all day, act fast, and maybe even know how to code if you wanted to build an automated strategy. But that’s changing fast. A new wave of platforms is making algorithmic trading easier and more accessible. One of the most exciting names leading that charge is Runbot. Today we interview Alexandre, CEO of this no-code, AI-powered platform to better understand their vision, objectives, technologies...

When an AI imitates humans too well, it dons the boots of MechaHitler. Grok, the new tragic clown of Elon Musk, is scarier than a bug in the cloud.

Stablecoins have become a widely used medium of cross-border transactions, especially for retail payments and other overseas remittances. Despite the growing adoption, some within the banking circles have expressed skepticism about these digital fiat-pegged assets. A prominent banking personality even warned the world's largest banks against issuing their own stablecoins.

As Bitcoin soars to new heights, some analysts shout about rational euphoria. Others, more cautious, remind us that the party may be short-lived. Behind the dizzying numbers and cascading records looms a shadow: that of the American Federal Reserve. For while markets anticipate a drop in rates, JPMorgan CEO Jamie Dimon plays the party pooper and suggests otherwise. A bad surprise from the Fed could derail Bitcoin's momentum, especially in a context where retail investors remain strangely absent. Is the king of cryptos running on empty? Analysis.

An explosive Bloomberg investigation accuses Binance and its co-founder Changpeng Zhao of supporting a stablecoin linked to Donald Trump. Named USD1 and issued by World Liberty Financial, this token has sparked numerous controversies. CZ denounces it as a "biased article" and is considering legal action for defamation. Such a case illustrates the growing tensions between political power, financial regulation, and crypto influence.

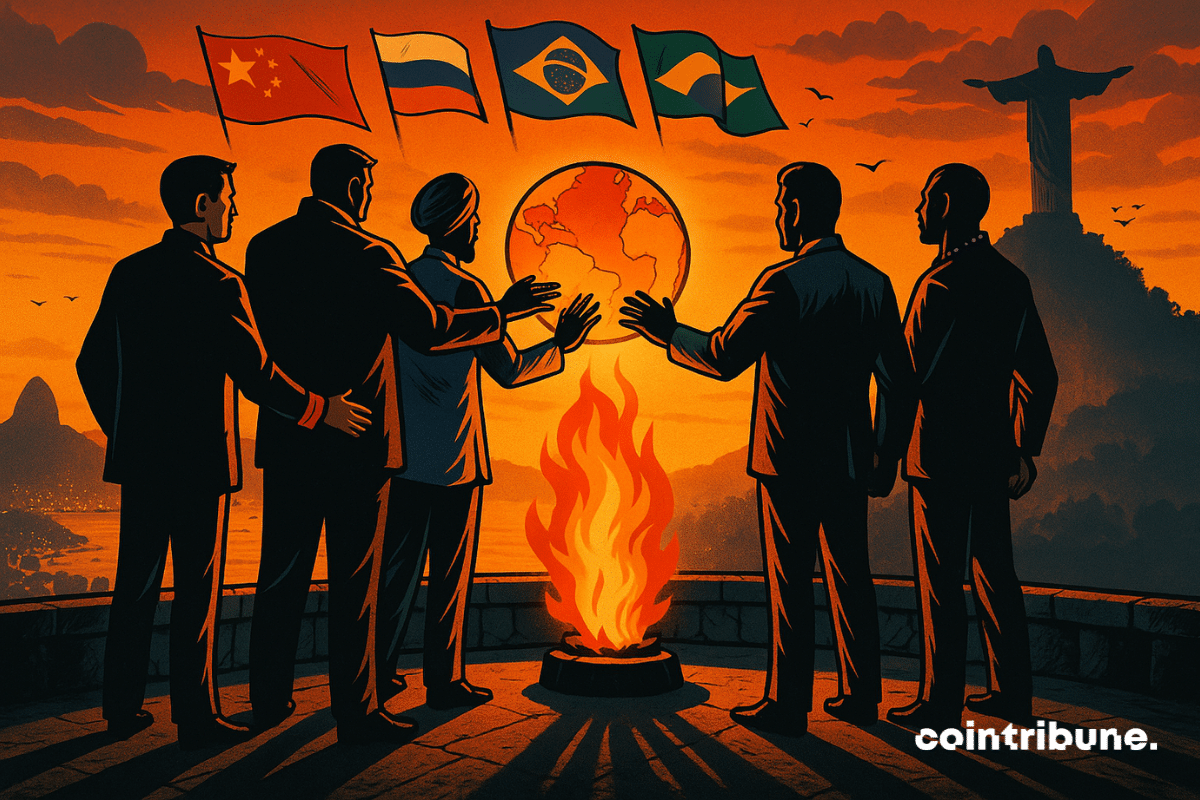

As global balances are being redrawn, the BRICS summit in Rio outlined the contours of a more pronounced multipolar influence. Behind the notable absence of Xi Jinping and Vladimir Putin, discussions led to concrete proposals: reform of international institutions, enhanced climate cooperation, and regulation of artificial intelligence. Less spectacular, but more strategic, this edition sheds light on the ambitions of the global South, while revealing the latent tensions that weaken the coherence of a bloc in search of credibility.