The traditional bond market remains complex, opaque, and reserved for an elite. Credefi is shaking up these norms by launching NFT Bonds, an innovative solution that makes investing in corporate bonds accessible, transparent, and profitable for everyone, thanks to the tokenization of real assets and the power of DeFi.

Article long

When crypto turns into an invitation card: to have dinner with Trump, all you need is to own his token. Political marketing is certainly no longer afraid of ridicule.

The crypto universe has just experienced a dramatic twist. While Bitcoin hovers around $94,000, Cardano (ADA) is making an unprecedented breakthrough: its trading volume exceeds one billion dollars in 24 hours, propelling its price up by 11%. A performance that raises as many questions as it fascinates. Behind these figures lie technical mechanisms, power struggles between buyers and sellers, and an alchemy unique to decentralized markets. A deep dive into the guts of a rebound that could reshape the balance of cryptocurrencies.

With Trump, we are witnessing the transition from a trade war to a total economic war between the United States and China.

Bitcoin dethrones Google, taunts Wall Street in a sweat, and climbs like a digital goat on amphetamines while the dollar stumbles and the stock markets take a tax nap.

The United States will have to abandon the exorbitant privilege of the dollar if the goal is truly to become an industrial power again. A good omen for bitcoin.

Gold continues to shine at $3,400 an ounce. A good omen for Bitcoin, which will inherit this fortune sooner or later.

Russia, an influential member of the BRICS bloc, has just crossed a historic monetary milestone: in February, more than half of its imports were settled in rubles. This strategic advancement, confirmed by the Central Bank, is part of a clear break with the dollar-dominated system. As tensions with the West escalate, Moscow is redirecting its trade towards partners deemed "friendly," thus redefining global financial balances and accelerating its trajectory towards strengthened economic autonomy.

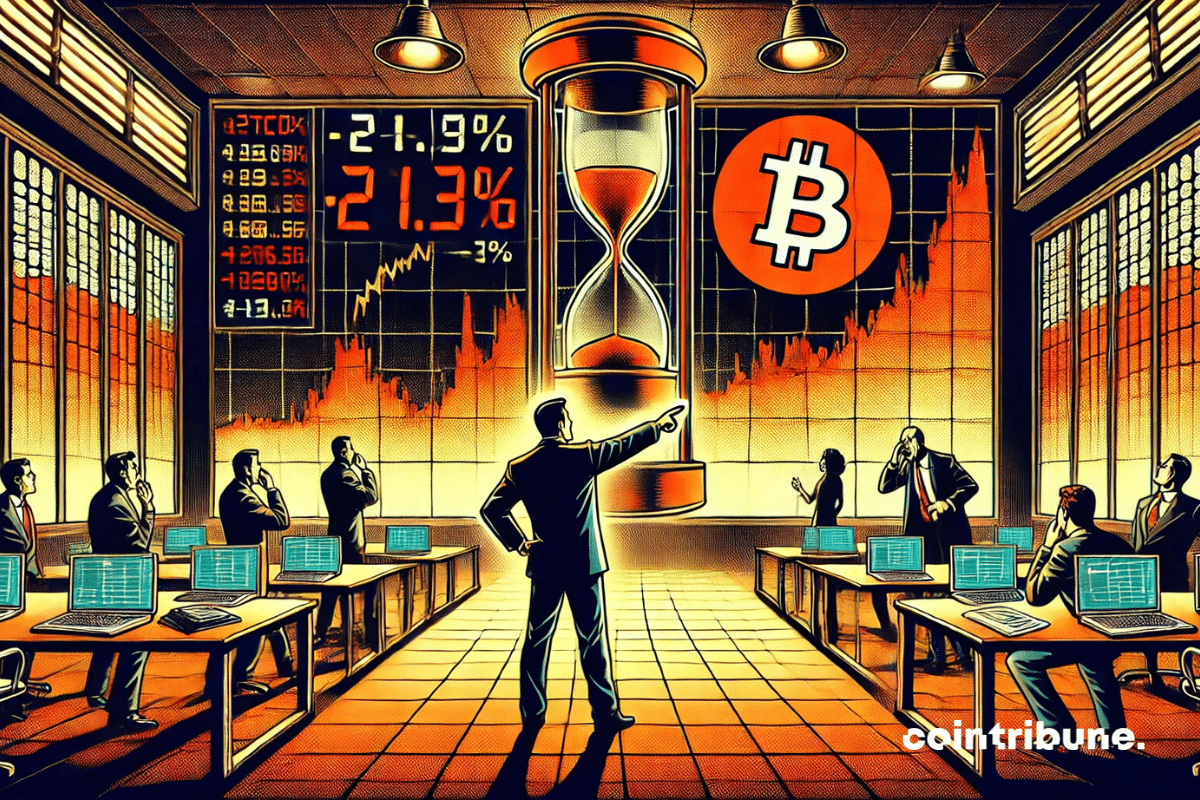

Bitcoin is currently navigating through troubled waters. Below the symbolic threshold of $90,000, the landscape turns red for recent holders, while crypto veterans stay the course. Between technical corrections and discreet accumulation by institutions, the market sketches a complex map: that of a fragile balance between latent losses and tenacious confidence. A dive into the meanders of an asset that refuses to yield to fatalism, despite the storms.

While Trump plays the customs officer, Tesla wavers, Alphabet holds firm, and Wall Street takes on water. The markets, on the other hand, brace for the next presidential tweet.

In a world where information often blends with misinformation, Telegram, the encrypted messaging app, found itself at the center of an unprecedented controversy. While France claims to have forced the platform to comply with European regulations following the arrest of its founder, Pavel Durov turns the accusation around: according to him, it was the French authorities who delayed implementing the procedures stipulated by the EU. A rhetorical duel that reveals deeper tensions over the control of tech giants.

The Bank for International Settlements (BIS) has just issued an unprecedented warning: cryptocurrencies and decentralized finance (DeFi) may have crossed a critical threshold, threatening global financial stability. Behind this observation lies a paradox. While the crypto ecosystem prides itself on democratizing finance, according to the BIS, it could amplify inequalities and create unexpected systemic risks. Between massive adoption, shaky regulation, and contagion effects, here is an analysis of a warning that is shaking the markets.

In the bustling city of Dubai, a company named Nexum has been quietly working behind the scenes for years to build a solution that could revolutionize global financial management. With blockchain technology at the core of its approach, Nexum's mission is to bridge the gap between traditional financial systems and the decentralized future. Its goal: to offer solutions that are both innovative and tailored to the real needs of industries such as maritime transport, trade finance, and commodities. As global economies face inefficiencies and regulatory challenges, Nexum's blockchain-powered solutions provide a pathway to a future where financial transactions are faster, more secure, and more inclusive.

Paris Blockchain Week, Europe's premier blockchain and Web3 event, wrapped up its sixth edition at the iconic Carrousel du Louvre, setting a new standard for industry gatherings. The event was a resounding success, drawing over 9,600 attendees from 95 countries, including an impressive 67% C-suite executives, demonstrating the strategic significance of blockchain across global business leadership.

If the United States bought 1 million BTC, the price of bitcoin could reach 1 million dollars. A strategic reserve that would disrupt the global economy and reinvent financial assets.

France is struggling with a massive deficit, Bayrou calls for more work, but amid social cuts and political tensions, the reform risks triggering a governance crisis.

Shiba Inu stagnates under pressure, its fall is imminent. Bitcoin absorbs investors, and SHIB, with its anemic volume, could lose a zero in value if no change occurs.

Bitcoin is nearing its peaks, but a specter hovers over its trajectory. While the asset tests $86,000, a dreaded technical indicator remains frozen: the "death cross." This crossover of moving averages, often associated with bearish reversals, persists despite the current surge. Why does such a signal persist? Is it merely an anomaly or a serious warning? As positions accumulate, traders oscillate between confidence and caution, torn by a market in full dissonance.

Trump and Bukele, in their meeting at the White House, ditch Bitcoin to talk about prison and commerce. The future of crypto? It will have to wait until serious matters are settled.

Canada has just set a global precedent by approving the first spot ETFs backed by Solana (SOL), with staking options. While the United States struggles to move beyond Bitcoin and Ethereum, this Canadian initiative elevates Solana to the status of an institutionalized asset, marking a clear break in the hierarchy of listed cryptocurrencies. This is a strong signal for an ecosystem that has long been relegated to the background.

Billionaire Ray Dalio warns that the international order is about to change at the expense of U.S. monetary hegemony. Bitcoin is lurking.

The recent imposition of massive tariffs by Donald Trump, followed by an unexpected pause on certain Chinese products, has thrown financial markets into turmoil. While some see this as a deliberate strategy to reorganize the global economic landscape, others interpret this turnaround as a capitulation to market pressures and Chinese intransigence.

"We do not defend nature. We are nature defending itself." This indigenous proverb illustrates the capacity of the natural world to survive crises without seeking absolute optimization. It reminds us that resilience is at the heart of living beings. Nature does not aim for speed or immediate efficiency, but for diversity and adaptation. Certain animal species, in particular, traverse the ages by evolving in response to threats. Similarly, Bitcoin does not rely on instant performance, but on its resilience due to its decentralized architecture. It follows the same laws of nature, being able to withstand multiple attacks and bans. The parallel drawn in this article between nature and Bitcoin raises an essential question about the model to adopt. Should we prioritize efficiency or resilience, in order to ensure the sustainability of a world in constant digital evolution?

Ethereum ETFs, still lagging behind Bitcoin, are awaiting the blessing of staking to rise. The SEC could seal their fate by the end of 2025, but uncertainty remains.

The crypto market, with its promises of exceptional returns, attracts thousands of new investors every day. However, in this volatile and complex ecosystem, mistakes can prove particularly costly. Amidst the deluge of contradictory information, fraudulent projects, and unpredictable fluctuations, navigating the crypto universe requires meticulous preparation and a rigorous strategy. Here is a detailed guide to the pitfalls to absolutely avoid in order to turn your crypto experience into lasting success.

As the trade war between the United States and China threatens the global balance, bitcoin is gradually emerging as the next international reserve currency.

"Kraken and Mastercard are teaming up to launch a crypto debit card in Europe and the UK. This announcement illustrates the willingness of industry giants to make cryptocurrencies a tangible payment tool, beyond speculation. In a market under regulatory pressure, this initiative embodies a new phase: that of usage and the real integration of cryptocurrencies into everyday life. It is a strong signal at a time when the industry is seeking tangible and compliant use cases."

James Murphy is suing the U.S. government under a FOIA complaint, hoping to obtain documents regarding the identity of Satoshi Nakamoto, following revelations from a DHS agent about a meeting in 2019.

WLFI, whose partner is the Trump family, is testing its stablecoin with a USD1 airdrop. While this initiative attracts attention, it also raises concerns about regulation.

1 Zettahash, a technical victory for Bitcoin, but a chilling economic blow for miners: a record power that hides compressed margins and falling prices.