Coinbase is one of the most popular platforms for buying, selling, and storing cryptocurrencies. However, some users may choose to close their account for various reasons, such as seeking an alternative or concerns about the management of their personal data. This comprehensive guide explains how to permanently delete your Coinbase account by following a clear and secure procedure.

Article long

The Coinbase API stands out as a preferred resource for developers and companies looking to integrate cryptocurrency-related features into their projects. This powerful interface offers a variety of possibilities, ranging from crypto wallet management to transaction automation. This comprehensive guide explores the features and use of the Coinbase API to meet the technical needs of its users.

The Coinbase Card has become an essential solution for those who want to use their cryptocurrencies in everyday life. It allows for payments in digital or fiat currencies, directly at merchants accepting Visa. With a user-friendly interface and advanced features, this card aims to democratize the use of cryptocurrencies in daily life. However, to make the most of it, it is necessary to understand its characteristics, advantages, and limitations.

Coinbase and Coinbase Advanced are two flagship platforms in the crypto ecosystem. Designed by the same company, they aim to meet the needs of a diverse range of users, whether they are beginners or seasoned traders. While complementary, they differ significantly in terms of objectives, features, and fees. This article guides you in determining which solution is best suited to your profile and ambitions in the world of crypto.

Coinbase is a well-established cryptocurrency exchange platform, providing services to millions of users worldwide. However, one of the major challenges for investors and traders with this crypto exchange lies in the fees that can significantly reduce profits. This guide thoroughly explores strategies to understand and optimize these fees, allowing users to make the most of their transactions.

Gains made through the Coinbase platform, like any other source of income from cryptocurrencies, must be declared for tax purposes. Tax regulations regarding digital assets have tightened over the years. This practical guide will accompany you step by step to understand the necessary procedures, calculate your taxable gains, and submit a declaration compliant with your country's law.

Coinbase's listing on the Nasdaq marked a historic advancement for the crypto ecosystem. In 2021, Coinbase Global Inc. became the first major crypto platform to go public, attracting the attention of traditional investors and blockchain enthusiasts. Understanding this listing, its implications, and the tools to analyze its market price is fundamental for anyone looking to explore the opportunities offered by this iconic company.

Coinbase is one of the most popular platforms for buying, selling, and trading cryptocurrencies. With its referral program, it offers users a unique opportunity to earn rewards by inviting others to sign up. This system relies on bonuses for each successful registration. However, to fully benefit from it, it's important to master certain techniques and strategies. In this article, discover how to maximize your earnings with five simple yet effective tips.

The Coinbase card is establishing itself as an essential tool for integrating cryptocurrencies into everyday life. Designed to combine simplicity and flexibility, it allows users to utilize their digital assets like traditional currency, facilitating payments and withdrawals on a global scale. The services and features of the Coinbase card, such as instant payments and cryptocurrency rewards, appeal to both beginners and experienced users alike. In this guide, discover everything you need to know about its operation, fees, as well as its advantages and limitations.

Ultra, the one-stop destination for gamers, publishers, and developers, has appointed Maxime van Steenberghe as its new COO, marking the next milestone in the company’s aggressive expansion plans. Maxime’s appointment underscores Ultra’s commitment to building a powerhouse leadership team to execute its bold vision for the future of gaming.

When justice resolves a long-standing conflict, markets do not hesitate to draw their conclusions. Thus, the end of the duel between Ripple and the SEC goes beyond the judicial framework: it reshapes the future of XRP. As regulatory uncertainty fades, a new dynamic emerges. Predictive markets are already getting excited: is an XRP ETF now inevitable? With influential players watching for any opening, Ripple may finally see a door that has long been closed open. But, is the SEC ready to take this step?

They said DeFi was invincible. Then came JELLY, so tender, so toxic. An invisible loss, a cry in the code. And trust, like the blocks, collapsed.

The stimulus from monetary easing and the public deficit bodes very well for Bitcoin, which remains poised just below $100,000.

The bitcoin market is moving, twitching, hesitating… and with it, the emotions of investors. Here are the 5 key points to absolutely know this week to avoid navigating blindly in this turbulent sea.

As the digital gold of Bitcoin attracts the crowds, the shadow of Ethereum thickens, abandoned, drained, powerless to entice the trembling hands of the crypto market.

The alignment of the planets continues. While the United States wants to accumulate "as many bitcoins as possible," the global money supply is climbing again.

The end of the endless legal battle between the SEC and Ripple surprised no one, as investors had already anticipated this withdrawal due to a pro-crypto shift driven by the Trump administration. While the announcement marked the closure of one of the sector's most emblematic legal cases, the markets had already priced in this outcome well before it was officially announced.

Ethereum ETFs pave the way for broader institutional adoption, but remain incomplete. According to Robbie Mitchnick of BlackRock, their main drawback lies in the absence of staking, a pillar of yield on Ethereum. This lack could limit their competitiveness against direct investment strategies, calling into question their ability to meet the expectations of professional investors.

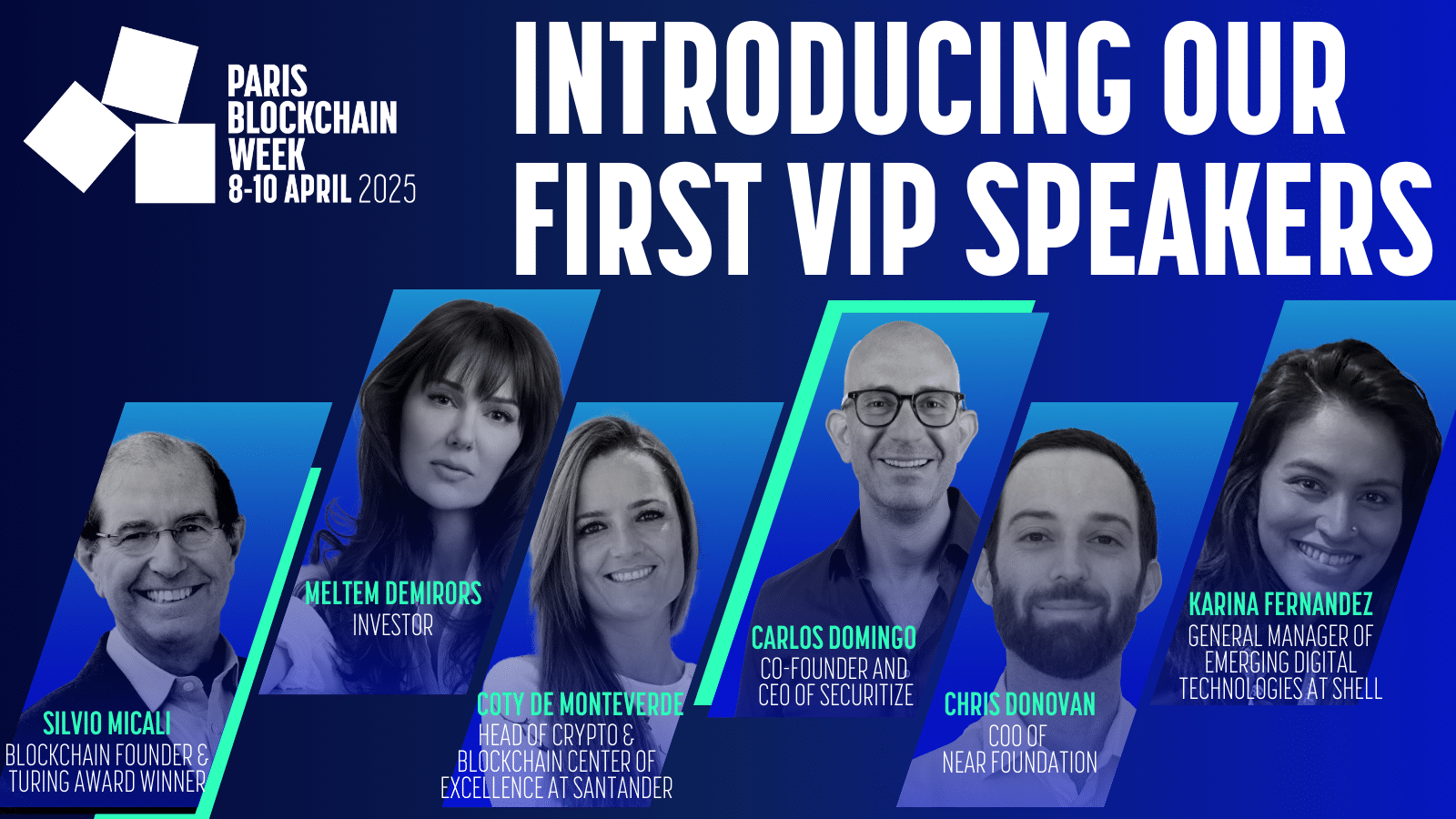

Paris Blockchain Week, the premier global event for blockchain professionals, reveals the first six headline speakers for its sixth edition, which will take place from April 8-10th, 2025, at the Carrousel du Louvre.

Money migrates, silent and methodical. Wall Street, once untouchable, sees its throne wobble under the hurried steps of investors, captivated by a Europe shining with trillions.

Artificial intelligence has reached a decisive milestone with the rapid rise of ChatGPT, revolutionizing both the general public and businesses. However, in the face of the limitations of giant models, a new approach is emerging: intelligent agents. Capable of acting and interacting with their digital environment, they are redefining the future of AI by moving from simple text generation to the execution of concrete, autonomous tasks.

In his recent intervention, Subrahmanyam Jaishankar sought to dispel any ambiguity about India's position regarding the dollar: "there is no policy on our part aimed at replacing the dollar. At the end of the day, the dollar as a reserve currency is a source of international economic stability."

Join Qubic & Vottun in Madrid for an exclusive hackathon where top Web3, blockchain, and AI developers will push the boundaries of decentralized computing. Compete for over €80,000 in prizes, network with industry leaders, and gain hands-on experience building on Qubic’s decentralized computing platform.

Investing in cryptocurrencies can seem complex, especially when it comes to understanding the fees imposed by platforms. However, these costs can greatly influence the profitability of your investments. Coinhouse, the first French platform regulated by the AMF as a Digital Asset Service Provider (PSAN), positions itself as a trustworthy choice thanks to its transparency and secure framework. Whether you are a beginner or an experienced investor, it offers you competitive fees and unique support. Discover in this article a detailed analysis of the fees applied by Coinhouse, a comparison with other platforms, and the advantages it offers to simplify your crypto investments.

Buying cryptocurrencies can quickly become complicated due to high fees, transaction delays, or unintuitive processes offered by some platforms. In the face of these challenges, Coinhouse offers an innovative solution: the Euro Account. This unique service allows users to manage their funds with simplicity, speed, and security, thanks to a French IBAN and instant transactions. Ideal for individuals and professionals, the Euro Account streamlines the purchase of cryptocurrencies while reducing fees and ensuring total transparency. In this article, discover how it works, its advantages, and the steps for registration to fully benefit from it.

Bitcoin is today a key pillar of digital investments, combining innovation with exceptional growth opportunities. Whether you are a beginner or an experienced investor, integrating this cryptocurrency into your portfolio can be a real opportunity for your personal finances. But how can you ensure a secure and efficient purchase? Coinhouse, the first French platform regulated by the AMF, supports you at every step with simplicity and transparency. In this article, discover why bitcoin is a strategic asset for your wealth, the detailed steps to acquire it on Coinhouse, and how a quick registration process with KYC ensures a smooth and secure experience.

Are you hesitant to invest in cryptocurrencies due to concerns about security risks? You are not alone. In this world where hacks and frauds are a reality, choosing a reliable platform is essential to protect your investments. Coinhouse, the first French platform regulated by the AMF, stands out for its commitment to transparency and security. With robust protocols and a simple and fast identity verification process (KYC), it guarantees you peaceful transactions. Discover in this guide how Coinhouse supports you to invest with complete confidence.

The crypto market is once again in a period of uncertainty, suspended on a single question: what will be the next decision of the American Federal Reserve? While bitcoin fluctuates below $85,000 and the crypto market's fear and greed index collapses to 23, investors hold their breath. The Federal Open Market Committee (FOMC) meeting concludes today, and all eyes are on Jerome Powell.

The president of the Russian central bank ridiculed herself by trying to rein in bitcoin.

Solana, the rising star of cryptocurrencies, dances with the giants of the CME. Its futures contracts sow the hope for an ETF, but the SEC plays the cautious divas. Guaranteed suspense!