In a crypto market marked by euphoria and panic, Changpeng Zhao, founder of Binance, gives decisive advice. For him, the best Bitcoin investors do not buy at the top, but in the dips, when fear dominates. A strategy that makes perfect sense at a time when the market experiences extreme volatility. CZ's words are more relevant than ever for those looking to operate in this uncertain environment.

Binance

On December 25, bitcoin briefly dropped to 24,000 USD on Binance's USD1 pair before rapidly returning to more usual levels. Such an unexpected move raises questions about the stability of low liquidity pairs and risk management on trading platforms. In a rapidly evolving crypto market, this incident reveals challenges related to liquidity and regulation.

Despite a historic agreement with US authorities in 2023 and strict commitments against money laundering, Binance reportedly failed to block suspicious accounts. These accounts transferred colossal sums, raising serious questions about the real effectiveness of the controls in place.

Binance has exceeded 300 million registered users, eight years after its launch. In crypto, this milestone matters as much for the symbol as for what it reveals. It tells a story of a liquidity machine, solid technical execution, and the ability to survive storms.

The Christmas season often raises the same question each year: what gift will have lasting value? For people involved in crypto, interests extend far beyond standard tech gadgets. Crypto users form a global community focused on digital ownership, financial independence, and long-term participation in blockchain networks. And as such, selecting a crypto-related gift shows awareness of these priorities. This article presents practical, beginner-friendly crypto gift ideas suited to different interests while remaining useful long after the holidays.

In an official communication, Binance warned its users and project holders against fraudulent agents claiming to facilitate token listing on Binance, often in exchange for payments. To accompany this message, the exchange announced a reward of up to 5 million dollars for any credible information identifying these practices.

Bitcoin’s Lightning Network has reached a new capacity record as major exchanges add more funds and developers roll out new tools. At the same time, an upgrade to Taproot Assets is pushing Bitcoin closer to supporting multiple asset types on its base ecosystem.

Regulatory pressure on the US crypto sector has eased sharply since President Donald Trump returned to office. Enforcement priorities at the Securities and Exchange Commission have shifted, with crypto firms now facing far fewer legal actions than in previous years.

The case quickly took a diplomatic turn. After the hacking of Upbit, one of the largest South Korean crypto exchanges, Binance finds itself at the center of a controversy: some investigators in Seoul claim that the platform only froze a small portion of the stolen funds. Binance, on the other hand, strongly disputes this version and assures it acted immediately.

The continuous decline of bitcoin reserves on Binance attracts the attention of analysts as the asset trades near $93,000. The latest data from CryptoQuant confirms an unprecedented drop, raising questions about the current market structure. This movement, far from indicating immediate weakness, invites examination of what drives these fund outflows and what they truly reveal about bitcoin's dynamics.

The world's largest crypto exchange platform strengthens its ties with the Trump family. Binance has massively integrated USD1, the stablecoin from World Liberty Financial, into its infrastructure. A rapprochement that comes just weeks after the presidential pardon granted to its founder.

Bitcoin is soaring, Binance is struggling, shrimps flee, whales dance… and ETFs scoop up the stakes. Here's a crypto-comedy that would be funny if it weren't so serious.

Financial commentator Peter Schiff is back in the news as tensions rise between him and President Donald Trump over the state of the U.S. economy. Schiff’s warnings about rising prices clash with Trump’s claims that affordability is improving across the country. At the same time, Schiff has also renewed his public dispute with Binance founder Changpeng Zhao (CZ), giving his comments even more visibility.

During Binance Blockchain Week, Peter Schiff was invited by Changpeng Zhao to authenticate a gold bar live. Unable to confirm its authenticity, the economist simply replied: "I don't know." A brief but revealing scene, which reignites the debate between physical gold and bitcoin, and raises questions about the verifiability of assets in a world increasingly oriented towards decentralization and blockchain transparency.

Binance redistributes roles: Yi He takes the stage. Should crypto investors rethink their strategy? Details here!

While many eyes remain fixed on Bitcoin and Ether, Solana is currently playing a much subtler game. The SOL crypto still holds above the 120 dollar area, but this level is not just a technical support: it is supported by a real shift in liquidity and on-chain supply. However, trader-side demand remains surprisingly timid. And as long as this gap persists, Solana's structural advantage is not fully reflected in the price.

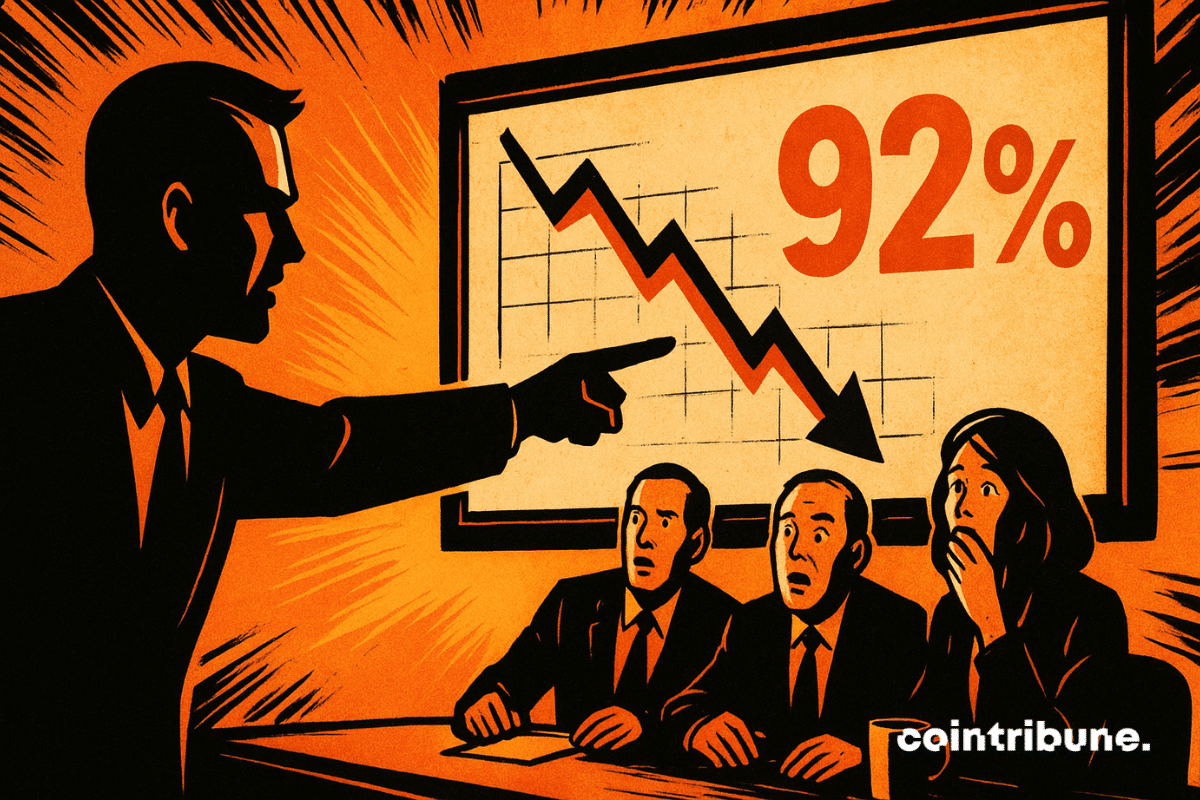

Changpeng Zhao and his investment company YZi Labs come out swinging against the management of CEA Industries, accused of letting the BNC stock price collapse by more than 90%. This offensive marks a turning point for the future of this treasury company dedicated to BNB. Will shareholders follow CZ in this battle to regain control?

Binance records a marked decrease in its Bitcoin and Ethereum reserves. At the same time, stablecoin deposits reach unprecedented levels. This surprising contrast draws the attention of analysts, who see a strong signal: the market is not disengaging, it is repositioning.

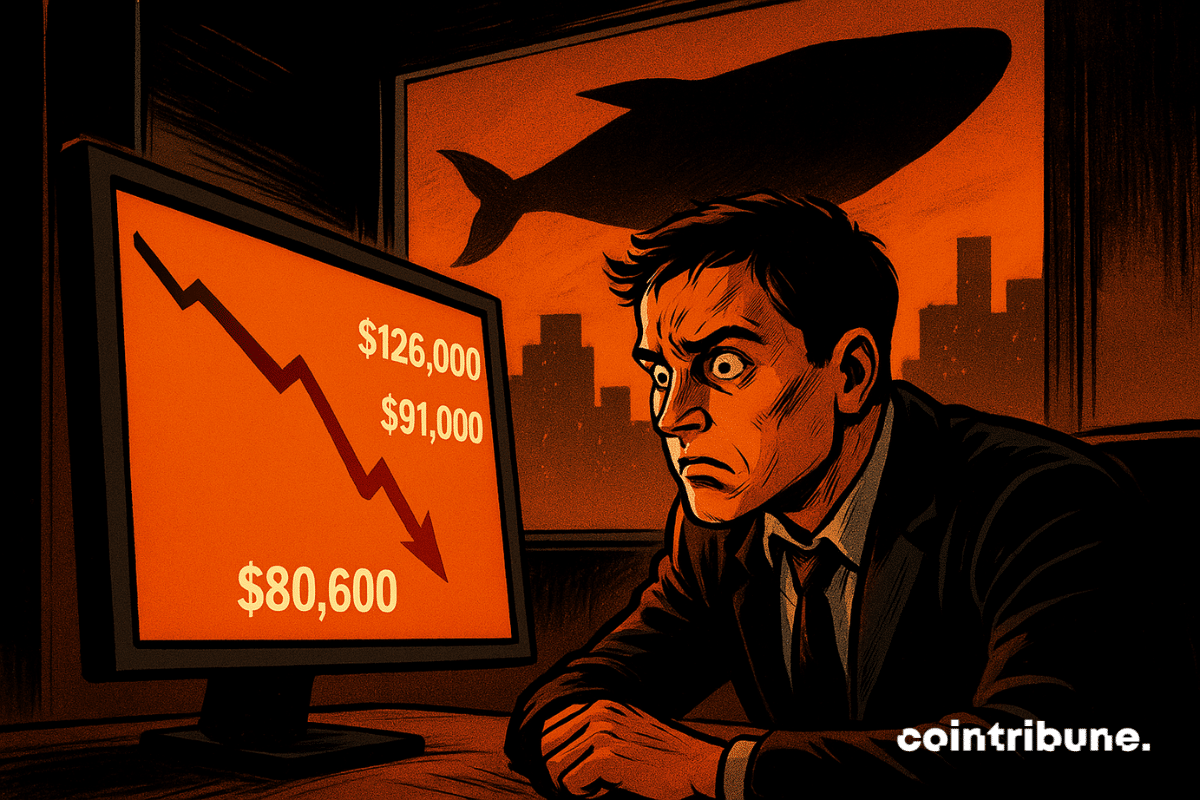

Fresh selling from large Bitcoin holders is putting renewed pressure on an already shaky market, as traders deal with one of the steepest pullbacks of the year. Price softness, rising exchange inflows, and cautious positioning across major trading venues all point to a market still trying to find its footing. Analysts at CryptoQuant say continued whale deposits could push Bitcoin lower if the pattern persists.

Bitcoin, in slide mode, flirts with the precipice of the CME Gap while whales do their shopping. Bounce to come or final plunge? Suspense guaranteed.

BlackRock’s BUIDL Token Gains Institutional Traction as Binance Expands Support

Coinbase has deepened its involvement in BNB Chain activity by adding Aster (ASTER) to its listing roadmap. According to market chatter, the exchange’s decision to broaden its coverage is driven primarily by growing interest in BNB Chain–linked assets. Following this recent development, attention has turned to Aster’s market trajectory and the renewed focus from Changpeng “CZ” Zhao.

Richard Teng, CEO of Binance, breaks the silence: facing rumors of collusion with Donald Trump’s USD1 stablecoin, he firmly denies them. Between presidential pardons and crypto stakes, this case reveals the behind-the-scenes of a tense sector. Is the truth finally unveiled?

Aster, a decentralized perpetuals exchange, surged over the weekend after Binance founder Changpeng “CZ” Zhao revealed a personal investment of more than $2 million in its native token. His entry into the project reignited market excitement, drawing investors back to the fast-growing DeFi platform and reaffirming his lasting influence over digital-asset markets.

Crypto venture capital activity continued its steady recovery in October, closing the month with $5.11 billion in reported deals. Investor confidence strengthened after a slower summer, and funding levels nearly matched the March 2025 peak of $5.79 billion. Early data suggests that October’s final total could rise further once all undisclosed rounds are reported.

While the small fry are stirring, crypto whales quietly pile up BTC on Binance... What if the real maneuvers are unfolding in the silence of order books?

A false information involving Changpeng Zhao in an alleged massive sale of ASTER tokens triggered a real earthquake on the crypto markets. The token of the decentralized platform Aster plummeted sharply, dragging millions of dollars in liquidations behind it. But what really happened?

In October, the Bitcoin market confirmed its vitality despite a sharp price correction. Spot volume exceeded 300 billion dollars, a sign of a return to "cash" trading and a reduction in leverage usage. According to CryptoQuant, this dynamic reflects a healthier market, capable of withstanding volatility without a sudden collapse. In short, despite the drop in BTC, investors, whether retail or institutional, show renewed confidence in the spot market, marking a structural evolution of the market towards greater stability.

With scammers growing more sophisticated, Binance outlines essential security measures to protect user accounts.

Seven Democratic senators raise concerns over Trump’s pardon of Binance’s CZ, citing possible connections to the Trump family and risks to law enforcement.