Influx of record and diversification of crypto assets since the beginning of the year: cryptocurrencies attract investors.

Bitcoin (BTC)

Bitcoin is bouncing back after starting April on a downward trend. Let's analyze together the future outlook for the BTC price.

Arthur Hayes predicts the fall of Bitcoin before and after the Halving. Let's discover his strategy to navigate through this volatility!

For the past seven weeks, Bitcoin ETFs have seen a massive influx of capital. While many experts and investors were expecting this trend to continue, it is fading. Here is what explains this trend, which also affects several other crypto funds, including Ethereum, Solana, and Cardano.

What do Bitcoin ETFs have in store for us this week? Will we finally hit a new all-time high?

Among revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battlefield of regulatory and economic struggles. Here is a summary of the most significant news of the past week around Bitcoin, Ethereum, Binance, Solana, etc.

On Sunday, April 7, Bitcoin (BTC) saw a new increase in its value. Its price, which had significantly dropped in the previous days to a level close to $65,000, rose to just over $70,000. Just days before the halving, this rise in the price of the flagship crypto is sparking speculation.

Binance crypto exchange announced the end of support for Bitcoin NFTs on its marketplace by April 18th. This decision comes as part of streamlining its product offerings, despite the success of Ordinals.

The next Bitcoin Halving is approaching fast. As speculations and uncertainties intensify, TimeChain Calendar offers a wealth of information and real-time analysis to understand the internal workings of the Bitcoin network.

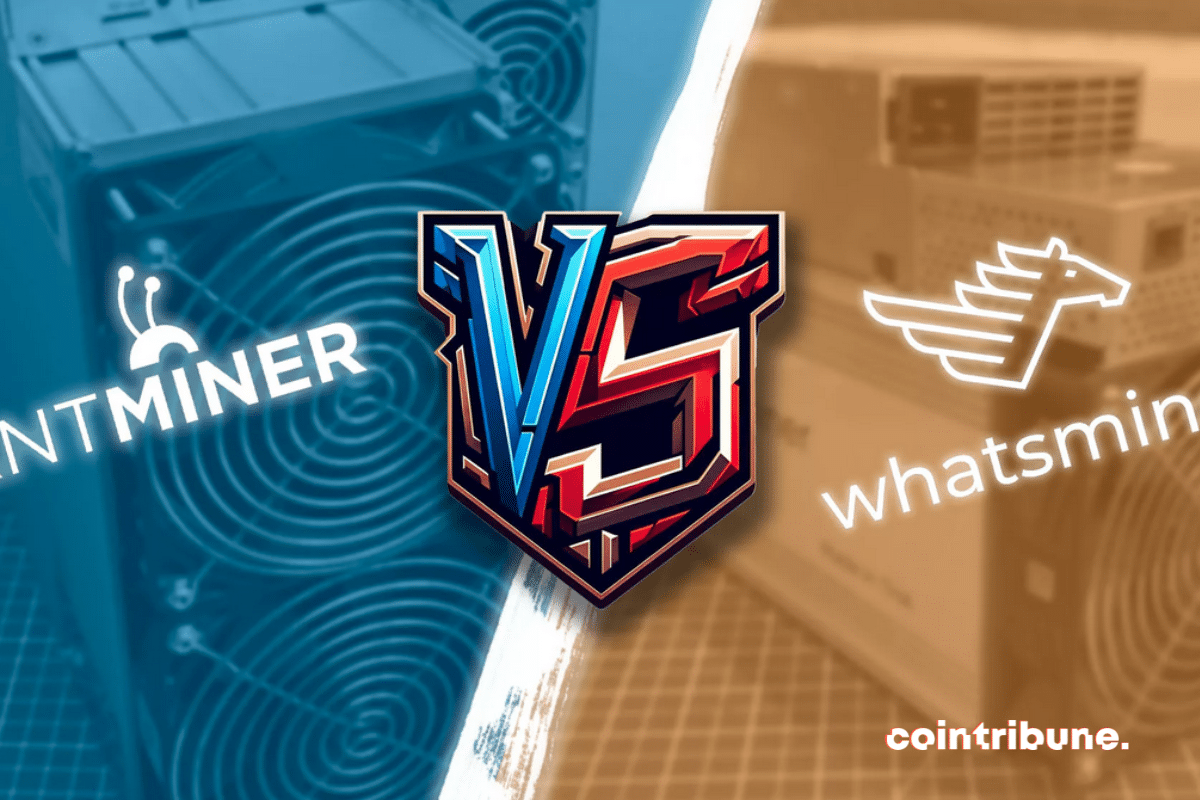

The high temperature performance of Bitcoin miners Whatsminer is significantly better than that of the Antminer.

It was known that with the dynamism that has been theirs for several months, cryptocurrencies have lifted many people out of financial misery. The magazine Fort, in a recent study, documented these perceptions. Its report shows how in the space of a year, these assets, both beloved by some and feared by others, have created new billionaires. As for the old ones, they have seen their financial assets linked to crypto grow in line with their faith in these assets. In this article, we present to you those who, through risks, have become wealthy thanks to crypto.

It is traditionally accepted that Bitcoin (BTC) maintains a relationship with the stock market in terms of movement. If this link remains, a crypto expert reveals that it is not as strong as commonly believed. He especially notes that Bitcoin's correlation with the S&P 500 is now negative.

Let's explore the implications of a significant decrease in Bitcoin reserves held by major cryptocurrency exchanges.

Bitcoin fluctuates between peaks and valleys! Let's look together at the key factors that have influenced this roller coaster.

The Ethereum Foundation wants to once again modify the monetary policy of Ethereum. The growing number of validators is the issue at hand.

On April 4, 2024, Bitcoin Cash (BCH) crossed a major milestone with its second halving, causing significant price volatility. As the crypto industry gears up for the highly anticipated Bitcoin halving, attention is turning to the potential implications of these two events.

The Bitcoin Ordinals are gaining interest from Franklin Templeton, highlighting their rising power in the market.

Translation:

For the first time, Cathie Wood's ARK 21shares Bitcoin ETF (ARKB) recorded more outflows than the Grayscale Bitcoin Trust (GBTC). On April 2, ARKB lost $87.5 million, surpassing GBTC's record for daily outflows.

Despite the headwinds in the crypto universe, AVALANCHE (AVAX) is showing resilience, offering investors a glimmer of hope!

According to Glassnode, long-term Bitcoin holders are reacting emotionally to the new peak of the flagship cryptocurrency.

In the United States, federal agents discreetly move $139 million in bitcoin from the black market!

Discover the impact of the recent Bitcoin crash, leading to a massive liquidation of $500 million. In-depth analysis

Explore the 5 major crypto events in April 2024 that will make the markets more volatile than ever!

After concluding seven consecutive months of growth, Bitcoin begins a new month in the negative. Let's analyze together the future prospects for the price of BTC.

Investors are rushing towards memecoins as major cryptocurrencies face financial difficulties.

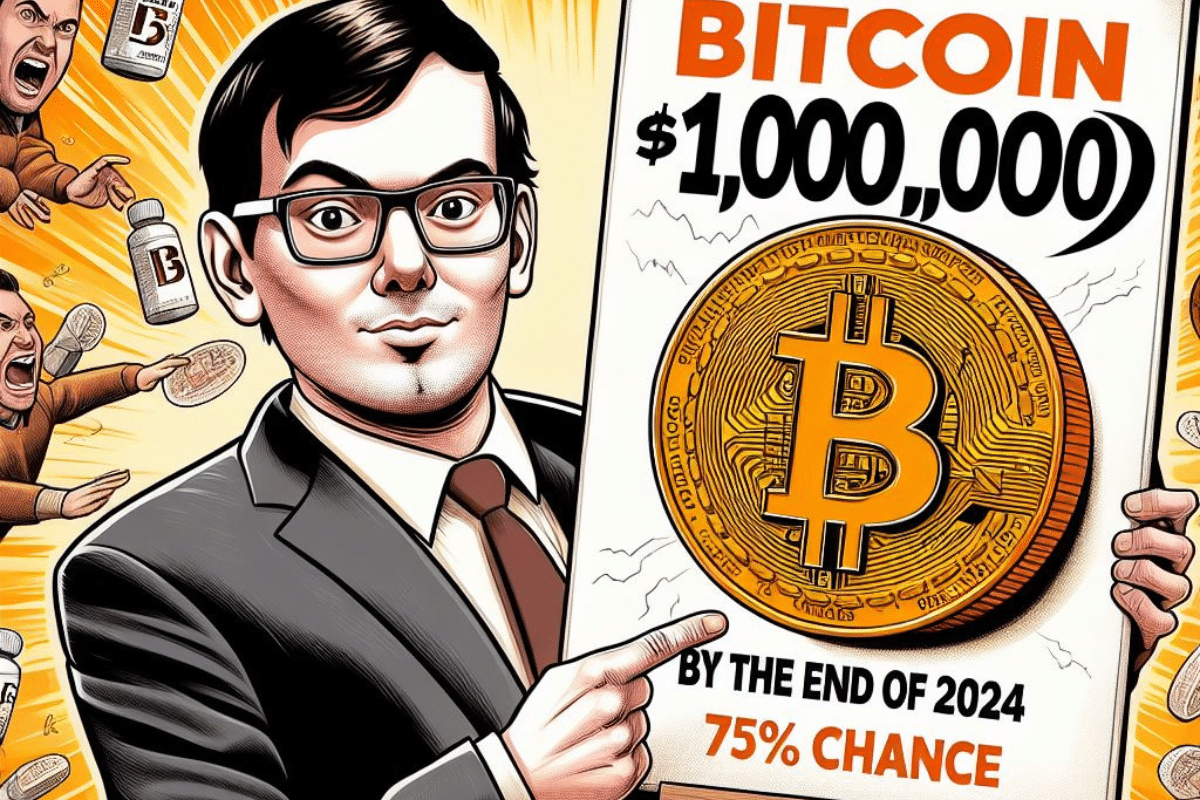

Martin Shkreli, a controversial figure in the pharmaceutical industry, caught everyone off guard with his bold prediction: a 75% chance that Bitcoin will reach $1 million by the end of 2024. This prophecy adds to those of other big names in finance like Cathie Wood and Robert Kiyosaki.

Are you worried about the post-ATH drop in Bitcoin? Explore proven methods to protect and optimize your crypto portfolio.

The famous bitcoiner and entrepreneur Balaji Srinivasan has just published a diatribe against the United States. According to him, the federal government is on the verge of bankruptcy and being swallowed by trillions of dollars in debt. Faced with such a crisis, the Fed would activate the largest money-printing policy in American history to divert money from taxpayers.

At the heart of the crypto ecosystem, Tether (USDT) has recently made headlines with a significant action. The acquisition of 8,889 bitcoins (BTC), worth around $627 million, marks a strategic turning point for the stablecoin giant. This bold move not only strengthens its reserves but also powerfully asserts Tether’s long-term…