Bitcoin is regaining the interest of institutional markets. This week, U.S. spot ETFs attracted $1.8 billion in inflows, a record peak since October 2025. Such a spectacular resurgence occurs in an uncertain macroeconomic environment, rekindling hopes of a new bull cycle. However, does this surge reflect a fundamental trend or just a technical rebound? As the $100,000 threshold fuels speculation, the market remains suspended on the consistency of these new funds.

Theme Bitcoin (BTC)

Patrick Witt confirmed that Bitcoin seized from the Samourai Wallet case will remain in the U.S. Strategic Reserve, dispelling rumors of a government sell-off.

While corporate bitcoin adoption remains a divisive subject, Michael Saylor continues to lead the movement. The executive chairman of Strategy no longer just accumulates BTC. He now steps up to defend, against criticism, an unapologetic vision of bitcoin as a strategic corporate treasury asset. In a context of macroeconomic uncertainty, his positions reignite the debate on the relevance and durability of this strategy.

The Iranian crypto economy experienced a spectacular acceleration in 2025, reaching around 7.78 billion dollars, according to Chainalysis data. This growth is far from being purely technical. It is closely linked to social movements, economic constraints, and digital disruptions that have shaken the country.

Wall Street panics its block: Jefferies trades bitcoin for bullion. Reason? Quantum computers, these little geniuses capable of cracking digital vaults.

CZ remains confident Bitcoin will reach $200K, says an altcoin season will eventually arrive, and warns only meaningful meme coins are likely to last.

The crypto market returns to a more neutral tone, but remains quiet. The Crypto Fear & Greed Index has risen to 54, a sign of a return to balance after weeks dominated by fear, while prices stabilize. Yet, the most telling signal comes from elsewhere: spot volumes remain close to…

While companies strengthen their presence in the crypto sector, a recent survey reveals the rise of Bitcoin treasuries. Investors anticipate spectacular growth in public companies' Bitcoin portfolios in 2026, marking a turning point for traditional financial strategies. This development could transform corporate management practices, but also redefine the architecture of digital financial markets and decentralized finance, thus heralding a new era for the integration of cryptos into the global economy.

Bitcoin is stalling at 97,000 dollars: crowds are reluctant, banks are indulging, and the Fed hesitates… Is the new financial world going in circles?

Since the beginning of this year, a key indicator of the Bitcoin derivatives markets has experienced a sharp decline. The open interest (OI) has dropped by approximately 30% from its October 2025 peak. This decrease is accompanied by a massive reduction in leverage across the derivatives ecosystem. For many analysts, this movement could signal not only the end of an intense speculative phase but also the building of a solid foundation for a possible bullish recovery.

Bitcoin and Ether crossed major technical thresholds on January 14, triggering nearly 700 million dollars in liquidations on short positions. In the absence of a fundamental catalyst, this brutal movement highlights the weight of market mechanics and leverage effects in the dynamics of cryptos. Thus, in a few hours, the excess exposures were swept away, recalling the vulnerability of poorly calibrated speculative strategies.

Despite the frenzy around Bitcoin, some signals cool the optimism of crypto traders. Discover the details in this article.

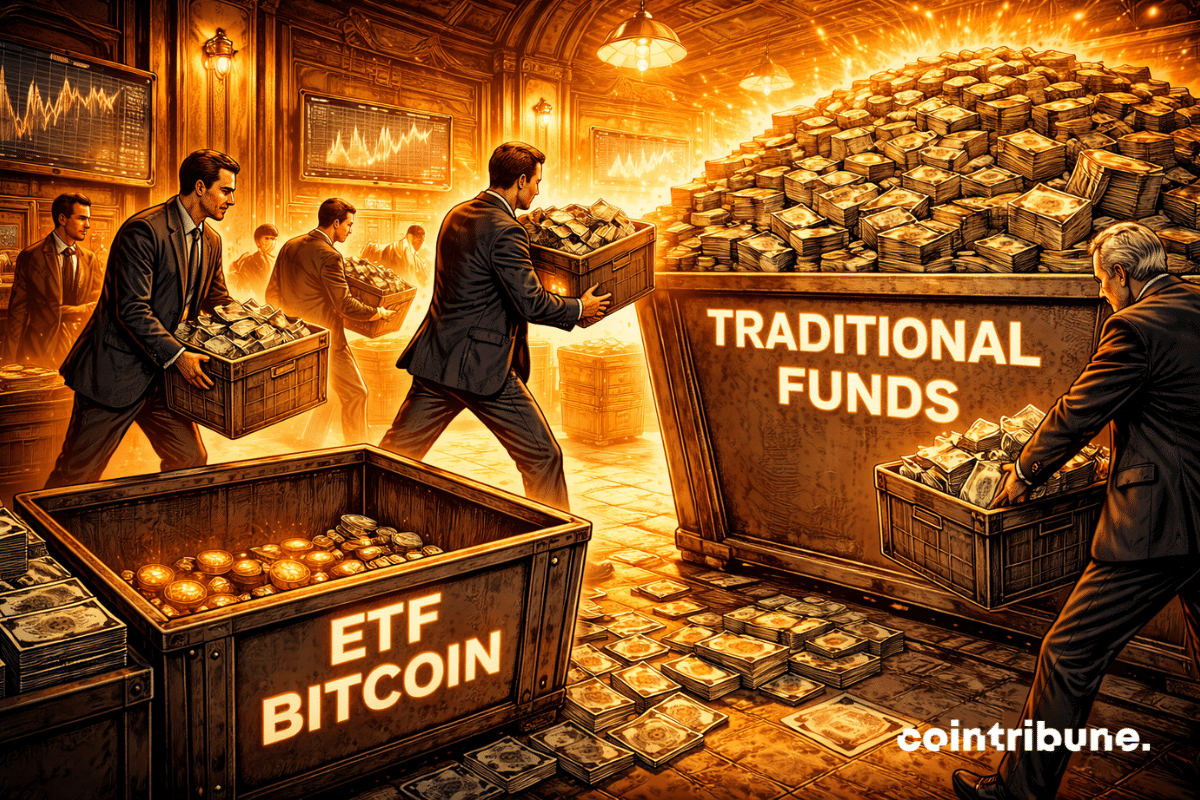

At the start of 2026, markets show a striking contrast: traditional funds attract record inflows, while Bitcoin ETFs lose momentum. This divergence, far from anecdotal, could signify a strategic shift among institutional investors, between seeking stability and persistent distrust of cryptos. In an uncertain economic context, arbitrages harden, redefining allocation priorities. Bitcoin, long touted as an alternative safe-haven asset, now seems relegated to the background by portfolio managers.

Bitcoin mining loves podiums. One number climbs, another falls, and the ecosystem tells itself a simple story. Except that in this industry, the way you count matters almost as much as the machines. And that’s exactly what makes the “Bitdeer moment” interesting. Bitdeer claims to have reached 71 EH/s of…

Investment firm VanEck expects the first quarter of 2026 to favor risk assets, citing clearer fiscal policy, steadier monetary signals, and renewed interest across several major investment themes. After years of uncertainty, improved visibility is shaping how investors position their portfolios heading into the new year.

The crypto market is entering a major zone of uncertainty. According to Wintermute, the historic four-year cycle, a pillar of investment strategies for over a decade, may have reached its limits. In a report published in early January, the market maker mentions a deep break in 2025, a strong signal that 2026 will not be a simple rebound, but a true test of resilience for an ecosystem undergoing redefinition.

While the regulatory climate in the United States remains uncertain, bitcoin surprises by surpassing $95,700. This weekly high comes despite the postponement of the CLARITY Act review, a key text for crypto regulation. Where markets once reacted with panic, resilience now dominates. Should this be seen as a sign of market maturity or a deceptive lull?

When a former politician buys a medical company to stack Bitcoins, crypto becomes a politico-financial novel where health and speculation share the same digital core.

There is talk of a 'treasure' of 600,000 BTC attributed to Venezuela: a figure that sounds like a threat. Washington is considering the idea of a seizure, without openly admitting it. Paul S. Atkins, chairman of the SEC, confirms nothing... but does not close the door. And that is where everything changes: bitcoin is no longer just an asset, it is a geopolitical lever. The essential remains to be decided: evidence, keys, and the power to seize.

Is Ethereum preparing a strong comeback against bitcoin? A well-known technical setup draws analysts' attention to the ETH/BTC pair. This pattern, previously observed before a historic rally, could indicate a major bullish reversal. If the breakout is confirmed, Ether could jump nearly 95% against bitcoin.

Crash or simple pause? Bitcoin drops while gold rises. The refuge asset duel intensifies. Details here!

Jerome Powell, chairman of the Federal Reserve, is the subject of a criminal investigation. The information, confirmed on Sunday, comes amid strong political tensions in the United States. It raises questions about the central bank's independence from the executive branch. Beyond Wall Street, this case also resonates in the crypto market. In a climate of institutional distrust, bitcoin regains its place at the heart of the debate as a non-sovereign asset.

While all eyes remain fixed on bitcoin in dollars, a discreet indicator could well announce a major shift: the ETH/BTC ratio. According to Michaël van de Poppe, this ratio reached a low in April 2025, in a chart configuration reminiscent of 2019. If history were to repeat itself, Ethereum could begin a strong comeback against bitcoin, without the majority of investors yet realizing this latent change.

Bitcoin faces a decisive zone. As the post-halving euphoria fades, the spotlight turns to a key level: $65,000. Much more than a former peak, this threshold becomes a cycle indicator, at the intersection of technical tensions and long-term projections. Jurrien Timmer, macroeconomic director at Fidelity, revives the debate by highlighting, via the power law model, that a drop below this level could trigger a prolonged compression phase.

On-chain data reveals a troubling trend: Bitcoin whales have sold 220,000 BTC in one year. A massive leak or anticipation of an imminent crash? Analysis of causes, risks, and opportunities to seize before it's too late.

On January 10, 2009, Hal Finney wrote "Running Bitcoin" on Twitter. Unknown to him, he had just engraved the public launch of the first decentralized digital currency network into modern monetary history. That day, he ran Satoshi Nakamoto's software and became the very first recipient of a BTC transaction. Seventeen years later, yesterday January 10, 2026, this message still echoes as the founding act of a technological and financial revolution.

While small wallets tremble, banks are piling up bitcoin. CZ watches, half amused, half worried: the crypto Wild West is changing sheriffs without warning.

The hope for sustainable institutional adoption through spot Bitcoin ETFs meets a harsh return of volatility. Praised in 2024 as vectors of stability, these products have just recorded over 680 million dollars in net outflows in the first week of 2026. This sudden decline, in a climate of monetary uncertainties and geopolitical tensions, calls into question the solidity of their anchorage in traditional finance and raises doubts about the market's ability to absorb shocks in the long term.

Bitcoin is nearing 90,000 dollars, but the main action is happening elsewhere. While ETFs suffer massive outflows, institutional investors are beginning a strategic repositioning. This double movement, discreet but structuring, reveals a market in transition, where capital flows no longer respond solely to price logic. Behind the apparent euphoria, a rigorous selection of assets is taking place, a sign of a new maturity in the crypto ecosystem.

While the US Supreme Court plays the role of economic arbitrator, Bitcoin itself meditates at $90,000, like a tired crypto king waiting for a judge to revive its digital crown.