BlackRock's Bitcoin ETF records 18 consecutive days of gains. A powerful bullish signal for BTC? Analysis.

BlackRock

eToro will raise $500 million and targets a $4 billion valuation. We tell you everything about this IPO that is shaking up the crypto sector.

For a long time hesitant towards bitcoin, American universities are beginning to make a discreet but decisive shift. Brown University, a pillar of the Ivy League, has just announced a direct exposure to BlackRock's IBIT ETF. This is a first, revealed in an official filing with the SEC, which could redefine the standards for endowment fund allocation. Why this movement now? What amounts are at stake? And what does this strong signal sent by an academic institution in the midst of a reshaping crypto market reveal?

BlackRock makes a major move in the Bitcoin ETF market. On April 28, 2025, the asset manager invested nearly $1 billion in bitcoin through its IBIT fund, thereby consolidating its leadership. This wave of institutional purchases could indeed propel BTC to new heights by the end of 2025.

BlackRock's Bitcoin ETF is making a meteoric rise in the markets. For Michael Saylor, this is just the beginning: he claims that IBIT will become the world's largest ETF within ten years. A bold prediction that reflects the unstoppable rise of bitcoin in traditional finance.

While uncertainty reigns in the markets and regulators tighten the noose, BlackRock continues its crypto strategy without faltering. The American asset manager has just injected an additional 37 million dollars into bitcoin through its IBIT fund. A strong move, going against the prevailing hesitations, which confirms a methodical accumulation. Through this new purchase, BlackRock reaffirms its confidence in the leading crypto and strengthens its role as a catalyst for institutional adoption.

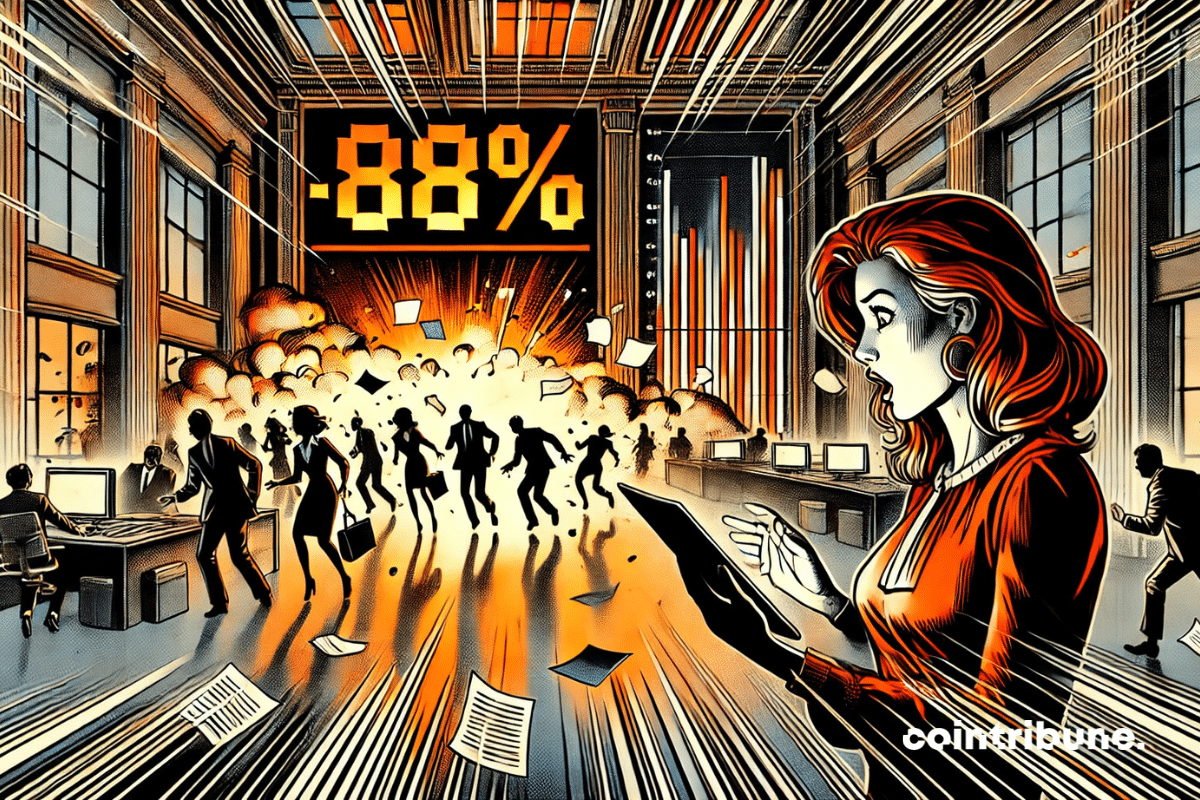

Crypto ETFs are in free fall: $795 million withdrawn last week. Discover more details in this article!

Larry Fink, head of the world's largest asset manager, BlackRock, believes that the American economy may have already entered into recession, mainly due to the impact of Donald Trump's tariff policies.

The American asset management giant, BlackRock, recorded $3 billion in net inflows into its cryptocurrency-related products in the first quarter of 2025. This amount represents 2.8% of the $107 billion in flows to its iShares ETFs, according to results published on April 11, 2025.

Numbers are plummeting, volumes are exploding, and institutional investors are quietly slipping away. Bitcoin ETFs may be entering this pivotal moment where silence speaks louder than words.

At the start of this year, amid high geopolitical tension, dedollarization emerges as a strong signal of a global monetary shift. Once relegated to the background of economic debate, this dynamic is intensifying as confidence in the stability of the United States erodes. The dollar's share in global reserves is slowly but surely declining, a trend closely watched by markets and feared by strategists. Behind this retreat, the international monetary order may be entering a phase of reorganization.

What if the dollar wavered under the weight of its own contradictions? Larry Fink, CEO of BlackRock, the global asset management giant, issues a striking warning: Bitcoin could supplant the American dollar as the world's benchmark currency. This prophecy, far from being isolated, is set against a backdrop of growing distrust towards the greenback. Between the explosive debt of the United States and the meteoric rise of cryptocurrencies, the global financial landscape is undergoing a transformation.

BlackRock launches its iShares Bitcoin ETP, a bold bet on a hesitant European market. Will BTC finally establish itself against traditional assets?

The world of crypto continues to blur the lines with traditional finance. This time, it's BlackRock making a media splash by integrating Solana into its tokenized monetary fund, BUIDL. This decision is not just a simple technical adjustment, but a strong signal: blockchain is no longer a marginal experiment. It is becoming the backbone of a financial revolution in progress.

Ethereum is once again in the spotlight. While its price flirts with a decisive technical level, indicators point to a possible rebound of 65%. In the shadows, BlackRock is massively increasing its exposure to ETH, surpassing one billion dollars in assets. This dual technical and institutional dynamic is repositioning Ethereum at the heart of bullish speculation.

Against all odds, BlackRock, the global asset management giant, is shaking up conventional wisdom about Bitcoin. While cryptocurrencies are often associated with volatility and risk, Robert Mitchnick, head of digital assets at BlackRock, debunks this narrative. In a context where Bitcoin has lost 20% of its value since its peak at the end of 2023, his recent statements on CNBC resonate like a bold advocacy. Why does a traditional institution defend such a disruptive vision? The answer lies in a subtle strategy and a deep understanding of market evolution.

Ethereum ETFs pave the way for broader institutional adoption, but remain incomplete. According to Robbie Mitchnick of BlackRock, their main drawback lies in the absence of staking, a pillar of yield on Ethereum. This lack could limit their competitiveness against direct investment strategies, calling into question their ability to meet the expectations of professional investors.

Money migrates, silent and methodical. Wall Street, once untouchable, sees its throne wobble under the hurried steps of investors, captivated by a Europe shining with trillions.

The traditional financial industry and the crypto sector continue to intersect, and every move of Wall Street giants is scrutinized closely. Indeed, the announcement of BlackRock's return to the bitcoin (BTC) market with a $25 million investment has not gone unnoticed.

Larry Fink sounds the alarm: Bitcoin could lead to a major crisis. Discover his full analysis in this article!

The BlackRock behemoth is walking a tightrope: a net of Bitcoin in its portfolio, 2% of audacity, a breeze of panic among the maximalists. Who will give in first?

A dried-up river of euros, a shaken financial fortress: the Bundesbank wavers, its gold evaporates, while Merz inherits a throne without treasure, a kingdom in doubt.

BlackRock's Bitcoin ETF now dominates the market with over 50% of assets under management, solidifying its leadership position among ETF issuers in the United States. This dynamic comes as Bitcoin ETFs experience three consecutive days of withdrawals, testing the resilience of BTC.

Bitcoin, long the absolute master, looks helpless as Ethereum steals the spotlight: 793 million injected against 407 million, a Trafalgar blow to the ETP market.

The world of traditional finance is increasingly intertwined with that of Bitcoin, and BlackRock's recent moves only confirm this dynamic. Indeed, the asset management giant, with its $11.6 trillion under management, has just increased its stake in MicroStrategy, now rebranded as Strategy, to 5%. This rise does not go unnoticed: it comes as Strategy continues to accumulate Bitcoin massively, in order to strengthen its role as a pioneer among publicly traded companies. More than just an investment, this strategic alignment raises questions about the future of Bitcoin in institutional portfolios and the place that giants like BlackRock wish to occupy in this rapidly expanding ecosystem.

Traditional finance and bitcoin are continuing to draw closer. Following the resounding success of its Bitcoin ETF IBIT in the United States, BlackRock, the world's largest asset manager, is preparing to take a new step: the launch of a Bitcoin Exchange Traded Product (ETP) in Europe. This fund, which will be domiciled in Switzerland, reflects the growing desire of financial institutions to establish a lasting presence in the crypto market. While the United States has seen Bitcoin ETFs capture more than $57 billion in assets in just a few months, this new product could change the European landscape. Why Switzerland rather than another country? What will be the effects on investors and the institutional adoption of bitcoin in Europe? These are all questions that arise as BlackRock accelerates its international offensive.

Between record figures and subtle strategies, BlackRock's Bitcoin ETF charts its course. The shine of the crypto beacon lights up finance.

The decree by Donald Trump and the repeal of the deadly accounting standard SAB 121 are very promising for bitcoin. Promise Kept Donald Trump promised that his government would stop putting obstacles in the way of bitcoin. This promise has been fulfilled with the decree “Strengthening…

Bitcoin, this $100,000 digital mirage, attracts Morgan Stanley into a dance where profits skyrocket and sanctions loom.

Fears related to the devaluation of national currencies are gaining new momentum following an important statement by Larry Fink, CEO of BlackRock, at the World Economic Forum in Davos. In fact, the leader of the world's largest asset manager mentioned the possibility of Bitcoin reaching $700,000, driven by increasing institutional adoption. In his view, this cryptocurrency offers protection against economic and political instability. In a context of rising inflation and increasing distrust of traditional currencies, this prediction raises questions about the future of cryptocurrencies and their role in the global financial system.