The Bybit EU platform finally launches its long-awaited "Recurring Buy" feature. European users can now schedule recurring cryptocurrency purchases directly from their bank card, at a daily, weekly, or monthly frequency. A revolution for DCA enthusiasts.

Bybit

Until December 30, 2025, the MiCA-regulated platform offers a welcome bonus to new European users. Full breakdown.

Crypto 2025: invisible hackers, billions lost, a rogue state involved... What if your wallet was the next silent victim?

The regulated MiCAR exchange platform multiplies attractive campaigns to entice European users, featuring record cashback, daily draws, and exceptional welcome bonuses.

The Bybit EU exchange, the world’s second-largest platform by transaction volume, is launching a highly attractive new promotional campaign for European users. The flagship offer right now: deposit 100€ and receive up to 70 USDC as a bonus. This initiative is part of a broader strategy to conquer the European market, now regulated by the MiCA (Markets in Crypto-Assets) regulation.

On October 16, 2025, Bybit EU officially launched its Rewards service, a fixed-term product designed for the Bybit EU Earn platform. This initiative marks an important step in the exchange's strategy to conquer the European market, six months after obtaining its MiCA license from the Austrian financial authority (FMA) in May 2025.

With 2.84 billion dollars stolen since early 2024, the Pyongyang regime perfects its hacking techniques and deploys thousands of clandestine IT workers. Facing this growing threat, Chainalysis experts observe encouraging signs: the response capacity of Western states and crypto companies is improving significantly.

Spot is making a comeback, Binance still reigns, and ETFs attract big fish: crypto hasn't said its last word... except for altcoins that are sulking.

In just 24 hours, 20 billion dollars evaporated in an unprecedented crypto crash. Binance, Bybit, Hyperliquid: these giants, once untouchable, are now accused of having worsened the disaster. Discover how technical malfunctions, depegs and crazy leverage made everything collapse. #Crypto #Binance #Bybit #Hyperliquid

Bybit EU offers a promotional campaign with 63,750 USDC, 5 portions of 0.3 ETH, 10 Ledger Stax, 20 Samsung Galaxy Tab A9+, 40 Shokz OpenDots ONE and 80 JBL Grip. Launched shortly after obtaining its MiCA license in Austria, this initiative is part of a strategy to acquire European users. But beyond the attractive numbers, what are the real mechanisms? What traps to avoid? This article analyzes the "Autumn's Lucky Times" campaign rigorously.

Spot trading activity across crypto exchanges slowed in September, hitting its weakest level in months, even as institutional demand for Bitcoin surged through exchange-traded funds. The contrasting trends highlight a shift in market behavior, with speculative trading losing momentum while long-term investment flows gaining strength.

Cryptocurrency trading requires constant vigilance, responsiveness, and emotional discipline. Bybit EU has just reached a decisive milestone by launching a suite of AI-powered trading bots designed to turn any user into a professional trader, even while sleeping.

VIENNA, September 24, 2025 — On September 24th, Bybit EU, the MiCAR-licensed crypto-asset service provider headquartered in Vienna, announced the launch of its first automated trading tools for European users: the Dollar-Cost Averaging (DCA) Bot and the Spot Grid Bot. Starting September 24, eligible users across the European Economic Area (EEA) can access these features directly on Bybit.eu, breaking down barriers for millions across Europe to safely trade and invest in crypto using AI-powered automation.

In this complete guide, we detail the registration process on Bybit EU, the KYC (Know Your Customer) verification steps, and the exclusive promotional campaigns available in September 2025.

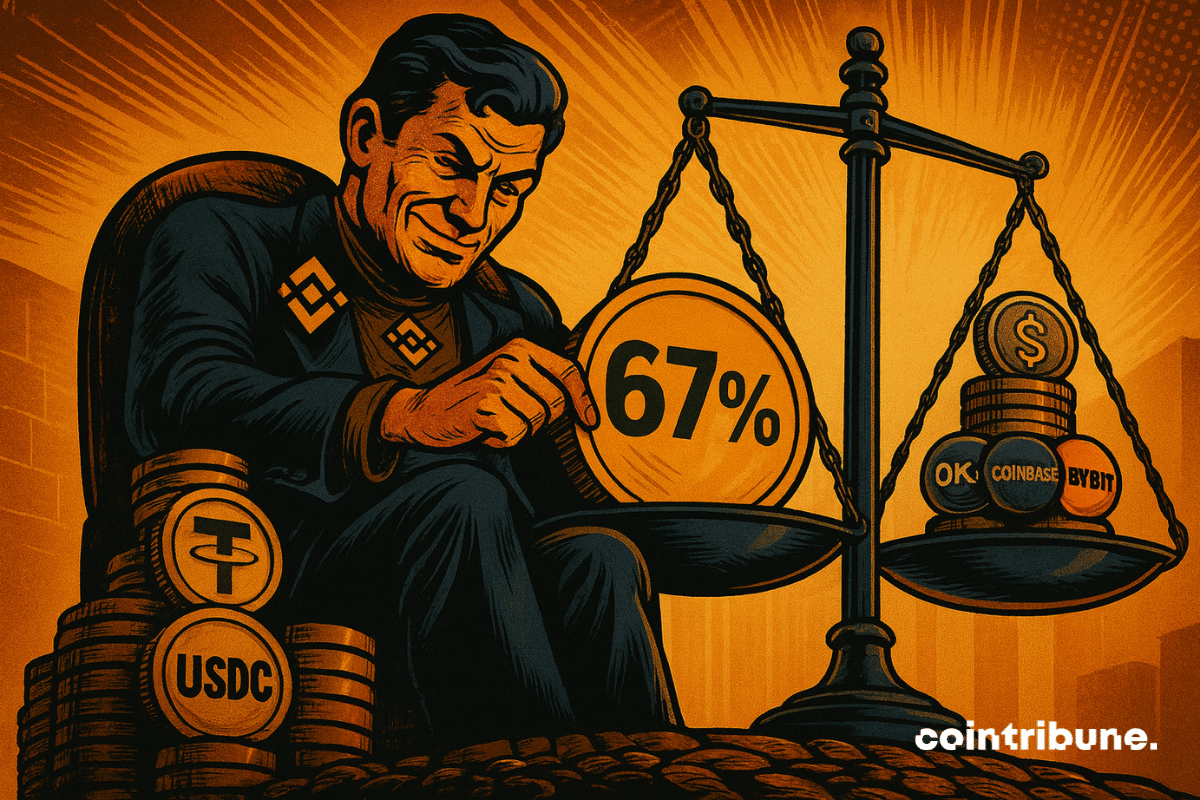

In the crypto arena, Binance sits like a central banker: 67% of stablecoins under lock. Historic record, guaranteed concern, and dry powder ready to explode.

Crypto exchange Bybit officially launches its payment card in the European Economic Area with an exceptional welcome offer of 20% cashback. An aggressive strategy to conquer the European crypto payments market.

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, is advancing its European expansion. Bybit EU Group took this next step with the formal application submission for a license under the Austrian implementation act of the Markets in Financial Instruments Directive (MiFID II) through one of its Austrian entities, Bybit X GmbH.

Institutional-grade technology will enhance the integrity of the world’s second-largest cryptocurrency exchange. The surveillance platform combines advanced pattern analytics with comprehensive market data to meet MiCAR obligations.

Bybit, the world’s second largest crypto exchange by volume, reaches a new milestone in Europe. The platform has just announced the launch of spot margin trading on Bybit.eu, offering European users leverage of up to 10x under a strict regulatory framework.

August 14, 2025 marks a historic milestone for the European crypto ecosystem: XION officially becomes the first Launchpool project on the newly licensed Bybit EU platform under MiCA. This strategic alliance perfectly illustrates the growing maturity of the blockchain sector in a strict regulatory environment.

Vienna, Austria, August 6, 2025 — Bybit, the world’s second-largest crypto exchange by trading volume, unveiled an ambitious roadmap for the future of crypto, announcing a new era of innovation, security, and trading excellence.

A law passed unnoticed allows borrowers to mobilize their digital assets as collateral. A discreet but symbolic turning point for the integration of cryptos into traditional finance.

With the launch of Bybit EU, a fully MiCA compliant platform operated from Vienna, the exchange now combines a unified regulatory framework and market depth, two important signals for users seeking robust and liquid access. In brief Bybit EU combines MiCA regulation and global liquidity. High…

Bybit, one of the two largest cryptocurrency exchanges in the world, is making its comeback in Europe with a dedicated site "Bybit EU", a regulated entity established in Vienna. To celebrate this resurgence, the platform is launching the campaign "All Roads Lead to Bybit": 100% chance to win a share of the total prize pool of 100,000 USDC, including more than a hundred high-tech prizes.

Vienna, July 10, 2025 – Today’s press conference marks the formal introduction of Bybit EU to Austrian and European media. With its EU headquarters now operational in Vienna and a full MiCAR license issued by Austria’s Financial Market Authority (FMA), Bybit EU enters the European market…

Bybit, the world's second largest cryptocurrency exchange platform by volume, today announces the official launch of Bybit.eu, a platform exclusively dedicated to users in the European Economic Area (EEA). Operated by Bybit EU GmbH, a crypto-asset service provider licensed under the MiCAR regulation, this initiative marks a major milestone in Bybit's mission: to offer a safe, transparent, and fully compliant digital asset exchange platform in Europe.

Crypto is stolen in 2025: from private keys to state-sponsored attacks. Bybit, a monumental hack. When governments take an interest in crypto-thefts, the game changes completely. Explanations below.

While Trump rushes headlong to save his stablecoins, Europe is rolling out MiCA and taking the crypto prize. What if, for once, bureaucracy won the race?

Bybit introduces Byreal, a Solana-based decentralised exchange (DEX) that combines centralised liquidity with decentralised transparency.

After suffering the largest crypto hack in history in February 2025, the exchange Bybit managed to reclaim its initial market share of 7%, demonstrating remarkable resilience in an otherwise unfavorable economic context.