While the Sino-American trade war seemed frozen in an endless game of retaliation, an unexpected gesture has rekindled hope: Beijing agrees to official talks with Washington. A first in months. This meeting, much more than a simple diplomatic exchange, crystallizes the deep tensions shaking global trade and the economy of the two giants.

Chine

China hoped to restore its economic reputation through conciliatory gestures towards the United States. Alas, despite a partial reduction in tariffs, the outlook remains bleak. The Chinese economy wavers, trapped by its own inertia and a frigid global environment.

Market: after a loss of 2.4%, gold rebounds ahead of the FED meeting. A strategy to follow for investors? Analysis.

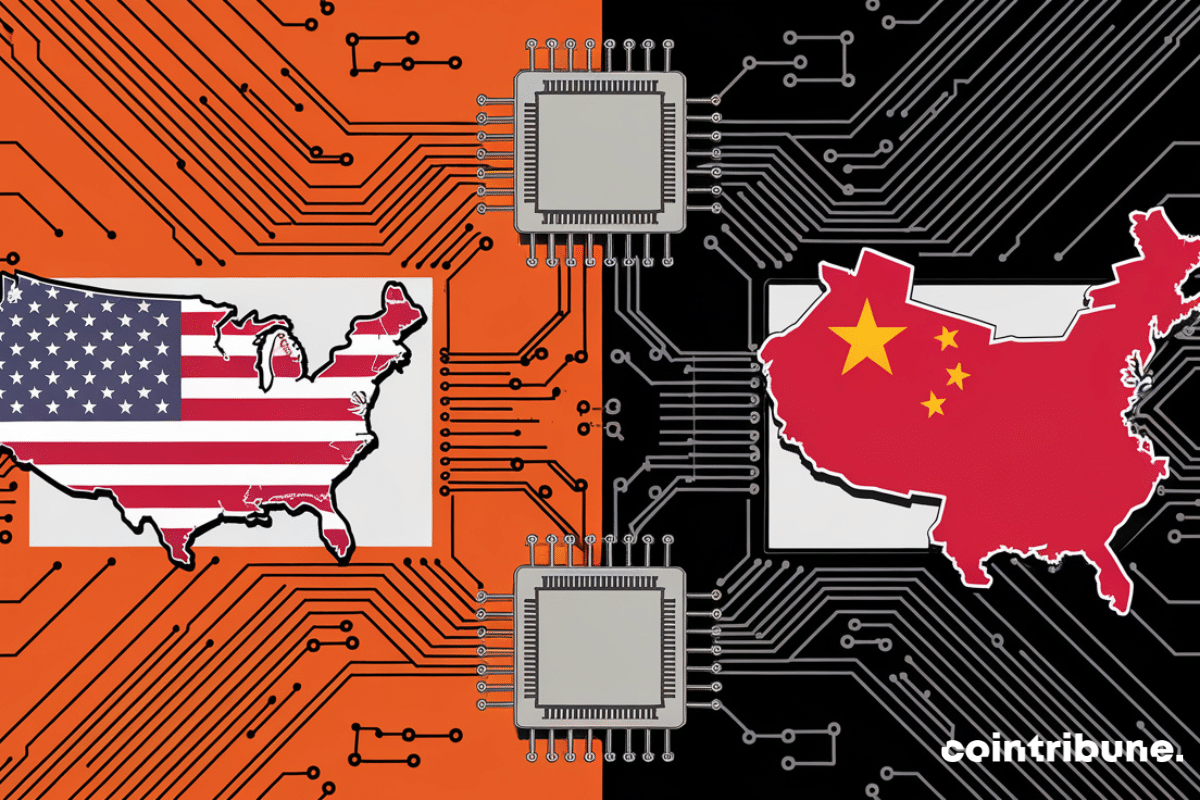

The AI war is on! Huawei releases its Ascend 910D chip to directly challenge Nvidia. Discover the details in this article.

The uncontested reign of the dollar in global reserves is wavering. In the face of geopolitical tensions and economic sanctions, powers like China are reassessing the security of their sovereign assets. A breaking dynamic is beginning, driven by a quest for financial independence and the desire to escape Western influence levers. This strategic realignment could permanently reshape the global monetary balance and open a new era for alternative assets like gold… and bitcoin.

Stock Market: Stock markets fluctuate under the effect of tariff tensions. Discover what this means for investors.

While Trump plays the customs officer, Tesla wavers, Alphabet holds firm, and Wall Street takes on water. The markets, on the other hand, brace for the next presidential tweet.

While Beijing maintains a strict ban on cryptocurrencies, a paradoxical reality is emerging: local governments are quietly selling off seized digital assets, filling their public coffers. Between opacity and financial urgency, this practice reveals the cracks in a system torn between repression and economic pragmatism. A tangle that reignites the debate on the legal framework for these assets, in a geopolitical context where China watches with suspicion the crypto-American advances.

China does not intend to yield to the new American protectionist measures. In response to the tariff surge imposed by Donald Trump, Beijing retaliates directly by demanding the immediate removal of tariffs, fearing the effects of a major global economic shock.

In the midst of a commercial battle, the European Union agrees to negotiate the elimination of tariffs on Chinese electric vehicles. Supported by massive subsidies, these low-cost models disrupt the balance of the European market. This turnaround marks a turning point, as Europe, torn between industrial protectionism and ecological transition, opens itself to a risky compromise. In a key sector, this rapprochement could reshuffle the cards between two rival powers, linked by competition as much as by interdependence.

China announced on April 9 a dramatic increase in tariffs on American products, which will rise to 84% starting April 10, 2025 at 12:01 AM. This decision is a direct response to Donald Trump, who had raised tariffs on Chinese imports to 104% the day before!

The Sino-American economic war is flaring up again and dragging the yuan down with it. In response to Donald Trump's aggressive decision to impose drastic tariffs on Chinese products, Beijing is retaliating by intentionally allowing its currency to slide to its lowest levels since 2023. The unexpected consequence? A massive rush of Chinese investors towards bitcoin, which has become a lifeline in the face of uncertainty.

In a move that further intensifies the economic tensions between Donald Trump and China, the White House announced the imposition of an additional 104% tariffs on Chinese imports. This measure comes after China has evidently maintained its own 34% duty on American exports.

Donald Trump reignited trade tensions with China on Monday, April 7, by threatening to impose "additional" tariffs of 50% on Chinese products. This new escalation would occur as soon as April 9, if Beijing does not reverse its decision to retaliate against the U.S. customs offensive. China had indeed announced an increase of its own tariffs to 34% on American imports, effective April 10.

Trump's new taxes destabilize the markets. What are the consequences for the American economy? The full analysis here!

The stimulus from monetary easing and the public deficit bodes very well for Bitcoin, which remains poised just below $100,000.

When Japan, China, and South Korea sit down at the same table, it's not to discuss the weather. In a world where trade tensions reshape alliances, their recent meeting could very well change the game in Asia... and beyond. Between promises, caution, and joint projects, a new geopolitical chapter seems to be unfolding in three voices.

In the face of economic slowdown and international trade tensions, the Chinese government is deploying an ambitious strategy to boost domestic demand. The State Council has just launched a "special action plan" aimed at revitalizing national consumption, viewed as the new growth engine to achieve the 5% target by 2025.

OpenAI has just announced the launch of new tools for developers, making it easier to create advanced AI agents. This initiative comes as Chinese startups, such as Monica and DeepSeek, are offering high-performing alternatives, often at a lower cost.

Bitcoin, the wavering king, falls below $90,000, wept over by runaway ETFs, drowned in a billion liquidated, against a backdrop of farcical Sino-American disputes.

The central Bank of China has just carried out an important medium-term lending operation to support its banking system. This injection of 300 billion yuan (approximately 41.83 billion dollars) is part of a broader strategy aimed at maintaining favorable liquidity conditions in an uncertain economic context.

In the whirlwind of Sino-American tensions, Bitcoin ETFs lost $1.14 billion in two weeks, victim of a geopolitical cataclysm, amid tariff threats and market uncertainty.

Like a cowboy drawing his six-shooter, Trump unleashes reciprocal tariffs, awakening old economic ghosts and sowing panic for Bitcoin in the stock markets.

Sino-American relations continue to deteriorate, pushing China to strengthen its ties with the European Union. Lin Jian, spokesperson for the Chinese Ministry of Foreign Affairs, stated that Beijing sees Europe as a "global strategic partner and an important and independent pillar in a multipolar world."

Donald Trump unveils his radical strategy to counter the monetary ambitions of the BRICS. In response to their proposal for a common currency, he threatens to impose 100% tariffs against any country that adopts it. This tough approach masks secret negotiations that could reshape the global monetary order.

The United States is reviving trade tensions with its major economic partners. Donald Trump has just announced massive new tariffs on imports from Canada, Mexico, and China, and is reigniting an aggressive protectionist policy. Presented as a response to the fight against fentanyl trafficking and illegal immigration, this decision primarily fits into a broader strategy aimed at renegotiating North American trade agreements and protecting the American industry from Chinese competition. This escalation has immediately provoked a virulent reaction from the targeted countries, which are already preparing retaliatory measures, foreshadowing a new economic showdown with uncertain consequences.

The Chinese AI DeepSeek has caused an earthquake within American tech. The geopolitical power dynamics have just changed.

When DeepSeek is siphoning the neurons from OpenAI, Microsoft cries foul, and the US Navy barricades its servers. The digital cold war is in full swing.

The world of crypto, known for its excitement and technological advancements, is once again confronted with a wave of sophisticated scams. Currently, the rapid rise of DeepSeek AI, a Chinese artificial intelligence application that went viral after its launch on January 20, marks a turning point. This popularity, which has propelled the app to the top of the App Store downloads, has also attracted the interest of fraudsters. In just 24 hours, no fewer than 75 fraudulent tokens have been created, exploiting DeepSeek's notoriety to target unsuspecting investors. This phenomenon illustrates how quickly scammers adapt their methods to take advantage of emerging technological trends.

Government decisions regarding cryptocurrencies often have a major impact on the markets, but the scale of China's recent action represents a significant turning point. Beijing has sold 194,000 bitcoins that were confiscated in 2019 during the dismantling of the PlusToken network, one of the largest Ponzi schemes in crypto history. Valued at nearly $19.7 billion, this massive liquidation raises questions about its economic implications and illustrates the growing complexity of the relationship between states and cryptocurrencies. While Bitcoin continues to establish itself as a global store of value, this action by China highlights the strategic role that governments can play in the evolution of this rapidly changing ecosystem.