The French subsidiary of the cryptocurrency exchange platform Binance confirmed on Thursday that one of its employees was the victim of a burglary at his home. Law enforcement arrested three suspects. This case is part of an unprecedented wave of attacks targeting the crypto sector in France.

Cmc RSS

In Washington, the regulatory future of cryptos may be decided in the coming months. Amid market volatility, the CLARITY Act stands as a pivotal text for the American crypto industry. Treasury Secretary Scott Bessent advocates for its rapid adoption, believing that legislative clarification could soothe investor sentiment. Behind this tight schedule lies a major political stake: securing the crypto framework before the 2026 electoral balances reshuffle the cards.

Within a few sessions, bitcoin has plunged back into a turbulence zone rarely seen since previous major crashes. On-chain data reveals $2.3 billion in realized losses over seven days, a shock that ranks this episode among the most violent in its recent history. This wave of capitulation follows a brutal correction of BTC, falling heavily after its peak above $126,000.

Bitcoin nears $66,500, and short positions reach unprecedented highs since 2024. Could this extreme pessimism, often a sign of a reversal, trigger a rapid rebound?

The session tastes more like a "breather" than a victory. Yes, Aster, Hyperliquid, and Hedera jumped, and yes, the total crypto market capitalization timidly goes back into the green. But this rebound looks more like a market catching its breath after bad macro news than a real regime change.

A massive expiration shakes the crypto markets this Friday. Nearly 3 billion dollars worth of Bitcoin and Ethereum options mature on Deribit at 8:00 UTC. Traders remain cautious after last week's liquidation shock.

Bitcoin has just erased its hard-earned gains after last week's crash. The world’s leading cryptocurrency falls back towards $65,000, a collateral victim of a panic that hits the tech sector hard. Even precious metals are not spared.

Central bank digital currencies (CBDCs) are moving closer to reality across much of the world. Policymakers often present them as faster and more efficient tools for payments and cross-border transfers. Yet billionaire investor and founder of Bridgewater Associates, Ray Dalio, argues that control remains at stake with such systems.

Bitcoin and the broader crypto market posted modest gains over the past 24 hours, even as fresh U.S. labor data complicated expectations for near-term rate cuts. January’s jobs report showed that hiring remained firm, but growth across several sectors appeared restrained. Markets had hoped for weaker data to strengthen the case for monetary easing. Instead, traders were left facing mixed signals.

The European Parliament has taken a decisive step in the development of the digital euro, endorsing a resolution that confirms its strategic importance for monetary sovereignty and the future of payments in Europe.

Did bitcoin really hit the bottom at $60,000? Michael Terpin, CEO of Transform Ventures, warns of a new drop to $40,000 before a sustainable recovery. Between historical cycles and market fragility, his analysis divides experts.

The crypto market sends contradictory signals. Indeed, investor sentiment has just reached a historic low, reflecting a strong distrust towards bitcoin. At the same time, some data from Binance indicate a slowdown in selling pressure. This discrepancy between market psychology and real flows raises a central question: are we witnessing a simple technical lull or the beginnings of a lasting rebalancing?

Bitcoin is going through a critical phase, but CryptoQuant encourages investors to stay calm. We tell you more in this article.

Crypto ETFs were supposed to mark the definitive entry of institutional investors into the ecosystem. A few months later, the reality is more mixed. While the market tries to identify a bottom, a clear gap is widening between bitcoin and Ethereum. The latest figures show that ETH ETF holders find themselves in a significantly more exposed position than their counterparts invested in Bitcoin ETFs. An imbalance that raises questions about the relative strength of the two assets during this correction phase.

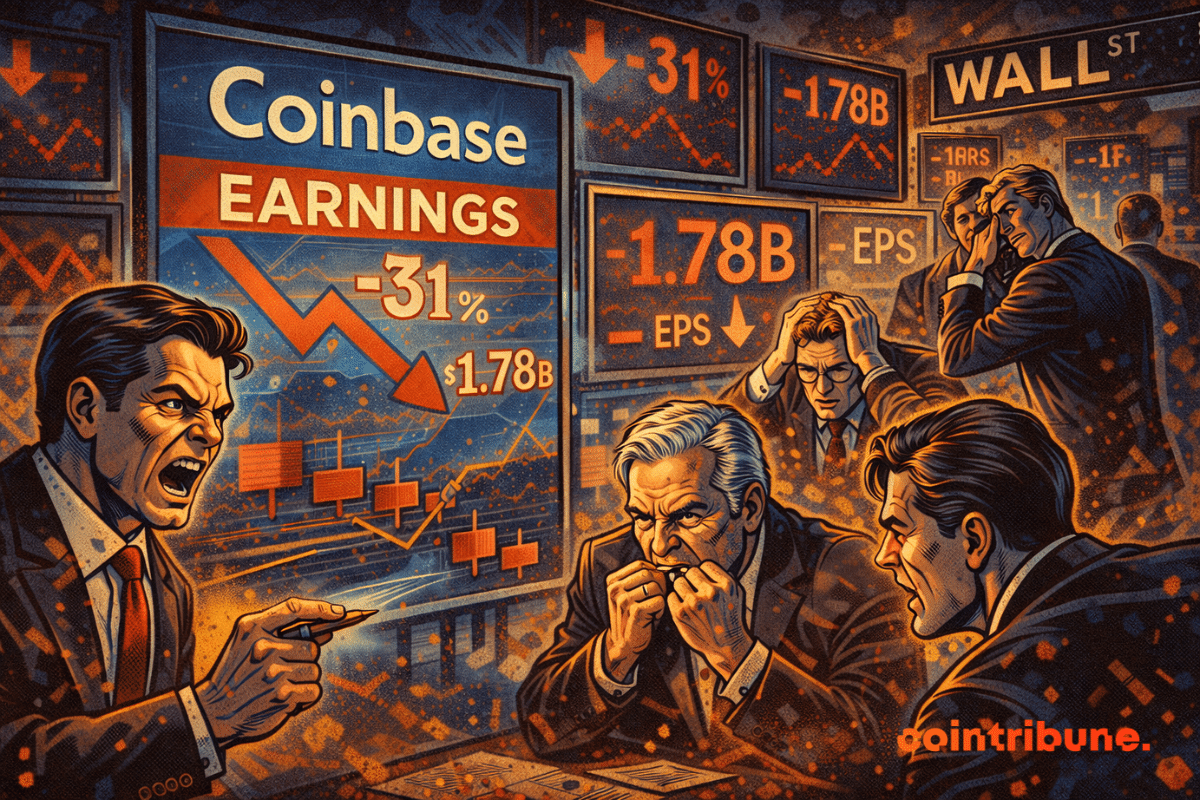

Coinbase loses 667 million. Yet, its subscribers are booming. Its stablecoins generate revenue. So do its loans. So? It's the trading that coughs. And Washington that sleeps in.

The boundary between traditional and decentralized finance continues to erode. This time, it is BlackRock that is shifting the lines. The global asset management giant has connected its tokenized fund BUIDL, backed by US Treasury bonds, to the Uniswap infrastructure. An initiative that goes beyond simple technological experimentation, as it materializes the entry of a major institutional player onto the operational rails of DeFi.

Ondo Finance integrates Chainlink to bring live pricing to tokenized U.S. stocks, allowing them to serve as collateral in Ethereum DeFi.

In trouble? Binance allegedly lost 17 billion. The exchange thanks its detractors, calls them friends, and offers them a holiday to withdraw their stakes. Clever.

Despite recent volatility and bitcoin falling below its production cost, the American investment bank maintains an optimistic outlook for crypto assets. Institutional flows are expected, according to it, to revive the market this year, provided the regulatory framework clears up. Will these expected flows be enough to reverse the trend?

Crypto: Trump wants to disrupt global transfers with an international exchange platform. All the details in this article!

Tokenized money market funds and digital bank deposits are moving beyond experimentation and into early financial infrastructure, executives said Wednesday at Consensus Hong Kong 2026. Speakers from Franklin Templeton, SWIFT and Ledger described an industry shifting from pilot programs to real-world deployment. Adoption remains small relative to global capital markets, but institutions are increasingly building systems designed for round-the-clock settlement and on-chain access.

Sam Bankman-Fried is seeking to reopen his criminal case tied to the collapse of FTX. The former crypto executive has requested a new trial, arguing that newly surfaced witness testimony could weaken key aspects of the prosecution’s case. Convicted on multiple fraud-related counts, Bankman-Fried now claims jurors did not see a complete and accurate picture of certain evidence. His filing frames the issue as one of fairness in the trial process rather than a disagreement with the verdict itself.

While the crypto market wavers and investors hold their breath, every statement from a sector leader becomes a decisive signal. Michael Saylor, co-founder and executive chairman of Strategy, reappears at the center of the game at a critical moment. As rumors of bitcoin sales spread, he answers frankly. Between prolonged price drops, loss-making results, and stock market tension, his statement sounds like an act of faith, or a risky bet, to defend a strategy that has become emblematic.

Braden Karony, former SafeMoon CEO, was sentenced to eight years in prison for defrauding investors and misusing company funds.

While bitcoin evolves in a persistent volatility climate, ETFs backed by the leading crypto have just sent an unexpected signal to the market. After several weeks dominated by capital outflows, these investment products record a marked return of inflows. This movement, closely observed by institutional investors, comes at a pivotal moment where confidence remains fragile and every flow variation can reshape crypto market expectations.

The crypto market is entering a new phase according to Mike Novogratz. End of explosive gains? Analysis of a major turning point in this article!

The SEC under Atkins lets go of Binance and Sun, coincidentally just as Trump and his crowd are feasting on WLFI… Coincidence or nepotism? The defrauded voters want more.

Digital gold bangs the 6 billion mark on the blockchain... Tether and Paxos are cashing in while Bitcoin coughs. But is it really gold or just a pretty lottery ticket?

Bitcoin hit $60,000 last week amid widespread panic. According to research firm K33, this plunge is not just another correction but indeed the end of capitulation. So, is the worst really behind us?

The standoff between the European press and Google has reached a new level. On February 10, 2026, the European Publishers Council filed an official complaint with the European Union authorities. It accuses the American giant of mining press articles to train its artificial intelligence tools, without ever asking for permission, and without paying a single cent to the newsrooms concerned.