The crypto market is experiencing a new breakthrough. Two listed companies have massively strengthened their bitcoin positions, confirming the rise of its institutional adoption. While BTC firmly holds the $118,000 mark, Metaplanet and Smarter Web Company sign spectacular purchases. This strong signal illustrates the growing confidence of businesses towards the asset, now seen as a strategic treasury pillar rather than a simple speculative bet.

Coin Stats RSS

Bitcoin could break 140,000 $ and Ethereum target 4,600 $. The signals are piling up and tension is rising in the crypto market. A crucial question arises: are we at the gates of a new all-time high?

2025 could mark one of the biggest crypto bull runs in history. Between record inflows into ETFs, favorable US regulation, and explosive technical signals, Bitcoin, Ethereum and altcoins are preparing for an unprecedented surge.

The U.S. Securities and Exchange Commission is shifting its focus toward building a clear regulatory framework for cryptocurrency markets following the conclusion of its nearly five-year legal battle with Ripple Labs.

Digital assets have transcended the corridors of financing, entering the realm of space exploration. In a recent update, Jeff Bezos’s Blue Origin has joined forces with American firm Shift4 Payments to offer crypto payment services for expeditions to outer space.

Ethereum drove strong inflows into crypto exchange-traded products last week, helping the market recover after earlier losses.

An Ethereum developer known as “Fede’s Intern” has been detained in Turkey amid allegations of helping users misuse the blockchain. The case has caused hesitations within the crypto community, however no actual charges have been validated at this moment.

A beverage brand on Nasdaq trades bubbles for BONK: $25M in a Solana memecoin, crazy bet or financial genius crypto-circus style?

The Avalanche crypto heats up under a tough resistance. Between pending ETFs, reduced fees and millions burned, AVAX sharpens appetites... and could soon outshine the competition.

Rumble is exploring a $1.17 billion deal for Northern Data to strengthen its position in the global AI cloud market.

MARA Holdings, American Bitcoin mining giant, plans to acquire 64% of Exaion, a subsidiary of EDF specializing in data centers and artificial intelligence. This operation, estimated at 168 million dollars, reflects the group's desire to diversify its revenue sources while strengthening its BTC accumulation strategy.

With $118 billion traded on the CME in July, Ethereum attracts institutional investors more than ever. Could this record announce a rally towards $5,000? Discover the signals igniting the crypto market.

An unidentified entity has been on a buying spree for Ethereum, snapping up nearly $1 billion worth of ETH in just one week, a move that coincides with Ethereum’s market cap overtaking Mastercard.

The rapid rise of quantum computing revives fears of massive bitcoin hacking. Indeed, Microsoft’s revelation of its Majorana 1 chip, potentially capable of reaching one million qubits, fueled speculation about the end of the inviolability of private keys. However, Graham Cooke, former Google executive and now CEO of Brava Labs, dismisses these concerns. According to him, bitcoin cryptography remains out of reach, even for the most advanced machines.

Sentora (formerly IntoTheBlock) reveals that 97% of Ethereum addresses are in profit, a rarely reached level shaking the market. This record recalls the 2021 bull run, when euphoria had preceded massive profit-taking. Today, analysts are divided between optimism and caution, seeing in this statistic either the sign of a new bullish momentum or the warning of a possible reversal.

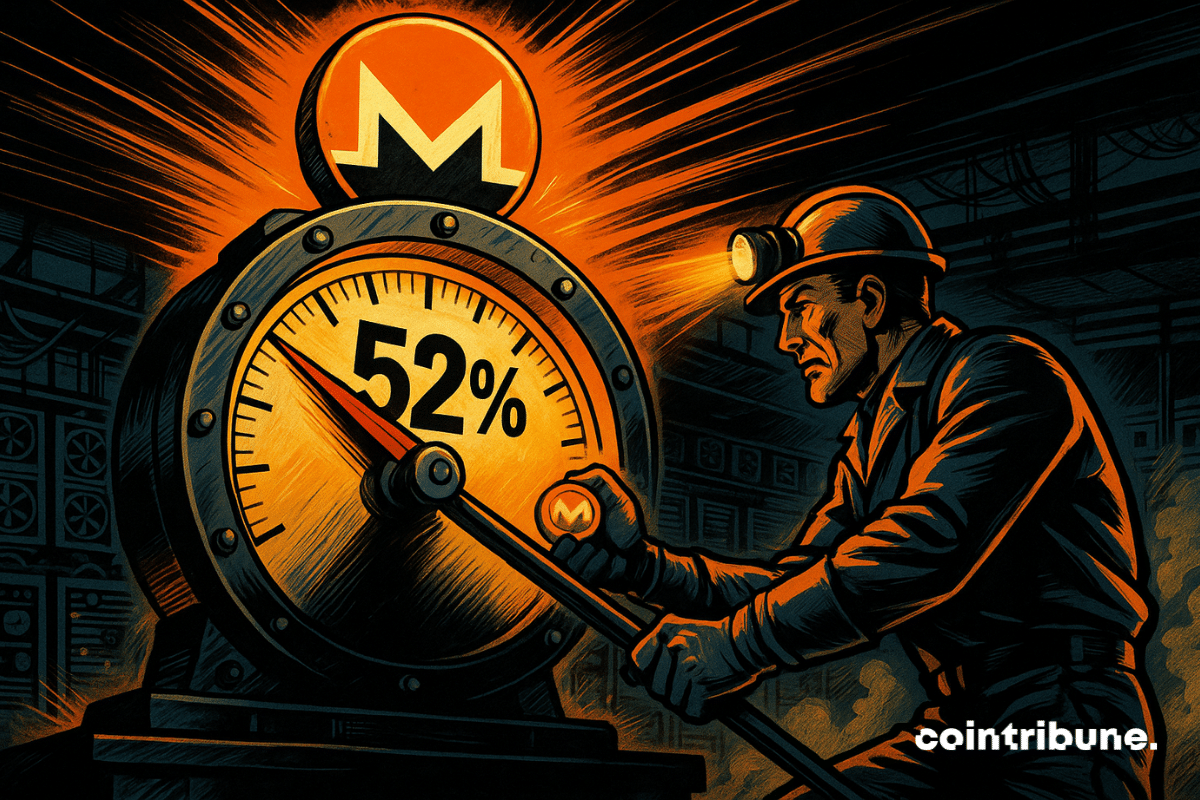

The Qubic network (QUBIC) surprised by temporarily reaching 52.72% of Monero’s (XMR) total hashrate, with a computing power of 3.01 GH/s. This technical performance, although brief, shows the power of this project.

Bitcoin is touching its all-time highs and Strategy is seizing the opportunity to celebrate a milestone: five years of uninterrupted purchases. The global leader among publicly listed companies holding BTC, Michael Saylor's group commemorates the event with a much more modest acquisition than usual. A symbolic gesture that, in a market hypersensitive to decisions by institutional heavyweights, reignites the debate on the viability of a forced-accumulation strategy, even when prices are flirting with their records.

The crypto XRP keeps breaking records after Ripple's victory against the SEC. Between massive institutional inflows and explosive technical signals, everything indicates that a new historical peak at 24 dollars could be reached very soon.

The company BNC purchased 200,000 BNB tokens, for a total amount of about 160 million dollars. Thanks to this purchase, it becomes the largest BNB holder worldwide among companies. This choice is not a simple investment. It is a new strategic direction.

The future of stablecoins is taking shape in this colorful and often unpredictable world of cryptos. Records are breaking one after another, driven by massive adoption and piling innovations. And while some see it as a simple fad, others bet that this wave will not stop anytime soon. The numbers speak for themselves... and they have rarely been so eloquent.

Robert Kiyosaki, the author of 'Rich Dad Poor Dad', believes Bitcoin could dip to $90,000 this month, and he’s ready to take advantage of it. Kiyosaki sees the potential drop as a golden opportunity to expand his holdings, calling Bitcoin “pure genius asset design” and the easiest way he has ever made millions.

Michael Saylor highlights Bitcoin as a superior store of value while the cryptocurrency climbs above $120,000 amid growing institutional interest.

Ethereum saw the biggest short liquidation in the crypto market on Friday, wiping out $105 million in bearish bets as the price surged past $4,000 for the first time in eight months. The move drew reactions from high-profile figures, including Eric Trump, who warned traders against betting against Bitcoin and Ethereum.

Altcoins are no longer a fleeting bubble. Their presence is consolidating to the point of attracting the biggest names in traditional finance. BlackRock, a Wall Street giant, is now opening up to leading cryptos like ether. This institutional shift changes the game in the crypto ecosystem. However, for Michael Saylor, a leading figure of MicroStrategy, a hierarchy is imposed: bitcoin remains the benchmark. And even if Ethereum shines, he refuses to grant it the same status.

After reaching an unprecedented high of $123,000, bitcoin begins a clear slowdown. The euphoria of recent weeks gives way to a consolidation phase, where every market movement is closely scrutinized. The latest Institutional Insights report from CryptoQuant reveals tangible signs of exhaustion: momentum decline, liquidity slumps, and sustained profit taking. This cocktail places the flagship asset at a crucial moment, between technical pause and correction risk.

The meteoric rise of Ether propels Vitalik Buterin back into the exclusive circle of on-chain billionaires. The co-founder of Ethereum sees the public value of his holdings exceed one billion dollars, driven by an ETH crossing $4,000 for the first time in eight months. This resurgence occurs in a boiling market, fueled by massive institutional flows and renewed confidence in the Ethereum ecosystem.

On the chessboard, two visions of AI faced each other. Sam Altman, head of OpenAI, and Elon Musk, founder of xAI, crossed their models in a chess tournament organized by Google. For three days, OpenAI’s o3 and xAI’s Grok 4 competed without any specialized assistance. Much more than a simple exhibition match, the event turned into a revealing moment: behind the final score was the real gap between two artificial intelligences, and two strategies, which came to light.

The asset tokenizer Brickken and the decentralized credit protocol Credefi announced, on July 28, 2025, a strategic partnership marking a major breakthrough in the convergence between regulated tokenization and decentralized finance. From now on, holders of shares or bonds tokenized via Brickken can use these securities as collateral to borrow USDC directly on Credefi, through a permissionless, peer-to-peer, and non-custodial mechanism.

Following a drop towards the end of July, the crypto market witnessed a fresh injection of optimism over the past week. Artificial intelligence (AI) assets also leveraged this market wave, with many experiencing a strong northward push, as the sector crossed $34 billion in valuation.

Bitcoin’s record-breaking rally above $123,000 in mid-July has given way to a choppy and uncertain phase. The price has slipped to $116,191 as of press time, showing minimal change over the past 24 hours but up 0.65% over the week.