Bitcoin attracts bettors, Ethereum seduces bankers, Dogecoin dreams of an ETF and Tether dresses in gold: the crypto circus continues its show, between promises, glitters and persistent doubts.

Ethereum (ETH)

The calm was short-lived. Indeed, the crypto market is plunging back into fear, according to the Crypto Fear & Greed Index, which dropped to 44 after several weeks of stability. This psychological signal is not isolated, as it accompanies a clear shift in investment flows, leaving the most volatile altcoins to refocus on the heavyweights of the sector, bitcoin and Ethereum.

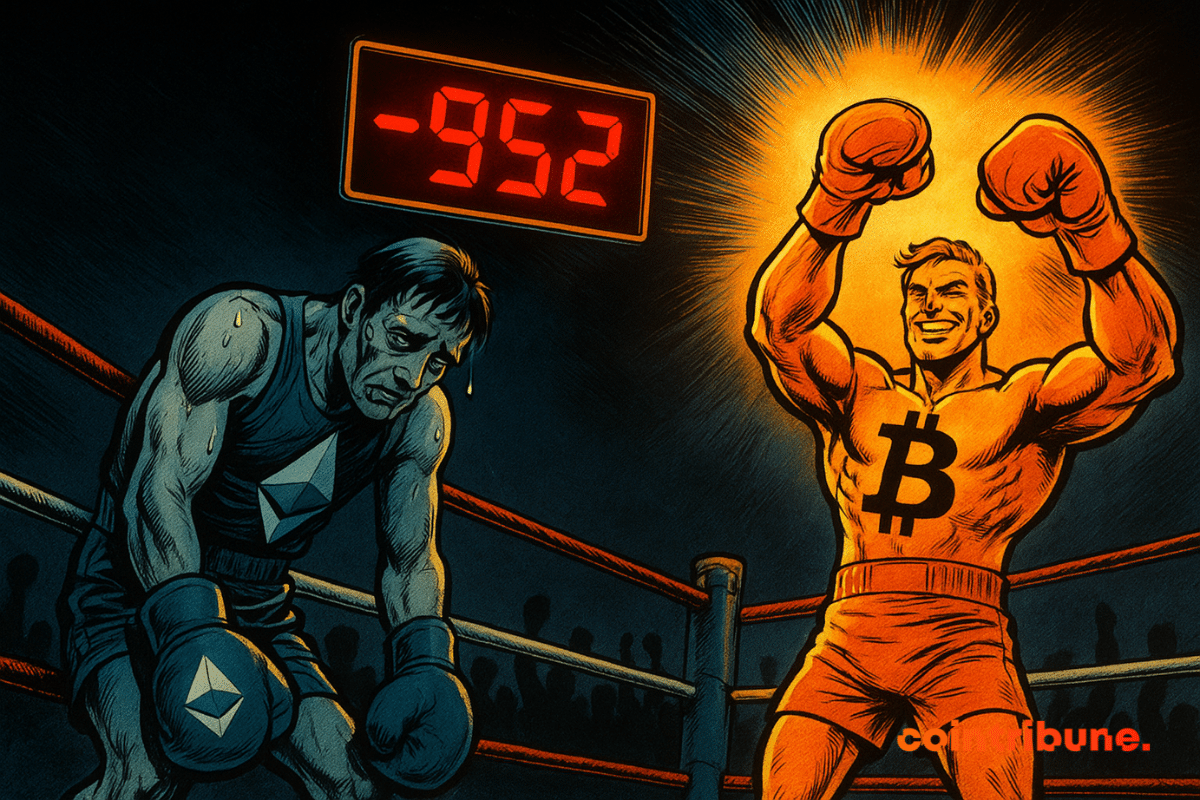

Spot Ether exchange-traded funds (ETFs) recorded $952 million in outflows over five trading days, raising concerns across digital asset markets. Investors reduced exposure to Ether products managed by major firms such as BlackRock and Fidelity, while capital shifted toward bitcoin ETFs. The withdrawals came during a period of rising recession fears and increased expectations of monetary policy easing in the United States.

Since its creation, Ethereum (ETH) has continually surprised the markets. But the latest indicator marks an unprecedented milestone. For the first time, Ethereum's exchange balance has turned negative: in other words, more ETH leave trading platforms than enter. This rare phenomenon could be the fuel for a surge towards $7,000, according to several analysts.

Stripe, once skeptical, now has its own in-house blockchain. Officially for stablecoins, unofficially to outshine the crypto heavyweights. Engineers grumble, Collison celebrates.

Reports from the U.S. labor market sent shockwaves through the financial markets, prompting risk assets like Bitcoin to experience sharp price swings. With job data for August coming in lower than expected, predictable alarms erupted regarding a looming recession, which could drive fresh appetite towards risk assets.

The tokenized real-world asset (RWA) market reaches a new milestone with Ondo Finance's groundbreaking announcement: the deployment of over 100 American stocks and ETFs directly on the Ethereum blockchain. This major initiative propels the ONDO token to new heights, flirting with the symbolic 1 dollar mark.nThe enthusiasm around Ondo Finance signifies a silent revolution redefining access to traditional financial markets. By eliminating intermediaries and offering 24/7 trading, tokenization fundamentally transforms how investors interact with traditional assets.nThis evolution is part of a broader movement where blockchain becomes the new standard for democratizing investment, from real estate with players like RealT to listed stocks with Ondo Finance. A breakdown of a sector that could well disrupt traditional finance.n

Solana speeds like lightning but stalls below 215 dollars: ETF lurking, record upgrade and flashy meme-coins. Crypto hesitates between a surge and a scheduled slip.

This Friday, September 5, nearly $4.7 billion worth of options on Bitcoin and Ethereum expire, while technical indicators waver and the U.S. economy sends signals of slowdown. This crucial deadline could reshape the spot markets' dynamics.

After trailing Bitcoin for most part of a decade, Ethereum has toppled the OG crypto in monthly and weekly spot trading volume on centralized exchanges. Market data ties this trend flip to recent trends, including increased institutional adoption of Ether, as well as capital rotation from BTC to ETH.

Software supply-chain attacks are evolving in a disturbing way as cybercriminals use Ethereum smart contracts to hide malicious code within open-source libraries. Research presented by a security firm ReversingLabs shows that hackers now insert command-and-control instructions within blockchain contracts, complicating detection and closure by defenders. This approach signifies the increased complexity of malware distribution and blockchain becoming a tool of cybercrime.

September starts with a marked contrast on crypto ETFs: Bitcoin captures $333M in inflows, while Ether suffers $135M in outflows. This movement confirms bitcoin's place as a safe haven, but the decline in overall volume ($3.93B) and net assets ($143.21B) highlights persistent caution in the crypto market. Crypto ETF flows reveal a clear divide between triumphant Bitcoin and struggling Ether. This crypto dynamic reflects a strategic repositioning by investors, strengthening confidence in Bitcoin despite the caution.

Bitcoin sulks, altcoins stir: 55% dominance and tokens lying in wait... But who will really take the pot by December?

Ethereum Foundation sells 10,000 ETH on centralized platforms. Pragmatic or heresy? The community cries out DeFi betrayal, the foundation pleads transparency… Schizophrenic atmosphere among cryptophiles.

Since the beginning of September, bitcoin (BTC) and Ethereum (ETH) have captured the attention of a crypto market suspended between hope and concern. While Wall Street falters, the two leaders show intriguing resilience. Yet, behind this apparent calm, technical indicators reveal growing tension. Between contradictory signals and increasingly polarized forecasts, traders are preparing for volatility that could make September a decisive month for the market's future.

SharpLink throws its dollars into ether like confetti: 39,008 ETH quietly bought, Joseph Lubin as the conductor of a risky all-in crypto.

What if the next crypto cycle was not only bullish but a historic turning point? At the WAIB Summit 2025, several experts stated that a single cycle could be enough to increase crypto users from 659 million in December 2024 to 5 billion users within ten years. A global adoption underway, driven not only by speculation but by the rise of concrete use cases, the maturity of blockchain technologies, and renewed interest from individuals as well as institutions.

As September begins, crypto traders approach the market cautiously, with Bitcoin, Ethereum, and XRP showing varied performance.

Ethereum plays the tightrope walker: programmed drop, then theatrical rise. September trembles, October rejoices. Crypto traders? They might applaud... after getting trapped.

Bitcoin wavers below 109,000 dollars, caught between macroeconomic uncertainty and unfavorable technical signals. While investors scrutinize upcoming indicators likely to guide US monetary policy, the pressure intensifies. Institutional capital outflows, tensions in derivatives products, and weakened sentiment indicators increase distrust. The market freezes in anticipation, exposed to latent volatility.

Ethereum takes the prize for the big players, Bitcoin clings to its throne. A duel of numbers, egos and billions: who will emerge victorious from this digital waltz?

Solana has reached a decisive milestone with the massive approval of Alpenglow, an upgrade set to disrupt its operation. This decision paves the way for unprecedented acceleration of transactions, bringing the blockchain closer to the speeds of modern Internet infrastructure. Ecosystem players see this change as an opportunity to strengthen competitiveness against Ethereum and Bitcoin. Alpenglow thus marks the beginning of a new technological era for a network seeking to combine speed and reliability

August was marked by two opposing signals in the crypto market. Ethereum reached an unprecedented peak of activity, confirming the growing interest of investors in its ecosystem. Conversely, Bitcoin suffered a brutal shock after the massive liquidation of 24,000 BTC by a single actor. This contrast is not just a technical divergence. It illustrates an ongoing rearrangement, between regulatory innovations, strategic repositioning of players, and the evolution of the balance of power between major assets.

Tron has just announced a landmark measure: a 60% reduction in its network fees. This decision was validated by a community vote and confirmed by Justin Sun. It aims to make transactions on its network more accessible after a period when costs had significantly increased.

While the market oscillates between technical consolidation and the return of institutional appetite, an extraordinary movement attracts all attention. An actor holding more than 5 billion dollars in bitcoin redirects a major part of its capital towards Ethereum. The scale of the amounts, the transparency of on-chain transactions, and the timing of the operation are striking. More than a simple arbitrage, this strategic repositioning seems to redraw the power relations between the two historical pillars of the crypto universe.

Hyperliquid (HYPE) holds around $50 after a peak at $51.50, supported by speculative and institutional interest. BitGo's integration of HyperEVM strengthens its credibility, positioning the token among the most followed crypto projects.

Since the beginning of the year, Solana (SOL) is clearly lagging behind Ethereum (ETH), which has returned to its highest levels. But behind this apparent underperformance, some analysts see a strategic opportunity for investors. Should we then take advantage of this moment to position ourselves on Solana?

Van Eck highlights Ethereum as a Wall Street token, positioning it at the centre of the growing stablecoin market.

On-chain report shows that stablecoin deposits on cryptocurrency exchange Binance have surpassed $1.65 billion. Such massive user deposits are generally known to precede increased appetite for spot assets, especially after recent market sell-offs. Interestingly, this move comes as Bitcoin crumbles under the weight of whale sheddings and heavy liquidations.

While BTC maximalists brood, whales set course for ether. Bluff move? Or real metamorphosis of a market tired of its digital dinosaur?