At Visa, it's no longer a toss-up with crypto: 91 million later, the card becomes the new favorite toy of decentralized financiers. To be continued…

Ethereum (ETH)

Grayscale reaches a historic milestone. For the first time in the United States, a crypto ETF will pay its investors income from Ethereum staking. This unprecedented move disrupts traditional finance codes and paves the way for a new generation of investment products combining cryptos and on-chain yield. In a context where regulation is being structured and innovation becomes a strategic lever, this decision propels Grayscale to the forefront of a rapidly evolving market.

The Fusaka update propels Ethereum. Its number of holders explodes, analysts raise alarms. All details in this article.

Ethereum is about to enter a new era. In a message published on X, Vitalik Buterin announces a major technical upheaval: zk-EVMs could become, by 2027, the main block validation mechanism. A profound transformation of the protocol, which would mark one of the most ambitious turning points since the creation of the network. Performance, decentralization, scalability... Buterin claims the trilemma is "solved" in practice. One challenge remains: ensuring security.

At the end of 2025, Ethereum didn't just finish the year well. It accelerated, then it broke the crypto counter. On December 29, 2025, the network validated 2.23 million transactions in a single day. A historic peak, supported by numbers.

Bitcoin and Ethereum ETFs attracted 645.8 million dollars on January 2. In a still hesitant market, this volume is surprising. It marks the strongest day of inflows in over a month for Bitcoin products and an unprecedented peak since December for Ether. While 2025 ended on a decline, this surge is striking.

Bitmine has just added +259 million dollars in ETH, driving the Ethereum validator queue to nearly one million. A record that reveals institutional enthusiasm for staking and raises a crucial question: Can Ethereum absorb this pressure without compromising its decentralization?

BitMine stock jumped 14% after an announcement described as "spectacular" by its chairman, Tom Lee. Indeed, the company is seeking shareholder approval to significantly increase the number of authorized shares. This strategic move comes as BitMine strengthens its position on Ethereum, of which it holds 3.41% of the circulating supply. In a market where crypto treasuries are growing, this initiative marks a key step for one of the largest institutional holders of ETH.

Crypto markets are showing a notable shift, with major altcoins recording solid gains. Bitcoin’s share of the overall market has weakened and is now nearing 59%. Capital rotation toward higher-beta assets has followed, renewing discussion around a potential altcoin-led phase.

Bitmine and Fundstrat head of research Tom Lee rehashed debates across crypto markets after forecasting a sharp rise in Ethereum’s price. Speaking at Binance Blockchain Week, Lee stated that Ether could reach $62,000 in the coming months as blockchain adoption enters a new phase. His remarks also reaffirmed his long-held bullish view on Bitcoin.

Crypto veteran and BitMEX co-founder Arthur Hayes has adjusted his portfolio, selling a significant amount of Ether and reallocating funds into decentralized finance projects. The move comes as Ethereum faces weak price momentum while network activity continues to grow steadily. Hayes’ actions have drawn mixed reactions across the crypto community, particularly as DeFi tokens remain under pressure.

A simple technical incident was enough to paralyze a large part of the crypto ecosystem. In November 2025, an outage at Cloudflare took offline Coinbase, BitMEX, Blockchain.com, Ledger, and many others. Within hours, the promise of Web3 resilience clashed with a brutal reality. Behind the smart contracts, the infrastructure remains vulnerable. Dependent on centralized Web2 services, many so-called decentralized projects expose a critical flaw. Vitalik Buterin sees this as a warning sign and a call to action.

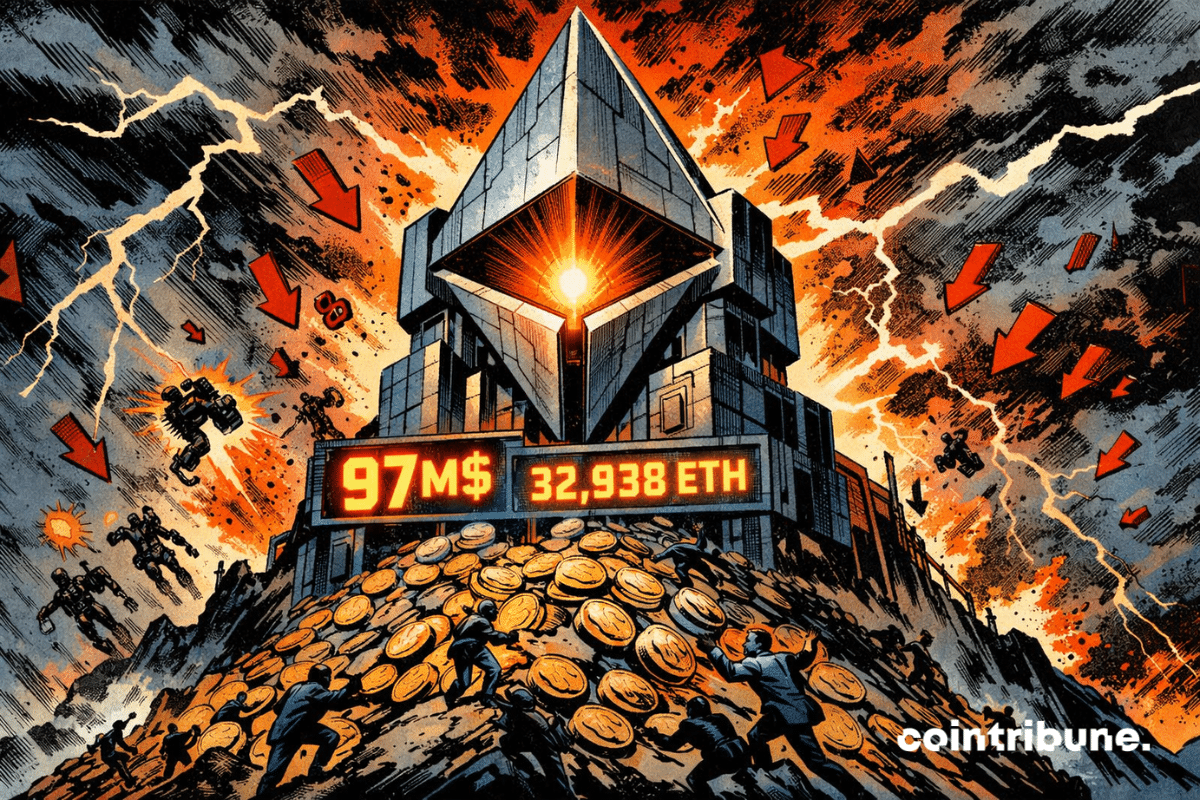

BitMine bets 97M$ on Ethereum in the middle of a bearish market. A risky bet or a calculated plan? Detailed analysis in this article.

While the market watches the price of crypto, another indicator emerges. Ethereum recorded a record 8.7 million smart contracts deployed in the fourth quarter, according to Token Terminal. This peak in activity, reached despite a price drop, confirms the strength of network usage. Far from cyclical effects, the on-chain dynamics outline a discreet but structuring underlying trend.

Bitcoin and Ether are showing early signs of a shift in investor behavior, even as broader market conditions remain weak. Long-term Bitcoin holders are easing selling pressure, while large Ether holders are adding to their positions. Prices, however, remain under pressure amid caution, macro risks, and year-end positioning.

Despite a 40% drop in trading activity, derivatives open interest rose $2 billion in December, driven by Bitcoin and Ethereum futures positions.

Crypto giants rush into a rapidly growing market: tokenized stocks. Discover the latest figures!

Bitcoin wavers as the New Year's Eve approaches: whales, options, silver ratios... What if 2026 rhymes with hangover in the crypto jungle? Holy tree!

Ethereum is taking a strategic turn in 2026, with two major updates planned within a few months: Glamsterdam in the first half, followed by Hegota at the end of the year. Long criticized for the slowness of its development, the blockchain is now opting for a faster schedule, aligned with the growing demands of its ecosystem. This acceleration marks a turning point in the protocol's governance and opens a new technical phase for Ethereum, as the sector enters an era of consolidation.

Charles Hoskinson compares Solana and Ethereum, noting Solana’s rapid growth potential and Ethereum’s focus on long-term, research-driven development

Regulation sometimes looks like a room too neatly arranged. Nothing sticks out. Not a draft. And that's precisely what Vitalik Buterin criticizes about the European Union: wanting a "clean" internet, without rough edges, to the point of reducing the oxygen available for crypto innovation. In a long message posted on X, the Ethereum co-founder points to the sore spot: the Digital Services Act (DSA) wouldn't just try to contain the damage, it seeks to eliminate the very space where controversial ideas are born.

Bitmine has just deposited 219 million dollars in ETH into staking, marking a historic turning point for Ethereum. With over 540 million invested in one month, this move could redefine the institutional rules of the game. A risky or visionary strategy? Decoding a bet that is already shaking up the crypto market.

When the boss of Aave puts 15 million on the table, crypto wonders who really governs... and who votes without raising a hand.

Ethereum is establishing itself as a new central player in global finance. Driven by the rise of tokenization, the blockchain is now attracting the attention of Wall Street. Major institutions like BlackRock and Robinhood are actively exploring this technology, marking a turning point in crypto adoption. For Tom Lee, co-founder of Fundstrat, Ethereum is becoming a key infrastructure of the financial system. A dynamic that, according to him, could push the asset's price to unprecedented levels.

NFT markets closed the year on a weak footing, with prices and trading activity falling instead of posting a typical year-end rebound. December data pointed to declining participation, softer sales, and lower valuations across most collections, signaling continued strain as the sector moves into the new year.

Hyperliquid progresses as a crypto desk that doesn't want to waste time with slogans. No big speeches "DeFi for all." Instead, two very concrete levers in pre-alpha: portfolio margin and BLP Earn vaults. Translation: more flexible risk management, and a yield and borrowing component directly connected to Hypercore. The kind of addition that makes no noise, until the day traders understand what it changes.

The expiration of Ethereum options worth 6 billion dollars this Friday could mark a key turning point for the crypto market. This event triggers major stakes for traders and investors, as the crypto price could be subject to decisive pressure. If the market fails to stabilize, a sharp price reassessment could follow, with notable short-term consequences.

In a crypto market undergoing upheaval, whale accumulation of Ether is gaining momentum. Despite a price that remains below $3,000, this trend, combined with a reduction in supply on exchanges, could trigger a significant price movement. Meanwhile, long positions on derivative contracts are multiplying, adding further pressure on the market.

Global crypto exchange-traded products (ETPs) saw a sharp pullback last week amid a return to regulatory uncertainty. New data from CoinShares shows investors withdrew nearly $1 billion, ending a three-week streak of inflows. Delays around the U.S. Clarity Act played a key role in weakening sentiment, especially among U.S.-based institutions. Market activity also pointed to rising caution around large holders and near-term policy risks.

While traditional markets slow down between Christmas and New Year, the digital derivatives ecosystem is preparing to absorb a major technical shock. Indeed, this Friday will see the expiration of 27 billion dollars worth of options on Bitcoin and Ethereum, concentrated on the Deribit platform. A crypto version of Boxing Day, both feared and closely watched.