The crypto market rebounds: ETFs fill up, BlackRock frowns, Solana hesitates. What if whales knew the weather before everyone else?

Exchange Traded Fund (ETF)

Solana is booming, but CoinShares is backing down: the ETF leaves the stage before entering. The crypto market, meanwhile, is still applauding... Go figure where the real show is.

After a historic series of 18 flawless days, Solana ETFs have just marked their first halt. The 21Shares Solana ETF faced massive withdrawals, dragging the entire sector into the red. Does this sudden reversal mark the end of the euphoria around SOL?

After months of tension, BTC finally crosses $90,000, offering unexpected relief to BlackRock Bitcoin ETF holders. How does this historic rebound redefine the crypto investment landscape? Dive into the analysis of a turnaround that changes everything for institutional and retail investors.

An ETF on a privacy coin? Grayscale dares where no one has gone before. Discover how Zcash could shake the US market.

While Bitcoin nears the highs, XRP quietly courts Wall Street with its ETFs... What if the real crypto maneuvers are played far from the spotlight? To watch.

When more than 8% of Bitcoin changes hands in a few days, it is never just a simple technical twitch. It is a massive shift of digital wealth, almost a silent earthquake that speaks volumes about the market's pulse. This week, the network experienced one of its most striking supply movements since the creation of the protocol. A true reshuffling of the cards, while the markets anxiously await the Fed's decision in December.

Bitwise's Dogecoin ETF has just received the long-awaited approval from the NYSE, but one question remains: will the market show up for DOGE? Between hopes and uncertainties, this launch could redefine the future of the most famous memecoin. Discover the stakes and projections for investors.

Franklin Templeton launched an XRP-backed ETF on NYSE Arca this Monday. This event marks a significant milestone in integrating altcoins into regulated markets. While attention is focused on Bitcoin ETFs, this initiative signals an expansion of institutional interest. After the litigation between Ripple and the SEC, this launch could pave the way for other cryptos previously sidelined by traditional markets.

Grayscale’s DOGE and XRP spot ETFs have cleared NYSE approval, moving closer to hitting the U.S. market amid ongoing crypto volatility.

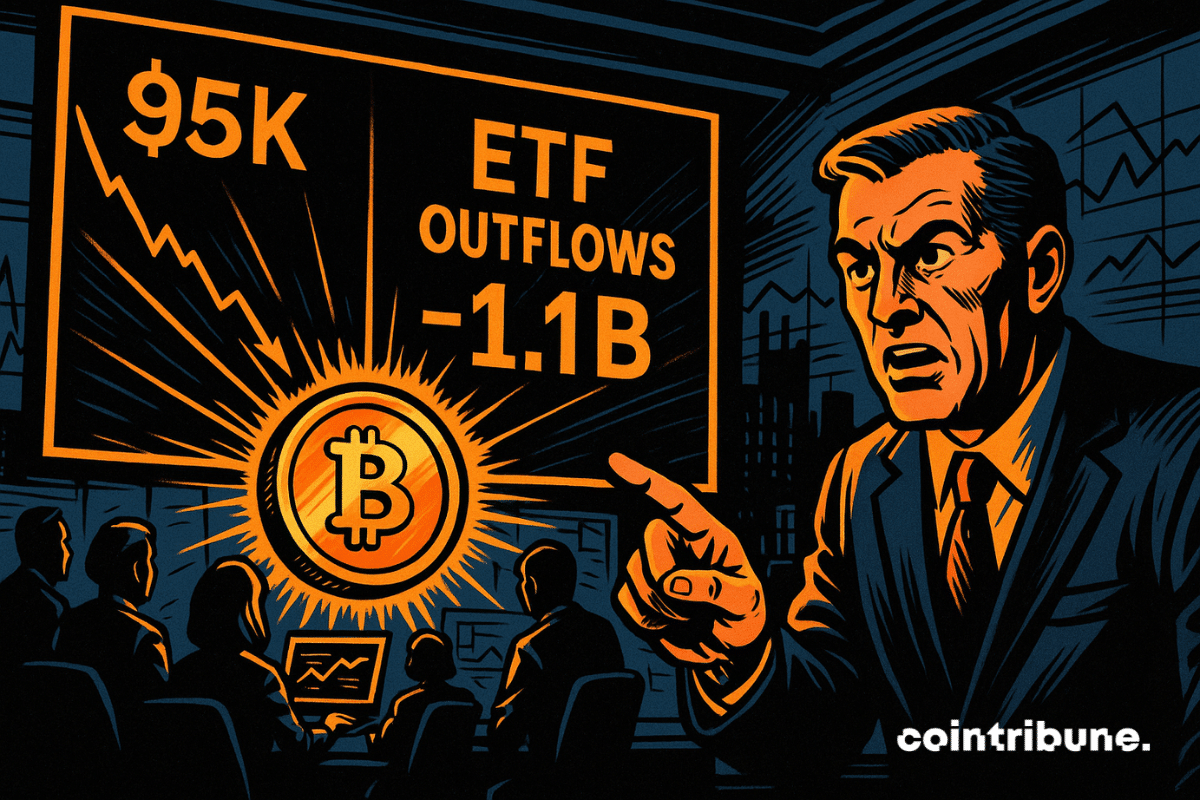

Crypto markets are showing signs of strain as several key measures of capital flow turn negative. Recent data points to a broad cooling of demand across Bitcoin ETFs, stablecoins, and corporate treasury activity. And as expected, this trend has raised concerns that the rally’s core drivers have stalled.

Market conditions continue to tighten around Bitcoin as traders confront nearly $2 billion in leveraged long positions that could be liquidated if prices fall to $80,000. Recent swings reveal how fragile derivative exposure has become, with borrowed positions at risk of automatic liquidation during sharp price moves.

Strong inflows returned to major crypto ETFs at the end of the week after several days of uncertainty across digital asset markets. Bitcoin, Ether, and Solana products all posted gains on Friday, hinting at early stabilization following sharp swings and heavy withdrawals earlier in the week. Sentiment remains cautious, but renewed allocations to key products suggest that some investors are selectively re-entering the market.

Two ETFs backed by XRP have just been listed on the NYSE, a first meant to propel Ripple to the rank of institutionalized crypto assets. However, the market sends an opposite signal. The crypto collapses below 2 dollars, down 35% for the quarter. Far from a bullish turning point, this regulatory advance reveals a persistent disinterest. The ETF effect, expected as a driver, seems to have had no tangible echo.

Long considered the spearhead of institutional adoption, Bitcoin ETFs have just experienced one of their worst weeks since their launch. With massive outflows and a tense market, confidence is wavering. Such a situation reminds us that in the crypto universe, nothing is ever fully guaranteed, not even the most solid financial products.

Solana has just recorded 18 consecutive days of positive net inflows on its ETFs, a first in the sector. Launched in early November, these financial products have already attracted over $500 million, triggering significant interest from institutional investors. In a market still overshadowed by the 2022–2023 bear cycle, this dynamic surprises and raises questions about Solana's repositioning in crypto portfolios.

Market pressure has surged across the crypto sector. Even so, analysts say the recent wave of Bitcoin ETF outflows reflects short-term trading adjustments rather than a meaningful pullback by institutional participants. Recent redemptions, combined with forced selling in spot markets, have put added stress on prices, but experts maintain that broader demand for Bitcoin remains intact.

While Bitcoin and Ethereum endure massive withdrawals, two newcomers shake up the scene. Solana and XRP ETFs accumulate nearly 900 million dollars in net inflows despite a market in full collapse. Are we witnessing the emergence of a new hierarchy in the crypto ecosystem?

Uptober fizzled out, November bleeds: $3.79 billion gone, Bitcoin stumbles, Solana rejoices… What if the BlackRock giant just pressed where it hurts?

Bitcoin has just reached 86,000 dollars, a pivotal threshold that places the asset at the heart of an area referred to as "max pain" by several analysts. In a climate of monetary tension, this drop fuels fears of an imminent institutional capitulation.

Bitcoin ETFs are attracting capital again: simple rebound or bearish trap? We deliver the details in this article.

Bitcoin’s fall under $90,000 on Wednesday revived market fear and extended a sell-off that has already lasted several days. Prices slipped to levels not seen since earlier periods of stress this year. Traders responded by stepping back from risk and reducing exposure across both spot and derivatives markets.

A new milestone has just been reached in the integration of cryptos into traditional markets. Bitwise filed the 8-A form for its XRP ETF on November 19, a clear signal of an imminent listing on the NYSE. The product, awaited by institutional players, could be launched in the next few hours, marking a strategic turning point for XRP and strengthening the legitimacy of cryptos with regulated finance.

Caution settles in on the markets. In a few weeks, investors have seen their hopes for monetary easing vanish while Bitcoin lost its momentum. But does this correction signal a simple pullback or the start of a real bear market?

BlackRock takes a staking cure for its Ethereum: a developing ETF that promises yield for large portfolios. Crypto, meanwhile, continues to trot towards Wall Street.

VanEck's Solana ETF has just entered the scene, and it's not just another product on the altcoin shelf. We are witnessing a real flood of crypto funds on the stock market, with Solana and soon Dogecoin at the forefront. Between slash fees, integrated staking, and a race against regulatory time, a new battle is playing out far from traditional exchange platforms.

The crypto market is wobbling. Bitcoin lost more than 10% in a few days and struggles to regain momentum. Arthur Hayes, a prominent figure in the ecosystem, points to an unexpected culprit: the contraction of dollar liquidity. His thesis challenges conventional analyses and opens a debate on the real drivers of the market.

Global cryptocurrency markets are under heavy pressure after a sharp decline in Bitcoin's value damaged sentiment across the sector. Prices are now giving back most of the gains made earlier in the year, while smaller tokens are falling to multi-year lows. Investors are reassessing risk, trading volumes are shrinking, and several analysts warn that further declines remain possible.

Ethereum faces steady ETF outflows, with investors viewing it as riskier than Bitcoin, signaling caution in the market.

U.S. Bitcoin ETFs faced another difficult week as steady capital outflows added strain to an already uneasy market. Investor caution increased as withdrawals accelerated, pushing Bitcoin further below the $100,000 mark and signaling a broader loss of confidence in digital assets.