Saga, a Layer-1 blockchain protocol, has paused its Ethereum-compatible SagaEVM chainlet after a $7 million exploit triggered unauthorized fund transfers. The attack involved assets being bridged out of the network and swapped into Ether. Although the affected chainlet remains offline, Saga says the broader network continues to operate normally.

Getting informed

Ethereum may have chained updates, but doubt persists about its ability to generate sustainable activity. In a report published this Wednesday, JPMorgan analysts question the real effects of the Fusaka update, which nevertheless caused an immediate surge on the network. Behind the technical gains, the question of economic viability remains unresolved. The blockchain co-founded by Vitalik Buterin faces limits that even its latest advances do not seem able to correct.

The crypto A7A5, Moscow’s digital weapon? This token allowed Russia to move billions despite the Western embargo.

Donald Trump accuses JPMorgan of having closed his accounts for political reasons and demands 5 billion dollars before the Florida courts. By directly targeting CEO Jamie Dimon, the president reignites the explosive debate on "debanking," a practice that fuels tensions between the political and financial spheres. This case questions the neutrality of major American banks. While Trump denounces ideological exclusion, JPMorgan, on its side, rejects any accusation of discrimination.

In Davos, the head of Circle promises that stablecoins will not blow up banks. What if crypto became the secret weapon... of AI? Allaire swears no, or almost.

Davos 2026: Ripple and Trump unite to transform the United States into a crypto empire. All the details in this article.

Faced with rising tensions around information control, Vitalik Buterin takes a stand. The Ethereum co-founder makes decentralized social networks his priority for 2026, calling for an open, interoperable model free from commercial logics. This choice marks a strategic and ideological turning point, supported by concrete actions and a frontal critique of dominant platforms. Buterin no longer just codes the Web's infrastructure but now wants to rethink how we exchange, debate, and share online.

On January 6, 2026, Kraken formalized a major partnership with Ethena Labs. The American exchange becomes one of the institutional custodians of assets backed by USDe, the synthetic dollar that rose to be among the three largest stablecoins in the world. This selection, validated by the Ethena Risk Committee (ERC), marks a decisive step in the institutionalization strategy of the DeFi protocol.

For years, the narrative has been well-oiled: Bitcoin as the ultimate reserve, the rest of the market playing more or less exotic satellites. Yet, some lines are starting to crack. According to crypto analyst and YouTuber FireHustle, the next wave of institutional adoption could well be built elsewhere. More precisely around Solana. A bold hypothesis, almost uncomfortable for maximalists, but deserving more than a shrug.

Crypto portfolio management platform adds real-time position monitoring for three major perpetual trading protocols

The crypto market evolves at a crazy pace, and Binance Wallet has just changed the game with three new AI tools: Topic Rush, Social Hype, and AI Assistant. Discover how these innovations help you anticipate crypto market movements and make informed decisions without wasting time.

Rapid progress in artificial intelligence is forcing governments and institutions to confront a much shorter path toward human-level systems than previously expected. Industry leaders now say the gap between today’s tools and artificial general intelligence is narrowing quickly. As development accelerates, concerns around jobs, governance, and economic stability are moving to the center of the debate.

Billionaire investor Tim Draper predicts Bitcoin could reach 250K USD within six months, citing rising adoption and supportive policies.

According to ARK Invest's projections, the value of tokenized assets could climb to 11 trillion dollars by 2030, compared to a current market estimated around 22 billion. In other words, ARK is not talking about a gadget, but about a plumbing change for finance.

The boundary between traditional banks and crypto could soon disappear. In Davos, David Sacks, White House crypto advisor, stated that these two worlds will soon form just one. Indeed, the CLARITY Act, a decisive bill for the future of the sector in the United States, is at stake. Behind the debates on stablecoin yields, a complete reconfiguration of the financial industry is emerging amid political tensions, power struggles, and strategic ambitions.

Caroline Ellison released from prison. FTX returns to the heart of debates in the crypto ecosystem. All the details in this article!

XRP is once again worrying analysts. A rare technical signal, identical to the one that preceded a 68% drop in 2022, has reappeared. As tensions return to the crypto market, this alert strengthens fears of a major pullback. At the same time, massive XRP ETF outflows increase the pressure on Ripple's crypto. Is history repeating itself?

“To the moon,” that’s what bitcoin fans have wanted recently. But for now, the stars belong to another celestial body: gold. The yellow metal is flying over the markets, leaving the crypto-sphere waiting. While crypto traders watch for a signal, traditional investors turn to the ultimate safe haven. Gold shines,…

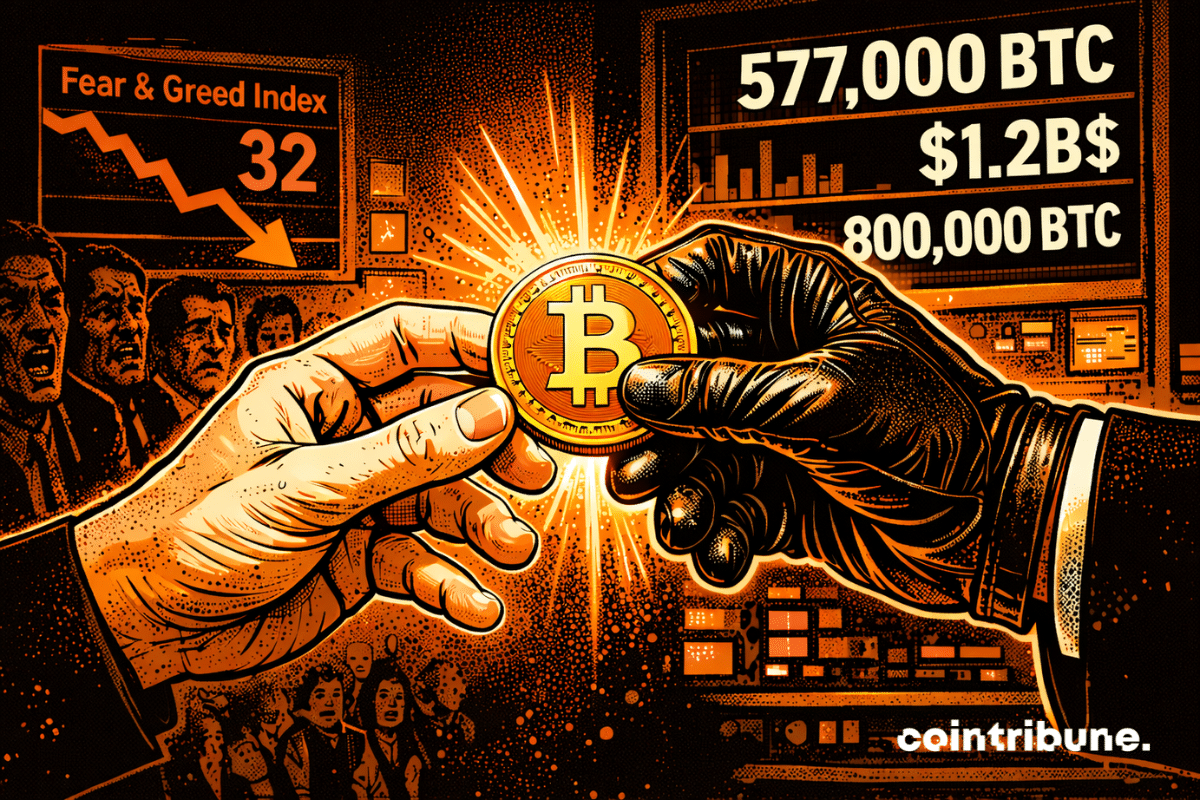

Bitcoin just broke a key threshold below $90,000, reigniting doubts about the market's strength. Between massive profit-taking by long-term holders and liquidity inflows from whales, selling pressure intensifies. Buyers struggle to contain the drop amid this shock. The balance is fragile, as speculative appetite faces increasingly vulnerable technical supports.

The so-called Ethereum Killer blockchains are stirring to nibble away market shares and gain media spotlight. But deep down, in reality as in collective perception, there is only one master. Its name comes up in every conference, every strategic plan, every institutional tweet. Ethereum is no longer just a technology…

The recent surge in activity on Ethereum might be less a sign of euphoria and more a malicious background noise. A security researcher, Andrey Sergeenkov, believes that part of this increase resembles an "address poisoning" campaign, a variant of dusting that takes advantage of transaction fees that have been very low since December. "Activity retention" nearly doubled in a month, around 8 million addresses, while daily transactions reached a record close to 2.9 million.

At Davos 2026, Scott Bessent reaffirms Trump’s Bitcoin vision: a strategic reserve to assert American crypto leadership. But behind this reaffirmation, doubt persists. Is it a show of strength or an admission of a lack of real progress in crypto innovation?

The US Commodity Futures Trading Commission (CFTC) is strengthening its leadership as it prepares for a potentially expanded role in overseeing digital asset markets. Chair Michael Selig has appointed two senior advisers, signaling the agency’s focus on crypto regulation as lawmakers consider legislation that could grant the CFTC broader authority over the sector.

Ray Dalio warns of uncertainty in global markets as U.S. economic policies shift. He notes rising stress in currencies and sees gold as a reliable hedge.

Trump Airdrop: a crypto without cash, but with real benefits. We deliver all the details in this article.

While the crypto market is going through a downturn phase, Solana (SOL) drops below $130, sowing doubt among investors. However, behind this sharp drop, the on-chain data outline a very different scenario. Whales buying, supply free-falling on exchanges, network activity booming: the fundamentals remain solid. A marked divergence between price and network reality, which could reshuffle the cards faster than imagined.

Bitcoin: Institutional accumulation explodes. Here are the figures confirming massive accumulation.

After three years under the yoke of sellers, Ethereum finally sends an unexpected signal. The "net taker volume" turns green again for the first time since January 2023, revealing a possible trend reversal. This sudden change in trader behavior on futures contracts intrigues analysts. Should we see it as the beginnings of a bullish recovery for the second largest crypto in the market?

Bitcoin loses its feathers while gold parades at the top perch. Temporary panic or true metamorphosis of a crypto market finally learning to breathe under pressure?

Michael Saylor scores another breakthrough. His company Strategy now holds more than 700,000 BTC after a massive purchase of 22,305 bitcoins for 2.13 billion dollars. An unprecedented milestone that confirms the company's committed transformation into a true Bitcoin company. In a tense market, this move strengthens Saylor's influence and repositions Strategy as a central player in the crypto ecosystem.