The U.S. Securities and Exchange Commission (SEC) has once again postponed its decisions regarding two highly anticipated crypto ETFs. The Bitwise Dogecoin and Grayscale Hedera ETFs will have to wait until November 12 to learn their fate.

Getting informed

XRP returns to the forefront, boosted by speculation around an ETF. After a long phase of inertia, Ripple's crypto makes a leap by briefly crossing $3, driven by an approval probability estimated at 95% by Bloomberg. This sudden resurgence of activity places XRP back at the center of discussions, between speculative frenzy and questions about the strength of its fundamentals.

As economic tensions intensify between major powers, a dissenting voice challenges the dominant narrative in Washington. According to Boris Kopeikin, chief economist at the Stolypin Institute, the US trade deficit with China is not the result of a BRICS strategy, but rather a structural weakening of the American economy. This interpretation reignites the debate on the root causes of American imbalances in a world undergoing major reconfiguration.

Bitcoin flirted with $113,000, traders were enthusiastic, the Fed was complacent, and Saylor was euphoric. But without spot buying, beware of a backlash: the intoxication could quickly turn to vertigo.

The hierarchy of European sovereign debts has just shifted. On Tuesday, September 9, France borrows at a higher rate than Italy on ten-year bonds. Less than 24 hours after the fall of the Bayrou government, the markets have decided: the French signature is no longer a refuge. This reversal, unprecedented in over a decade, marks a loss of confidence affecting the State's budgetary credibility.

OpenSea, the leading NFT marketplace, has launched a $1 million reserve to acquire and preserve culturally important digital art. The reserve began with the purchase of CryptoPunk #5273, marking a new chapter for the platform in showcasing NFTs as historical and artistic artifacts.

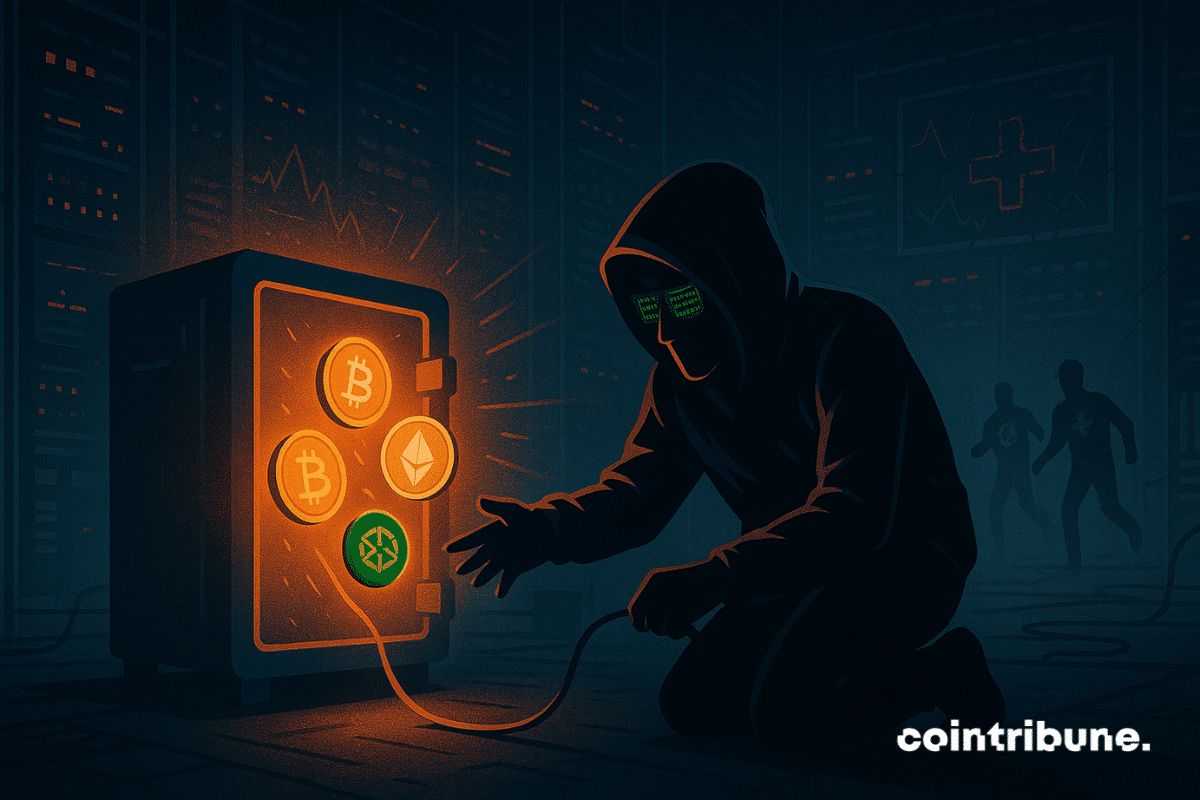

Malicious actors are at it again, this time targeting the account of a well-known software developer's node package manager (NPM). Investigations revealed that the hackers added malware to popular JavaScript libraries, primarily attacking crypto wallets. However, after launching what industry sleuths describe as the largest supply chain attack in crypto history, the hackers managed to steal only $50 worth of crypto assets.

A hijacked NPM account was at the center of a major supply-chain breach, putting the JavaScript ecosystem and crypto users at risk.

NFT sales dropped below $100 million in the first week of September, ending a two-month streak of strong summer performance.

The crypto ecosystem has just suffered one of the most sophisticated attacks in its history. A "crypto-clipper" injected via compromised NPM modules quietly diverts wallet addresses during transactions. How did this breach escape security radars?

While most nations are still hesitant to take the step, Kazakhstan is accelerating. Its president, Kassym-Jomart Tokayev, has just announced the creation of a national cryptocurrency reserve, accompanied by a clear call to build a true ecosystem of digital assets. A bold decision for this Central Asian country, already a major player in global mining.

Pump.fun rejoices, Solana celebrates: PumpSwap dethrones its rivals. Crypto record at $878M, but already, criticisms and rug pulls darken the memecoins sky.

With more than 9.2 billion dollars in assets and cash, BitMine Immersion establishes itself as the new key player in crypto treasuries. Under the leadership of Tom Lee, the company listed on NYSE American accelerates its Ethereum-focused strategy, becoming the largest holder of ETH among listed companies. In a context of growing crypto balance sheets, BitMine redraws the contours of financial management by betting on Ether as a strategic reserve asset.

The crypto platform Finst officially enters the French market on September 9, 2025, promising to shake up cryptocurrency investing with ultra-competitive rates and a transparent approach. Founded by former DEGIRO executives and regulated by the Dutch Financial Markets Authority (AFM), this Dutch platform aims to democratize access to crypto-assets in France.

Bitcoin clings to its $110,000 like an old sailor to his raft. While giants buy, whales sell, and traders sweat.

SwissBorg has just suffered one of the most striking hacks of the year. In a few hours, 193,000 SOL, or 41 million dollars, were siphoned off via a flaw in the Kiln validator API, a provider responsible for staking on Solana. It was not SwissBorg's infrastructure that failed, but that of a third-party partner. The incident reignites the debate on the security of external integrations in a sector where the slightest failure can be enough to bring down the entire chain.

While bitcoin wavers, Michael Saylor forces a smile: he spends 217 million, stacks 638,460 BTC, and transforms Strategy into a financial factory dedicated to cryptos.

Germany allegedly let 5 billion in bitcoin slip away in the Movie2K case. Discover all the details in this article.

El Salvador marked the fourth anniversary of its Bitcoin Law with a symbolic purchase of 21 BTC, just as analysts warned that September 8 often proves unfavorable for the cryptocurrency.

XRP has just signed its strongest accumulation phase in two years, against the backdrop of an uncertain market. While altcoins struggle to find a second wind, Ripple's crypto stands out through unusual accumulation activity. This surge, supported by significant volumes, reactivates speculation about a possible lasting rebound.

The Trump family is back in the spotlight after their wealth coffers grew following American Bitcoin's (ABTC) debut and World Liberty Financial's (WLFI) price surge. However, both DeFi projects linked to the family have since faced a market correction of over double digits.

Ethereum’s revenue fell sharply in August, even as its price and institutional interest continued to rise.

Bitcoin attracts bettors, Ethereum seduces bankers, Dogecoin dreams of an ETF and Tether dresses in gold: the crypto circus continues its show, between promises, glitters and persistent doubts.

Cloned Drake, TaTa invented by Timbaland, Grimes shares her voice... When AI thinks of itself as the new pop star, artists shout genius or scandal.

As artificial intelligence radically transforms the job market and particularly threatens several positions, OpenAI launches an ambitious counter-offensive. The parent company of ChatGPT is developing a job platform specialized in AI, positioned as a direct competitor to LinkedIn.

Bitcoin, does it take away or does it enrich? For Michael Saylor, it inflates the wallet: $7.37 billion gained despite a market drop. Proof that faith pays off.

Since 2011, Satoshi Nakamoto has disappeared, leaving behind an unresolved enigma. However, some believe that the threat of quantum computing could force his return. This is the somewhat crazy but fascinating thesis of Joseph Chalom, co-CEO of SharpLink Gaming

The calm was short-lived. Indeed, the crypto market is plunging back into fear, according to the Crypto Fear & Greed Index, which dropped to 44 after several weeks of stability. This psychological signal is not isolated, as it accompanies a clear shift in investment flows, leaving the most volatile altcoins to refocus on the heavyweights of the sector, bitcoin and Ethereum.

The disappearance of a few thousand bitcoins from a balance sheet is enough to fuel controversies. This weekend, the issuer of USDT found itself at the center of a media whirlwind: did it secretly sell its BTC? Some saw a strategic shift there. However, behind the seemingly worrying figures, another reality emerges, much more nuanced, and above all, revealing the discreet movements of a giant in crypto finance.

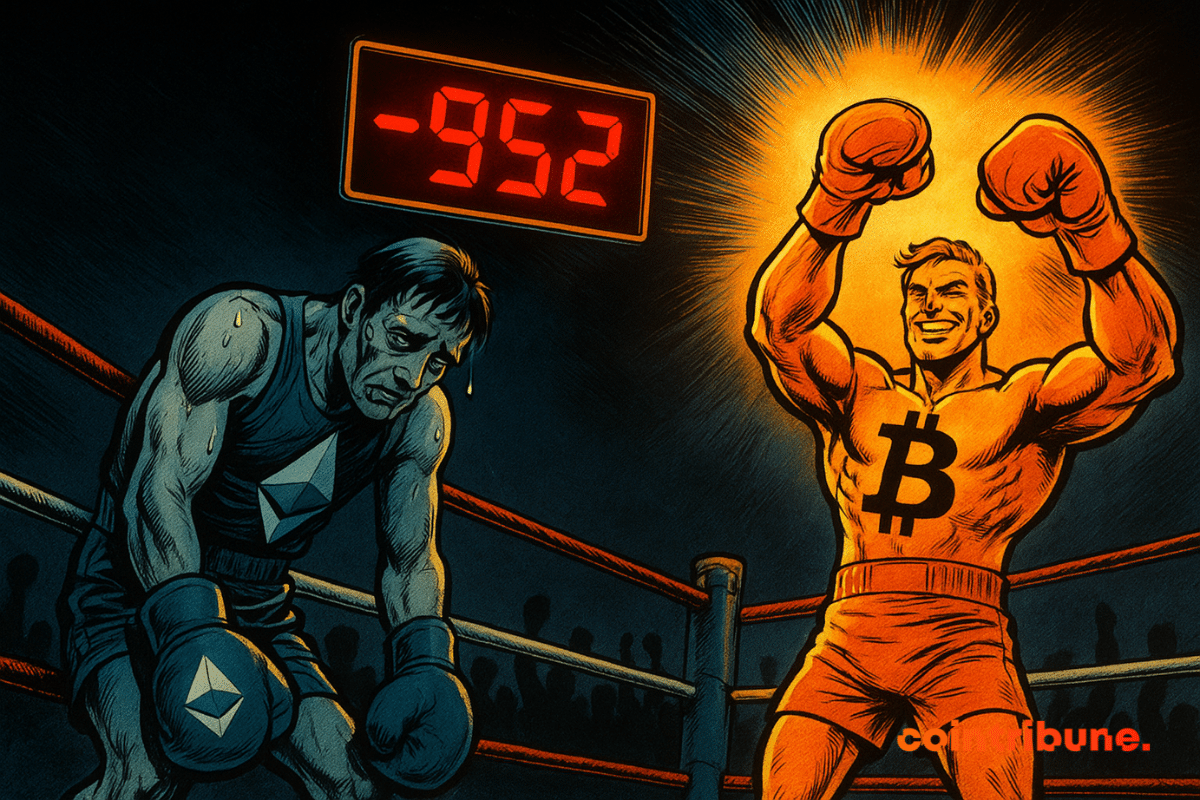

Spot Ether exchange-traded funds (ETFs) recorded $952 million in outflows over five trading days, raising concerns across digital asset markets. Investors reduced exposure to Ether products managed by major firms such as BlackRock and Fidelity, while capital shifted toward bitcoin ETFs. The withdrawals came during a period of rising recession fears and increased expectations of monetary policy easing in the United States.