The May US inflation shows a deceptive calm: +0.1% for the month, a figure below expectations that immediately boosted risky assets. However, behind this lull lies more enduring tensions, fueled by the renewed offensive of tariff hikes decided by the Trump administration. This seemingly reassuring figure conceals a more unstable reality, where weak signals of a coming inflation resurgence trigger doubts about the robustness of the current economic cycle.

Inflation

For two years, Russia has been showing an economic growth of over 4%, a figure that could pale in comparison to many European economies. Yet, behind these seemingly solid indicators, the reality on the ground is quite different: high inflation, degraded consumption, persistent shortages. The country, largely transformed into a "war economy", seems to be reaching the limits of a model based on military spending and energy rents.

Blanched in a crypto scandal but rinsed by the judges, Milei offers the pope as a wildcard. A papal blessing to bury the tokens and drown the fish?

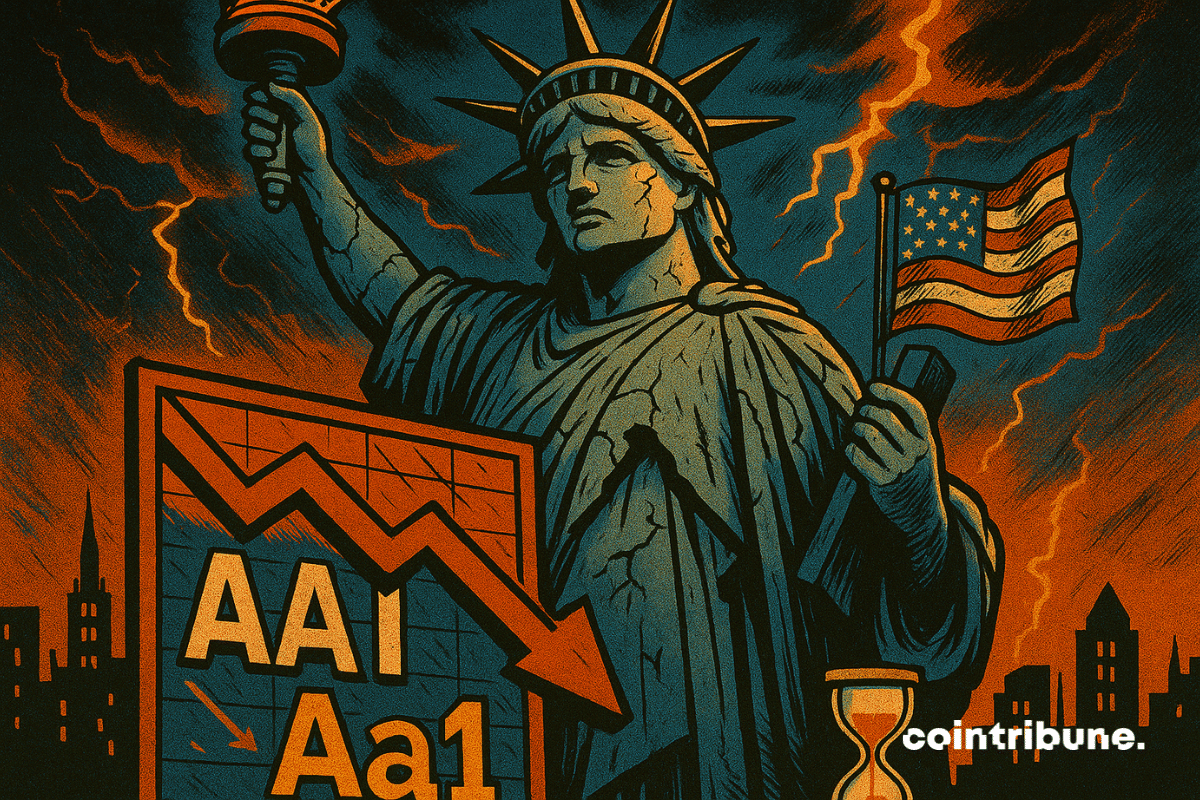

Trump promised miracles, Moody's delivers slaps: the American economy is sinking, the debt is exploding, and the rating falls. Budget magic or just an electoral sleight of hand?

Trump eases up (a bit) on customs tariffs: the economy breathes, analysts cough, and Beijing chuckles. 90 days of truce, or 90 days until the storm?

American inflation defied all doomsday predictions in April, falling to 2.3% despite the implementation of massive tariffs by the Trump administration. This unexpected decline raises a troubling question: what if analysts had exaggerated the impact of protectionist measures? Are fears of an inflationary spiral overstated?

While Wall Street soars amid easing tensions between Washington and Beijing, Bitcoin has dropped below $102,400 on May 12. An unexpected decline that contrasts with the prevailing optimism and institutional momentum of recent weeks. Why hasn't BTC benefited from the market euphoria? With just hours before the release of the U.S. CPI, investors are questioning whether this is simply profit-taking or an early sign of deeper macroeconomic stress.

Chinese economy: prices are sinking, the people are saving, Beijing is patching things up, dishes are changing. The dragon is coughing, but still plays the mystery card to avoid being roasted.

The American economy is declining for the first time since 2022. Heading towards a recession? Discover some key figures in this article!

The American economy, that giant which once seemed untamable, today wobbles on a tightrope, caught between heightened trade tensions and a loss of domestic confidence. While some spoke of a mere gust of wind, the storm could very well be of unexpected violence.

The United States will have to abandon the exorbitant privilege of the dollar if the goal is truly to become an industrial power again. A good omen for bitcoin.

While economists count illusions, Bitcoiners sense the truth. False data, weakening dollar: a new monetary dogma is being born before our eyes, far from official reports.

Binance is giving away bitcoins, traders are balancing between euphoria and price headaches, and the CPI hovers like a sentence. The question remains who will suffer: the bulls or the bears.

Four consecutive red months for ETH. A slow, silent hemorrhage, where each absent transaction digs a little deeper into the grave of an asset in search of a second wind.

All eyes are on the PCE index, a barometer of inflation in the United States. Due on March 28, this figure could trigger a upheaval in risky asset markets. Bitcoin, in the crosshairs, could be the first beneficiary or the first victim. In a climate of geopolitical tensions and monetary uncertainties, this publication represents a decisive test to gauge speculative appetite and the strength of the bullish momentum in cryptocurrencies.

Powell, the guardian of the threshold, shapes the moment. Frozen rates, blurred hopes. The economy wavers, suspended between the fire of inflation and the ice of slowdown. The markets shiver.

As the U.S. Consumer Price Index (CPI) shows a slight decline in inflation, Bitcoin holds its breath. At 3.1%, the number is below expectations, but the king of crypto paradoxically plunges from $84,000 to $83,000 in just a few hours. A paradox? Not really. Between hopes for interest rate cuts and political maneuvering, the landscape is becoming more complex. An analysis of a scenario where Bitcoin, lying in wait, could surprise the markets.

The EU defends its economy against new American sanctions. We provide all the details in this article.

The American economy is going through a turbulent phase. Between rising inflation and a marked slowdown in growth, a long-forgotten specter resurfaces: stagflation. This phenomenon, which combines economic stagnation and rising prices, evokes the crises of the 1970s. Today, Donald Trump's new tariff policies rekindle fears of a return to that time when growth was stalled and purchasing power was eroding rapidly. The American president's decision to impose heavy taxes on Chinese, Mexican, and Canadian imports raises many questions about their real effects on the economy. As the Federal Reserve is pushed to its limits, markets are wavering, and businesses are concerned about the repercussions on their profitability.

The United States has taken the bull by the horns both economically and geopolitically. Many things are going to change and, in the end, bitcoin will find its way.

The figure has startled the markets: inflation in the eurozone was set at 2.4% in February, according to Eurostat. A slight decrease, indeed, but enough to reignite the debate on the European Central Bank's (ECB) next moves. Between cautious optimism and geopolitical clouds, the euro wavers on a tightrope. Behind these percentages lie contrasting realities: declining energy, resilient services, and a Germany that holds firm. An analysis of a somewhat muted economic landscape.

Stock Market: spectacular rebound of the markets. Europe is coming out on top while Wall Street plunges! The details in this article.

France votes on a budget, the French express distrust: 80% predict collapse, 61% no longer even hope for themselves.

While the Fed hesitates between caution and action, inflation runs rampant, and crypto wavers, poised for a week of financial roller coasters.

February 12 and 13, 2025, will be marked as two particularly difficult days for Bitcoin, which had to face a double piece of bad news on the American inflation front. The queen of cryptos, which had already fallen below $95,000 on Wednesday, continues to struggle to maintain this critical level.

Like a cowboy drawing his six-shooter, Trump unleashes reciprocal tariffs, awakening old economic ghosts and sowing panic for Bitcoin in the stock markets.

The upcoming release of inflation data in the United States could be a key factor for the price of bitcoin. According to a recent report by 10x Research, a decrease in the Consumer Price Index (CPI) could trigger a new bullish rally, bringing BTC closer to its historical highs.

Donald Trump unveils his radical strategy to counter the monetary ambitions of the BRICS. In response to their proposal for a common currency, he threatens to impose 100% tariffs against any country that adopts it. This tough approach masks secret negotiations that could reshape the global monetary order.

Under the reassuring glow of the CPI, Binance ignites: Bitcoin captures 500 million in two hours, crowning the crypto with a new hope.

The crypto market is experiencing unprecedented excitement. Indeed, Bitcoin, the undisputed leader of the sector, is nearing the symbolic threshold of 100,000 dollars, a level that signifies much more than just a simple increase in value. This ascent reflects the evolution of the global economy, where cryptocurrencies hold an important place in the portfolios of investors seeking alternative assets. Boosted by favorable U.S. economic data, notably an apparent control of inflation, this progression provides insights into the opportunities and challenges of a constantly shifting market, amid optimism and uncertainties related to fluctuations in traditional markets.