JPMorgan plays the bankers of the future: its JPM Coin infiltrates Canton, the blockchain of the big players. It smells like crypto fragrance on Wall Street, with more control than utopia.

Institutional Investor

Is Bitcoin bored? Not really. Between wild OGs, voracious ETFs, and complicit regulations, the beast calms down... but could bite again where it's least expected.

BitMine bets 97M$ on Ethereum in the middle of a bearish market. A risky bet or a calculated plan? Detailed analysis in this article.

JPMorgan Chase, one of the world's largest banks, takes a bold step towards crypto by exploring the introduction of trading services for its institutional clients. This development comes amid regulatory changes in the United States, even prompting the most conservative financial institutions to reassess their approach to these assets. Such a decision could well redefine the relationship between traditional finance and this ecosystem.

For the first time in six weeks, institutional bitcoin purchases surpassed the supply coming from mining. This subtle reversal, revealed by CryptoQuant data, occurs in a market undergoing consolidation, marked by a retreat of retail investors.

Despite strong institutional demand and nearly a billion dollars injected into XRP ETFs, the token fell below the symbolic $2 threshold. While incoming flows multiply, the spot market remains under pressure. This divergence between fundamentals and price is striking. Why is XRP falling while major investors are buying? Between a bullish signal and technical fragility, the market seems divided. Such a situation complicates reading the upcoming trends.

While Solana is losing ground in the crypto market, its ETFs show an unprecedented series of seven days of net inflows. In a downtrend, this institutional flow is intriguing: why inject so much capital into a declining asset? This contrast, between disinterest in the spot and enthusiasm for regulated products, raises questions about the real perception of the Solana project and its medium-term prospects.

Bitcoin pauses in the balance sheets, but some actors buy more than ever. Here are the numbers worrying analysts.

When Ethereum no longer inspires companies, BitMine feasts, the small ones die... and the crypto market wonders: is it a pause or the end of recess?

Despite a cautious atmosphere in the crypto market, one asset captures the attention of institutional investors: XRP. Long weighed down by its regulatory troubles, the altcoin has triggered a spectacular resurgence of interest since the launch of several spot ETFs in the United States. Capital inflows continue at an unprecedented pace, revealing a possible turning point in the token's trajectory. Should this be seen as the signal of a new bullish cycle, driven both by traditional finance and encouraging technical signals?

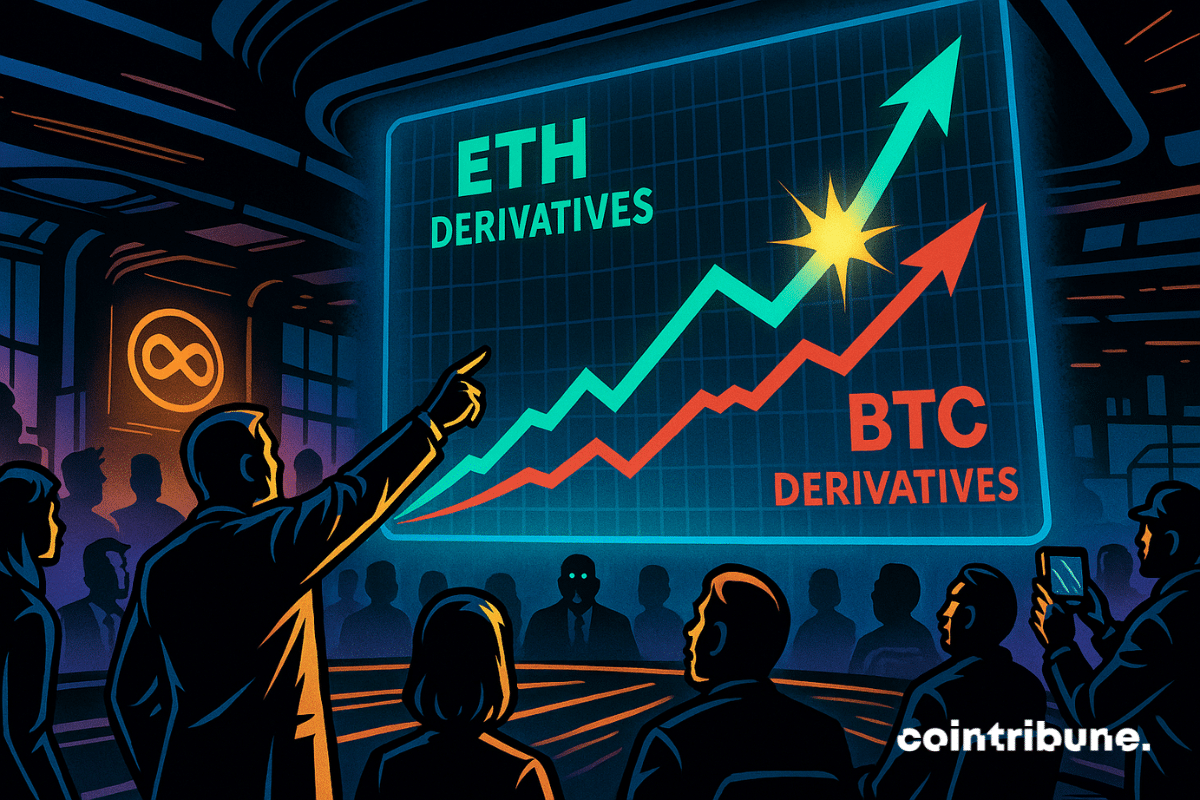

In the derivatives market, a milestone has just been reached. For the first time, Ether (ETH) futures contracts have generated more volume than those on bitcoin (BTC) on the Chicago Mercantile Exchange. This reversal occurs in a climate of high volatility, reflecting a marked repositioning of institutional players. Such an overtaking could then signal a deeper change in the balance between the two main assets.

Little known outside Japan, Metaplanet now intends to play in the big leagues. With an aggressive bitcoin accumulation strategy, this Tokyo-listed company is about to raise 135 million dollars to further strengthen its treasury in BTC. A bold initiative that confirms the growing place of bitcoin in the financial strategies of listed companies, and further fuels the parallel with Strategy.

Bitcoin explodes in ETFs with $524M in 24h: simple rebound or massive return of institutions? Complete analysis here!

When bitcoin falters, Saylor blazes: 397 BTC more, 641,205 in stock... The man who confuses corporate strategy with a collection of digital coins still does not intend to ease off.

Bitcoin wavers, and the market divides. While crypto suffers a drop of nearly 15% in a few weeks, a clear rift appears between small holders and institutional investors. While the former take advantage of the decline to strengthen their positions, the whales quietly liquidate thousands of BTC. This strategic gap, observed by the Santiment platform, could mark a decisive turning point in the market's evolution.

The drop of bitcoin below 100,000 dollars has revived tensions in the market, shaking a symbolic threshold for investors. Behind this technical retreat are more complex signals. While some fear a lasting bearish trend, several influential voices in the sector see it as a transitional phase, carrying potential for a rebound. Between behavioral analysis and macroeconomic dynamics, this correction could mark much more than a simple temporary adjustment.

In a rebuilding sector, Ripple takes a strategic step by launching its primary spot brokerage service aimed at American institutions. This turning point, made official at the Swell 2025 conference in New York, relies on the acquisition of Hidden Road, finalized in October. By betting on an integrated infrastructure, Ripple intends to capture a growing demand for professional asset trading services, at a time when market standards are being redefined.

Michael Saylor replenishes his Bitcoin treasury, but at a less frantic pace: simple strategy or market warning? Analysis.

Michael Saylor sees bitcoin soaring to the skies, Wall Street is converting... What if the crypto guru was still right despite geopolitical turbulence?

SharpLink Gaming acquired 19,271 ETH for an estimated amount of over 75 million dollars. This operation brings its total reserves to 859,853 ETH, or 3.5 billion dollars as of October 19. The company, listed on the stock exchange and active in the gaming sector, thus becomes one of the largest global holders of Ethereum. In an still uncertain market, this move raises questions about the company's long-term strategy.

While traditional markets wobble under macroeconomic uncertainties, the crypto sphere is not spared, especially on the institutional investment vehicle side. This week, US spot Bitcoin ETFs experienced a massive capital outflow, exceeding one billion dollars in net withdrawals, a strong signal that does not go unnoticed by observers.

Bitcoin ETFs record $536M in withdrawals in 24 hours. Are investors changing course? Complete analysis here!

This week, the bitcoin fear and greed index dropped to its lowest level in a year, plunging investors into uncertainty. This sudden decline fuels speculation: should one give in to panic or take advantage of this correction to accumulate at low prices? For Bitwise analysts, this fear phase could actually signal the start of a new accumulation cycle, thus offering a strategic investment opportunity in a volatile market.

In the middle of a market crash weekend, BitMine invested 827 million dollars to acquire more than 200,000 ETH. The company now holds 2.5% of the total Ethereum supply, confirming its position as the leading institutional player on the asset. In a context of massive liquidations, this targeted move reflects a conscious long-term accumulation strategy.

Ethereum is no longer just the infrastructure for smart contracts. It becomes a strategic lever in corporate balance sheets. This week, as ETH surpassed 4,700 dollars, SharpLink Gaming approaches one billion dollars in latent gains. Thanks to a methodical accumulation started in June, the company transforms its treasury into a value creation tool, drawing market attention.

While bitcoin exceeded $126,000 for the first time, Michael Saylor chose to stay away. The leader of Strategy, accustomed to increasing his positions at every peak, made no purchases this quarter. This unusual decision contrasts with his aggressive accumulation strategy and raises questions among observers.

Investor sentiment around Bitcoin is heating up once again, driven by renewed market optimism and bullish projections from key industry figures. A recent social media poll conducted by MicroStrategy CEO Michael Saylor has become a focal point for discussions about Bitcoin’s year-end potential. Amid growing institutional interest and other positive metrics, many market participants are betting on a strong year-end finish for the firstborn coin.

While Ethereum staggers, Wall Street joins the crypto party: ETFs galore, billions lurking, and a network that makes less noise, but more waves.

Most Bitcoin is controlled by a small number of wallets, with experts revealing that just 20,000 addresses hold over 60% of the supply.

While bitcoin establishes itself as a reference asset on a global scale, it is the very architecture of its market that is evolving deeply. Beyond prices and regulatory controversies, a mutation is underway. Indeed, the rise of derivatives, particularly options, is redefining market balances. This often overlooked shift could well mark bitcoin's entry into a new era of maturity and financial integration.