UBS Group AG is preparing a move that could bring crypto investing into its private banking business. Plans are taking shape to give selected high-net-worth clients access to digital assets, marking a shift in how the Swiss bank approaches the sector. The effort reflects growing client demand, ongoing regulatory review, and UBS’s wider push into blockchain-based finance.

Invest

After a sharp drop, Bitcoin stabilizes and shows signs of recovery. Technical analysis and key scenarios for BTC.

The Kraken exchange platform officially launches xStocks for European investors, allowing the purchase of tokenized versions of American stocks and ETFs such as Apple, Tesla, or NVIDIA. A revolution in access to US markets, but with nuances to understand.

The crypto market was hit by a wave of heavy corrections as a rough weekly outing triggered cautious sentiment among investors. During the downturn, heavy liquidations were recorded as some whales took profits while others moved to limit losses. On-chain data shows increased activity from large Bitcoin and Ethereum holders. In fact, U.S. spot Bitcoin and Ether ETFs recorded combined outflows of over $580 million on Monday, extending a broader trend of capital exits. As these heavy outflows persisted, market watchers observed whales rotating capital into a new game-based memecoin project.

Crypto venture funding climbed to 4.65 billion dollars in Q3 2025, driven by major deals and growing support for startups across the sector.

Ark Invest, led by Cathie Wood, has increased its stakes in crypto-linked companies, including Coinbase and Circle, while revising Bitcoin’s 2030 target to $1.2M.

The Real-World Asset (RWA) tokenization market is experiencing exponential growth, rising from $85 million in 2020 to $24 billion in June 2025, a 308-fold increase in three years according to the latest reports from RedStone, Gauntlet, and RWA.xyz. In this context of radical transformation of financial markets, Stobox and REAL Finance have signed a Memorandum of Understanding (MoU) to explore new technical and commercial synergies between regulated tokenization platforms and emerging blockchain networks.

The Bybit EU exchange, the world’s second-largest platform by transaction volume, is launching a highly attractive new promotional campaign for European users. The flagship offer right now: deposit 100€ and receive up to 70 USDC as a bonus. This initiative is part of a broader strategy to conquer the European market, now regulated by the MiCA (Markets in Crypto-Assets) regulation.

The American exchange platform Kraken has just introduced a new feature called "Bundles", allowing users to purchase a diversified basket of cryptocurrencies grouped by theme in a single transaction. Officially launched in September 2025, this service targets both beginner and experienced investors who want to gain exposure to multiple digital assets without having to manually compose a portfolio.

Solana is experiencing a marked correction phase after the break of a key support, in a market context dominated by Bitcoin's decline. Discover the technical outlook for the future evolution of SOL.

After a marked rebound on support, bitcoin broke through its last major resistance, reaching a new ATH at $126,293. Discover the technical outlook for BTC's future evolution.

The startup unveils a layer-1 infrastructure dedicated to RWAs, backed by Wiener Privatbank and designed to solve the security-decentralization-compliance "trilemma".

Ethereum regains some stability after a correction phase. Find our complete analysis and the current technical outlook for ETH.

Cryptocurrency trading requires constant vigilance, responsiveness, and emotional discipline. Bybit EU has just reached a decisive milestone by launching a suite of AI-powered trading bots designed to turn any user into a professional trader, even while sleeping.

Bitcoin consolidates around $112,500 after a bounce on support, but fails to regain clear momentum. Discover the technical outlook for BTC's future evolution.

With renewed confidence in the crypto market following macroeconomic events, the decentralized finance (DeFi) niche is showing strong performance, as evidenced by its recent growth. The latest data now shows that the sector could be poised to touch the previous peak it reached nearly four years ago.

The tickchain Qubic (QUBIC) is making headlines with the launch of an ambitious marketing campaign in partnership with OKX, one of the largest crypto exchanges in the world. This initiative, endowed with an impressive budget, rekindles speculation about a potential listing of QUBIC on top-tier platforms.

With the U.S. Federal Reserve set to deliberate on a possible rate cut, appetite for risk assets is building. In fact, investors have poured over $600 million into crypto-focused exchange-traded funds (ETFs) in the past seven days. Capital rotation in Ethereum ETFs has also resumed, following periods of exits.

Unknown to the general public but omnipresent behind the scenes of power, Palantir works with governments and multinationals by exploiting data. Valued at over 400 billion dollars after a 2000% increase since 2023, it represents either the investment opportunity of a generation or the next speculative bubble ready to burst.

Bitcoin shows signs of bearish pressure after its recent all-time high. Discover the technical outlook for BTC's future development.

Bybit, the world’s second largest crypto exchange by volume, reaches a new milestone in Europe. The platform has just announced the launch of spot margin trading on Bybit.eu, offering European users leverage of up to 10x under a strict regulatory framework.

The U.S. Securities and Exchange Commission’s (SEC) statement regarding liquid staking has, as expected, drawn different views and opinions across all corners of the crypto space. Although some believe that this nonbinding guidance could help drive institutional and retail adoption, others have raised concerns over the risk, potential challenges and key legal hurdles.

Despite the recent Dogecoin price slip, on-chain data have revealed an interesting trend: DOGE whales are actively accumulating the coin. As the asset records southbound movements, these large wallets have seized the opportunity to buy the dip. Could they be positioning for a possible market reversal?

Kraken unfolds its roadmap and makes its own tour of France. Heading to marketplaces, village halls and provincial media libraries. The idea is simple, almost obvious: go where the French live, to talk crypto without filter or jargon, face to face. No cold keynote or impersonal livestream: a physical presence, concrete demonstrations, Q&A at eye level.

Warning signs are everywhere. Between the explosion of inequalities and record debt, the global financial system is dangerously shaky. Faced with 37 trillion dollars of debt in the United States alone, one question arises: are we witnessing the end of capitalism as we know it?

The next bullish cycle ("bull run") is already attracting new investors. Market indicators (Bitcoin at $120,000, Ethereum at $3,800, rising volumes, new ATHs on several altcoins, return of liquidity) show that the impulse phase has started: it is time to position oneself wisely.

When Bitcoin flirts with unprecedented highs, the spotlight once again shines on the crypto universe. This spectacular rebound, fueled by ETFs and growing institutional adoption, coincides with the emergence of another phenomenon: the tokenization of real-world assets (Real World Assets or RWA). These hybrid instruments, halfway between traditional finance and Web3, attract a new wave of investors seeking stability and diversification.

The current global chaos is not a product of chance. According to a theory developed by historians Neil Howe and William Strauss, we are entering a destructive cycle that reshapes societies every 80 to 100 years. This major transformation could disrupt the global economy, financial markets, and redefine the geopolitical order as we know it.

Jerome Powell's term will expire in May 2026, and Donald Trump has already announced that he is considering three to four candidates to replace him. This crucial decision could radically transform American monetary policy and create shockwaves in global financial markets.

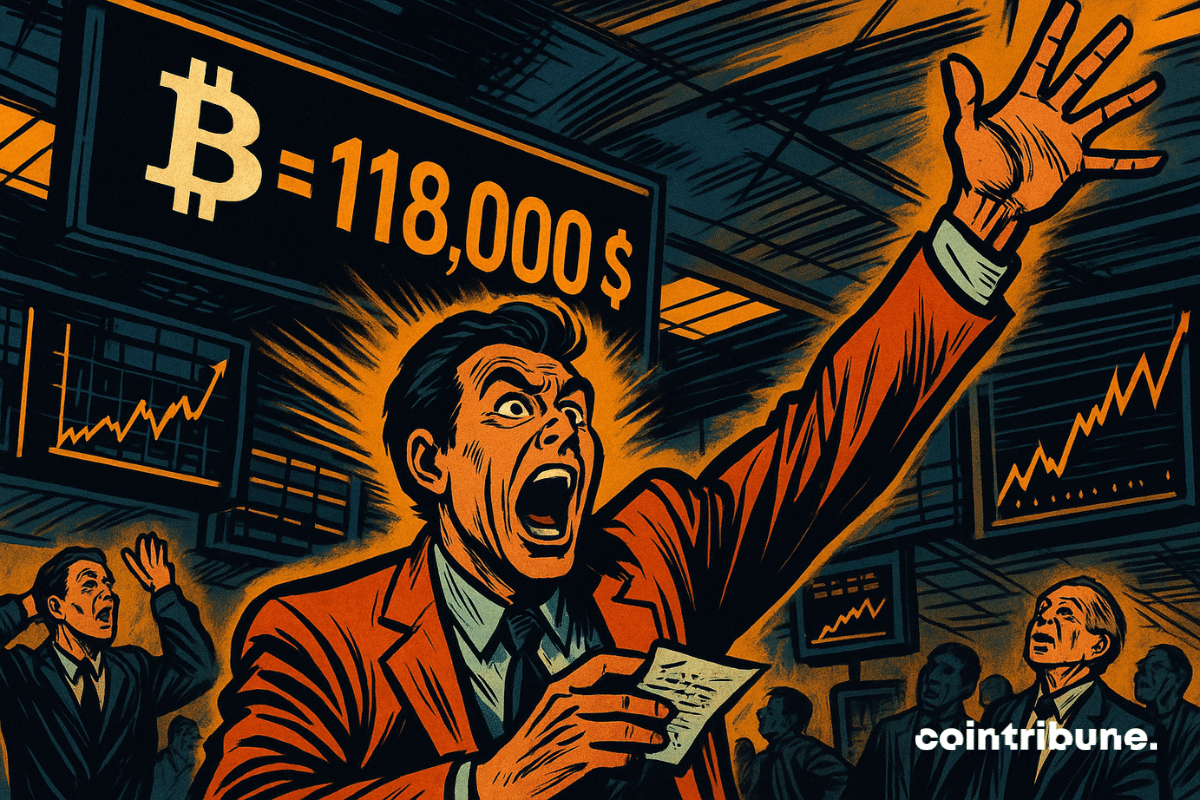

Bitcoin surpassed the 118,000 dollar mark this Friday morning, just two days after setting a historical record above 112,000 dollars.