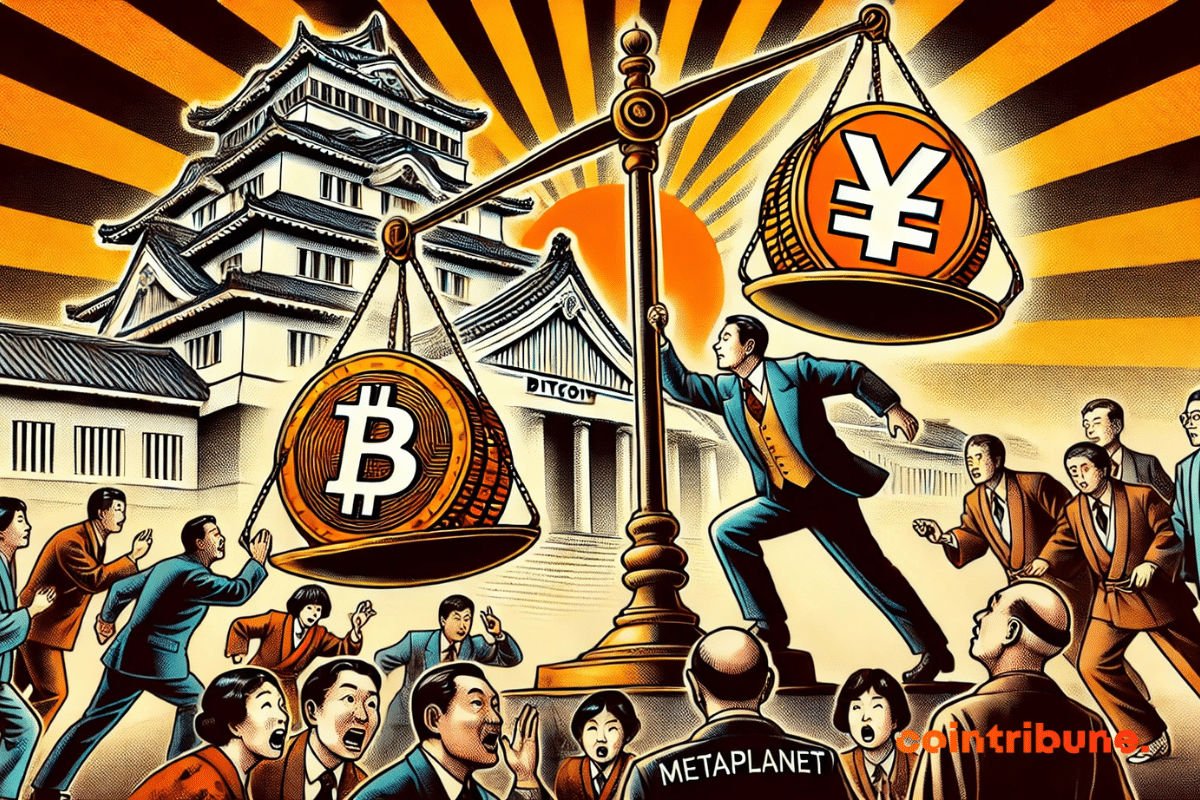

When the yen drowns, Metaplanet rows towards bitcoin: a strategy that makes Tokyo smile... except creditors. While Japan goes into debt, others stack BTC.

Japan

The Bank of Japan is about to break with three decades of accommodative monetary policy. An almost certain rate hike puts markets under pressure. Contrary to usual expectations focused on the Fed or the ECB, it is Tokyo that worries. For bitcoin, the prospect of a stronger yen and the drying up of the carry trade revives fears of a liquidity shock. In an already fragile market, this pivot could redefine short-term balances.

Tokyo throws 17 trillion yen, dreams of AI everywhere… but its hotels close due to a lack of workers. What if Japan also programmed a robot to hire?

Growing interest in digital public infrastructure is prompting the United Nations to take a more active role in blockchain policy and training. A new wave of programs is being developed to help governments understand and apply technology in real-world systems. Momentum inside the UN suggests a coordinated effort to guide countries through the next phase of digital transformation.

Japan has entered a new phase of digital finance with the launch of its first yen-backed stablecoin, JPYC. Developed by Tokyo-based fintech firm JPYC, the token aims to bring the stability of traditional finance into the expanding digital asset market—offering Japanese consumers and businesses a secure bridge between fiat and blockchain-based payments.

Japan’s financial regulators are planning new rules to prevent insider trading in cryptocurrencies and boost market confidence.

Tokenization is gaining momentum in global finance, with many top financial institutions racing to explore the niche. Japan Post Bank is the latest to join after declaring its intentions to introduce a tokenized asset network in fiscal year 2026.

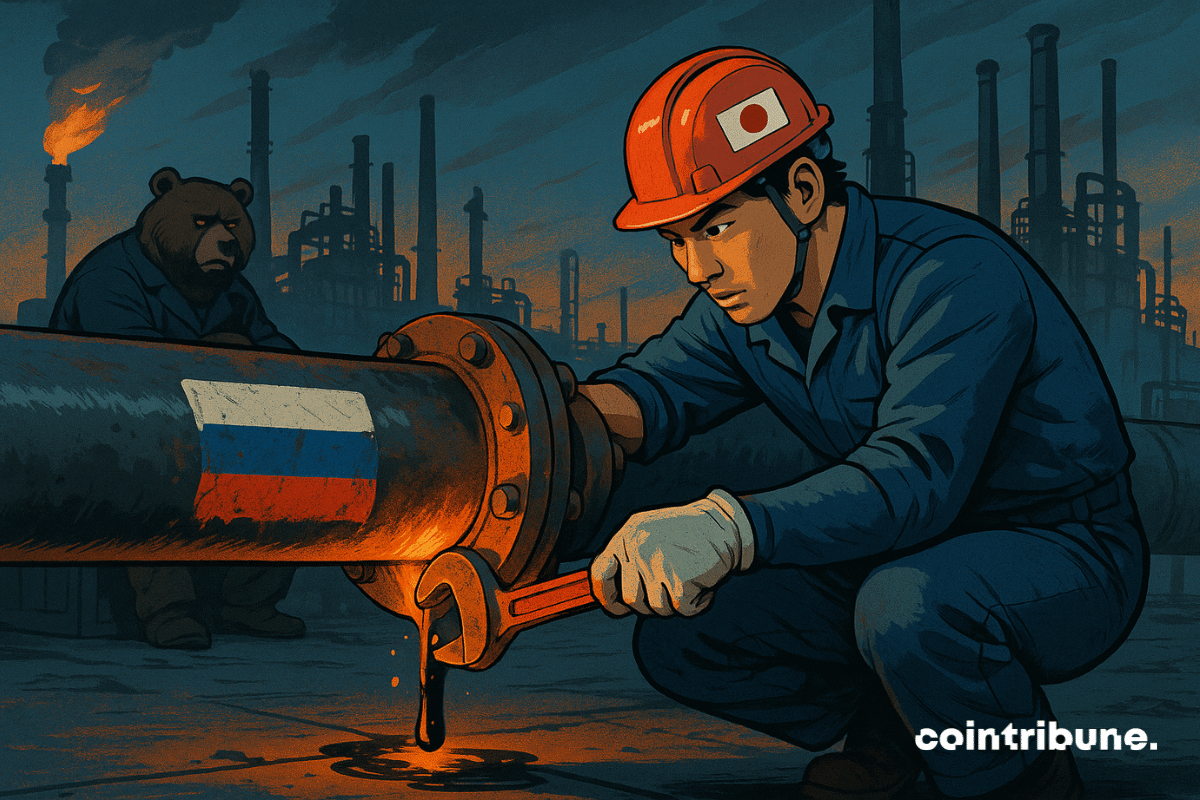

On June 8, 2025, a tanker under American and European sanctions discreetly docked in Japan, delivering Russian crude to a local refinery. This act, far from negligible, reveals a silent fracture in the Western consensus on energy. While the G7 has been trying for two years to isolate Moscow, Tokyo prioritizes its energy security. This episode, both symbolic and strategic, could subtly reshape the lines of a transforming global energy order.

How long will Japan be able to absorb the surge in borrowing rates without resorting to printing money?

Beijing is picking Uncle Sam's pockets, offloading its Treasury bonds, and whispering to the global economy: "I love you... me neither."

When Japan, China, and South Korea sit down at the same table, it's not to discuss the weather. In a world where trade tensions reshape alliances, their recent meeting could very well change the game in Asia... and beyond. Between promises, caution, and joint projects, a new geopolitical chapter seems to be unfolding in three voices.

Metaplanet, smelling a good deal, is offering 150 BTC at a discounted price. A bargain? A ticking time bomb? The future will decide.

While the Fed hesitates between caution and action, inflation runs rampant, and crypto wavers, poised for a week of financial roller coasters.

Cryptos are increasingly disrupting the foundations of the global economy, prompting governments to rethink their financial strategies. Among these initiatives, an ambitious proposal is emerging from Japan. Lawmaker Satoshi Yamada has urged his government to explore an innovative idea: to include bitcoin in national foreign exchange reserves. This project, which fits within a growing international trend, is sparking a passionate debate about the use of cryptos as a strategic lever.

After a historic drop on Monday, the Tokyo Stock Exchange experienced a remarkable rebound at the opening on Tuesday. The Nikkei index, which had plunged by 12.4% the day before, climbed by 10.02% shortly after the opening.

Crypto: Join the exceptional global celebrations for Ethereum's 10th anniversary

The American and Western hegemony is being challenged by the rise of China. As Beijing continues to strengthen its economic influence across the globe, perceptions vary significantly depending on the income levels of nations. This analysis explores how China is reshaping the global economic landscape and the contrasting reactions from different regions of the world to this evolution.

The crypto platform S.BLOX from Sony, resulting from the acquisition of Amber Group, promises to redefine digital exchanges.

The 3rd largest economy in terms of GDP is on the brink of collapse with a colossal debt and a free-falling currency. If the trend continues, the problems will be terrible for the entire world...

Shiba Inu regains its vitality with a 9.4% increase, erasing the losses of the week thanks to several factors.

The yen collapses against bitcoin, which has appreciated by over 150% over the past year.

The SEC's approval of Bitcoin ETFs could shake things up in Asia. Rumor has it that Hong Kong will give the green light before June.

The SEC's approval of Bitcoin ETFs could unlock things in Asia. It is rumored that Hong Kong will give the green light before June.

The Tokyo stock market is celebrating as the Nikkei surpasses 40,000 points, fueled by strong technological advancements.

In recession and surpassed by Germany, the decline in Japan's finance seems inevitable. What are the causes?

Bitcoin has just reached a historical record against the yen, Japan's currency. This is also the case in nearly twenty other countries.

According to recent figures, five countries excel due to the financial problems they encounter. These countries attract the attention of analysts for their debts reaching record levels. The case of the United States is well known. France is also part of this select group of developed countries heavily in debt.

The Nikkei index recently surpassed 36,000 points in the stock market, returning to its highest level since 1989.

Stablecoins, much like crypto assets, do not enjoy unanimous support from governments. Even though stablecoins appear to offer more security, Japan is grappling with a crucial question: are they as reliable as they seem? And in case they are not, how can greater security be ensured in the sector?

In 2017, an offshore exchange burst onto the crypto scene. Quickly rising to become a major player within the crypto industry, Binance is now showing signs of weaknesses though. Some dubious elements related to the centralization of BNB and the recent legal actions brought by the CFTC could well lead to the collapse of the colossus with feet of clay. So should we take the plunge to avoid a FTX-like scenario?