Binance: Should we run away from it?

In 2017, an offshore exchange burst onto the crypto scene. Quickly rising to become a major player within the crypto industry, Binance is now showing signs of weaknesses though. Some dubious elements related to the centralization of BNB and the recent legal actions brought by the CFTC could well lead to the collapse of the colossus with feet of clay. So should we take the plunge to avoid a FTX-like scenario?

Binance: a very successful ICO

The origin of Binance’s prosperity comes from 2017, in the midst of the Initial Coin Offering (ICO) boom. ICOs were celebrated as a new method of fundraising that allowed projects to raise capital by issuing and selling their own tokens to investors.

In hindsight, ICOs are now synonymous with fraud, as the majority of them turned out to be nothing more than blatant scams.

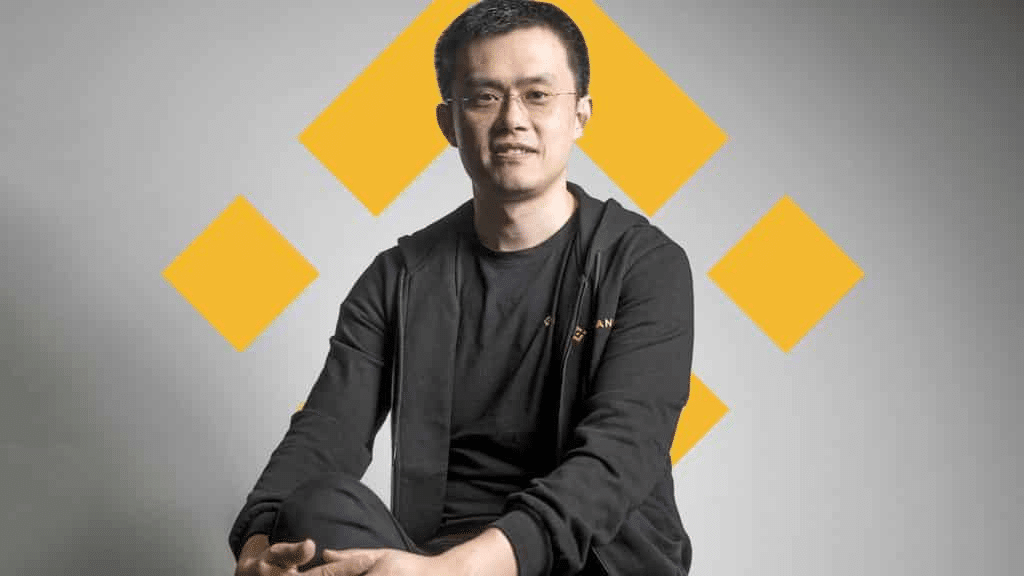

Legend has it that CZ first heard about ICOs in the summer of 2017. Seeing an easy opportunity to raise money for his exchange, he rushed to launch his own token, which he named BNB. In just three days, the BNB white paper was written. Nine days later, the BNB ICO began. Within a week, CZ easily raised $15 millions.

Binance issued a total of 200 millions BNB tokens. As with most ICOs at the time, the founding team received 40% of the tokens for future development and marketing efforts.

BNB: a “security”?

In the white paper, it is stated that the purpose of the fundraising is to fund the company’s investments to become a world-class crypto exchange. Investors in BNB tokens bought them with the anticipation that they would increase in value as Binance grows, and because of the tokenomics around the token itself.

- BNB token holders received a discount on the platform’s fees

- Each quarter, Binance would use 20% of its profits to buy back BNBs and burn them, reducing the supply of tokens.

- The BNBs would be used to pay the fees for Binance’s future decentralized platform, the Binance Chain, once it was built.

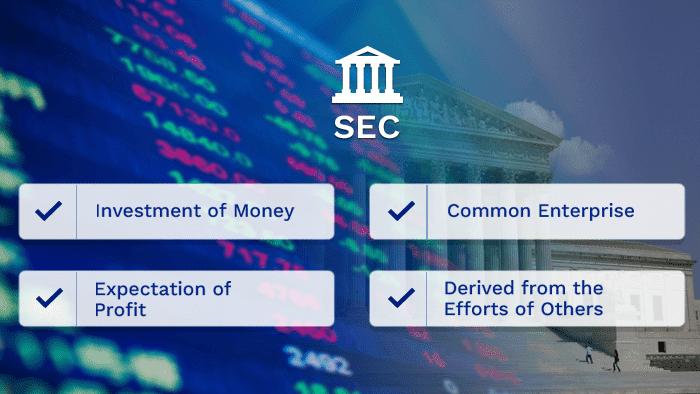

When BNBs were issued by Binance, regulators began to question them, as to many market participants they looked very much like a security as defined by the Howey test.

The Howey test is used to determine whether a financial product qualifies as an investment contract and therefore as a security under federal securities laws.

The BNB and the Howey test

These regulations impose registration and disclosure requirements with the SEC. Despite BNB’s striking resemblance to a security, Binance refrained from taking either of these necessary steps. Instead, it proceeded to issue the token and jumped in without regard to the regulator.

When CZ was asked on a podcast in 2018 if BNB was a security, this is what he said.

“No. In fact, it is not a corporate token. Right now the token lives on the Ethereum blockchain, but very soon we will have our own blockchain which is also a decentralized platform. We are the issuers. People bought it and the token spread. We hold a lot of them, but we won’t be able to issue it anymore. So we don’t have much control over the token anymore. What we could control, since we are the very large holders of the token, is that we have a financial incentive to increase the value of the coin. We have a strong incentive to do so. We don’t promise a return. But we are working hard to increase the value of BNB.” CZ

CZ’s lies about the BNB

This statement from CZ is almost a lie. In it, the founder of Binance explains that even though Binance issued the tokens, it is not a corporate token because it “lives on the blockchain which is also decentralized.” He goes on to say that given the distribution of the tokens, Binance has no control.

Therefore, it is likely that Binance was funded by issuing an unregistered security (BNB), but let’s consider the possibility that CZ is right. Let’s assume that the existence of BNB on a decentralized blockchain and its distribution among holders makes it uncontrollable. But is this really true?

Binance’s highly centralized blockchain

Initially, Binance issued BNB as an ERC-20 token on the Ethereum blockchain. However, in 2019, Binance launched its own rival blockchain, dubbed Binance Chain. According to Binance, the main motivation for launching its own blockchain was to create a blockchain specifically designed for speed and scalability. Ethereum is infamous for being slow and congested during high-volume periods. Binance wanted to remedy this. The problem is that there are inherent trade-offs in designing a blockchain. This is commonly referred to as the “blockchain trilemma”.

Binance has the control

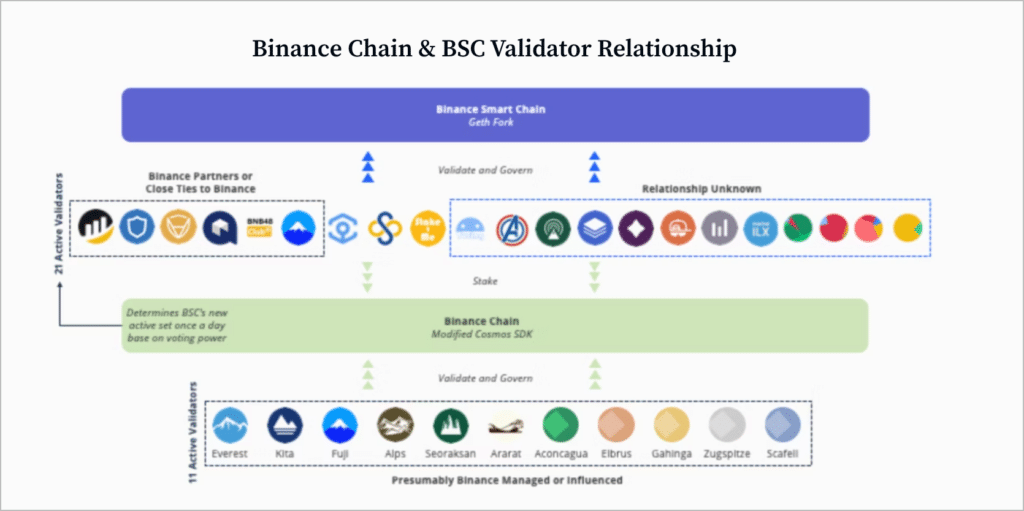

In the case of Binance Chain, Binance clearly sought to build a scalable blockchain and, in doing so, sacrificed decentralization and security. Binance’s stated goal was to gradually decentralize Binance Chain as new validators joined the network and the ecosystem grew. The initial heavy centralization was to be temporary during the product launch phase.

In September 2020, the BNB, now primarily on the Binance Chain, fueled the launch of the Binance Smart Chain (BSC), and the Binance Chain was renamed the Beacon Chain. The Beacon Chain is used for governance and decision-making platforms, and the BSC is used for smart contract functionality and decentralized application creation. In February 2022, the two chains came together to form the BNB Chain, which consists of the BNB Beacon Chain and the BNB Smart Chain.

The Proof of Staked Authority (PoSA)

First, the BNB Chain uses a consensus mechanism called Proof of Staked Authority (PoSA) for transaction validation and network governance.

In this system, a validator must undergo a strict Binance verification process before being allowed to validate transactions and generate new blocks. Once approved, users can delegate their BNB tokens to these validators, who then share in the block rewards.

In Proof-of-Stake protocols, users can stake their tokens and become validators, thus influencing the governance of the protocol. But with the Binance consensus mechanism, a centralized company, Binance, authorizes validators. So you have to get Binance’s authorization to access all the validators on the chain, which is far from an authorization-free system.

How many validators are there in the BNB Smart Chain today?

There are only 21 active BNB chain validators. Even worse, most of the validators in the BNB Chain ecosystem are either directly managed by Binance or have close relationships or partnerships with the company.

Decentralization, we were told…

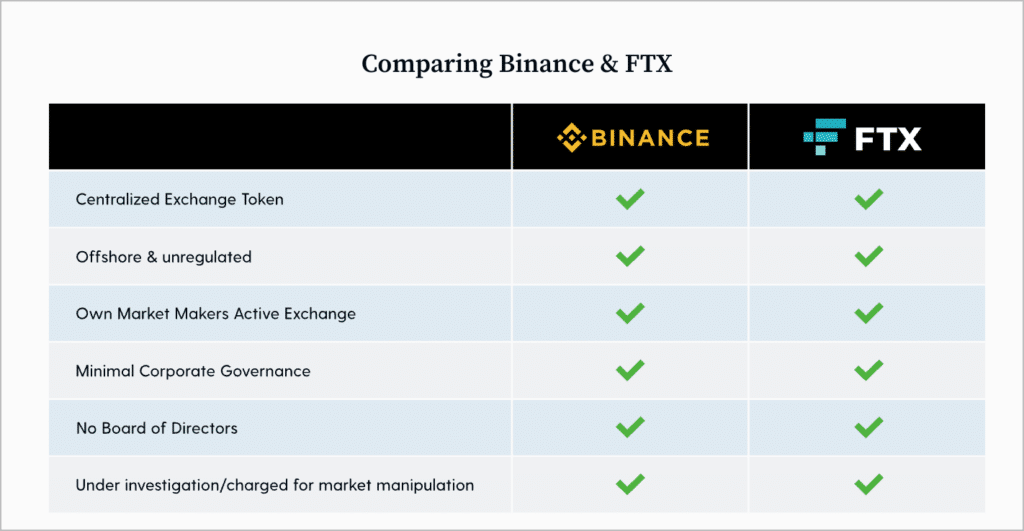

Binance and FTX: the same thing?

At the heart of the FTX fiasco was the issuance of its own token, FTT, which allowed the company to inflate its balance sheet. By controlling the liquidity of the FTT token on the exchange, FTX was able to inflate its price to astronomical levels, which caused the company’s valuation to skyrocket. This attracted additional funding from venture capitalists, allowing FTX to grow and increase its influence. The company even used FTT tokens as collateral for loans to acquire dollars, which were then spent on a variety of investments ranging from crypto startups to beachfront property in the Bahamas.

Binance followed a similar path, offering its own exchange token (BNB), with over 40% of the offering allocated to the founding team. Looking at Binance’s strategy over time, it becomes clear that most of the action is focused on increasing the price of BNB. This makes sense since Binance is the largest holder of the token.

BNB must be pummeled at all costs!

Therefore, Binance is actively bringing value to BNB through use cases, incentives and strategic implementations. Users receive discounts on transaction fees when using BNB, the token is also used as gas on the BNB blockchain, and users can bet on BNB to earn a return on the platform.

The most blatant method that Binance has employed to boost the price of BNB is its burn program. In the ICO white paper, it states, “Each quarter, we will use 20% of our profits to buy back BNB and burn them until we buy back 50% of all BNB.” In a 2018 interview, CZ said, “This burn mechanism is similar to a dividend, but instead of sending money, we destroy the coins we have.”

Binance’s questionable audit

Following the FTX collapse, Binance came under scrutiny and requested an independent audit to ensure that all user funds were safe on the exchange. In a now famous interview on CNBC, the anchor asked CZ if Binance could handle a $2.1 billion withdrawal request.

CZ dodged the question by replying, “We’re financially comfortable. We will let the lawyers handle it. We are financially sound.” What followed was not a full independent audit as requested, but rather a report on the evidence of reserves from Binance’s audit firm, Mazar’s Group, which provided an incomplete view of the company’s balance sheet. Mazar’s Group eventually removed Binance’s proof of reserves from its website and then suspended all business with crypto companies.

Like FTX, this creates a conflict of interest and leads us to wonder if Binance acted to manipulate the price of BNB for the benefit of its own business. The similarities in the price movements of BNB and FTX are certainly cause for concern.

Binance: a prosperity based on shitcoins

When Binance burst onto the scene in 2017, the platform attracted new users at an astonishing rate. One of the strategies Binance used to differentiate itself from its competitors was to offer visibility to a wide variety of cryptos. Binance has listed every conceivable shitcoin.

If a user wants to buy an obscure token, chances are they can find it on Binance. As of the end of 2018, Binance listed 151 coins. To put that in perspective, at the end of 2018, Coinbase had 9 cryptos listed. This led to many accusations that Binance did not have internal policies and procedures in place to verify if a token was a scam.

The point is that Binance has an incentive to list as many tokens as possible to collect fees and generate revenue, regardless of the legitimacy of the tokens.

The imaginary seat

One of the key factors that allowed Binance to become the world’s first crypto exchange was its ability to evade regulators by not establishing a fixed headquarters in a specific jurisdiction. Initially, Binance was based in China, but it moved its servers to Japan shortly before China cracked down on crypto platforms.

Japanese regulators then issued a warning to Binance that it was operating without a license, prompting Binance to move to Malta in 2018. In February 2020, Malta’s financial regulators clarified in a statement that Binance did not have a license to operate in the country. The precise location of Binance’s operations remains unclear today. A holding company is located in the Cayman Islands, and at least 73 entities controlled by CZ exist around the world, but it refuses to disclose which entity is responsible for the main exchange.

This failure to comply with financial laws is at the heart of the CFTC’s recent lawsuit against Binance in the United States. In the complaint, the CFTC explains how Binance deliberately evaded U.S. regulations by concealing the location of its headquarters.

If Binance is found guilty, the court could fine the company billions of dollars. Although Binance has not yet been formally charged with fraud, it is hard to ignore the many red flags and striking similarities to the FTX collapse. If you still have funds in Binance, the warning signs are undeniable. Not your keys, not your coins.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.