The appointment of a new chairman at the head of the Federal Reserve is never trivial. This Friday, Donald Trump announced his intention to entrust the reins of the Fed to Kevin Warsh, a former governor critical of current monetary policy. Such a strategic choice, interpreted as a possible ideological shift, is already shaking up financial and crypto markets. As Jerome Powell’s term comes to an end, the Warsh hypothesis reshapes monetary expectations and power balances.

Jerome Powell

In Washington, Trump is plotting his revenge: a former hawk ready to embrace Bitcoin and bring the Fed back into line, while Powell counts down the hours.

Kevin Hassett has withdrawn from consideration to lead the U.S. Fed, narrowing the field in a leadership contest increasingly shaped by political and legal pressure. President Donald Trump has made clear that he prefers Hassett to remain in his current White House role. And this stance has effectively removed him from contention and reshaped expectations around the Fed’s next chair.

Jerome Powell, chairman of the Federal Reserve, is the subject of a criminal investigation. The information, confirmed on Sunday, comes amid strong political tensions in the United States. It raises questions about the central bank's independence from the executive branch. Beyond Wall Street, this case also resonates in the crypto market. In a climate of institutional distrust, bitcoin regains its place at the heart of the debate as a non-sovereign asset.

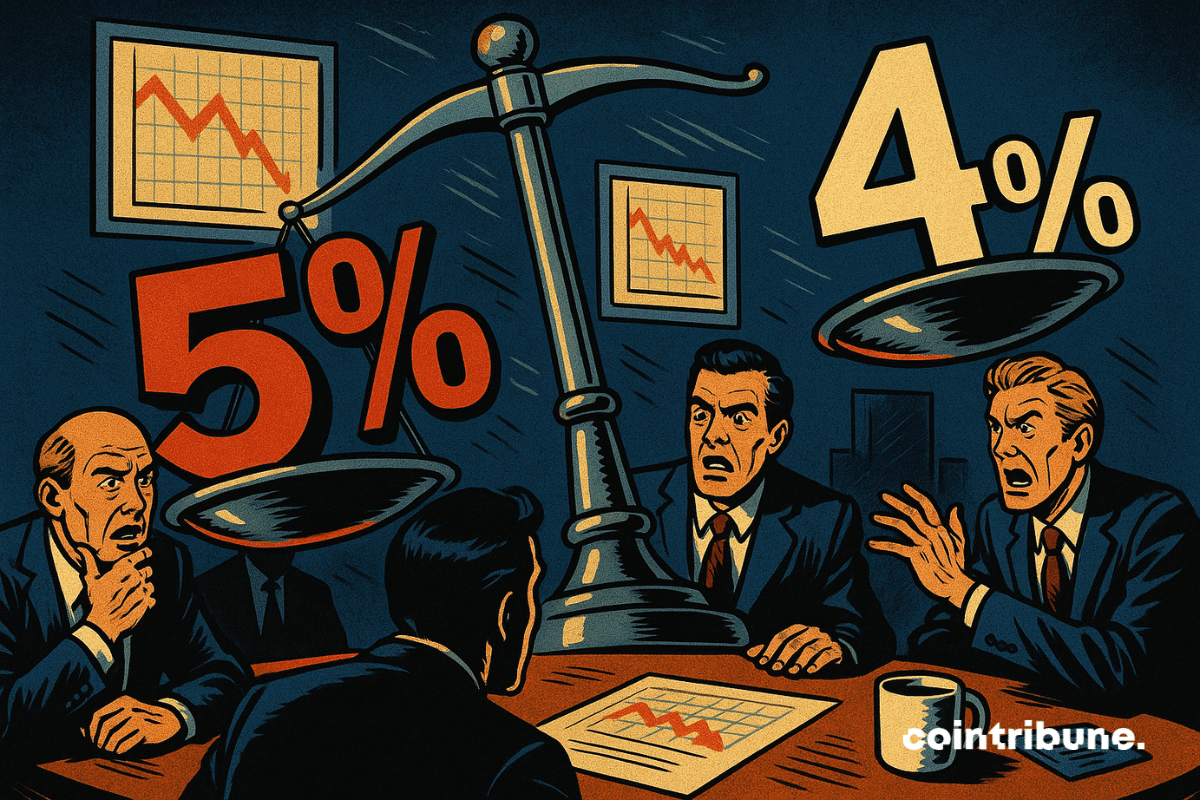

On December 10, the Fed announced a 25 basis point cut to its key interest rates, confirming market expectations. However, behind this seemingly routine decision lie deep divisions: split votes, unclear economic context, and unprecedented political pressures. In a context marked by the absence of key economic data due to the shutdown, interpreting the U.S. monetary strategy becomes increasingly complex and potentially destabilizing.

Donald Trump launches this week the interviews to designate the successor of Jerome Powell at the head of the Fed. A crucial decision that could change everything: interest rates, financial markets, and even the Bitcoin price. Who will be chosen and what impacts for crypto?

The latest PPI figures for September 2025 have just been released, and they are more alarming than expected. With inflation stubbornly high, the Fed finds itself backed into a corner ahead of its December meeting. A crucial decision is brewing: will it cut rates or risk an economic slowdown?

November 2025 sees the Fed paralyzed by uncertainty, while Trump multiplies attacks against Powell, calling him a "mental patient." Between frozen rates and presidential insults, the crypto market wavers. Who will emerge victorious from this chaos?

The European stock market has just closed an exceptional week. The STOXX 600 rises by 2.8% and continues to break records. Health, banks, and mining lead the way, driven by palpable optimism.

What if an overly soft banker awakened the bitcoin beast? Behind the Trumpian nominations, a financial parabola ready to explode… Novogratz lights the fuse, hide the dollars!

Powell cuts timidly, Trump shouts louder than ever, and crypto cheers. In Washington, the FED lowers its arms, while Bitcoin and stablecoins revise their choreography.

This Wednesday, September 17, the US central bank is expected to cut its key interest rate by 25 basis points. A decision already priced in by the markets, but far from trivial, as inflation remains above target and employment slows down. Behind this monetary shift, investors are looking for a signal. Temporary shock or catalyst for a new cycle? From bitcoin to gold, through Wall Street, all assets are watching Jerome Powell’s verdict.

Two weeks before a crucial Federal Reserve meeting, the governor, expected to succeed Jerome Powell in 2026, stood out with an unambiguous statement. He wants a rate cut as early as September. In an interview with CNBC, he said the US economy requires an immediate adjustment, breaking with the caution shown by other monetary officials.

Crypto markets pulse to the beat of the Federal Reserve. As Jerome Powell mentions a possible rate cut in September, Santiment sounds the alarm. Could the current euphoria be hiding a trap for investors?

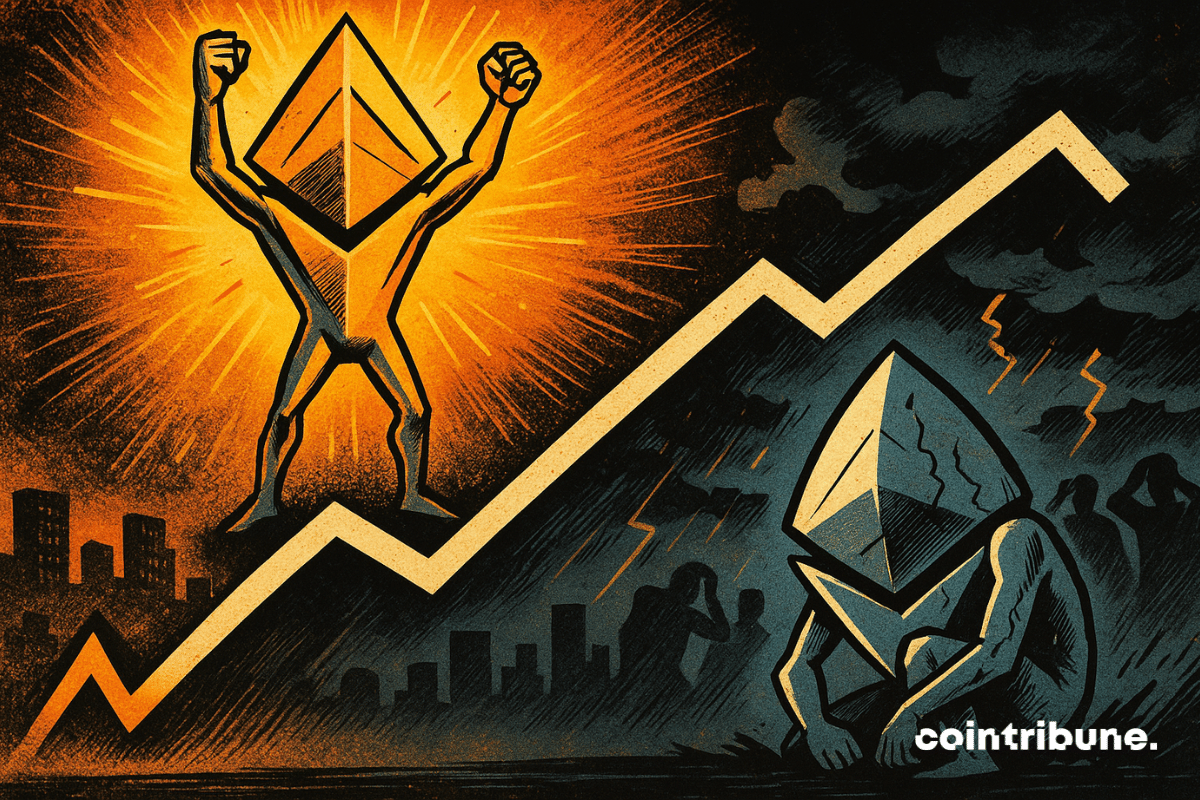

While Ether (ETH) is reaching new highs with a surge of more than 25% in August, investors wonder: are we witnessing a lasting consolidation or just a rebound before a correction? Driven by ETF inflows and a favorable macroeconomic climate, ETH is once again attracting institutional investors. However, history tempers optimism. Since 2016, every August rally has been followed by a bearish September. Will the current euphoria mark a break or will it reactivate the market's seasonal mechanics?

At $37 trillion, American debt reaches an unprecedented level, fueling doubts about the dollar's strength. While markets question, bitcoin climbs beyond $124,000, driving the entire crypto sector to new heights. Between budgetary concerns and a rush toward alternative assets, a shift seems to be occurring.

While traditional markets seek new momentum, Ethereum confirms its central role in the digital financial ecosystem. This Friday, ETH crossed a historic threshold at 4,880 dollars, surpassing its 2021 record. This symbolic peak is part of a global crypto market rally, driven by a more accommodative tone from the Fed and renewed interest from institutional investors. The event marks a strategic turning point for Ethereum, now seen not merely as a speculative asset but as a pillar of future financial infrastructures.

Jerome Powell caught everyone off guard at Jackson Hole by adopting a much more accommodative monetary stance. This unexpected change in tone immediately boosted risky assets. Bitcoin, at the forefront, broke through $116,000. This strategic reversal could mark a major turning point in the Fed's direction.

This Friday, the chairman of the Federal Reserve could deliver his last major speech, in a tense economic context and under unprecedented political pressure. Wall Street, the White House, and all markets are waiting for clear signals. Rate guidance, stance on inflation, Fed independence: every word will count, and could weigh heavily.

Jerome Powell's term will expire in May 2026, and Donald Trump has already announced that he is considering three to four candidates to replace him. This crucial decision could radically transform American monetary policy and create shockwaves in global financial markets.

While markets were expecting a clear monetary shift in 2025, Jerome Powell, the chairman of the Federal Reserve, dampened hopes by pointing to an unexpected culprit: Trump. Yes, Donald Trump, back in the White House since January, is leaving his mark on the American economy, to the point of forcing the Fed to play for time. In a context where every word matters, Powell dropped a diplomatic bombshell, accusing Trump's policies of blocking interest rate cuts.

The BIS stands up to defend the Fed. Can the economy withstand a monetary crisis? The details in this article!

Against the backdrop of years of regulatory ambiguity, Washington seems to want to take control of the crypto ecosystem. On June 18, Federal Reserve Chairman Jerome Powell surprised many by clearly supporting two landmark bills on stablecoins and the crypto market. In a changing political climate in the United States, this stance marks a potential turning point for the industry, which has long awaited a solid and predictable legal framework.

By maintaining its benchmark rates for the fourth consecutive time, the Fed has not simply extended a monetary policy. It has taken a stance in a tense economic and political landscape. Stubborn inflation, weakened growth, barely concealed political pressure... The status quo decided on June 18 resembles a statement of intent. Behind the silence of the numbers, a strategy of resistance is taking shape as the central bank finds itself at the heart of an increasingly unstable balancing act.

Israeli airstrikes against Iran are disrupting the calculations of the American Federal Reserve (Fed). While Donald Trump is ramping up pressure for monetary easing, central bankers must now contend with a new factor of uncertainty: the geopolitical escalation that is driving oil prices up.

While monetary decisions now dictate the pace of global markets, the White House is preparing to shake up the institutional chessboard. Donald Trump has announced that a change at the head of the Federal Reserve could be decided "very soon." From Air Force One, he is directly rekindling his standoff with Jerome Powell, against a backdrop of ongoing disagreements over rates. By threatening the independence of the Fed, Trump is reviving an old fracture with major economic and political implications.

Will the Fed really keep its rates unchanged in June? Between persistent inflation and a surprising labor market, discover why this decision could disrupt the economy and the markets, including Bitcoin!

Fed meeting June 2025: inflation, unemployment, trade tensions... Discover how these crucial issues could disrupt interest rates and why some are already betting on bitcoin. Don't miss out!

Washington cuts in post-crash regulation: a small snip to the SLR to inflate the economy... or the next bubble? Thrilled banks, shivering taxpayers. Who pays the price?

As anticipated by the majority of analysts, the United States Federal Reserve (Fed) has just kept its key interest rates in the range of 4.25-4.50% following today’s meeting. This decision comes in a context of increasing economic uncertainty and persistent political pressures.