End of the Web3 dream for Nike. The company quietly sold RTFKT, its NFT subsidiary. All the details in this article.

Market

While traditional markets slow down between Christmas and New Year, the digital derivatives ecosystem is preparing to absorb a major technical shock. Indeed, this Friday will see the expiration of 27 billion dollars worth of options on Bitcoin and Ethereum, concentrated on the Deribit platform. A crypto version of Boxing Day, both feared and closely watched.

The Bank of Japan tightens the screws, cryptos fall, but Bitcoin, that old trickster, attracts big fish. Social panic, full ETFs: explosive cocktail or flash in the pan?

Cryptos falter, whales buy quietly, and small holders watch their tokens melt away like snow in the sun... Suspense guaranteed until summer 2026?

The quantum threat looms over Bitcoin. Charles Edwards, founder of the Capriole fund, issues a clear warning: without adequate protection by 2028, the king of cryptos could collapse. A prediction that resonates as the market is already experiencing turbulence.

While Powell gives mixed signals, bitcoin wavers: between rally promises and upsetting votes, traders hesitate... and ETFs sneeze.

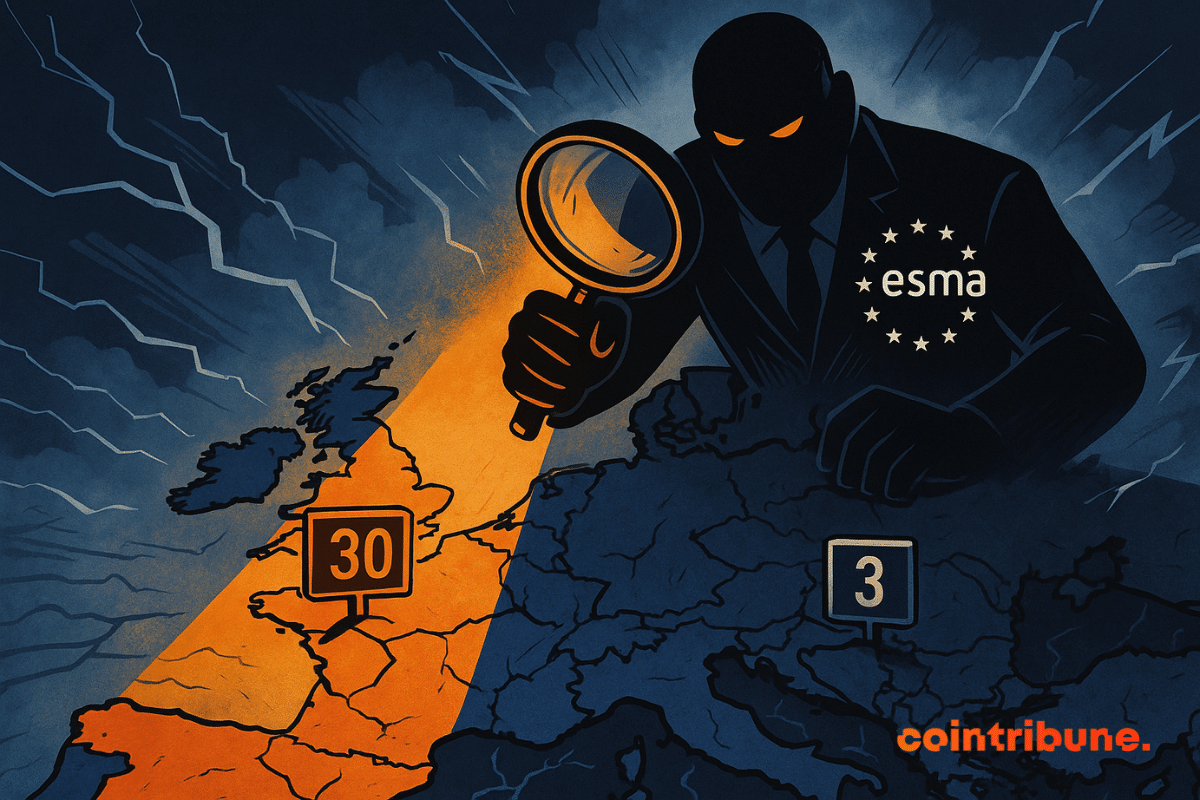

When the EU regulates, it sometimes tailors the rules... MiCA stalls, ESMA heats up, states hesitate: in the crypto jungle, Brussels dreams of cutting local freedoms short.

Cardano shows weakened momentum. Its price remains under pressure after several weeks of decline, and some retail investors are gradually reducing their exposure. However, major ADA holders are strengthening their positions while small wallets decrease theirs. This divergence between the activity of large investors and that of retail frequently appears in the final phase of a bearish trend.

Memecoins are dead, long live memecoins? While the entire market is burying them, some see... a nap. The crypto circus may not have said its last word.

Bitcoin is playing roller coasters: Powell sneezes, whales wave their fins, and traders shout "to the moon"... or crash. The economy, meanwhile, is tense.

Bitcoin is soaring, Binance is struggling, shrimps flee, whales dance… and ETFs scoop up the stakes. Here's a crypto-comedy that would be funny if it weren't so serious.

When a company named Strategy becomes the compass of bitcoin, even JPMorgan takes out its calculator. Bull run or crash? The answer lies between MSCI, reserves, and a few well-placed billions.

Bitcoin still under $100,000... but the crypto industry is rejoicing. Whales sell, small buyers buy, hopes rise: what if the crypto winter was just an illusion?

Bitcoin, in slide mode, flirts with the precipice of the CME Gap while whales do their shopping. Bounce to come or final plunge? Suspense guaranteed.

While crypto traders tremble at the thought of a crash, the charts whisper promises. Should you flee or buy? Breath-taking suspense in the token jungle.

Bitcoin was supposed to take off after the US budget chaos. Result? ETFs on strike, Solana showing off... and investors biting their nails, eyes fixed on December.

Sequans, bitcoin's friend just yesterday, quietly dumps 970 tokens: tactic or panic? Meanwhile, crypto markets are tying themselves in knots with their wallet.

Bitcoin’s rally is showing signs of fatigue after a sharp sell-off pushed prices under $109,000. Long-term holders have realized billions in profits while exchange-traded fund inflows slow, raising concerns that the market may be entering a cooling phase similar to past cycle tops.

Bitcoin, once called a bubble, is now creating millionaires in series: 145,000 in one year. Bankers are grinding their teeth, speculators are popping champagne.

Bitcoin is becoming scarce… at least on the open market. The “illiquid supply” has just registered a new high at 14.3 million BTC, while whales absorb more than the annual production. As a result, there are fewer coins available for sale and selling pressure is weakening.

Powell cuts timidly, Trump shouts louder than ever, and crypto cheers. In Washington, the FED lowers its arms, while Bitcoin and stablecoins revise their choreography.

Ethereum plays the tightrope walker: programmed drop, then theatrical rise. September trembles, October rejoices. Crypto traders? They might applaud... after getting trapped.

Trump, crypto and millions at stake: WLFI unlocks its tokens, promises of a jackpot or a new speculative prank? Investors oscillate between euphoria and suspicion.

After fleeing like thieves, the giants of finance return to bitcoin. Bluff, opportunity or reverse panic? Capital is swirling, the suspense remains intact.

While Bitcoin strengthens its hegemony, XRP awaits a verdict, Avalanche slips, and the crypto-sphere holds its breath: suspense, ETF lurking, and whales lying in wait.

While Ethereum was showing off at nearly $5,000, Bitcoin was crashing… Traders saw their dreams evaporate faster than a presidential alibi.

While bitcoin oscillates around critical thresholds, between selling pressures and bullish technical signals, investors wonder: simple market breathing or prelude to a new surge towards 75,000 dollars

As the summer heat reaches its peak, the crypto market could experience an unexpected cooling. In August, the value of token unlocks could drop by half to around 3 billion dollars, down from over 6 billion in July. A sharp decline, certainly, but far from signaling a lasting calm.

In July, the market capitalization of non-fungible tokens (NFTs) reached an unexpected peak of $6.6 billion, representing a spectacular surge of 94% compared to the previous month. This rebound is no coincidence. It is indeed driven by iconic figures of Web3 such as CryptoPunks, along with a new wave of speculative and cultural interest.

Crypto is unstable, and young traders have understood this well. To better manage risks, 67% of them use artificial intelligence to tame volatility. This is revealed by a recent study from MEXC Research. Rather than reacting in urgency, Generation Z relies on automated tools to maintain control.