Memecoins were dying. Pump.fun got scared. No more parasitic creators, room for traders. Cashback galore. Volumes soar, millionaires cry. The circus continues.

Memecoin

Memecoins have faced heavy selling pressure over the past month, reinforcing the view among many traders that the sector’s best days are over. Social media sentiment has turned sharply negative, and market participants are increasingly writing off meme tokens as a failed trend. However, crypto analytics firm Santiment argues that such widespread pessimism may signal a potential reversal rather than a permanent decline.

The SEC under Atkins lets go of Binance and Sun, coincidentally just as Trump and his crowd are feasting on WLFI… Coincidence or nepotism? The defrauded voters want more.

Pump.fun, an iconic memecoin platform, surprises with Pump Fund: a 3 million dollar fund to support 12 startups. A bold transition from speculation to concrete investment. How could this strategic shift redefine the future of startups in the crypto ecosystem?

Former New York City Mayor Eric Adams unveiled a new memecoin project on Monday, drawing swift attention from both local media and crypto analysts. The token, called NYC Token, was introduced during a press conference in Times Square shortly after Adams officially left office on Jan. 1. Within hours, on-chain data began raising concerns about the project’s liquidity structure and risk profile.

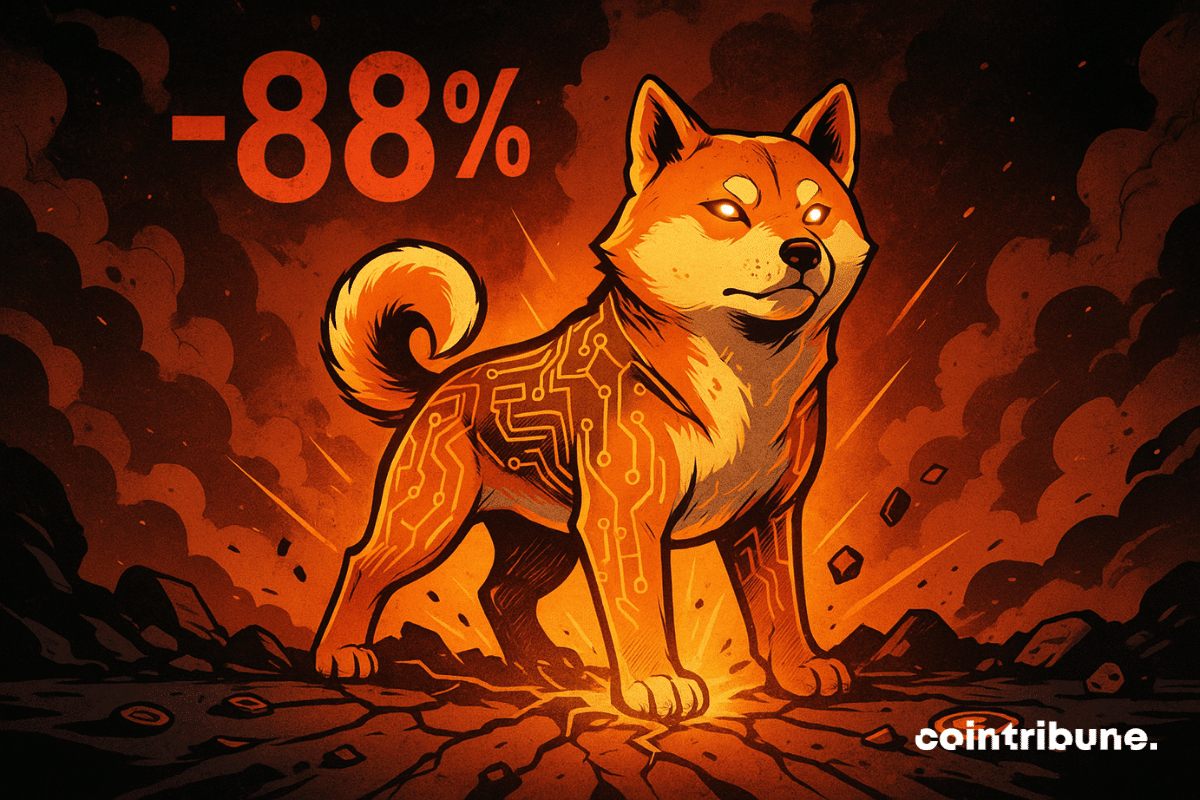

Shiba Inu SHIB sees rising exchange reserves as holders prepare to sell, keeping the token’s price under cautious watch.

Memecoins live at a strange pace. Everything goes very fast, then nothing. On Solana, Pump.fun has been one of the main accelerators of this dynamic. But when a platform grows, every setting becomes political. Even a simple fee.

Pump.fun has just made crypto history by exceeding 2 billion dollars in daily volume thanks to Solana memecoins. Between rapid opportunities and legal risks, this explosion raises questions: sustainable revolution or bubble ready to burst?

At the beginning of 2026, memecoins establish themselves as the stars of the crypto market. PEPE, Dogecoin and Shiba Inu record spectacular gains, driven by massive whale accumulations and short position liquidations. This spectacular rebound, marked by a 20% increase in the sector's capitalization in a few days, raises questions: is it a simple technical rebound or the start of a new memecoin season?

The capitalization of memecoins jumped by more than 23% in early 2026, with a trading volume that almost quadrupled. In short, "hot" money is back, the kind that tests limits. According to data relayed around CoinMarketCap, the sector went from about $38 billion on December 29 to over $47.7 billion a week later, while volumes climbed towards $8.7 billion.

Shiba Inu (SHIB) is under renewed pressure as its market position weakens. Once ranked among the top 15 cryptocurrencies, SHIB now sits near the lower end of the top 40 by market capitalization. Recent price movement and fading interest have raised questions about whether the token can recover in the next market cycle.

Once shining symbols of speculative euphoria, memecoins are going through a major crisis. Their market capitalization has collapsed from 100 to 35 billion dollars within twelve months, reflecting a radical shift in retail investors' appetite. Does this spectacular drop mark the end of an era for these controversial digital assets?

As 2025 ends on a bitter note for SHIB holders, could the most famous memecoin after Dogecoin finally regain its colors next year? Between encouraging technical signals and structural changes in the crypto market, several elements suggest a possible revival.

In December 2024, memecoins were leading the trends. Their capitalization flirted with unprecedented highs. And then, in 2025... everything collapsed. Who would have thought that only one year would separate the spotlight from oblivion? Digital fortunes melted away. Beloved tokens disappeared. What could possibly have happened? Volatility, scams, saturation, or mutation? An analysis of a sharp turn in the ruthless world of the most bizarre cryptos. Nothing hinted at such a reversal for such a popular crypto market.

Memecoin trading on Solana is under new legal scrutiny after investors accused several crypto firms of operating an unfair trading system. A federal lawsuit alleges private messages show coordination between blockchain engineers and a popular memecoin platform, putting retail traders at a disadvantage. A judge has allowed the case to proceed with expanded claims.

The crypto market was hit by a wave of heavy corrections as a rough weekly outing triggered cautious sentiment among investors. During the downturn, heavy liquidations were recorded as some whales took profits while others moved to limit losses. On-chain data shows increased activity from large Bitcoin and Ethereum holders. In fact, U.S. spot Bitcoin and Ether ETFs recorded combined outflows of over $580 million on Monday, extending a broader trend of capital exits. As these heavy outflows persisted, market watchers observed whales rotating capital into a new game-based memecoin project.

Memecoins are dead, long live memecoins? While the entire market is burying them, some see... a nap. The crypto circus may not have said its last word.

Trump’s growing footprint in digital assets now reaches into mobile gaming, as a new Trump-licensed crypto title moves toward release. Early previews show a project that combines light strategy mechanics with token-based rewards. The timing comes as several Trump-linked crypto assets face steep volatility and rising political attention.

Shiba Inu is moving through a quiet but steady phase as the broader crypto market works toward a gradual recovery. Price action stays compressed between $0.0000085 and $0.000009, creating a stable zone while traders wait for a clearer shift in sentiment. Even with the calm movement on charts, several ecosystem updates show the project continues to focus on long-term progress.

Dogecoin struggles to convince institutional investors. Despite a strong capitalization and a media-covered launch, crypto-backed ETFs show volumes in free fall. In a sector where Bitcoin and Ethereum concentrate the bulk of flows, the disinterest in DOGE illustrates the limits of assets perceived as too speculative.

At PEPE, memes were promised, not malware. The result? A hacked site, emptied wallets, and a resurrected hacking tool. Everything is swimming in crypto-cacophony!

Billy Markus, creator of Dogecoin, has just torn apart the manipulation accusations that bloom after every crypto crash. His sarcastic message on X is timely: the market just lost 200 billion dollars in 24 hours. Who to blame this time?

Massive cash-out: Pump.fun withdraws $436M in crypto and triggers a shockwave on Solana. All the details in this article.

The crypto market is going through an unstable period, marked by a sharp decline in the most speculative assets. In 24 hours, memecoins lost more than 5 billion dollars, bringing their capitalization to an annual floor. NFTs follow the same trajectory, reaching their lowest level since April. This plunge is part of a broader flight-to-safety movement, with investors massively deserting high-risk assets.

Solana saw over 200,000 new tokens launched last week, led by pump.fun, but most projects struggle to gain trading traction.

It was said to be gone, buried, burned... But here comes Shiba Inu barking again! A crypto building in the shadows, while others play disposable stars.

The crypto universe seems to be restarting: NFTs on fire, memecoins going wild! Discover why the market is exploding.

Dogecoin, the quirkiest crypto on the market, could soon enter institutional portfolios. Bitwise has filed a new spot ETF application with the SEC, removing the last administrative barriers. The green light could come within twenty days… triggering a new rush towards Elon Musk's favorite meme.

Hackers disguised as pink rabbits siphon your cryptos through charming tweets. CZ, the former head of Binance, reveals the backstage of a great tense digital circus.

A dog CEO, a playful tweet, a skyrocketing price: in the crypto jungle, Musk barks again... and traders rush in, noses to the wind and wallets open.