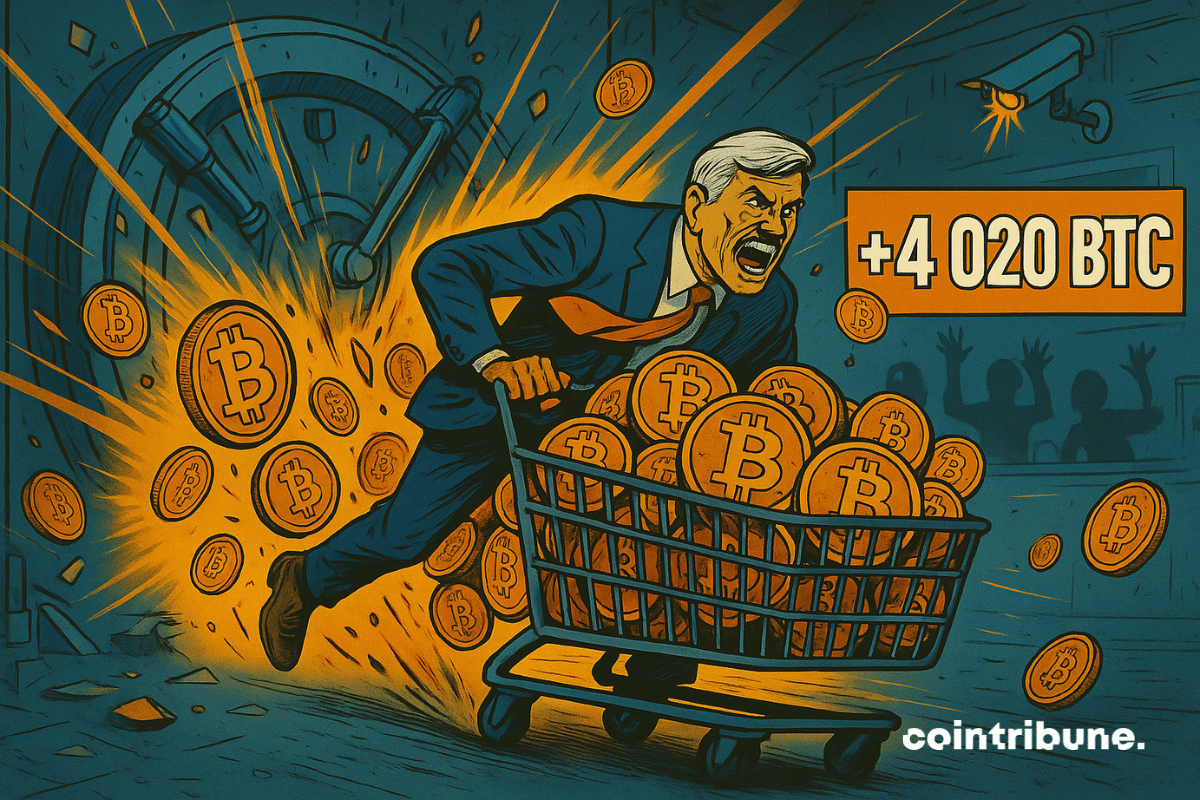

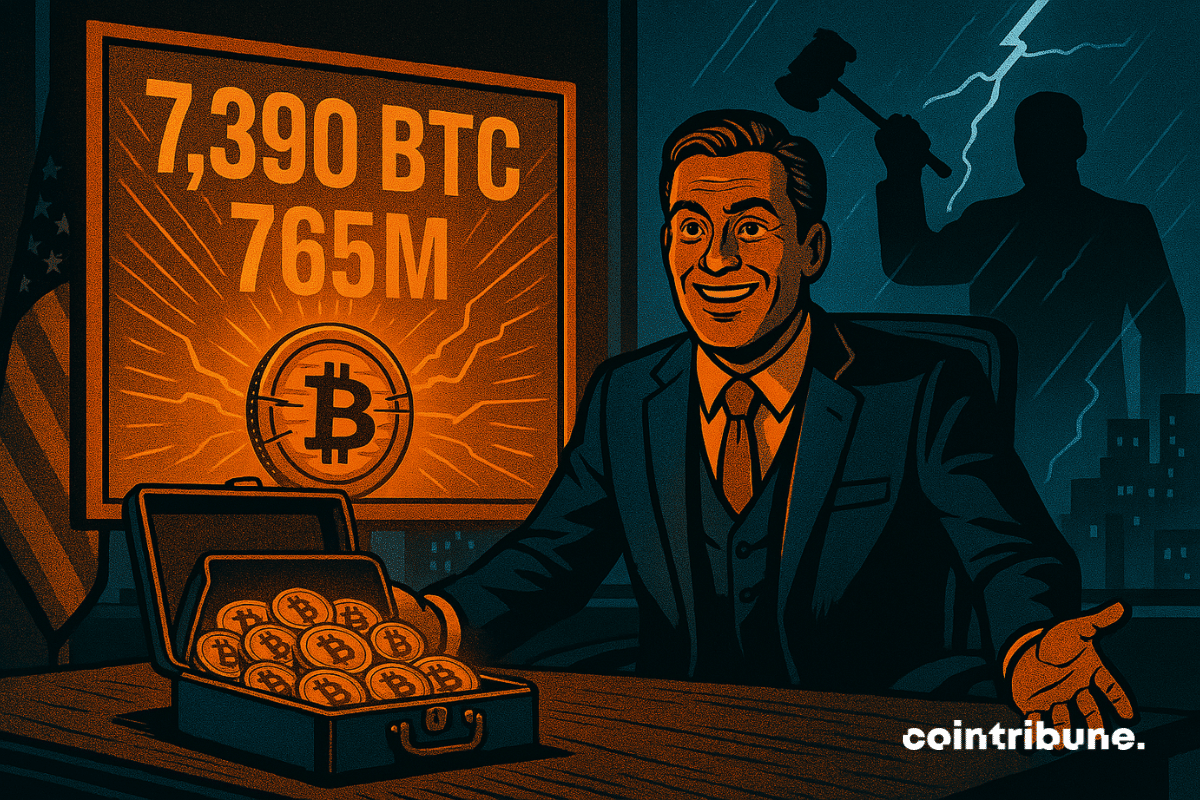

Strategy, ex-MicroStrategy, is intensifying its bet on Bitcoin with a record raise of $4.2 billion through perpetual preferred shares at 10%. Under the leadership of Michael Saylor, the firm is strengthening its accumulation strategy despite a noticeable pause in its BTC purchases. This tactical shift, between liquidity seeking and financial optimization, marks a new phase in the controversial alliance between traditional markets and cryptocurrencies.

Michael Saylor

Michael Saylor and Adam Back have just unveiled a bold roadmap to propel BTC to 3 million dollars. Their model aims to transform traditional businesses into ultra-efficient bitcoin acquisition machines.

While the markets hesitate, Saylor is accumulating bitcoins by the thousands. Another 4,980 units? At this rate, it's the FED that will end up calling him.

Michael Saylor has just confirmed his 11th consecutive week of Bitcoin acquisitions, an impressive streak that perfectly illustrates his relentless accumulation strategy. With 592,345 BTC in reserve, his company Strategy is becoming a true fortress of Bitcoin. But how far will he go?

Has the crypto casino definitely closed its doors? Probably. There are signs that cannot be mistaken...

Michael Saylor's company, Strategy (formerly MicroStrategy), could soon be included in the prestigious S&P 500 index. According to analyst Jeff Walton, it has a 91% chance of achieving this within the next 5 days. However, a crucial condition must be met: Bitcoin must remain above a critical threshold.

Saylor persists and signs: 245 BTC at 26 million dollars. While some tremble, he firmly believes that Bitcoin will one day reach 21 million. A strategy that defies the obvious.

Between financial scandal and assumed strategy, Michael Saylor remains committed to his bet on bitcoin. The details in this article!

The president of Strategy has just revised his projections for Bitcoin. His new target? 21 million dollars in 21 years. A prediction that is causing debate within the crypto community and raises questions about the foundations of this heightened optimism.

As Bitcoin stumbles under the blows of brutal volatility, an enigmatic tweet from Michael Saylor adds fuel to the fire. An AI-generated image, a nod to The Matrix, and this cryptic phrase: "Tickets to escape the Matrix are sold in Bitcoin." Is it just a jest? Or a coded message for those who still know how to read between the lines?

Michael Saylor stays confident in Bitcoin despite the Federal Reserve’s decision to keep rates steady. His company recently added 10,100 BTC, boosting its total holdings to over 590,000 coins, signalling strong belief in Bitcoin’s long-term value amid mixed market reactions.

With $1 billion invested, Strategy boosts its bitcoin yield to 19%. A profitable or dangerous strategy? Experts are questioning!

As tensions mount between Israel and Iran, Michael Saylor revives the machine. The co-founder of Strategy (formerly MicroStrategy), a fervent advocate of bitcoin, suggested this weekend a new massive purchase of BTC. This announcement comes in an explosive context, with targeted strikes in Tehran and risks of regional escalation. Against the grain of traditional markets, Saylor confirms his accumulation strategy, once again defying the logic of cycles and crises.

When Novogratz reads into the bubbles, he sees a seven-figure bitcoin. Prophecy? Deception? Or just a calculated bet from a mogul well-positioned to pull the strings?

Saylor assures us: the crypto winter is over. But when Bitcoin climbs to new heights, who picks up the shovels, and above all… who sells the picks?

Bitcoin is back at around 110,000 dollars, galvanized by the rush of corporate treasurers and the teasing of White House advisor Bo Hines.

When Michael Saylor proposes to Apple to exchange its shares for bitcoin, it's not a joke... or maybe a crypto revolution wrapped in an iPhone, who knows?

Saylor dilutes, bitcoins are piling up, and shareholders applaud. MicroStrategy turns the stock market into a mine, without shovel or pickaxe. How far will the captain of the digital treasure go?

Michael Saylor says fears over quantum computing breaking Bitcoin are overblown. He believes the network can adapt and tech giants won’t risk their own security.

Strategy proceeds openly: accumulate bitcoin at any price. However, when the company announces a fundraising of one billion dollars and Michael Saylor subsequently publishes an enigmatic post, the strategy takes on a whole new dimension. Within hours, the markets stir, and speculation resumes. The businessman rekindles the interest of the entire ecosystem and reinforces the idea that Strategy is much more than a tech company: a strong institutional signal in favor of bitcoin.

Retired NBA star Scottie Pippen is encouraging everyone to learn about Bitcoin. Experts and recent data show the cryptocurrency’s growing strength and possible price gains ahead.

Are bosses becoming miners? While MicroStrategy inspires, others dive into Bitcoin... but if it crashes, will they need to sell the desks or just the chairs?

Michael Saylor continues to feed Strategy's crypto reserves. The company has just acquired an additional 705 bitcoins for $75.1 million, bringing its digital treasure to over 580,955 BTC. An accumulation strategy that shows no signs of weakening, despite the turbulence in the crypto market.

When six words and a simple bitcoin graphic are enough to spark excitement, it means Michael Saylor has struck again. The co-founder of Strategy, a leading figure in BTC maximalism, posted a message on X that is as short as it is eloquent: "orange is my favorite color." Behind this wink lies a new strategic purchase operation, in a climate where his company continues to acquire bitcoin. An enigmatic statement, but unequivocal for insiders.

According to Michael Saylor, bitcoin is the key to a generational fortune by 2025. In this article, discover his strategies!

The price of Bitcoin is reaching historic peaks, but the interest it generates has never been so divisive. While some see it as a final opportunity, others question the relevance of an investment at this stage. This year, signals from financial institutions, influential investors, and the markets themselves are fueling a strategic debate: should we still buy Bitcoin, or has that train already left?

Michael Saylor shakes up the Bitcoin market once again with a massive new purchase. The details in this article!

Is it important for Bitcoin to become a popular means of payment? Michael Saylor reignited the controversy in a tweet published on the occasion of "Pizza Day."

A key figure in institutional bitcoin, Michael Saylor now sees his legitimacy challenged. The co-founder of Strategy (formerly MicroStrategy), who has made BTC the core of his business strategy, is facing a class action lawsuit. Investors accuse him and his executives of misleading the market by concealing key information about the financial viability of their massive bitcoin accumulation policy. This represents a potential judicial setback for one of the staunchest advocates of the queen of crypto.

Strategy is buying bitcoins hand over fist, but a lawsuit attacks it for "concealing" risks. Is Saylor at risk of being checkmated in his strategy? Find out more.